Every American knows that they should be saving money, but what are people really saving for?

When you received your first paycheck, you likely were also given the advice to put a certain percentage of your earnings aside for a rainy day. Those that follow this practice know that strategically saving a portion of each paycheck helps establish solid financial habits and can help you prepare for big expenses and purchases down the road.

While most people know that they should be saving their money, how and what Americans are saving for varies greatly. With a small interest rate and a wide variety of ways to grow your money available, savings accounts are being used less as a place to grow wealth and more commonly as a rainy day fund to be supplemented by other saving practices.

In an effort to uncover how exactly people use their savings accounts — and whether they do so responsibly — we surveyed over 4,000 Americans on the purpose of their savings account, how much money they have saved and how often they dip into their savings.

Key findings

- Nearly 3 in 5 Americans have less than $5,000 in savings

- 37 percent of Americans are saving toward an unspecified goal

- Only 14 percent of people under the age of 54 consider retirement savings a priority

Many Americans don’t have savings goals

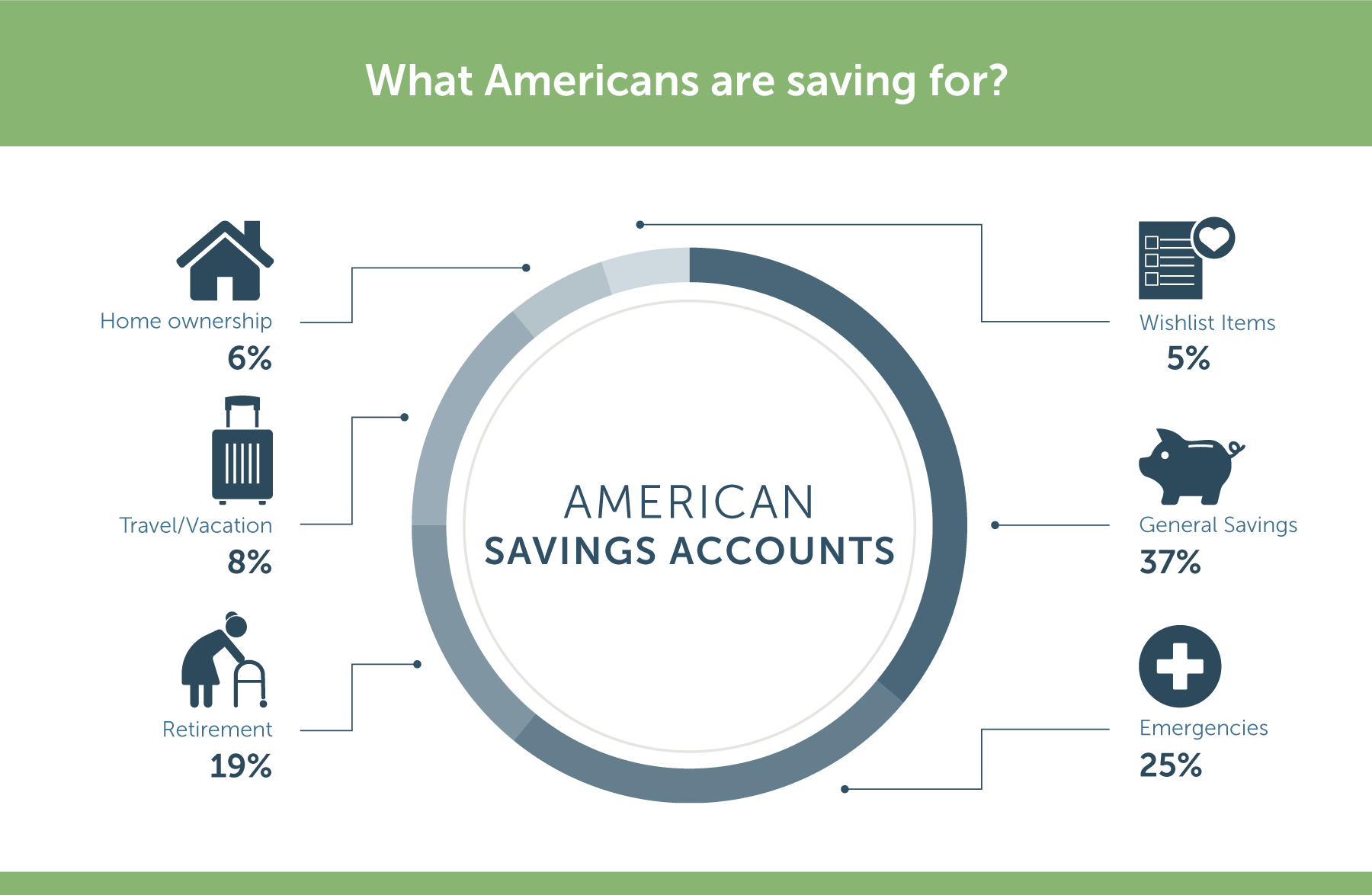

When asked what they are saving for, the most popular response, at just over one third of those surveyed, is general savings. General savings can refer to any reason someone might save, suggesting many Americans may not have an exact purpose for their savings account, but know they should be saving money. Another quarter reported dedicating the account to emergencies. Although, according to the Federal Reserve Board, four in ten Americans can’t cover an unexpected $400 expense.

Are Americans waiting too long to prioritize retirement?

Unsurprisingly, those 55 and older are most likely to dedicate their savings account to retirement, while young Millennials are least likely to be saving for retirement. This finding is likely due to the fact that many Millennials must dedicate money to other things, like paying off student loan debt or allocating more funds to rent. What’s surprising is that those aged 45–54 don’t seem much more inclined to save for retirement.

Around the age of 55 the number of people prioritizing retirement saving doubles. Only 15 percent of people ages 45–54 consider retirement their main saving goal, but 30 percent of people ages 55–64. Does this mean Americans are only considering retirement once it’s too late? According to a recent study, people who wait to start putting aside money at age 40 have to save 16 percent of their salary to reach the same amount at 65 as someone who saves 6 percent of their salary starting at 25.

Savings goals to consider for each decade

In Your Twenties

- Secure your own health insurance.

- Eliminate student loan debt.

- Fully fund an emergency savings account.

- Have one times your annual salary set aside for retirement.

In Your Thirties

- Save for a down payment on a home.

- Secure life insurance.

- Continue to grow your emergency fund proportionately to your increase in expenses.

- Have three times your annual salary put aside for retirement.

In Your Forties

- Pay off all consumer debt.

- Save for your kids’ college education.

- Prioritize retirement savings by maxing out contributions.

In Your Fifties and Beyond

- Review your retirement goals and adjust as needed.

- Rebalance your retirement portfolio.

- Review your life insurance policy and will.

Majority of Americans never touch their savings account

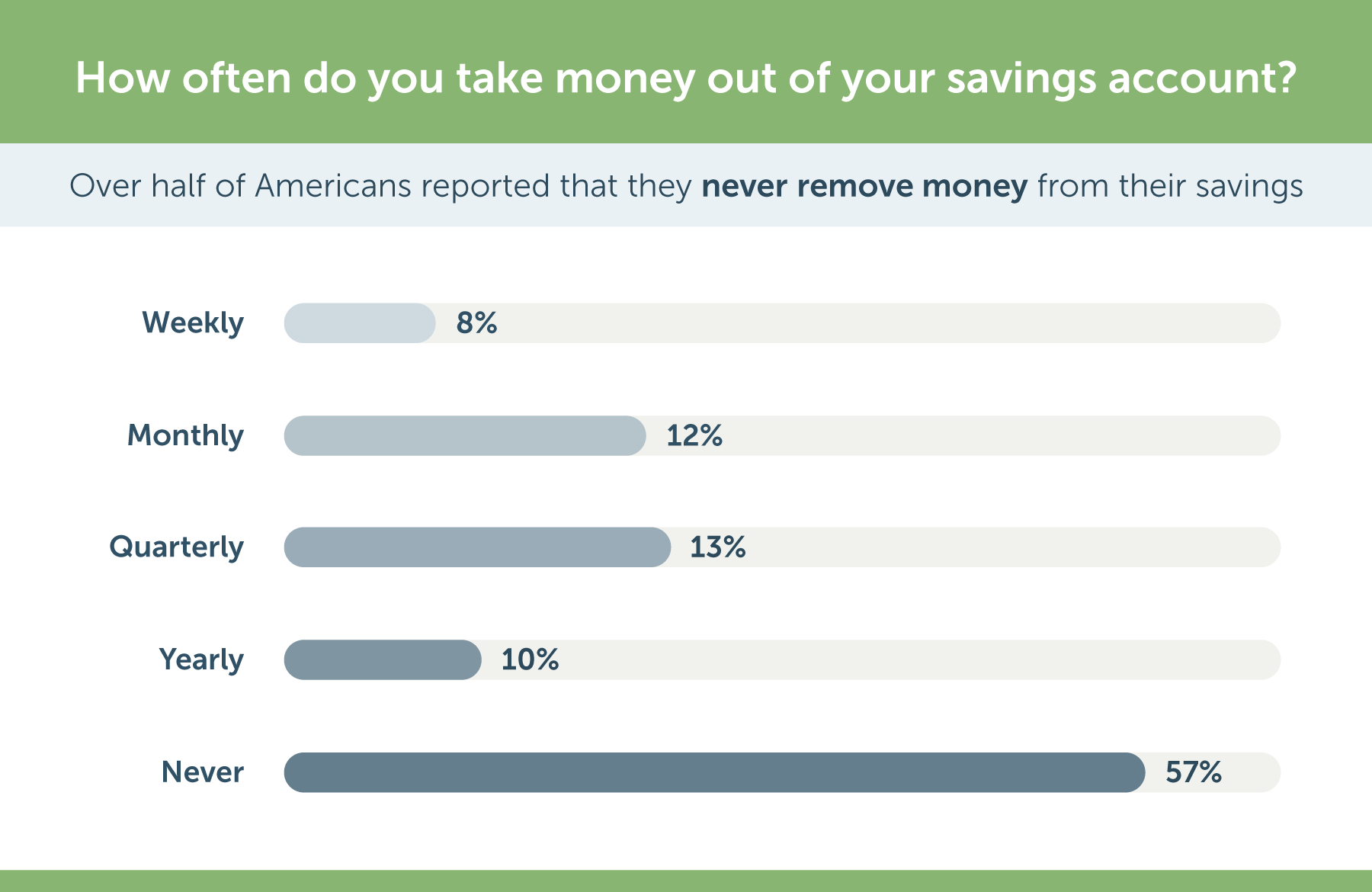

Our research revealed that a whopping 57 percent of people say they never take money from their savings account. Of the 43 percent who reported that they do remove money from their savings account periodically, 13 percent said they do so quarterly and 12 percent said they do so monthly.

As mentioned, many Americans are saving without a goal, which makes the fact that over half of them never touch their savings concerning. Savings accounts offer a low return on investment and are more flexible than other ways of saving money, making it easy to move money from one’s savings to an asset that will offer a larger return, such as real estate or the stock market. For this reason, it is surprising that over half of those surveyed reported that they never remove money from their accounts. Not only is it easy to remove money, but moving money from savings to other investments such as the stock market or retirement plans leads to a healthier income growth. It seems that a lack of goal setting might be hurting Americans’ saving efforts.

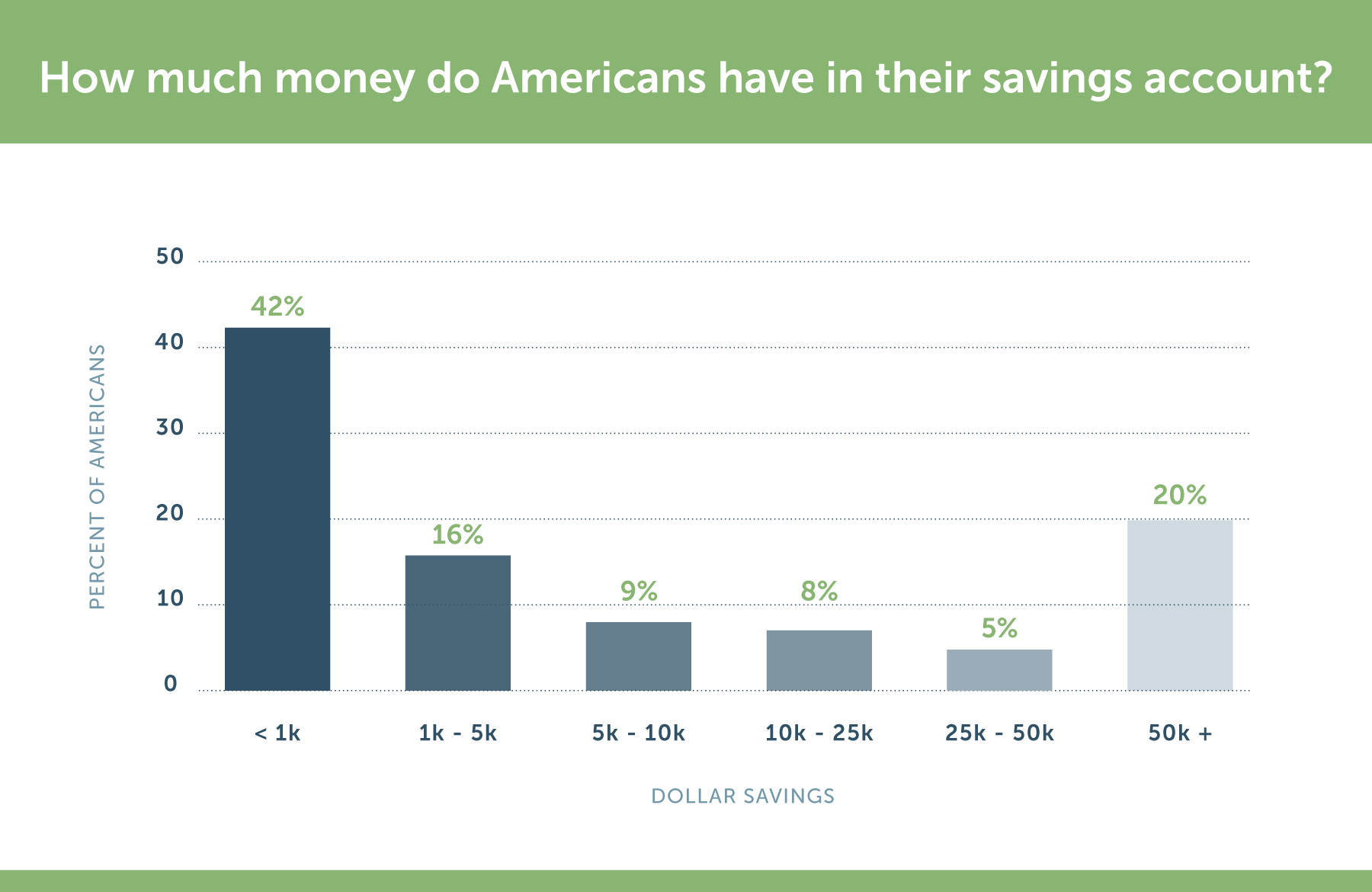

2 in 5 Americans have less than $1,000 in savings

Despite many Americans knowing the importance of saving, our survey found that almost half of Americans have less than $1,000 in their account. In order to live comfortably, experts say your retirement income should be about 80% of your final pre-retirement salary. As our survey shows, very few people meet that goal for their overall savings, let alone retirement savings.

While most Americans understand the importance of being financially responsible, they don’t always know what exactly they are saving for. This lack of clarity can contribute to lower bank account balances and accounts that remain largely untouched. With other forms of investments, such as the stock and real estate market offering a higher return, the flexibility of a savings account should encourage Americans to move their money around, not leave it untouched. By better understanding why exactly they are using savings accounts, consumers will be better prepared to make smart financial choices for the long term.