The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The total outstanding student loan debt is over $1.7 trillion with an average of $37,787 owed per borrower. Approximately 43.5 million Americans have some form of student loan debt. Source: Federal Reserve

Going into 2023, student loan debt in the United States totals at over $1.7 trillion dollars, according to the Federal Reserve. This includes outstanding federal student loan balances as well as private loans.

To help you better understand student loan debt in America and see how you compare, we’ve compiled the latest student loan debt statistics. We cover both federal and private student loan debt, which states have the highest amount of student loan debt as well as debt broken down by age group.

Table of contents:

- Average student loan debt highlights

- How many Americans have student loan debt?

- Total federal student loan debt

- Total private student loan debt

- Student loan repayment status

- Average student loan debt by age group

- Student loan default and delinquency rates

- Student loan debt forgiveness

- Student loan debt by state

- Student loan debt statistics FAQ

Average student loan debt highlights

- As of October 2022, Americans held a total of over $1.7 trillion in student loan debt. (Federal Reserve)

- Those who take out a federal student loan have an average balance of $37,787. (Education Data Initiative)

- Roughly 43.5 million Americans have student loan debt (U.S. Department of Education)

- Federal Perkins loans are given based on financial need, and the total outstanding debt has decreased from $5.2 billion to $3.9 billion between 2020 and 2022 in the fourth quarter. (U.S. Department of Education)

- The major with the most student loan debt after graduating with a Bachelor’s degree is Behavioral Sciences at an average of $42,820. (Education Data Initiative)

How many Americans have student loan debt?

If you have student loan debt, you’re not alone. Here’s a look at how many Americans currently hold some form of student loan debt:

- Over 43.5 million Americans have student loans on file, adding up to $1.7 trillion in October 2022. (Federal Reserve)

- Federal student loan borrowers owe an average of $37,787. (Education Data Initiative)

- The average college graduate only earns about $55,000 per year. (National Association of Colleges and Employers)

- 23% of Americans held a bachelor’s degree or higher in 2021, which is 9% less than in 2019. (United States Census Bureau)

The burden of student loans is poised to have lasting effects on graduates as homeownership among Americans under the age of 35 is down and the expected retirement age is rising. With college tuition increasing, it is important for graduates and potential student loan borrowers to practice strategic financial planning in order to plan for future investments.

Total federal student loan debt

The United States Department of Education provides an annual portfolio documenting how many Americans owe both federal and private student loans. Out of the total $1.7 trillion in outstanding student loan debt, $1.6 trillion is owed to the federal government. The breakdown is as follows according to the 2022 Q4 report:

- $207.8 billion in Federal Family Education Loans (FFEL) are owed by 9.2 million Americans.

- 1.3 million Americans owe a total of $3.9 billion in Perkins Loans.

- $1.4 trillion in direct loans are owed by 37.8 million Americans.

Total private student loan debt

Taking out a private loan to pay for education is a route that many college students use to fund school. Unlike Stafford Loans which are subsidized by the government, a private loan tends to have a higher interest rate and does not come with any of the benefits of federal loan forgiveness and income-based payment programs.

- The total outstanding private student loan debt is $131 billion. (MeasureOne)

- Some private lenders charge as much as 16.75% interest for private student loans. (Education Data Initiative)

- 53% of private student loan borrowers from 2015–2016 borrowed less than they could have for a Stafford Loan. (TICAS)

- 43% of private loan borrowers could not have borrowed more with a Stafford loan. (TICAS)

- The majority of private student loans are for undergraduates at 88.5% compared to 11.5% for graduate loans. (Education Data Inititiave)

- In 2015-2016, 51 percent of private loan borrowers attended schools with tuition costs above $10,000, while 31 percent of borrowers attended schools charging less than $10,000. (TICAS)

- 92% of undergraduates with student loans used a co-signer (Education Data Initiative)

Student loan repayment status

Borrowers who can’t make their payments can apply for deferment or forbearance, which are both methods to postpone loan payments. It’s important to remember that during this time, interest may still accrue.

The following is the data from Q4 2022 from the U.S. Department of Education tracking loan repayment status:

- There are 6.3 million recipients currently in school with a total of $116 billion total dollars in debt.

- There are 1.3 million recipients within the loan grace period with a total of $34.1 billion in debt.

- There are 400,000 recipients in repayment with a total of $11.8 billion in debt.

- There are 3 million recipients in deferment with $109 billion in debt.

- There are over 25 million recipients in forbearance with $1 trillion in debt.

- There are 4.8 million recipients in default with $105 billion in debt.

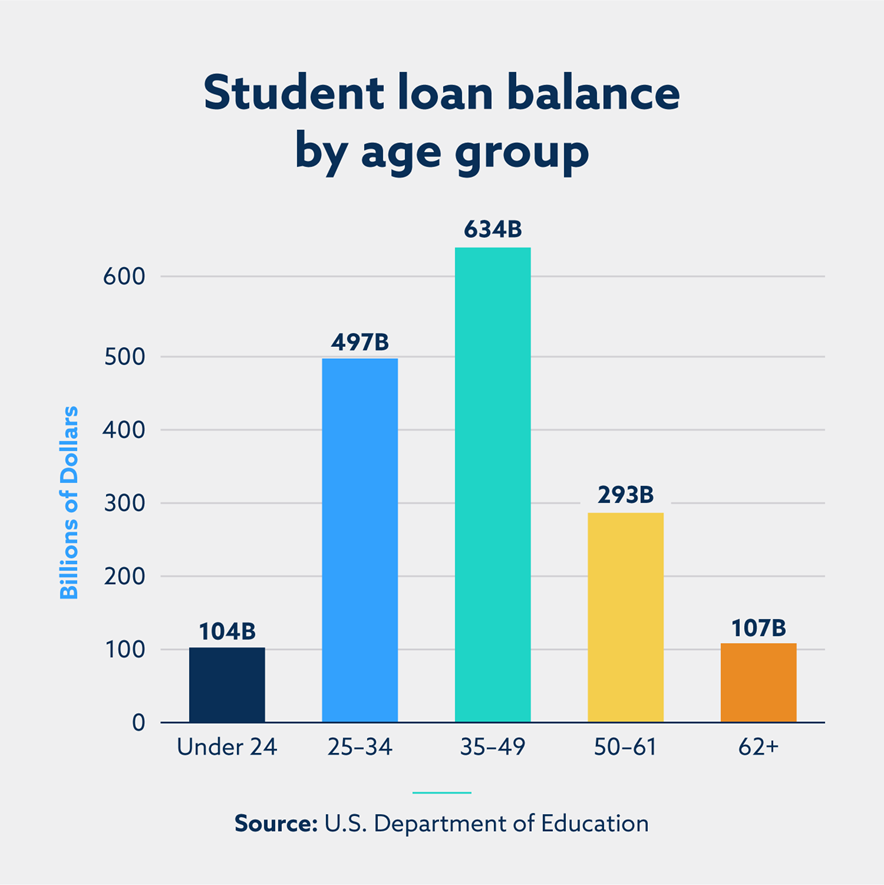

Average student loan debt by age group

Analyzing student loan borrowers by age demographics can be helpful in understanding the financial status of Americans. According to the Pew Research Center, 34% of all student loan borrowers were under the age of 30 and around 22% were between the age of 30 – 44.

Age of direct federal student loan borrowers in 2023

The United States Department of Education reports the following as the total student loan debt broken by total amount owed per age group as well as how many Americans are in each group:

- Ages 24 and younger: 7.3 million with $104 billion in outstanding debt.

- Ages 25–34: 15 million with $497 billion in outstanding debt.

- Ages 35–49: 14.6 million with $634 billion in outstanding debt.

- Ages 50–61: 6.5 million with $293 billion in outstanding debt.

- Ages 62 and older: 2.6 million with $107 billion in outstanding debt.

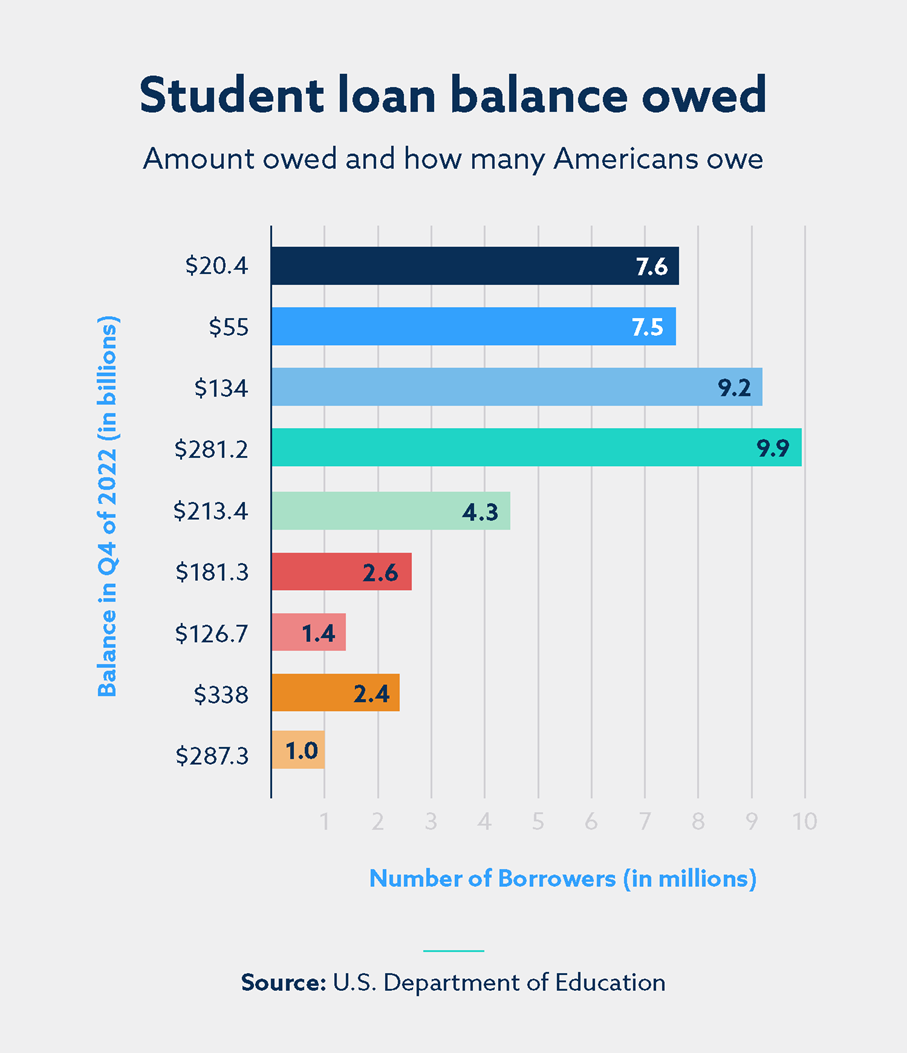

| Balance in Q4 of 2022 (in billions) | Number of borrowers (in millions) |

| $20.4 | 7.6 |

| $55 | 7.5 |

| $134 | 9.2 |

| $281.2 | 9.9 |

| $213.4 | 4.3 |

| $181.3 | 2.6 |

| $126.7 | 1.4 |

| $338 | 2.4 |

| $287.3 | 1.0 |

Student loan default and delinquency rates

A borrower defaults on a loan when the payment is more than 270 days late. Missing and defaulting on student loan payments cause severe effects on your credit score and can create barriers when applying for insurance plans and financing, as well as seeking housing and loans.

The following is the latest information from the Education Data Initiative:

- Roughly 7% of all student loans are in default status at any given time.

- Over 10% of student borrowers default within their first year of repayment.

- The largest group of borrowers in default owe within the range of $20,000 to $40,000.

- Only 1% of borrowers owe more than $200,000.

- Over 17% of borrowers in default are Black/African American and 13% are Hispanic/Latino.

Student loan debt forgiveness statistics

There are various government and private programs that offer student loan debt forgiveness. These programs pay off a certain amount of your debt, and often require you to meet specific criteria, which varies based on the program.

The most common program is the federal Public Service Loan Forgiveness (PLSF) program from the government. As of October 2022, they reported:

- 97% of applicants met employment certification requirements.

- 36% of applicants were missing information on their forms.

According to the Education Data Initiative, only 2.16% of all PSLF applicants got approvals in 2020. Aside from incomplete forms, 35% of the forms had yet to be processed. They also report that only 6.7% of eligible borrowers apply.

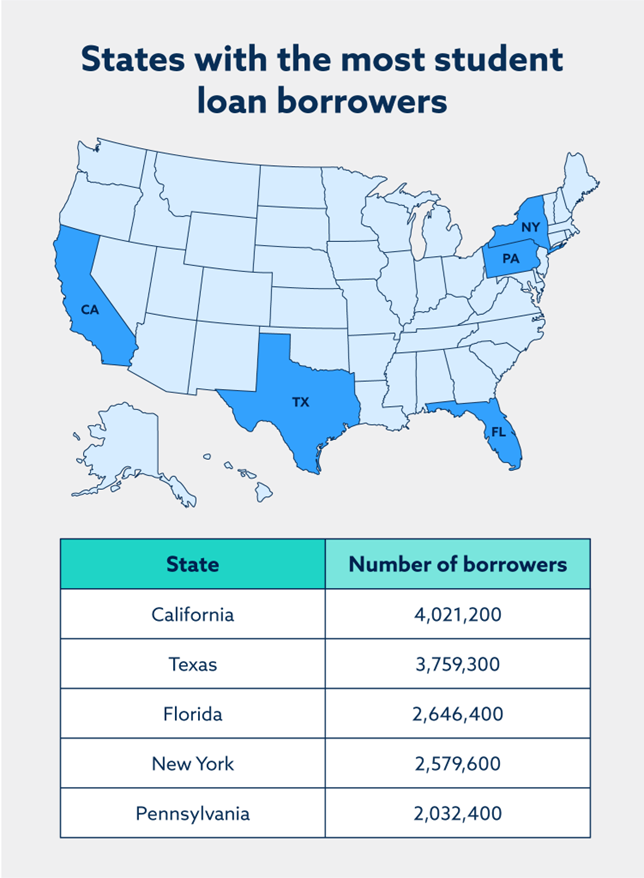

Student loan debt by state

The cost of education is not the same throughout the United States. Since universities receive funds on a state level and the cost of living changes throughout the country, the location of a college graduate will influence their financial performance.

The following data comes from the Federal Reserve Bank of New York as of 2021.

States with the most student loan borrowers

- California: 4,021,200

- Texas: 3,759,300

- Florida: 2,646,400

- New York: 2,579,600

- Pennsylvania: 2,032,400

States with the highest average outstanding student loan balance

- Maryland: $43,543

- Georgia: $41,826

- Delaware: $39,238

- Virginia: $39,001

- New York: $38,668

States with the lowest average outstanding student loan balance

- South Dakota: $28,218

- Iowa: $29,845

- Alaska: $30,427

- North Dakota: $30,542

- Wyoming: $30,581

States with the highest delinquency rates per borrower

- West Virginia: 11% delinquency rate

- Mississippi: 10.7% delinquency rate

- Kentucky: 10% delinquency rate

- Nevada: 9.8% delinquency rate

- Oklahoma: 9.6% delinquency rate

Student loan debt statistics FAQ

Here, we cover some common questions people have about student loans.

Is student loan debt increasing?

According to Experian, student loan debt in America has increased every year since 2009 and is increasing faster than inflation.

What is student loan refinancing?

Student loan refinancing is an option for borrowers to lower their interest rate and monthly payment, but this also extends the duration of the loan.

What is student loan debt consolidation?

Student loan debt consolidation is for those who have multiple loans. This allows the borrower to combine the loans into one lump sum by “consolidating” them.

At what age do most people pay off student loans?

The Education Data Initiative reports that it takes the average borrower 20 years to pay off their student loan debt.

How student loans affect your credit

Borrowing any large sum of money can largely impact your credit score. Payment history is a major contributing factor to your credit score, which can quickly decline if you fall behind on payments. Hopefully, these student loan debt statistics have helped you see where you stand compared to other Americans. If you are unsure if student loans are having a negative effect on your credit score, allow Lexington Law to provide you with a free credit snapshot and consultation to help assess your student loans and other credit factors.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.