The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Your credit affects more than you’d think. That’s why it’s so important to make sure your reports are both fair and accurate. After all, your best credit score is one that accurately represents you.

What is Lexington Law?

Lexington Law is a legitimate industry-leading credit repair firm operating since 2004. Unlike other companies, we have a team of lawyers guiding our credit repair process. With the help of our experienced attorneys and paralegals, we help clients address unfair, inaccurate and unsubstantiated items on their credit reports. In addition to providing credit repair services, we also hope to educate and empower our clients to maintain their credit health and achieve their financial goals moving forward.

How does Lexington Law work?

Lexington Law uses a proven process to help our clients work to repair any inaccurate and unfair negative items—like late payments or collections—that are wrongfully hurting their credit reports. Here’s how it works.

Step one: We review your case

When you sign up for Lexington Law’s services, we’ll start your case by pulling your credit reports. You’ll then need to log into your account and answer some questions about the items on your report so our team can decide how best to handle your credit repair needs.

We want to know which items are unfair, unsubstantiated or inaccurate, so we’ll look into whether all relevant laws have been followed and whether all information is being reported accurately. These items could be wrongfully hurting your credit.

If necessary, one of our paralegals will reach out to you to get more information.

Step two: We send challenges and disputes

After we’ve worked with you to identify which negative items on your report can and should be addressed, our team will get to work sending challenges and disputes on your behalf. If your creditors and the credit bureaus can’t provide evidence that the items in question are fair and accurate, they’re legally required to remove them.

Throughout this process, you can check the status of your case through your online client portal. You can also use our app (here for Apple and here for Android).

Step three: We continue monitoring your credit

As we systematically address each questionable negative item on your reports, our team will also help you monitor and manage your credit. We’ll notify you of any new negative items that need to be addressed and we’ll provide credit education opportunities to help you develop wise credit habits. We offer credit score analyses and mentoring through our online portal.

How long does it take for Lexington Law to repair your credit?

There is no definitive timeline for credit repair, as the process varies based on each person’s credit needs. How many negative items you have, what kind of negative items they are, how quickly your creditors and the bureaus respond to disputes or challenges—these are all factors that will influence your unique credit repair case.

We can report that 77 percent of Lexington Law clients who saw a credit score increase had an average increase of 40 points in six months, but there are no guarantees when it comes to fixing credit. Just remember, improving your credit takes time, and you may not see results right away. Lexington Law will do everything possible to help you push your credit in the right direction.

Can Lexington Law remove unpaid collections?

If an unpaid collection account is inaccurate, our credit repair consultants can work with you to help address the collection on your credit report. Our professionals can file a dispute with the credit bureaus on your behalf to request they remove it.

On the other hand, if the unpaid collection on your account is in fact legitimate, Lexington Law Firm can assist you with sending a pay for delete letter. In this instance, you may have to pay all or part of the balance of the collection to have it removed.

Who will Lexington Law help the most?

While Lexington Law was designed to help anyone who wants to improve their credit, our service has typically been more effective for those who have a poor credit score (anything below 600). Here are some example situations to help you know if credit repair is right for you:

- You can’t access certain credit products due to a low credit score

- You’re paying a lot in interest due to a low credit score

- You have many items on your credit reports that need addressing

- You have already tried repairing your credit yourself, with limited success

- You don’t really know what your credit rights are

- You don’t have much time to dedicate to fixing your credit yourself

If you want to know whether you’re a good fit for Lexington Law’s services, you can use our free credit assessment tool or speak to a representative via phone.

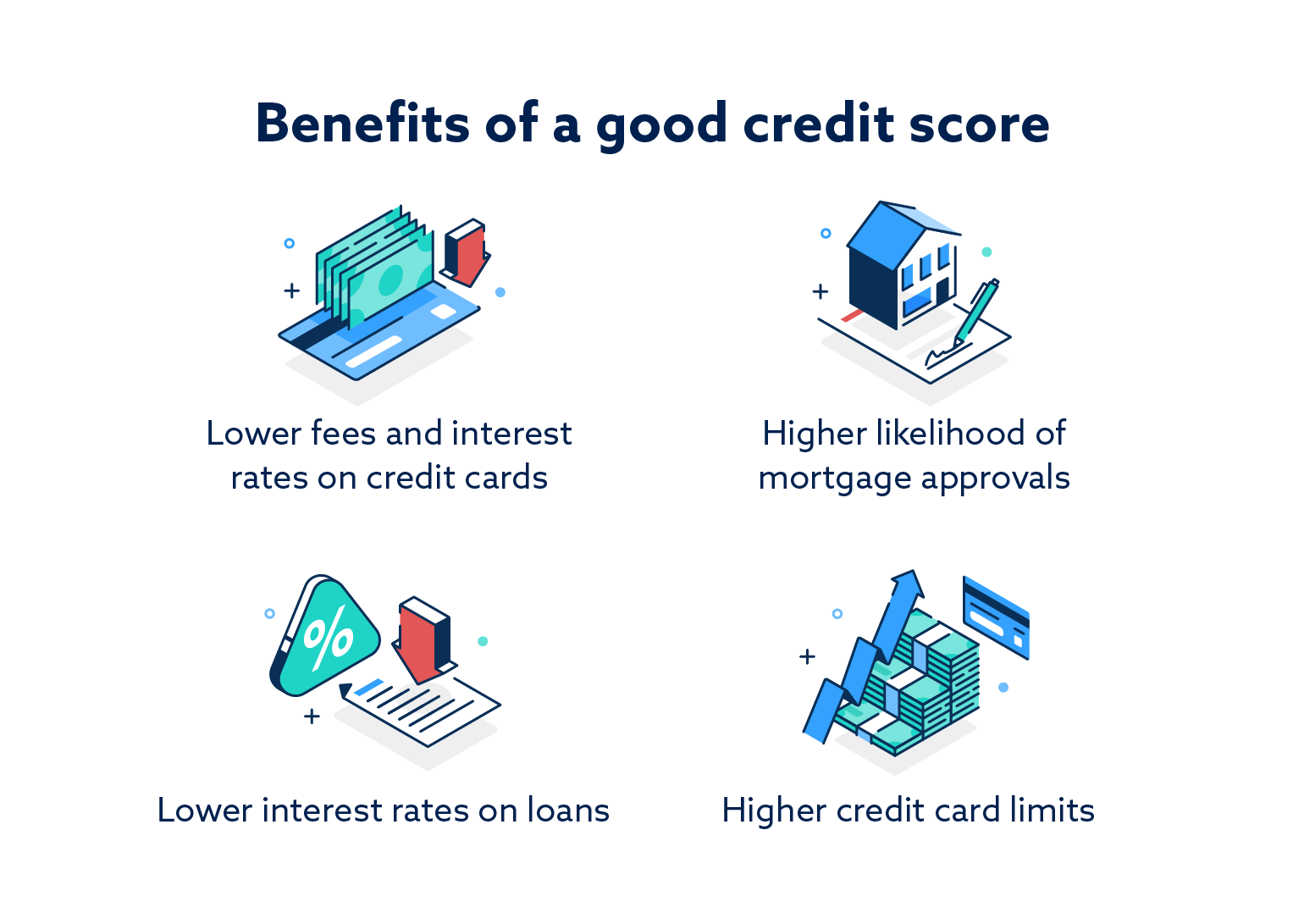

Benefits of a good credit score for you

Having a good credit score can open up many doors and make it easier to take advantage of things like credit card offers, lower insurance rates and better housing options. Here are some potential benefits of having a good credit score:

- Lower fees and interest rates on credit cards

- Higher credit card limits

- More access to credit card rewards and perks

- Lower interest rates on loans

- Better car insurance rates

- Easier access to utilities

- Less expensive cell phone fees

- Higher likelihood of mortgage approvals

Plus, if you have good credit, you’ll look like a better candidate to potential employers and landlords, who can ask for your permission to check your credit during their screening processes.

Of course, you don’t have to have a good credit score to access many financial products and services, but you’re much more likely to get favorable terms if you do. That means that working on having a good credit score is a great investment for your future.

Free credit education available

We want to help all consumers make smart credit decisions, so we make credit education a priority on our site, as well as throughout the credit repair process. Our paralegals and credit advisors are happy to answer your questions, whether you want to know more about how Lexington Law works or more about credit in general. As you work to build your credit, use our team as a resource.

We also highly encourage checking out our credit advice blog to get detailed and up-to-date information related to credit and other aspects of your finances.

Get credit repair help today from Lexington Law

Fixing your credit won’t be easy, but it will be worth it. We’re here to help. See if Lexington Law’s attorney-driven process is the right fit for you, or you can sign up online. Don’t let denied turn into defeated—get started with Lexington Law today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.