If you’re younger than 30, chances are you’re not thinking about retirement. It’s a long way off, you’re just getting started in your career and you have your whole life ahead of you. For all these reasons, it’s the perfect time to get started on saving for retirement. You can make minimal contributions that will grow over time and allow you to retire in comfort.

While many retirees live on the money they receive from Social Security, this may not be an option for future generations. Projections show that the Social Security trust fund could be depleted by 2034. If you expect your retirement to continue after that date, you need a contingency plan. This Retirement 101 primer offers a roadmap to prepare for your future.

Setting Retirement Goals

First, you need to figure out how much money you need to live comfortably in retirement. Here are some things to consider when planning for retirement:

- Current household income, both before and after taxes

- Age you plan to retire

- Goals for retirement, such as where you want to live and your desired lifestyle

- Current and future budget

Create an estimated budget for retirement that represents 80 to 100% of your current income. For example, if you bring home $5,000 a month, make a retirement budget of $4,000 to $5,000 a month. Be as detailed and realistic as possible.

Plug the numbers into a retirement calculator. This will give you a savings goal to strive toward.

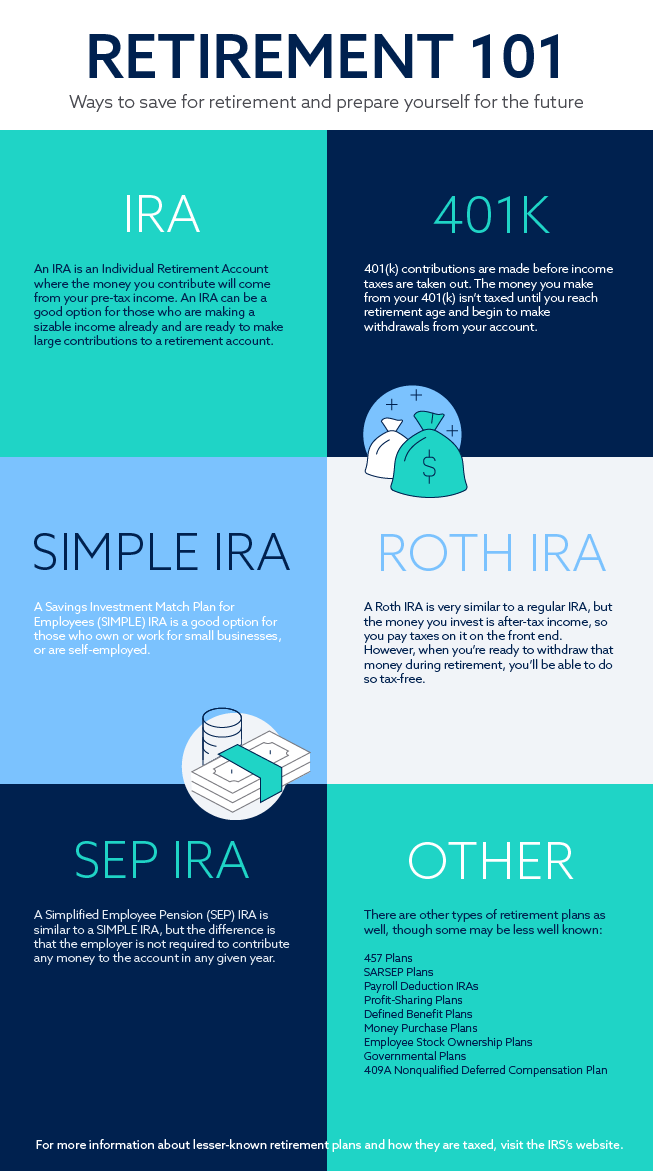

Types of Retirement Plans

Once you’ve gathered the necessary data, you can begin to explore the investment options available for retirement funds.

401(K)

Matching 401(k) programs are commonly offered to workers as an employer benefit. If you haven’t started saving for retirement, start by contributing to an employer-sponsored 401(k) if available. This type of retirement fund offers several advantages:

- Employer matching programs. Many employers match a percentage of the employee’s 401(k) contribution up to a certain threshold.

- Tax advantages. Money put in a 401(k) comes from your pre-tax income, which means you aren’t taxed on your contributions until they are withdrawn at retirement age. You’ll likely be in a lower tax bracket when you retire, so your tax burden will be even lower.

- Investment savings. Many funds are offered at a discount to 401(k) programs compared to what you would pay if you purchased them on the open market.

These are some potential 401(k) downsides:

- Contribution limits. For 2019, you can only contribute up to $19,000 to a 401(k) if you are younger than 50 or up to $25,000 after age 50. The IRS adjusts this threshold each year based on cost of living.

- Limited selection. You won’t have much control over where your money is invested with a 401(k).

- Tax disadvantages. You are required to take distributions beginning at age 70.5 and these withdrawals are taxed as ordinary income.

IRA

An IRA, or individual retirement account, is available to all individuals without employer involvement. Many tax experts recommend starting your retirement savings with an IRA if you don’t have an available 401(k) through your employer or if your employer doesn’t offer a matching program.

- Tax advantages. As with a 401(k), the funds come from your pre-tax income.

- Investment selection. This type of retirement account offers more control and flexibility than a 401(k).

However, there are some negative aspects to an IRA:

- Tax disadvantages. Money is taxed as regular income when you retire. If you need to make early withdrawals, they will be subject to additional tax. As with a 401(k), you must take distributions starting at age 70.5.

- Contribution limits. You can put away up to $6,000 in an IRA for 2019, or $7,000 if you are older than 50.

Roth IRA

A Roth IRA is similar to a standard IRA, but it’s funded with after-tax income. Since you’ve already paid taxes before investing in a Roth IRA, withdrawals are tax-free. For this reason, a Roth IRA is a good choice if you expect substantial income growth over the course of your career. You’ll be able to pay taxes on the investment while you’re in a lower tax bracket.

There are other advantages of a Roth IRA:

- Unlike funds that carry a penalty for distributions before retirement, Roth IRA funds can be withdrawn at any time. Minimum distributions during retirement are not required.

- Fund selection. With a Roth IRA, you can control the choice of funds and can choose from diverse investments.

The Roth plan does have downsides as well:

- Low contribution threshold. Like a traditional IRA, you can contribute $6,000 in 2019 or $7,000 if you are older than 50.

- Income limits. Higher-income individuals are not eligible to contribute to a Roth IRA. For 2019, this program phases out at annual income of $137,000 for single filers and $203,000 for married couples filing jointly

SIMPLE IRA

Self-employed individuals and small business owners can contribute to a Savings Investment Match Plan for Employees (SIMPLE) IRA. This type of account requires a matching contribution from your employer (whether that’s yourself or a company you don’t own, but are employed by), and is taxed under similar rules as a traditional IRA. You’ll contribute pre-tax dollars, but you will be taxed when you begin to withdraw the money.

SEP IRA

A Simplified Employee Pension (SEP) IRA is similar to a SIMPLE IRA, but does not require a matching employer contribution. Match programs that are offered must be the same percentage for each employee. Contributions made by the employer and by self-employed individuals are tax-deductible.

Other Retirement Plans

Although the options described above are the most common types of retirement plans, countless other plans exist. Each has unique tax advantages and disadvantages. The IRS provides detailed information about less common plans and how they are taxed.

When you get your credit score on track, you’ll save money by qualifying for lower interest rates. When less money is going toward repaying debts, you’ll have more freedom to begin building your next egg for retirement.

Take the first step on the path to a brighter financial future by repairing your credit with Lexington Law Firm. Call us today for a free personalized credit consultation to see how we can help you.

You can also start up a conversation on our social media channels. Like and follow and interact with us on Facebook, Instagram, and Twitter.

Article Updated June 2019