Credit cards and debit cards look nearly identical. Each has a 16-digit number and an expiration date. However, that’s the full extent of the similarity between these two cards.

Debit cards function very differently from credit cards, relying on money you actually have in your checking account to engage in transactions. On the other hand, credit cards essentially function as mediums for small loans in that you engage in a transaction on “credit” with the promise to repay it at a later date.

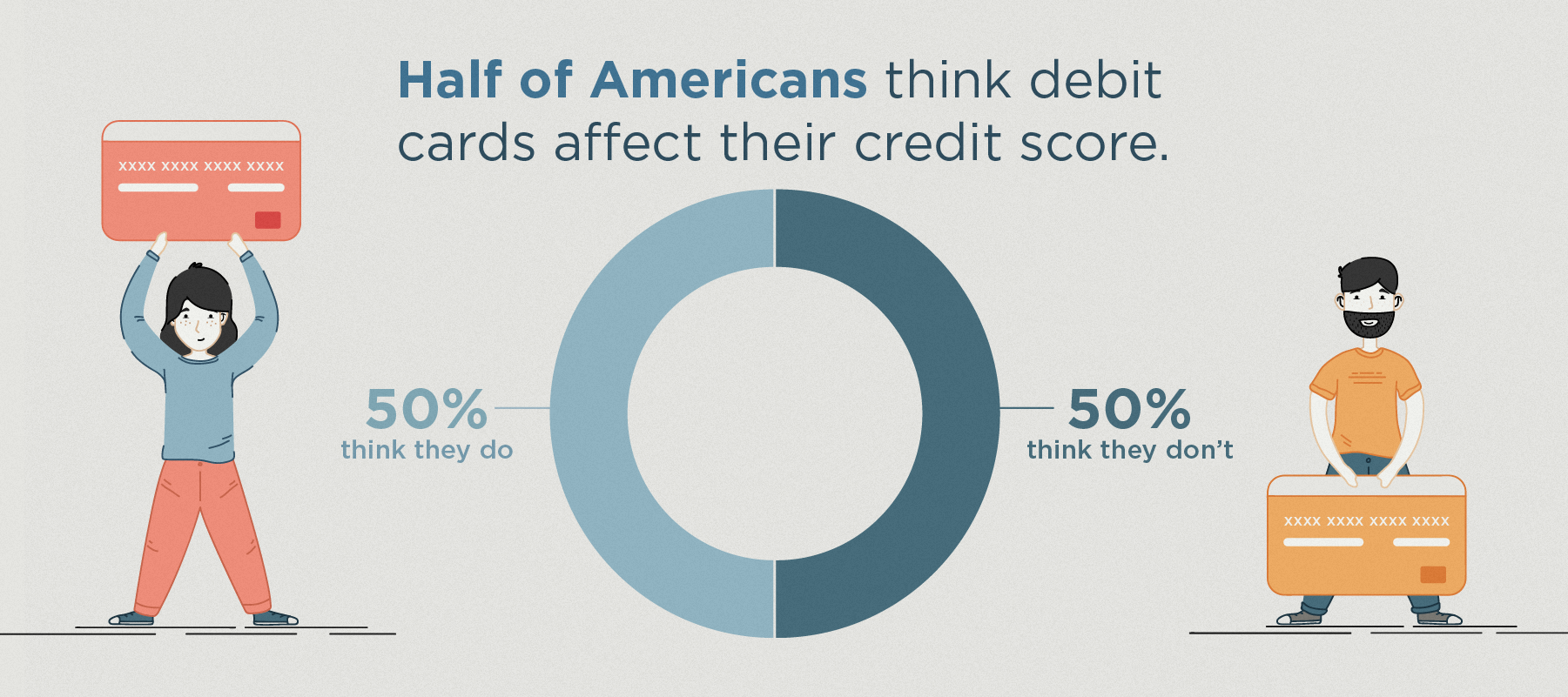

We wanted to see if Americans know the difference between credit cards and debit cards, so we surveyed 2,000 people and found that:

- Half of Americans think debit card spending impacts their credit score

- 1 in 3 Americans wrongly believe there are no fees associated with debit cards

When we asked Americans if they thought debit cards affect their credit score, there was a 50/50 split, suggesting many are unsure.

Based on these results, it seems that Americans don’t know which factors affect their credit score and which do not. This is pretty startling, considering that credit scores determine your eligibility to make major purchases and borrow money for mortgages, auto loans and student loans.

Credit agencies have specific formulas for calculating your credit score. Each of the three major credit bureaus (Experian, Equifax and TransUnion) report these scores with minor differences, but all represent a similar view of your credit history. Your credit score is calculated using payment history, amount owed and types of credit used among other things. However, it does not use any activity from debit card usage, since this cannot be found on your credit report.

Over 1 in 3 Americans think there are no fees or payments associated with debit cards

In March 2018, there were approximately 555 million VISA debit card holders in the United States. With so many card holders, you’d think that most Americans would understand the way debit cards work when compared to credit cards. This doesn’t seem to be the case.

We asked Americans if there were fees or payments associated with debit cards, just as there are with credit cards. Nearly 37 percent incorrectly said there were no fees for debit cards.

In fact, there are many types of fees that can be accrued through debit card usage, including PIN fees, overdraft fees, ATM card charges, minimum fees and international fees.

One of the most common of these charges is the overdraft fee. Users of checking accounts sometimes engage in transactions that use more money than is available in their account. This usually results in a financial institution charging an overdraft fee.

The Consumer Finance Protection Bureau states that overdraft fees are typically triggered by small transactions – the median amount is $24 for debit cards. These small transactions may go unnoticed by card holders who don’t know the fees associated with overdrafting or who treat their debit cards like credit cards and as a result, could be at risk of losing additional money via these charges. In fact, for those penalized by overdrafting, these fees account for 75 percent of their total checking account fees and average around $250 per year.

It’s important to understand the differences in function between credit and debit cards. Confusing them can lead to expensive consequences like overdraft fees and dings to your credit score. Overdraft protection is one way you can protect yourself, but it may be more efficient to first understand how your cards work.

If you’re unsure how to build your credit, get a new credit card or use a debit card and checking account, contact your financial institution for advice. This will help you avoid making a serious mistake that could potentially affect your credit score and your financial stability.

Sources

Investopedia | Statista | Consumer Finance | Department of Financial Institutions