As the school year ushers in a new class of high school seniors, college questions abound. For many students and their families, cost concerns are centrally important. Is going to a private college worth the extra expense over a public university? Will you earn more over your lifetime with a private school degree – enough to offset the additional costs?

These questions are more relevant than ever as college graduates across the nation now struggle with massive student loan debt. In this project, we hoped to shed some light on the cost calculus, taking a purely financial view of the value of a degree from the nation’s top public and private schools. If you’re looking for an educational investment that will pay dividends in cold, hard cash, our results are worth a look.

Methodology

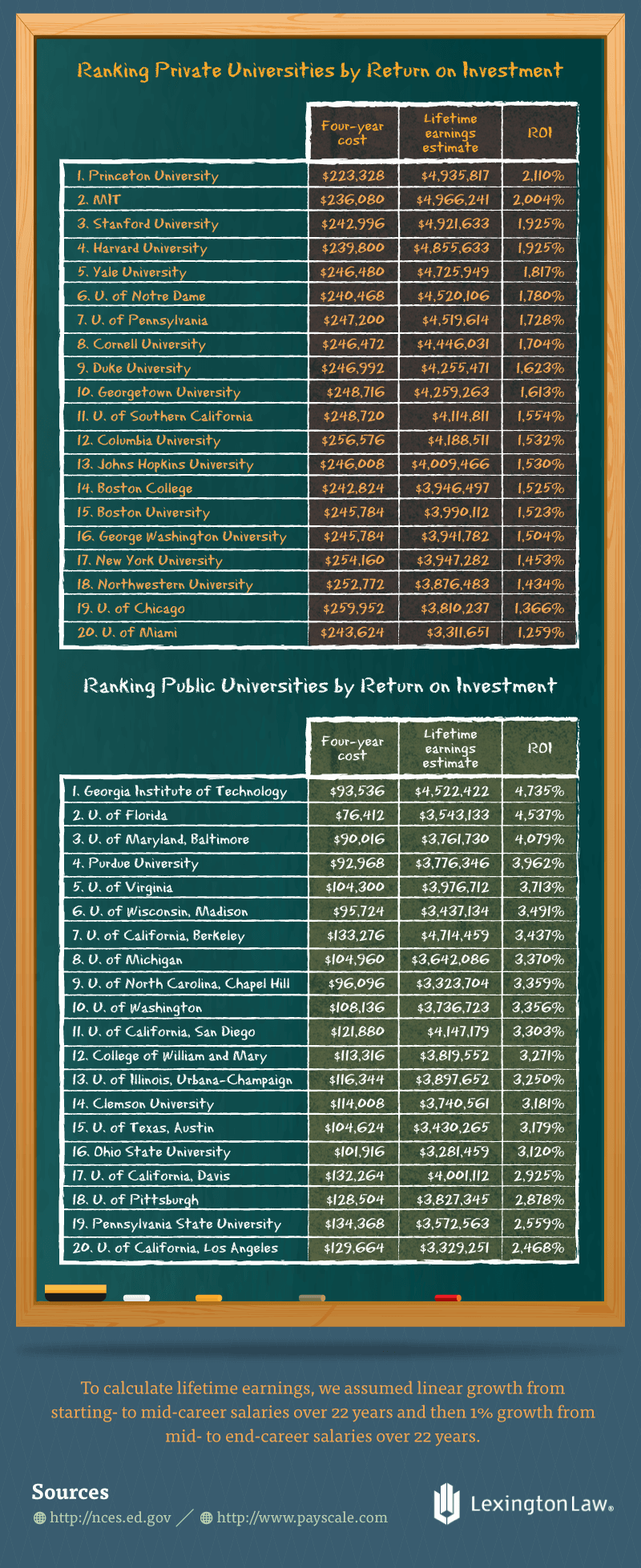

We studied data from the top 20 public and private universities, based on the most recent U.S. News and World Report ranking of national universities. Average starting and mid-career salaries were also based on data from that list. Since viable research for end-of-career salary estimates was unavailable, we applied an estimated 1% salary increase each year, from age 44 to 65.

We collected total student debt from the National Center for Education Statistics from the 2013–2014 school year for our list of universities as well. This includes the costs of in-state tuition, books, room and board, and miscellaneous fees. We subtracted cost of living expenses from accumulated earnings, starting at $25,677 per year and increasing by 1% annually.

Some Conclusions

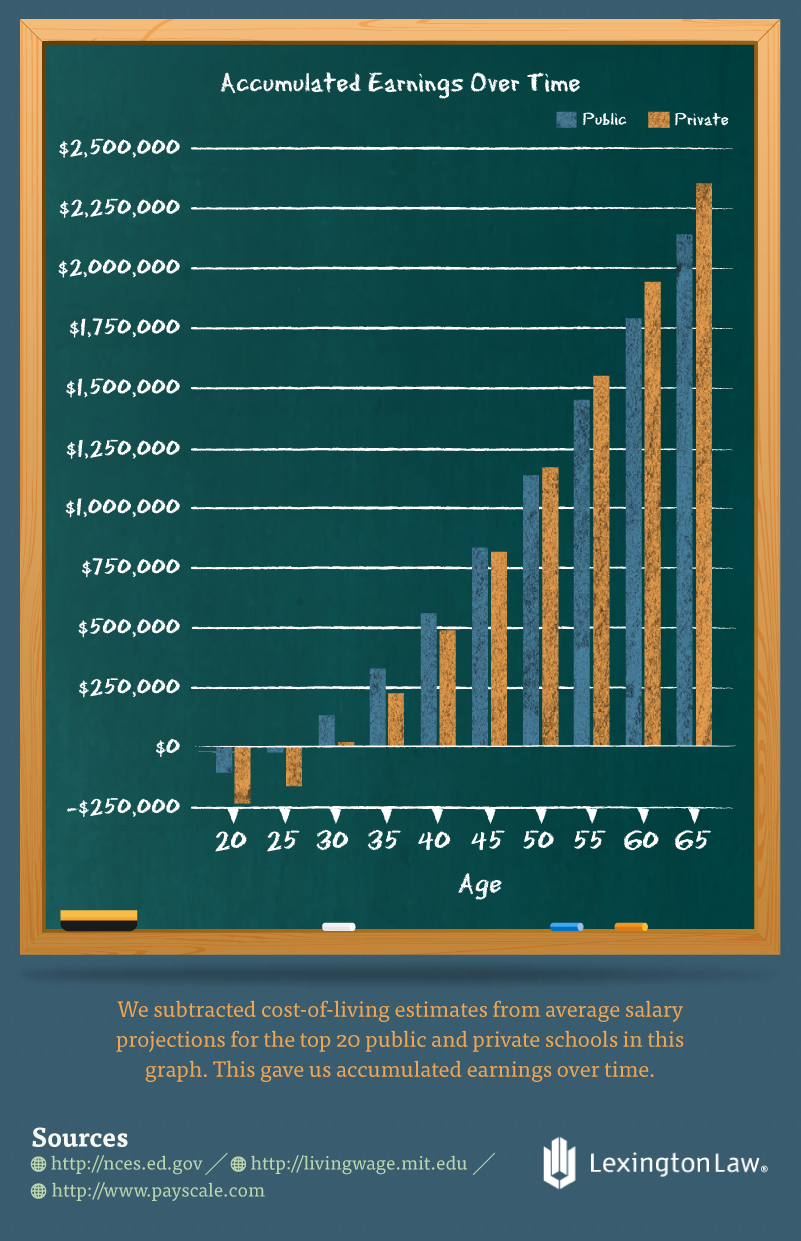

Here’s the short answer: Over a lifetime, you will earn about 10% more income if you go to a private college. That’s enough to retire about three years earlier. The long answer is that a private college may only be feasible for those who can overcome the initial roadblocks. Average tuition this year at a private, nonprofit, four-year college is $31,231 – exponentially higher than $1,832 in 1971–1972 (in current dollars). On the other hand, average tuition this year at a public, four-year college is $9,139, which – while still much higher than $428 in 1971–1972 – is substantially lower than private college tuition.

A private college education also adds at least four extra years to your debt versus a public college, and paying off student loans for years without the ability to save can hurt retirement funds. A lower sticker price and less initial debt may sway prospective students to choose public universities.

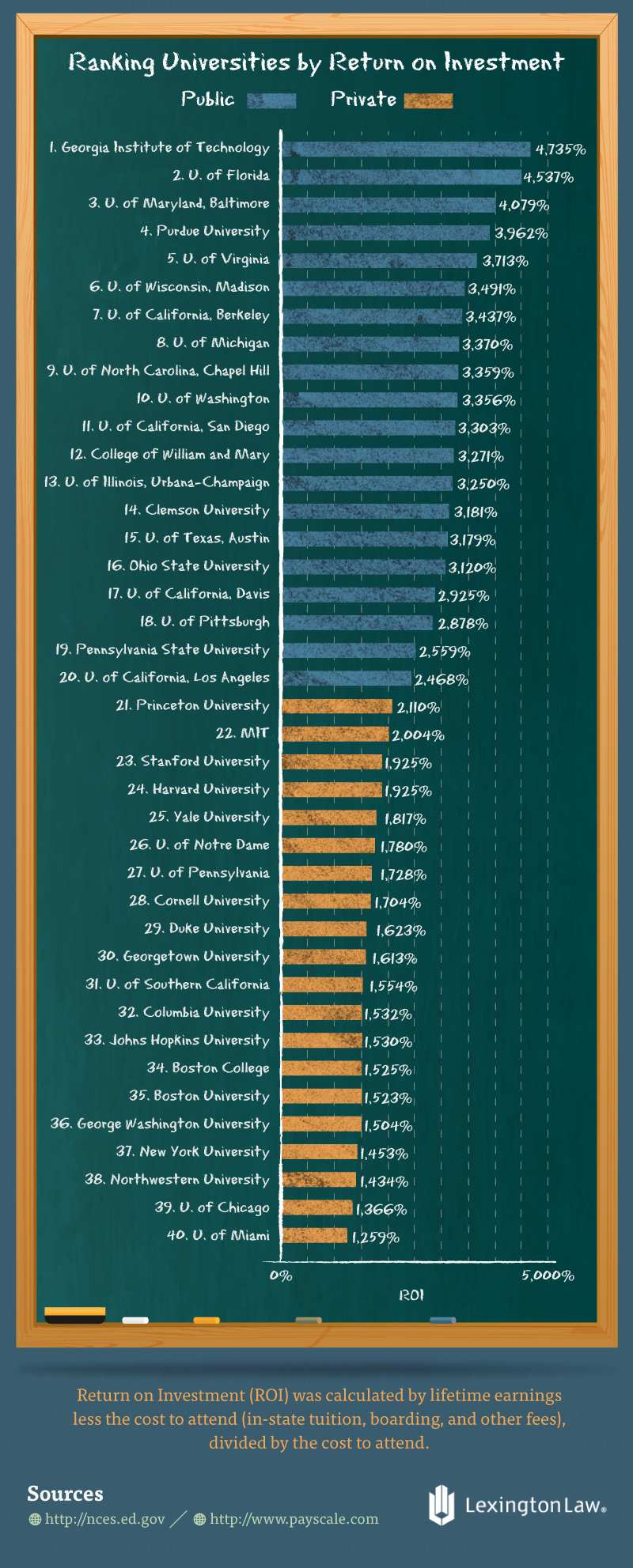

Those in their early 20s and facing major life decisions may especially find public universities attractive. The cost of an average wedding, for example, has risen to over $30,000, and the average cost of raising a child to the age of 18 has risen to $245,000 (excluding higher education costs); student debt can make these choices financially difficult. Another plus for public colleges is their return on investment (ROI) is twice what it is for private colleges, which means you can still achieve significant lifetime earnings with a public university education.

There are many factors that contribute to which college is best for you: Different colleges specialize in different fields and programs, and they also carry varying levels of prestige in the job market.

For example, many private colleges specialize in the liberal arts and offer four-year programs that lead to a bachelor’s degree. Public universities, on the other hand, are often larger and have a wider variety of majors and degree options. Both prepare you for various careers or graduate study, but one might be a better fit than the other.

Some colleges are considered more prestigious than others, but private colleges aren’t always more so than public universities. We looked at lifetime earnings estimates for the top 20 public and private colleges in America as well as their ROI and found that in some cases, a top-tier public university will net you more than a private college further down the list.

Here is another graph focusing on the ROI difference between those same public and private universities. One might assume that because private colleges lead to a higher annual income, they would have a higher ROI than public colleges. The results, however, clearly point to public universities as having the highest ROI. This is because the initial “investment” of tuition, room and board, books, and other fees is higher at private universities.

On the other hand, there are some aspects of a college education that the ROI calculation cannot measure, such as the college’s prestige, the quality of a professor’s instruction, the student’s choice of major, and the school’s alumni network, which tends to thrive at top-tier private colleges. All of these factors play a part in the ROI you get from your college education.

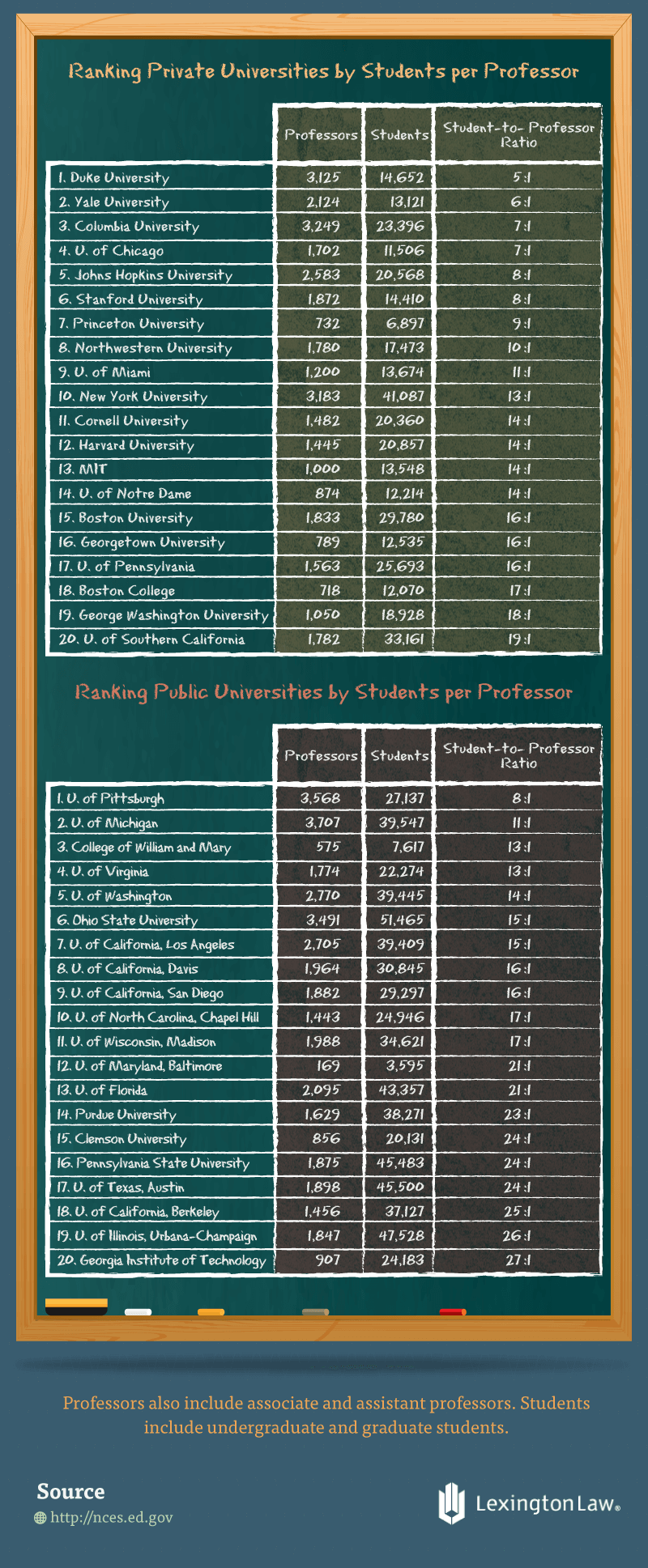

A good professor can mean the difference between a student acing a subject and feeling utterly lost. However, it’s challenging to measure a professor’s quality of teaching. Most universities use student evaluations to track professor performance, but response rates and sampling biases make the averaging of results unreliable.

Still, there’s one simple metric that sheds light: the ratio of a university’s professors to students. The main benefit of this perspective? Smaller classes typically equal more attention from professors, and when professors get to know their students personally, they are able to educate them more effectively. Our findings show private universities have a slight edge on public universities in this area.

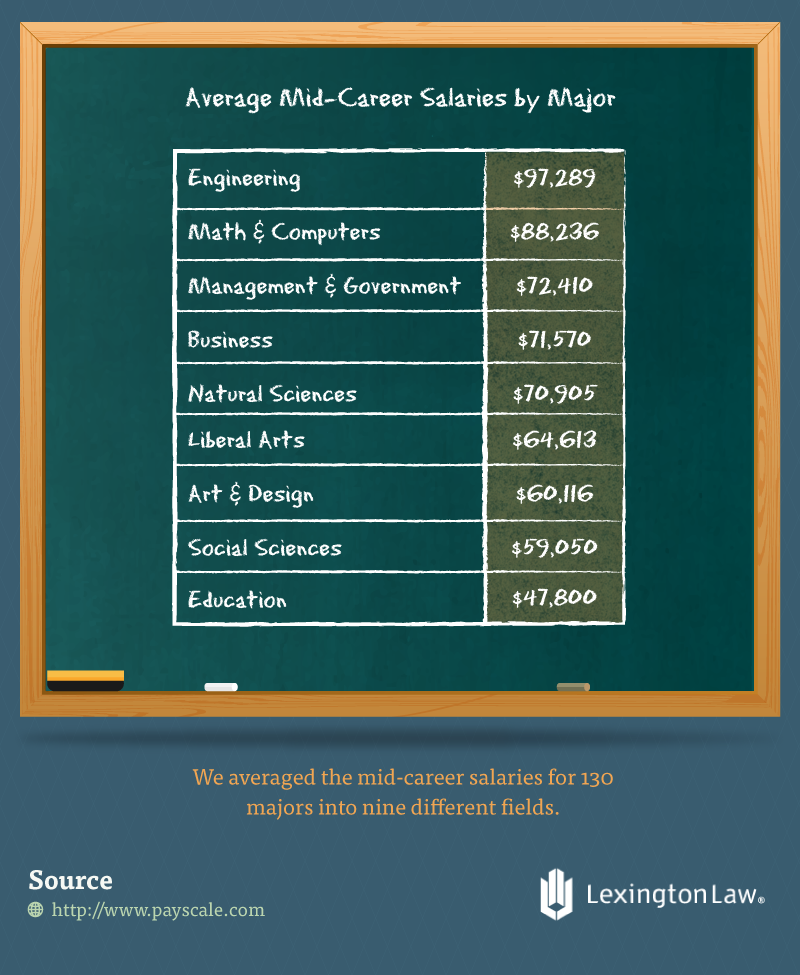

The major you choose has a big influence on your future salary. Certain majors often lead to either high or low-paying job fields, and your choice also greatly affects the specific job you land and how quickly you can work your way up the corporate ladder.

The general assumption is that science, technology, engineering, and math (STEM) majors guarantee students higher future salaries than majors in the humanities, which is often true, but a study from Georgetown University revealed that it’s not always the case: The top 25% of humanities and liberal arts majors, for instance, earn more than the bottom 25% of engineering majors. This implies that it’s not always about what major you choose but how effectively you take advantage of that major in your future.

Know your options, make an informed decision, and follow your passions when deciding on your major. Salary is important, but it’s not the complete picture for your future happiness. Many studies have found a correlation between money and happiness but not causation. It may be more that money helps avoid unhappiness, yet in the end you have control over how you spend your money.

Conclusion

If you have the financial means and previous academic success to impress the admissions committee at a top-tier private college, you will likely make the most money going there over your lifetime. However, for many students the public route is a viable alternative. The main difference comes down to financial stability in your 20s. Increased levels of student debt may force major life purchases to occur later on in life.

Sources:

- http://www.cnbc.com/2015/06/15/the-high-economic-and-social-costs-of-student-loan-debt.html

- http://nces.ed.gov/ipeds/datacenter

- http://livingwage.mit.edu/states/06

- http://colleges.usnews.rankingsandreviews.com/best-colleges

- http://www.payscale.com/college-salary-report-2014/full-list-of-schools

- http://trends.collegeboard.org/college-pricing/figures-tables/tuition-fees-room-board-time

- http://www.nytimes.com/2014/06/14/your-money/student-loans/paying-off-student-loans-can-cost-you-in-retirement.html

- https://bigfuture.collegeboard.org/find-colleges/college-101/types-of-colleges-the-basics

- http://money.cnn.com/2015/03/12/pf/planning-for-wedding-costs/

- http://money.cnn.com/2014/08/18/pf/child-cost/

- http://www.cnbc.com/2015/07/03/do-public-colleges-offer-the-best-return-on-investment.html

- http://www.npr.org/sections/ed/2015/04/26/401953167/what-if-students-could-fire-their-professors

- http://edglossary.org/student-teacher-ratio/

- http://www.forbes.com/sites/susanadams/2015/05/07/the-highest-and-lowest-paying-college-majors/

- http://time.com/money/3680465/happiness-and-money-study/