What’s a good credit score? A guide to credit score ranges

February 27, 2024

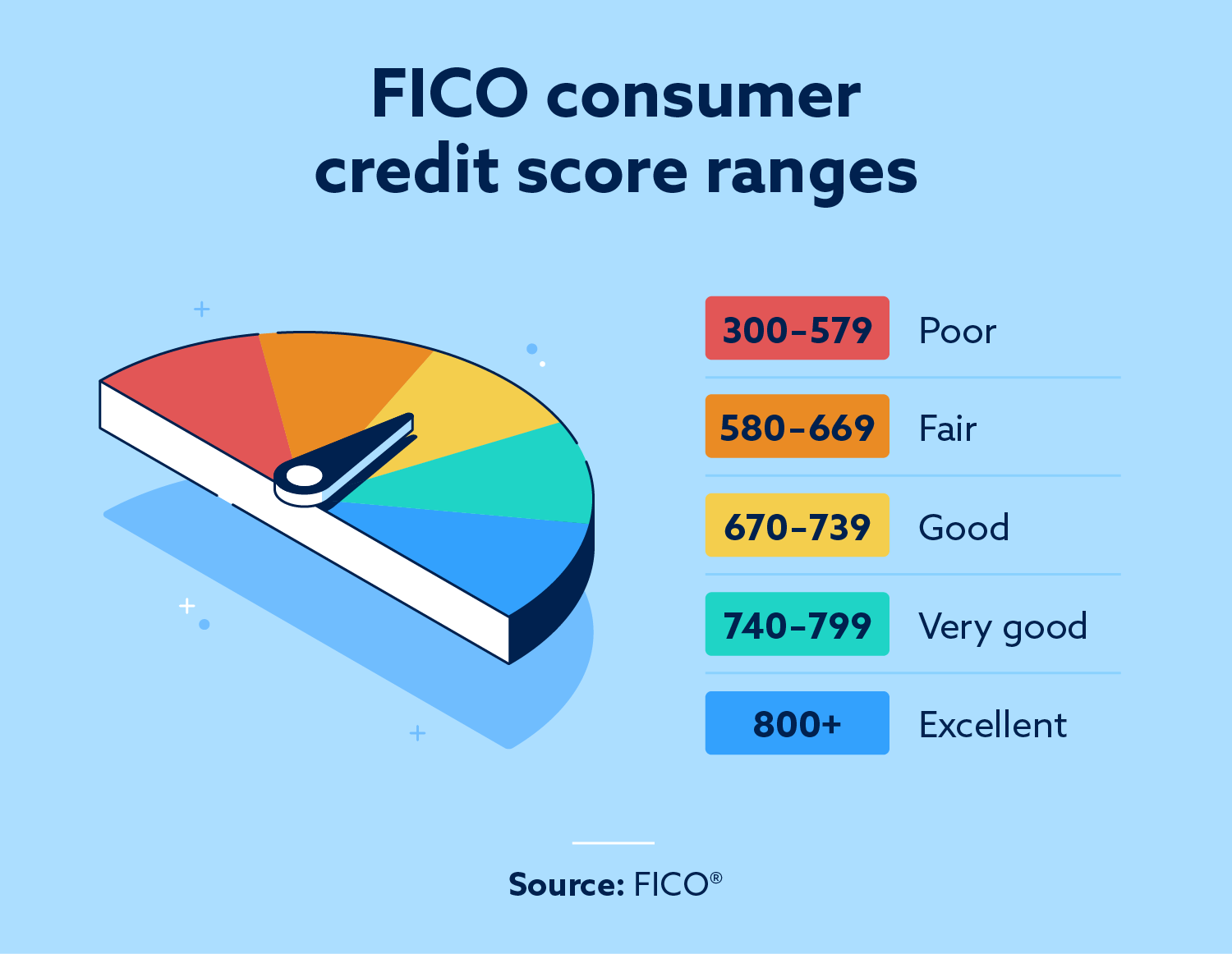

Your credit score is a three-digit number, often between 300 and 850, designed to represent how likely you are going to pay bills on time. Depending on your number, you’ll fall into one of the following credit score ranges: poor, fair, good, very good or excellent.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Whether you’re applying for a new line of credit, looking to rent an apartment or signing up for a new cell phone service, your credit score may determine how much you pay. In some cases, your score may prevent you from getting approved at all. By having an excellent credit score, you avoid a lot of these issues, but what constitutes “excellent”?

Your FICO® credit score is typically a number between 300 and 850 that falls into one of these more specific credit score ranges: poor, fair, good, very good or excellent. In this guide, you’ll learn the differences between each credit tier, what separates a “bad” credit score from a “good” credit score and how to improve your credit no matter where you’re at to set yourself up for financial success.

What is a credit score range?

A credit score range is a smaller grouping of scores within the overall scale, which is usually 300 – 850. There are many scoring models available, and they all have their own specifications for their ranges. The two most popular scoring models, VantageScore® and FICO, each use their own formulas that prioritize different aspects of your credit history. FICO has the poor, fair, good, very good and excellent credit score ranges, while VantageScore only uses poor, fair, good and excellent.

When you better understand how credit scores work within these ranges, you’ll be better able to improve your credit in the long run. Plus, it makes it easier for you to predict whether you’ll qualify for a new loan or credit card.

VantageScore 3.0 credit score ranges

The VantageScore 3.0 model uses the following ranges to determine the health of your score:

| Credit score range | Rating |

|---|---|

| 300 – 600 | Poor |

| 601 – 660 | Fair |

| 661 – 780 | Good |

| 781 – 850 | Excellent |

FICO credit score ranges

FICO has two primary types of credit scores: consumer credit scores and industry-specific credit scores. While a consumer credit score gives a basic idea of your overall credit history, industry-specific scores are more refined for the type of loan you’re seeking. For example, a lender may use a FICO Auto Score if you’re seeking an auto loan.

It’s important to note that more lending decisions will be based on your FICO score than any other score. According to Forbes, lenders use FICO scores 90 percent of the time for their decisions.

FICO consumer score ranges

| Credit score range | Rating |

|---|---|

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very good |

| 800 – 850 | Excellent |

FICO industry-specific score ranges

| Credit score range | Rating |

|---|---|

| 250 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very good |

| 800 – 900 | Excellent |

What is considered a good credit score?

A “good” FICO credit score typically falls in the range of 670 – 739, while a good VantageScore is between 661 and 780. This means that a score of 670 or higher will generally be considered “good” no matter what model your lender is using.

As mentioned earlier, FICO is the predominant scoring model lenders use, so that’s what we’ll be focusing on while discussing the various ranges.

Poor credit score range: 300 – 579

A poor credit score is going to make it difficult for you to receive loans or any line of credit. Within this range, the majority of lenders will deny your application. If you are approved for services, they may require a large deposit or give you unfavorable terms that cost you a lot more in the long run. If your credit score is below 579, it’s advantageous to learn how to fix your credit, which can make life much easier and save you money.

Fair credit score range: 580 – 669

While consumers with fair scores still have a lot of room for improvement, they’re more likely to be approved for credit than those with poor scores. When you’re in this range, you’ll want to ensure you pay your bills on time to continue to build your credit, because doing so can save you money on interest rates.

Good credit score range: 670 – 739

The benefits of having a good credit score are that you have an easier time being approved for loans and often get better interest rates. These scores won’t get you the very best interest rates, but you’re less likely to pay high fees and interest, which is a big plus. As of 2022, Experian reported that the average credit score in the U.S. fell within this range at 714 points.

Very good to excellent credit score range: 740+

Those with scores in this range will generally get the best offers and lowest interest rates on the market. If you’re an overachiever, you may be asking, “What is the best credit score, and how do I achieve it?” The best standard FICO credit score is 850. Even if you can do everything right in order to improve your credit, achieving a score of 850 can still take a long time. A key factor for your score is credit age, so it may take years of checking your credit reports and maintaining responsible credit usage before you reach this goal.

Fortunately, even without hitting 850 exactly, you’ll still get many benefits from being in the very good to excellent credit score ranges, especially when it comes to saving money on loans and credit cards. With time and effort, having a score in this range can be attainable for you.

Understanding your credit range

Understanding which range your score is in can help you make strategic choices about what you should apply for. For example, if you have a poor credit score, you have a high chance of being denied if you apply for a loan or a high-reward credit card, so you might want to improve your credit before you apply. Understanding where you fall can also help you set goals to improve your credit.

Different credit scores

Due to the variety of scoring models, it may be difficult to understand what range you actually fall in. For example, a score of 665 is “good” for a VantageScore, but it’s considered “fair” with the FICO scoring model. As we mentioned before, a lot of lenders create their own credit score scale that may have a different definition of what is poor, fair, good or excellent.

What lenders look for

Remember, your credit score is a number that gives lenders a way to assess your credit risk. Lenders are asking, “Will this person pay their bills on time?” Aside from your credit score, lenders may look at your credit report for negative marks like late payments, collections and bankruptcies. They may also look at your debt-to-income ratio for larger purchases like home loans, which means they want to see how much money you make compared to your debt.

What factors affect your credit score?

FICO weighs credit scores based on five primary factors. Each factor is weighted differently to compose your overall total score. For example, applying for new lines of credit accounts for only 10 percent of your score, whereas your credit utilization rate makes up 30 percent of your score.

- Payment history (35 percent): How often you pay your accounts on time

- Credit utilization (30 percent): How much you spend compared to your overall credit limit (ideally, you want to spend less than 30 percent of your max limit)

- Length of credit history (15 percent): How much experience you have with credit based on the age of your oldest account

- Credit mix (10 percent): What types of different credit accounts you have, such as credit cards, auto loans, student loans and home loans

- New credit (10 percent): How often you apply for new lines of credit

How credit score ranges affect your life

What credit score range you fall into can cost you money or save you money. For example, if your score is lower than 600, you may be able to get credit, but it will often come with high fees and interest rates. Here are a few other ways your credit can affect your life that you may not know about.

- Employment: Some employers check credit during the application process. This is most common when the specific job involves handling money or high-risk situations.

- Insurance: Insurance companies calculate their own insurance score to predict the likelihood you will have an accident or file a claim, and credit scores are a part of this calculation.

- Utilities: When you open an account to get water, electricity and heat at your house, the company will likely run your credit. If your credit score is low, you may have to pay a hefty deposit.

- Rentals: Most people know that a good credit score is required to take out a mortgage loan, but leases often require good credit as well. Landlords will often look at your credit to determine if you will be able to make rent on time. Those with a low score may pay higher deposits or may not be approved at all.

How to improve your credit

If you have a low credit score, you can always work to improve it as long as you take the necessary steps. Now that you know what affects your credit score, here are some simple tips to improve your credit:

- Pay off any collections first

- Never miss a payment

- Reduce your credit utilization to below 30 percent of your max limit

- Pay more than the minimum, and pay early when possible

- Regularly check your credit report for potential errors

The benefits of credit monitoring

Since your credit score impacts so many areas of your life, monitoring your credit score is important. The ability to monitor your credit can help you catch any drops in your score or potential errors sooner rather than later. Errors that show missed payments and other negative marks can significantly drop your score, so it’s important to know as soon as these happen.

If you have errors on your credit reports, Lexington Law may be able to help. For 19 years, we’ve been helping clients work on their credit by addressing negative information that is unfair, inaccurate and unsubstantiated. Take our free credit assessment now to get started.

Sarah Raja was born and raised in Phoenix, Arizona. In 2010 she earned a bachelor’s degree in Psychology from Arizona State University. Sarah then clerked at personal injury firm while she studied for the Law School Admissions Test. In 2016, Sarah graduated from Arizona Summit Law School with a Juris Doctor degree. While in law school Sarah had a passion for mediation and participated in the school’s mediation clinic and mediated cases for the Phoenix Justice Courts.

Prior to joining Lexington Law Firm, Sarah practiced in the areas of real property law, HOA law, family law, and disability law in the State of Arizona. In 2020, Sarah opened her own mediation firm with her business partner, where they specialize in assisting couples through divorce in a communicative and civilized manner. In her spare time, Sarah enjoys spending time with family and friends, practicing yoga, and traveling.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.