The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A credit report breaks down your credit history into five main sections: personal information, public records, credit inquiries, account information and consumer statements.

While a credit score offers a high-level overview of your current financial standing, a credit report offers an in-depth look at your lending history. Each consumer has three main credit reports (one each from Experian, Equifax, and TransUnion), and it’s important to read through each of these credit reports at least once a year in order to stay on top of any inaccurate, outdated, or missing information.

Below, we walk through how to read a credit report and the red flags to watch out for in a credit report, and then we break down the different codes used by the credit bureaus in their reports.

Why are credit reports important

Before unpacking what goes into a credit report, you should know why it matters. Your credit report reflects how responsible you are with your money and can impact your ability to secure a loan, an apartment or house, a reasonable insurance rate, and even a job. By learning how to read a credit report, you’ll be able to make decisions that improve your creditworthiness and therefore your ability to achieve your long-term financial goals.

How to read your credit report

A credit report breaks down your credit history into five main sections:

- Personal information

- Public records

- Credit inquiries

- Account information

- Consumer statements

Personal information

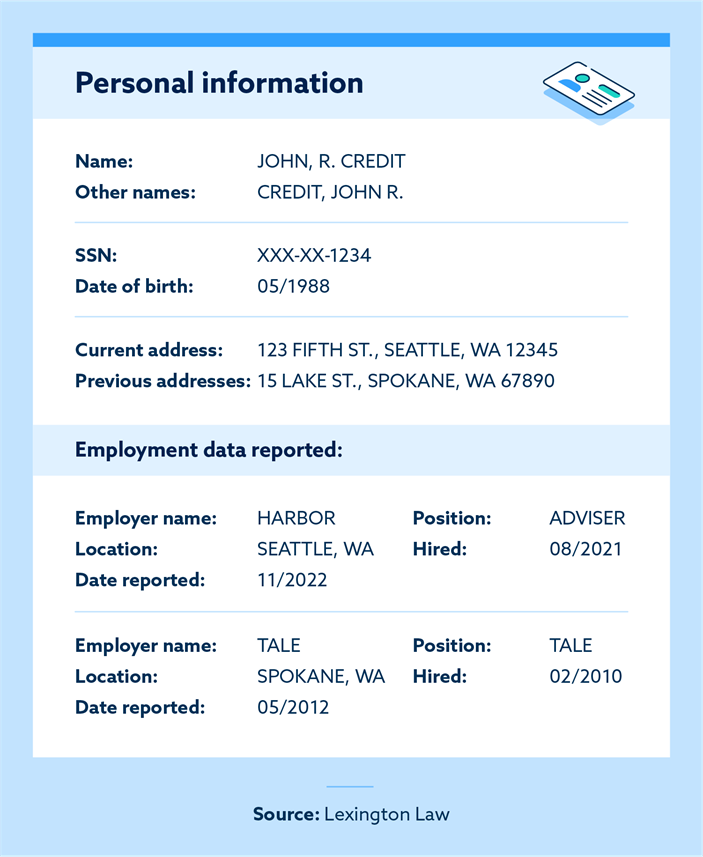

The first section in your credit report is your personal information, which includes your:

- Full name

- Current and previous addresses

- Date of birth

- Social Security number

- Phone number

- Employment information

Personal information is updated using data that you and your creditors provide. Inaccurate information in this section can be a sign that some applications were reported in error or that fraudulent accounts were opened under your name.

Watch out for:

- Names you don’t recognize: Multiple names could mean someone is using your information to apply for credit.

- Addresses at which you haven’t resided: Fraudulent accounts may be tied to a separate address in order to redirect mail and important documents without your knowledge.

- Unknown phone numbers: Scammers offer separate phone numbers to creditors so that you won’t receive calls about fraudulent accounts.

- Incorrect Social Security number: Social Security numbers you don’t recognize can also be a sign of fraudulent activity.

Public records

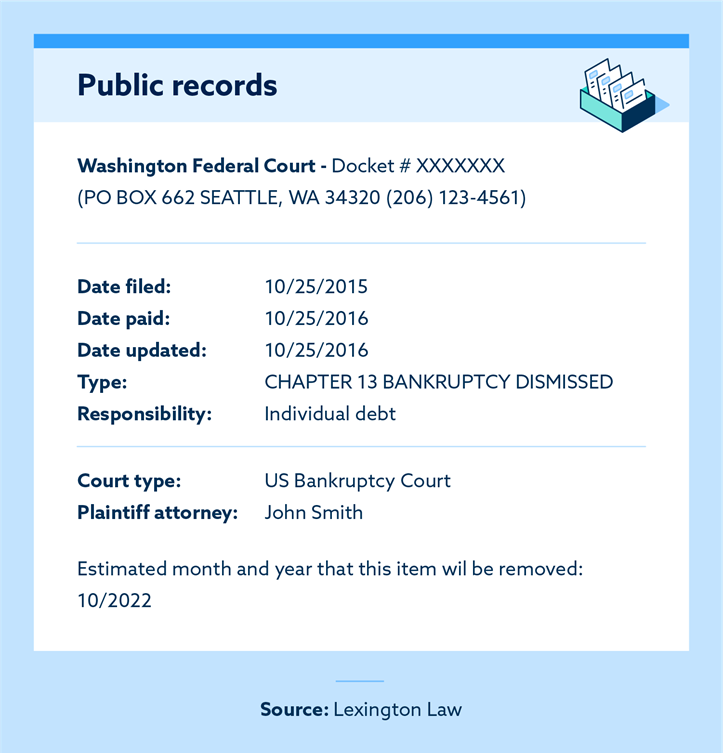

Public records cover information gathered from courts or other government agencies about legal matters related to you. Due to recent changes in the law, the only public records shown on credit reports are bankruptcies.

Watch out for:

- Public records that are too old: Bankruptcies will stay on your credit report for seven to 10 years. If you see bankruptcy or foreclosure information on your report after the seven- to 10 year-mark, contact the credit bureaus to have this information corrected.

Credit inquiries

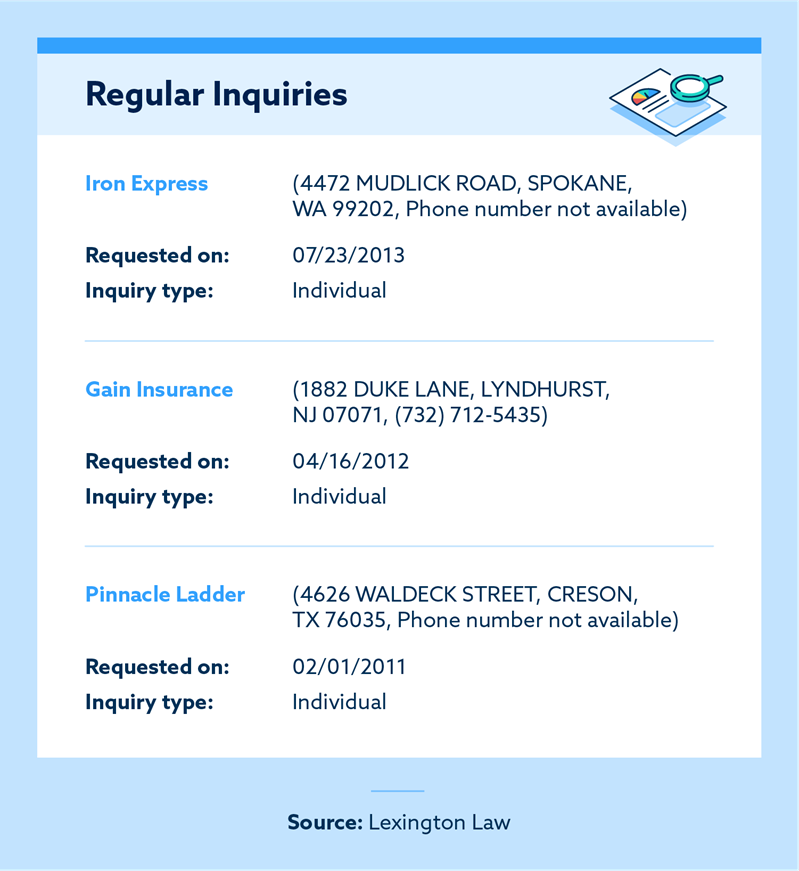

Hard and soft credit inquiries are listed on your credit report and give you a good idea of what creditors are viewing your credit report.

- Soft inquiries: This includes times you have viewed your own credit report and when creditors prequalify you for credit cards or loans. Soft inquiries will not affect your credit.

- Hard inquiries: These are conducted mostly by creditors as a part of their application process. Hard inquiries should be checked thoroughly for any issues, as they will affect your credit score for up to two years.

Watch out for:

- Inquiries you don’t recognize: Some hard inquiries are filed in error and others could be signs of fraudulent accounts or fraudulent application processes. If you do not recognize the creditor who filed the inquiry, it’s best to dispute the instance and ask for its removal.

- Multiple hard inquiries from the same creditor: Occasionally the same creditor might submit a hard pull for your credit multiple times. Even if you approved the original inquiry, if the creditor was not up front about the number of hard credit pulls, you may ask for its removal.

Account information

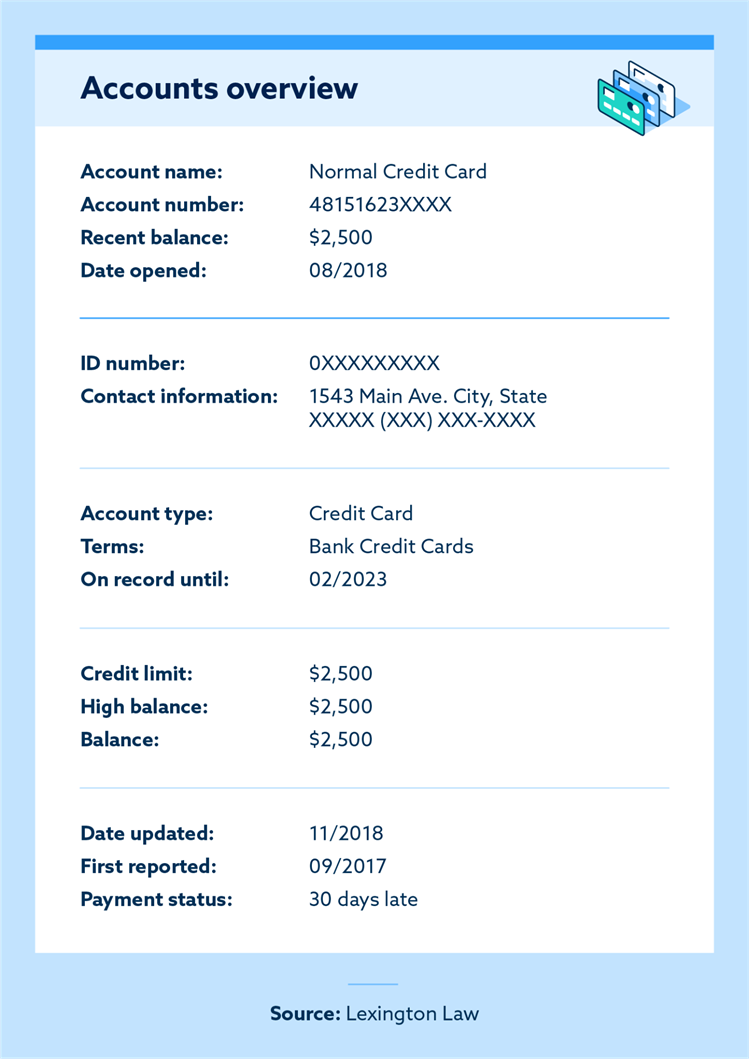

The account portion of your credit report will display all your accounts and lines of credit, including credit cards and loans, reporting to the relevant credit bureau. This section will include both open accounts (all active lines of credit) and closed accounts (including information on why the account was closed).

Additional account information included in your report includes:

- Type of account (credit card, student loan, etc.)

- Dates the account was opened and closed

- Payment history

- Credit utilization

- Current account balance

- Loan payment status

- Name and address of the creditor

- Whether you’re an individual or joint owner of the account or simply an authorized user

Watch out for:

- Accounts you’re not aware of opening: If you notice any accounts you don’t recall opening, you should contact the creditor for more information regarding the line of credit.

- Charges you don’t remember: Charges or account totals can be reported in error. If charge numbers vary significantly, they can impact your credit utilization, which factors into your overall credit score.

- Late payments that you made on time: Late payments count as negative marks on your credit and mark you as a higher risk when you apply for new lines of credit.

- Reported delinquencies you’ve paid off: If you’ve paid any delinquent or late debts it might be worthwhile to send a goodwill letter to the creditor.

Consumer statements

Consumer statements are a flag of sorts to lenders that you were unable to make a payment on time or had a dispute with a creditor at some point. If you were able to resolve the issue that spurred you to write a consumer statement before the 10-year mark, you can request it be removed from your credit report.

Any statements you have given to a credit bureau appear here. For instance, if you disagree with the results of a dispute, you can add a statement that’s included in your credit report.

Watch out for:

- Consumer statements that are too old: Consumer statements can remain on your report for 10 years. Keep track of how long it’s been since you added your consumer statement to ensure it falls off your report within the expected time frame.

How to read reports from each credit bureau

The information included in your credit report is largely the same across the three credit bureaus.

However, the codes used to categorize your information differ from bureau to bureau—so a code used by one bureau doesn’t necessarily mean the same thing for another bureau.

Each bureau offers its own guide for how to read their reports, including a glossary of codes. You can access the guides below:

How to get your free credit report information

AnnualCreditReport.com is an online portal through which you can see copies of your credit reports for free, although you should note that your credit reports don’t include your credit score. The Fair Credit Reporting Act gives you the right to access a free credit report once a year from each of the three major credit bureaus. In addition, you are entitled to a free credit report after you are denied credit from a potential lender or creditor or an adverse action was taking against you. The company that denied you credit must provide the name, address, and phone number of the credit bureau where they received the information.

How to dispute errors on your credit report

When you spot an error on one of your credit reports, you’ll want to contact the credit bureau that included the inaccurate information in the report.

Here’s the general process for disputing an error on your credit report:

- Gather documentation proving that the error is indeed an error.

- Mail off all the documents to the credit bureau. Don’t forget to ask for a tracking number to ensure your dispute reaches the bureau.

- Wait for the credit bureau to respond to you. They have 30 – 45 days from the date they receive your dispute to respond.

For help with the dispute process, you can turn to the credit repair consultants at Lexington Law Firm. We can help clean up your credit reports by thoroughly examining your reports, with your help find inaccuracies and disputing questionable negative items on your behalf. Knowing how to read a credit report correctly will help you spot any signs of identity theft and erroneous or unsubstantiated negative items that don’t belong on your report. Lexington Law Firm can help you work to address inaccurate information and improve your credit through our credit repair process.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.