How to dispute errors on your credit report in 3 simple steps

May 06, 2025

If you have an error on your credit report, you can file a dispute to have the inaccurate information removed. Filing a dispute is as simple as sending a letter along with evidence to the credit bureau that is reporting the error: Equifax, Experian or TransUnion.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Any inaccurate information on your credit report could be bringing down your credit score. Credit report errors vary from simple mistakes like a misspelled name to serious problems like fraudulent accounts resulting from identity theft.

A 2021 survey by Consumer Reports revealed that more than one-third of respondents found at least one error on their credit report. About 10 percent of those surveyed found errors related to things like unrecognized accounts or payments incorrectly marked as late or missing. These errors could lead to your score decreasing, so it’s important to take action on removing any inaccurate information.

Fortunately, the dispute process is completely free and fairly straightforward: get a copy of your credit reports to review, send a letter to the credit bureaus to initiate a dispute and, if necessary, contact whoever furnished the inaccurate information. Keep reading to learn exactly how to file a dispute and get answers to common questions about this process.

Step 1: Get a copy of your credit reports

Though technically not part of the dispute process, the first thing you’ll want to do is get a copy of your credit reports. While people often talk about a single credit report, the truth is that each of the three major credit bureaus—Equifax, Experian and TransUnion—maintains individual credit reports.

To get a copy of your free credit reports, you can visit the federally authorized Annual Credit Report website, which enables you to access your report from each bureau weekly. Once you’ve provided your information and gotten access to your report, make sure to download a copy so you can take a closer look at the information.

If you’ve already spotted an error on one report, you’ll want to see if the error is replicated on other reports. If it is, you’ll want to file a dispute with every credit bureau that is reporting the inaccurate information.

If you’ve spotted any errors, you’re ready to take the next step and send a letter to the credit bureaus so that they can begin an investigation.

Step 2: Send a letter to the credit bureaus

The most crucial step in the dispute process is sending a letter—along with supporting evidence—to the credit bureau reporting the inaccurate information. The process for each credit bureau varies slightly, but you can find information for each of the bureaus using the links in the table below.

| Equifax | TransUnion | Experian |

|---|---|---|

| File a dispute online | File a dispute online | File a dispute online |

| Equifax PO Box 740256 Atlanta, GA 30374-0256 1 (888) 378-4329 Instructions |

TransUnion LLC Consumer Dispute Center PO Box 2000 Chester, PA 19016 1 (800) 916-8800 Instructions |

Experian PO Box 4500 Allen, TX 75013 1 (888) 397-3742 Instructions |

In general, each credit bureau requires that you provide the following information when submitting your dispute letter:

- Your full name, date of birth and Social Security number

- Your current address and past addresses from the previous two years

- A copy of valid identification, like a driver’s license or passport

- A list of the items you believe are incorrect, including account numbers and the reasons the information is inaccurate

- Supporting documentation that verifies your claim about the erroneous information

Before mailing your letter, it’s best to make copies of anything you send to the credit bureaus for your own records. Note that while credit bureaus do allow for disputes filed online or over the phone, the best way to submit a dispute is with a certified letter. This way, you’ll have a written record and verification that your dispute has been received.

Step 3: Contact the data furnisher

In some cases, it’s also helpful to contact the company that provided the inaccurate data to the credit bureaus. Since the three credit bureaus simply report the data they are provided, ultimately any investigation of a mistake will lead back to the data furnisher. Many different companies provide (or furnish) data to the credit bureaus, including banks, credit card companies and lending institutions.

Your credit report will likely note who provided the information, in which case you can contact that company directly to try to have the inaccurate information removed. Just as with the credit bureau, you’ll want to send a certified letter that includes information about yourself and your dispute—and any documentation or evidence that can support your case.

You’re able to contact the data furnisher before or after you submit a dispute with the credit bureau, or you can choose to only reach out to the data furnisher to see if that resolves the matter.

However, if the inaccuracies involve your personal identification information, you’ll need to contact the credit bureaus directly, as this could result from data entry problems or an accidentally merged credit report.

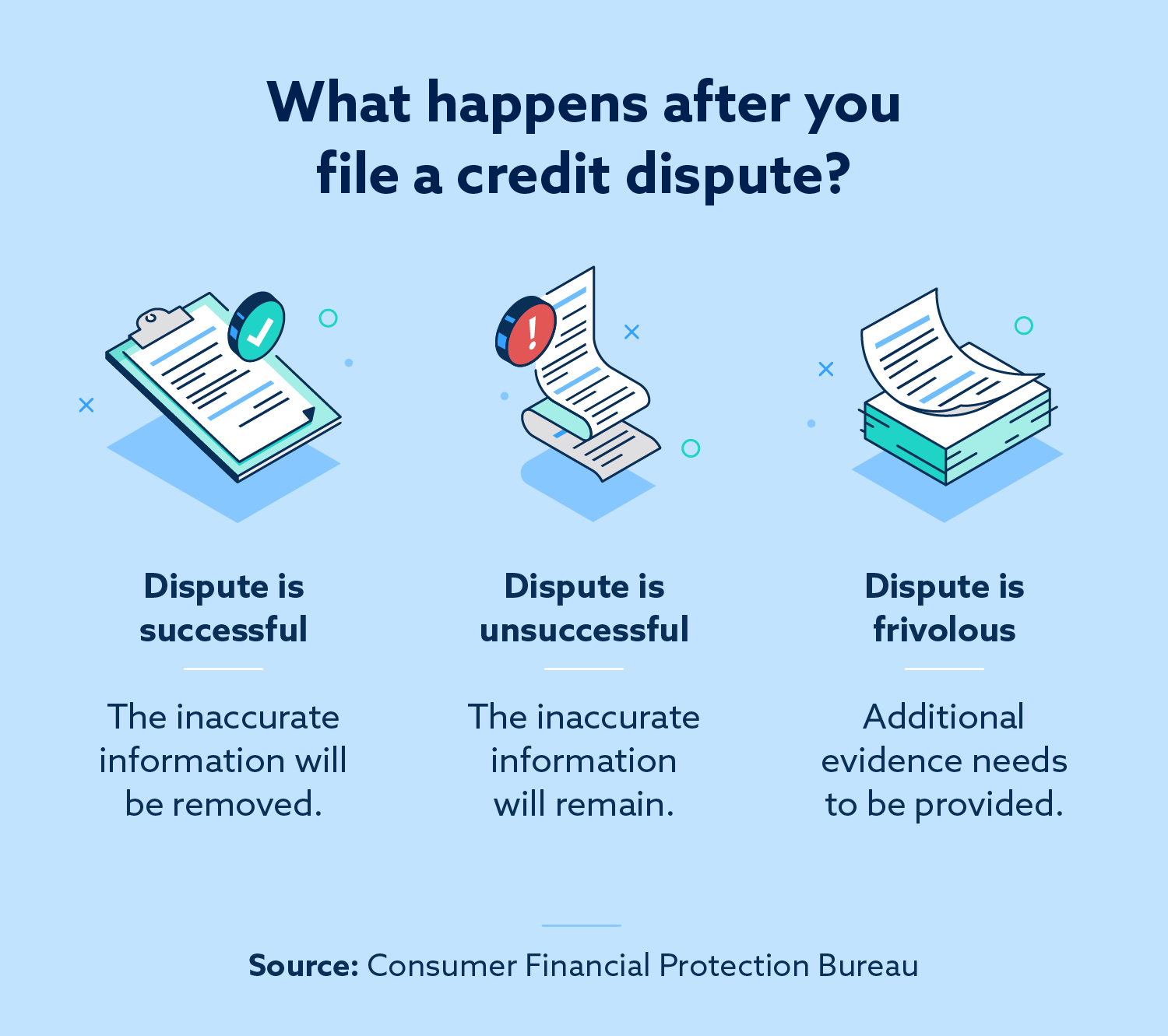

What happens after you file a credit dispute?

After you file a credit dispute with the bureaus or a data furnisher, you’ll need to wait up to 30 to 45 days for the investigation to conclude. During that time, the credit bureau and data furnisher will examine your evidence and try to determine the validity of your dispute.

After the dispute process is complete, you’ll get one of three results:

- Your dispute is successful. In this case, the inaccurate information will be removed from your credit report.

- Your dispute is unsuccessful. In this case, the inaccurate information will remain on your credit report, as the credit bureau or data furnisher did not find your evidence compelling.

- Your dispute was found frivolous. If the credit bureau or data furnisher feels you did not provide sufficient evidence to examine your claim, they may not conduct an investigation at all.

Depending on the result of your dispute, you have different courses of action.

With a successful dispute, you’ll want to monitor your report and score to ensure the inaccurate information is removed and see how that affects your credit.

An unsuccessful or frivolous dispute can be disappointing, but you still have some potential courses of action. You can consider resubmitting your dispute with new evidence, or you can submit a consumer statement that will be included in your credit report indicating your belief about the inaccurate information. When lenders review your credit report, they’ll be able to see this statement, which may influence potential lending decisions.

What items can you dispute on a credit report?

When you’re looking to file a credit dispute, not all information on your credit report should be disputed. If you dispute items that you know are fair, accurate and substantiated, your dispute will likely be deemed frivolous.

However, many pieces of information can be disputed, especially those that involve erroneous personal information or inaccurate accounts.

If you’re scanning your credit report for inaccuracies, keep in mind the kinds of errors that you should be looking for:

- Inaccurate personal information

- Unrecognized accounts

- Accounts belonging to someone with the same name or a similar name

- Incorrect reporting, like an on-time payment reported late

- Inaccurate details, like balances or credit limits

If you notice any of these errors on your credit report, you should work to get them corrected by filing a dispute.

Does filing a dispute hurt your score?

Filing a credit dispute does not inherently hurt your credit score, as this is a process protected by the Fair Credit Reporting Act (FCRA).

You may see your score fluctuate during a credit dispute, but this is often the result of one of the following factors:

- One of your accounts is marked as “under dispute,” which could temporarily change your score. Your credit report can contain what’s known as an “XB” code to let lenders know to temporarily ignore certain information during the investigation. With this information not factored in, your credit score could change.

- A successful dispute could lead to a change in your credit score. In general, having mistaken negative items removed will raise your credit score, but correcting other information could either raise or lower your score. However, the long-term benefit of having an accurate credit report likely outweighs any short-term fluctuations in your score.

Overall, you should file a credit dispute if you notice inaccurate information with the assurance that disputing will not directly lower your credit score.

How to get help disputing an error on your report

Although you can try this DIY credit repair method by submitting a credit dispute on your own, it can be helpful to get support from individuals or companies who have experience working with the credit bureaus to address inaccurate information.

Working with a credit repair company to file a credit dispute will help you identify errors on your report and find the right evidence to support your dispute—and let someone else do some of the heavy lifting and paperwork for you.

If you’re interested in getting more information, reach out to the team at Lexington Law Firm, who have the legal knowledge and experience to support you through the entire process.

Moriah is an attorney practicing in consumer advocacy at Lexington Law. Before joining Lexington, she represented plaintiffs in personal injury litigation, dealing with claims arising from car accidents, slip and falls, and dog bites.

Moriah studied English at Brigham Young University for her undergraduate degree and went on to graduate from Brigham Young University’s J. Reuben Clark Law School. She is from Hau’ula, Hawaii, but has been a resident of Utah for over 10 years now.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.