Is 407 a good credit score?

October 11, 2021

Quick answer

The FICO credit score ranking ranges from 300 to 850. If you pulled your credit recently and received a 407, you might be wondering whether it’s a good credit score. Unfortunately, the simple and straightforward answer is no.

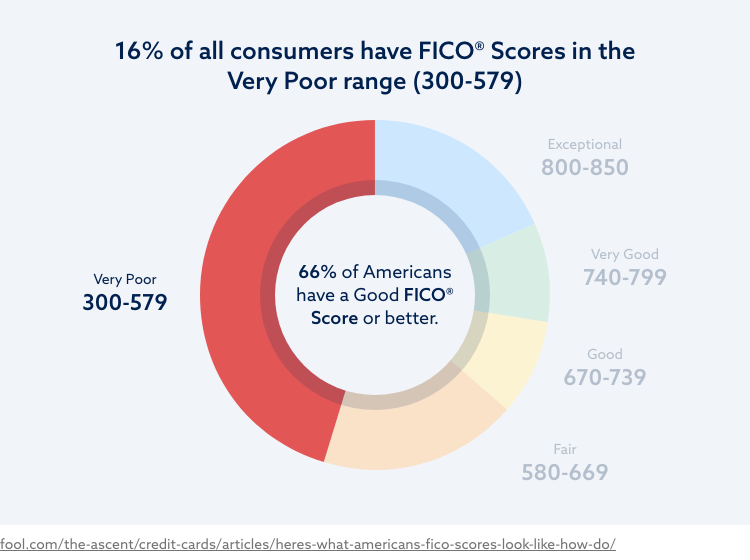

Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 407 ) usually falls into the “very poor” category. Having a 407 score likely means you’ve had a history of poor financial habits and possibly have had your accounts sent to collections, have had judgments or have filed for bankruptcy, to name a few possibilities. In comparison, the average FICO credit score across the United States is 703—sitting in the “good” category.

So, what does having a credit score of 407 mean for you? Essentially, when it comes to applying for loans, you’re unlikely to qualify for many. And when you do qualify, you’ll likely be given extraordinarily high interest rates. Having a bad credit score won’t exclude you from all options, but it will limit you and cost you money in interest paid on loans or credit.

What can I do with a 407 credit score?

You may still be able to qualify for some financial products with a 407 credit score, but it will be challenging. You can start taking on new credit, such as a credit card, and building up responsible credit history to improve your score.

Note that most of the credit and loan options out there will be high-interest and restrictive. It’s crucial that you don’t sign up for something new and end up in circumstances that might make your credit score worse.

Not sure of your credit score? Find out with our FREE Credit Assessment

Get Started407 credit score mortgage loan options

The minimum credit score you need to be approved for a mortgage varies from lender to lender. Generally speaking, experts recommend you have a credit score of 760 or higher to get a reasonable interest rate.

Of course, that doesn’t mean you need a 760 score to be approved. In most cases, a conventional mortgage loan requires a credit score of 620. If you have a score of 407 , it’s almost guaranteed you won’t get a standard mortgage loan.

The category that your credit score falls into plays a significant role in your mortgage interest rate and can cost or save you thousands of dollars over the life of a loan. As of March 2021, someone with a score of 620 (the lowest for most conventional mortgage approvals) will pay 4.414 percent interest on a 30-year mortgage.

In comparison, an individual with a credit score of 760 or higher could qualify for a rate of 2.825 percent. (These mortgage rates are as of March 29, 2021.) On a mortgage amount of $300,000, the person with a poor credit score would end up paying $268 more in interest every month.

407 credit score car loan options

It won’t be easy to get approved for a car loan with a credit score of 407. If you are approved, it may be at an extremely high interest rate that can almost double the vehicle’s price over the life of a loan. According to CarsDirect.com, the average interest rates for auto loans for people with credit scores between 501 and 600 are 10.58 percent for new cars and 16.56 percent for used cars.

People with poor credit who need a new car loan have other alternatives such as:

- Apply for a secured car loan where you provide additional collateral.

- Get a cosigner who has excellent credit for your auto loan.

407 credit score credit card options

When it comes to a credit card, you may only be able to get a secured credit card. This means you give the creditor the amount of your limit to hold onto as collateral. If you want a secured credit card with a $1,000 limit, you’ll have to give a $1,000 deposit.

If you qualify for a credit card (secured or unsecured), it will likely have a low limit and a high interest rate. If you get a credit card with a 407 score, you can expect an average interest rate of 21 percent.

Still, getting a credit card might be a step in the right direction. You can use this credit card to build positive credit for yourself by using it responsibly, paying it off on time and in its entirety and not using too much of the balance available to you.

How to check your credit score for free

Take a closer look at your credit with our FREE credit assesment tool which includes your scredit score, a negative item summary and a recommended solution.

Get started today with a FREE online credit report consultation

- FREE Credit Score

- FREE Credit Report Summary

- FREE Credit Repair Recommendation

Before we can view your credit, we’ll need some information from you.

Don’t worry, this is completely secure and won’t hurt your credit score.

By clicking "Submit" I agree by electronic signature to: (1) be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email (consent to be contacted is not a condition to purchase services); and (2) the Privacy Policy and Terms of Use (including this arbitration provision).

What is the fastest way to fix a very poor credit score?

The most efficient way to fix your “very poor” 407 credit score is to stay current with all your payments—pay everything on time and in full (if possible).

The next crucial step is to review your credit report for any inaccurate items that may be dragging your score down. According to the Federal Trade Commission, it’s estimated that one in five Americans has at least one error on their credit report. If there’s an incorrect negative item on your report, you should contact the Credit Reporting Agencies to have it removed.

Lastly, you can improve your credit score by understanding the five factors that affect your credit in order of what impacts your credit the most. Your credit score is made up of the following elements:

- Payment history: 35 percent

- Credit utilization ratio: 30 percent

- Length of credit history: 15 percent

- Mix of credit accounts: 10 percent

- New credit inquiries: 10 percent

Prioritize working on all five of these factors as much as you possibly can.

How long does it take to fix a very poor credit score?

How long it takes to fix your credit score depends on what is currently impacting your score. For example, suppose you have an accurate bankruptcy on your credit report. In that case, that negative item isn’t likely going away for seven years, and any improvement in your credit will be slow.

On the other hand, if your credit score is low due to an incorrect negative item on your report, you may see an improvement almost as soon as the item is successfully removed from your report.

Whatever the situation, assume that credit repair will take some time. If you focus on consistently making payments on time and keeping your credit utilization ratio down, your score should gradually improve as you showcase a pattern of responsible behavior.

How to build your credit

Some of the steps you should take to build and maintain good credit over time include:

- Monitoring your credit report and reviewing it for mistakes

- Keeping an eye on your credit score

- Paying your accounts in full and on time

- Maintaining a credit utilization ratio under 30 percent

- Avoiding opening new accounts at once

- Avoiding several hard inquiries too close together

Building good credit is vital to your overall financial well-being. Having a solid credit score will help you gain access to more opportunities and secure lower interest rates. Moving up from “very poor” to “good” can have significant benefits for you—it’ll just take some determination to get there.