Is 630 a good credit score?

October 11, 2021

Quick answer

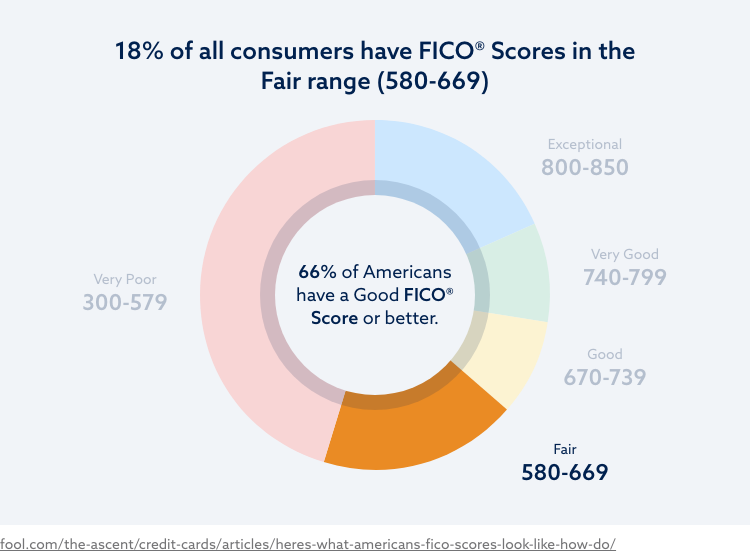

The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score of 630 falls into the “fair” range, which includes scores between 580 and 669—essentially, if you have a 630 credit score, it isn’t great, but it’s not awful either.

Having a fair credit score means you’ll have fewer options when applying for loans. Additionally, the few loans you’re approved for will probably come with high interest rates.

What can I do with a 630 credit score?

Luckily, when you have a 630 credit score, your hands aren’t tied—you have options. Most notably, you should be able to get approved for a credit card quite easily. You can then use this credit card to build up your credit and improve your score.

However, you should also be very careful when taking out any new credit. Lenders know you have few options with a 630 score, and some will try to take advantage of you.

For example, you might be approved for loans with an incredibly high interest rate and strict loan terms. You’ll want to be careful and thoroughly research any new loans you take on. The last thing you want to do is end up in a situation where you make your credit worse.

For example, let’s say you take on a loan with a high interest rate of 25 percent. If you miss one payment and don’t realize there’s a penalty that increases your interest by 4 percent, your loan will now be sitting at 29 percent. This is just one way that lower credit scores can end up costing you significantly more.

Not sure how your credit compares? Find out with our free credit Assessment

Get Started630 credit score mortgage loan options

When it comes to getting a mortgage, experts recommend having a credit score of at least 760 to qualify for the best interest rates, and a conventional mortgage loan typically requires a minimum credit score of 620.

According to myFICO, if you have a credit score between 620 and 669, you can expect to have an average interest rate of between 4.293 percent and 3.317 percent on a $300,000 mortgage. (Numbers are current as of April 2021.) In comparison, someone with an exceptional credit score will get an average interest rate of 2.704 percent on a $300,000 mortgage and pay somewhere around $200 less every month.

If you aren’t approved for a conventional mortgage, there are alternative lending options for people with low credit scores. You can consider an FHA loan, a VA loan or a USDA loan—all of which can be given to people with credit scores of 640 or lower.

630 credit score car loan options

You should be able to get a car loan with a 630 credit score without a problem. Truthfully, people can get a car loan with almost any credit score—the difference will be what kind of interest rate you can secure.

A score of 630 may get you an interest rate of between 11.92 percent and 4.68 percent on a new car loan. In comparison, if you can improve your credit score by a few points and move up to the good credit score range, your interest rate can potentially decrease by a decent amount.

If you’re having difficulties getting approved for an auto loan with a 630 credit score, your best alternatives are:

- Find a cosigner

- Save up a large down payment

- Find a lender that specializes in lending to individuals with bad credit scores

630 credit score credit card options

An individual with a 630 credit score will typically receive a credit card interest rate of between 20.5 and 16.5 percent. In comparison, someone with excellent credit can receive an average credit card interest rate of 13.5 percent. That’s a big difference in interest, and if you make a habit of carrying a balance on your credit card, it could add up to hundreds of dollars in interest annually.

You should be able to get approved for a credit card with a 630 credit score—you’ll just probably be given an interest rate around 20 percent. If you can’t seem to get approved for a traditional unsecured credit card, you can opt for a secured credit card instead.

How to check your credit score for free

Take a closer look at your credit with our FREE credit assesment tool which includes your scredit score, a negative item summary and a recommended solution.

Get started today with a FREE online credit report consultation

- FREE Credit Score

- FREE Credit Report Summary

- FREE Credit Repair Recommendation

Before we can view your credit, we’ll need some information from you.

Don’t worry, this is completely secure and won’t hurt your credit score.

By clicking "Submit" I agree by electronic signature to: (1) be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email (consent to be contacted is not a condition to purchase services); and (2) the Privacy Policy and Terms of Use (including this arbitration provision).

What is the fastest way to fix a fair credit score?

The good news about having a fair credit score is that you’re only a few points away from a good credit score. If you’re smart with your finances, you can improve your credit score relatively quickly.

The first step to improving your credit score is making all your payments on time and in full. This shows the credit bureaus you can be trusted with credit.

Next, you’ll want to check your credit report for any inaccurate items that may be dragging your score down. If you find any, you can dispute them and potentially see a significant increase in your credit score.

Lastly, you must understand the five factors that affect your credit. When researching the five factors, you’ll learn which factor affects your credit the most. Understanding the five factors will teach you to:

- Keep your credit utilization below 30%

- Avoid opening several new accounts all at once

- Avoid multiple hard inquiries at once

How long does it take to fix a fair credit score?

How long it takes to fix a score of 630 will depend on various factors. If you have accurate negative items on your report, such as a collection account, these items can stay on your report for up to seven years. Until these items fall off your report, it’ll be much more challenging to see significant increases in your credit.

On the other hand, if you don’t have anything serious bringing your score down, a few months of on-time payments and responsible financial patterns can result in a relatively quick improvement in your score.

As we mentioned earlier, a fair score is only a few points away from a good credit score. If you take the right actions, your score might improve to the good range within a few months.

How to build your credit

If you want to build and maintain good credit over time, all you have to do is use the five factors that your credit score is made up of as guiding principles. Through these principles, you learn to make regular payments, keep debts down, maintain a healthy credit utilization ratio and have diverse credit. Some factors, such as your credit history length, are out of your control and just require patience.

Credit helps you with all the major purchases in your life—car loans, mortgages, student loans, business loans and more. Improving your credit is a time investment that can quite literally save you money in the future, so consider starting to work on it today.