Is 682 a good credit score?

October 11, 2021

Quick answer

A credit score of 800 puts you in the top credit score range. Having a score in this top range gives you more accessibility to loan options, better loan terms and better interest rates overall.

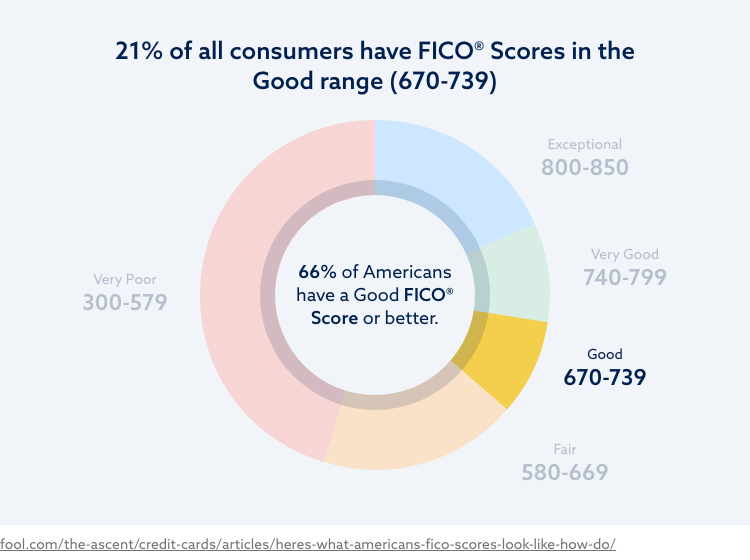

When a lender pulls your credit score, it most often comes from FICO. This credit scoring model gives consumers a score ranging from 300 to 850. If you have a credit score of 682, you might be asking yourself, “is 682 a good credit score?” Luckily, the answer is yes: a score of 700 falls into the “good” category, which includes any number between 670 and 739. Approximately 21 percent of American consumers hold a FICO score in the good range.

Your 682 score will give you access to more loan options and better interest rates than people in lower ranges. However, FICO does have ranges above good, so you won’t be qualifying for the absolute best loan terms with lenders.

What can I do with a 682 credit score?

As 682 is a good credit score, you should not be limited in your loan options. You’ll likely easily qualify for most credit cards, personal loans, auto loans, lines of credit and more.

Since you’re not in the top range of credit scores, you’ll still always want to review your loan terms. For example, you want to ensure you’re getting a reasonable interest rate and manageable loan terms.

If you damage your credit and fall back into the fair credit score range, may find your loan options much more limited. Do everything in your power to maintain your score and even improve it over time.

How does your score compare? Find out with our FREE Credit Assessment tool

Try it Now682 credit score mortgage loan options

A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 682, you have a high probability of being approved for a mortgage loan. But lenders won’t be offering you the best interest rates out there—some experts suggest that you need score of 760 to get those.

It’s important to note that having a score of 682 doesn’t guarantee you’ll be approved for a mortgage. People who have insufficient income or a history of filing for bankruptcy can still be denied loans, mortgages or credit cards even with a good score.

If you’ve been denied a mortgage with a 682 score, you can check if you qualify for a USDA loan or a VA loan. Otherwise, you’ll have to improve your credit score, increase your down payment or speak to your lender on how you can work toward a mortgage approval.

682 credit score car loan options

A 682 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 percent on a used car. Scores above 720 are more likely to net you the lower percentage rates.

If you are having trouble getting approved for a car loan with a 682 credit score, you have some options. You can opt for a less expensive vehicle, find a cosigner or make a bigger down payment

682credit score credit card options

Having a credit score in the good range should make you eligible for most credit cards. You can expect an average interest rate of 13.5 to 16.5 percent on most credit cards.

A 682 credit score is not a guarantee of credit card approvals. If you’ve filed bankruptcy in the past, have a low income or have a history of opening credit cards frequently, you can still be denied. Individuals who are denied traditional unsecured credit cards often choose to open a secured card as they have higher approval rates.

How to check your credit score for free

Take a closer look at your credit with our FREE credit assesment tool which includes your scredit score, a negative item summary and a recommended solution.

Get started today with a FREE online credit report consultation

- FREE Credit Score

- FREE Credit Report Summary

- FREE Credit Repair Recommendation

Before we can view your credit, we’ll need some information from you.

Don’t worry, this is completely secure and won’t hurt your credit score.

By clicking "Submit" I agree by electronic signature to: (1) be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email (consent to be contacted is not a condition to purchase services); and (2) the Privacy Policy and Terms of Use (including this arbitration provision).

What is the fastest way to improve a good credit score?

You can work to improve your good credit score and upgrade to the next credit range. First, it’s very beneficial to know the five factors that impact your credit in order of what affects your credit the most. Those factors and their weighted importance are:

- Payment history – 35 percent

- Outstanding debts – 30 percent

- Credit history length – 15 percent

- New accounts – 10 percent

- Credit mix – 10 percent

Next, always pay your payments on time and in full. This is what lenders want to see most—that if they give you access to credit, you’re responsible and pay it back reliably. You can make sure you never miss a payment by signing up for automatic payments whenever possible.

Lastly, take advantage of the free credit report you’re entitled to annually from each national credit bureaus. In 2020, more than 280,000 consumers filed complaints about mistakes on their credit reports, and many more Americans have errors on their credit reports they aren’t aware of. Inaccurate or unsubstantiated negative items on your report could be drastically dragging down your credit score, so always review your credit report and file a dispute for any errors found.

If you don’t have time to check your report yourself, you can hire credit repair services. Lexington Law provides professional credit repair services, taking all the hassle out of filing disputes out of your hands.

How long does it take to improve a good credit score?

Ultimately, how long it will take to improve your credit score will depend on a few things. If you have serious and accurate negative items on your report—such as a collection account or bankruptcy—it can slow down your progress. These types of negative items can stay on your credit report for more than seven years and prevent you from seeing an improvement in your score for several months or years.

On the other hand, some consumers see results in just a couple of months. For example, let’s say an outstanding debt is the only thing keeping you at 682. If you get rid of this debt, you might see an increase in your score.

Regardless of how long it takes, you should start to work on improving your credit right away.

How to build your credit

Here are some basic steps to help build your credit score:

- Always make payments on time.

- Pay down debts.

- Check your credit report annually.

- Keep your credit utilization below 30 percent.

- Reduce the number of hard inquiries on your credit report.

- Avoid opening many new loans all at once.

- Keep your first credit card open (even if you don’t use it) so you can take advantage of the long credit history.

Great credit opens the door to financial opportunities, better interest rates and more. You can work to improve your credit score and get to a higher credit range. You took the first step today by learning what can improve your credit score. Now, you only have to start implementing these new financial habits.

Your best credit score is an accurate & fair one start working to repair your credit with Lexington Law

Sign up onlineOr sign up online