Is 751 a good credit score?

October 11, 2021

Quick answer

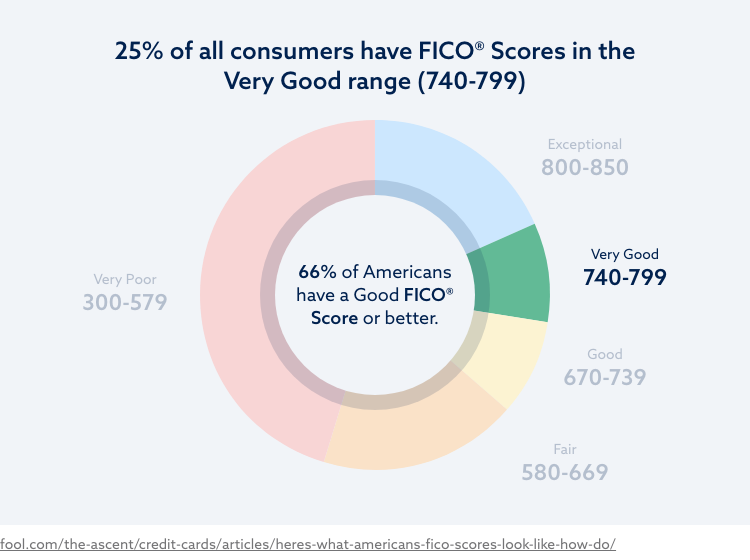

The FICO credit score model gives consumers a score between 300 and 850. As your score increases, you go up in credit score ranges. The ranges include very poor, fair, good, very good and exceptional, and fortunately, a score of 751 lands you in the “very good” credit range of 740 to 799. This means that you’re likely to be approved for most loans and you’ll receive some of the best interest rates available.

What can I do with a 751 credit score?

751 credit score puts you just one level below the top-tier credit range of exceptional. So, as you may guess, you should have access to most credit and loan options you apply to. And while you may not secure the best interest rates or loan terms possible on the market (these are reserved for people with exceptional credit scores of 800+), you'll often get very competitive offers.

Need to know your credit score? Find out with our free Credit Assessment

Get Started751 credit score mortgage loan options

Experts say you need a minimum credit score of 620 to be approved for a conventional mortgage loan. As a result, a credit score of 751 should make a mortgage approval highly likely.

Your 751 credit score will likely get you an average interest rate of 2.36 percent on a 30-year loan. In comparison, if you had credit in the good range, you’d get an average mortgage interest rate of 2.58 percent.

That difference of 0.22 percent might not seem like a significant variation. However, let’s look at the loan term calculations. Assuming you purchase a property for $350,000 with a credit score of 751 and an interest rate of 2.36 percent, over a 30-year loan term, you’ll pay $14,379 less in interest than a person with a 2.58 percent interest rate.

When it comes to large loans or long loan terms, a slight decrease in interest can mean thousands of dollars saved.

751 credit score car loan options

When it comes to securing a car loan, your credit score likely won’t matter much in the approval process. That’s because even people in the lowest credit score range of very poor can often get approved for an auto loan. Where your credit score comes into play is the interest rate you’ll get on the loan.

With a credit score of 751, you’ll receive—on average—an interest rate of 3.65 percent for a new vehicle and 4.29 percent for a used vehicle. This is very different from the rates you might get if you had a much lower credit score.

Additionally, having a score in the very good credit range will likely help you receive reasonable loan terms that include fewer potential penalties.

751 credit score credit card options

With your score of 751, you should be approved for most credit cards. And since your credit score is relatively high, you’ll often get the cards with the best perks. This can include sign-up bonuses, no annual fees, travel programs, airport lounge or hotel perks and more.

Your score should secure you an average interest rate of 13.5 percent, while those with deep subprime credit scores will often have a rate above 20 percent.

How to check your credit score for free

Take a closer look at your credit with our FREE credit assessment tool which includes your scredit score, a negative item summary and a recommended solution.

Get started today with a FREE online credit report consultation

- FREE Credit Score

- FREE Credit Report Summary

- FREE Credit Repair Recommendation

Before we can view your credit, we’ll need some information from you.

Don’t worry, this is completely secure and won’t hurt your credit score.

By clicking "Submit" I agree by electronic signature to: (1) be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email (consent to be contacted is not a condition to purchase services); and (2) the Privacy Policy and Terms of Use (including this arbitration provision).

What is the fastest way to achieve a very good credit score?

If your score is below 751, you can take steps to build up to the very good credit score range. People with a very good credit score always stay up to date on their payments, keep a low credit utilization ratio and have no negative items on their credit report. If they have any negative items, the items are several years old and are likely to drop off their report soon.

The first step you can take is educating yourself on the five factors that affect your credit score. Your score takes into consideration five elements, and some are weighted heavier than others. By understanding these factors, you’ll know what to prioritize and what mistakes to avoid.

You’ll also want to avoid having negative items on your report. All consumers are legally entitled to one free credit report annually from each of the major credit bureaus, so take advantage of this perk every year and review your report. If you spot any inaccurate negative items on your account, you should file a dispute right away to hopefully stop them from dragging your score down.

How long does it take to improve a very good credit score?

How long it’ll take to improve your score depends on a variety of factors. If you have accurate negative items one to two years from falling off your report, you might not reach the exceptional tier until those items are gone. On the other hand, maybe something as simple as reducing your credit utilization to under 10 percent could bump up your score.

If you can patiently maintain the responsible financial habits that got you to a score of 751, you can eventually get to 800. According to FICO, 22 percent of consumers have a credit score that qualifies them to be in the 800 Club. Typically, any improvement from 800 onwards isn’t likely to get you better interest rates or loan terms—you’ll already be getting the best. So, set a goal to get to the exceptional tier, focus on the five credit factors and regularly monitor your credit reports.

How to build your credit

Building your credit is all about showing lenders that you’re consistently responsible with loans. Examples include:

- Always pay your bills on time and in full. Even one late payment can knock several points off your score. You can reduce the risk of this happening by signing up for auto-payments whenever possible.

- Don’t carry a lot of debt. And the debt you do have, consistently pay down. If you have a mortgage, an auto loan or a personal line of credit, try to pay it off as quickly as possible.

- Keep your credit utilization rate below 30 percent. However, people in the very top credit score ranges tend to keep their utilization rates significantly lower—often maintaining a rate of 5 – 10 percent.

- Always review your credit report from every credit bureau. If you see inaccurate negative items on your report, you can dispute them. Check things like debt amounts, dates, names and other pieces of information.

- Turn to professionals when you need help. Many people hire a tax professional when they need help with taxes, so why shouldn’t it be the same for credit? Lexington Law offers professional services for credit repair and credit education. Hiring out these services ensures you’re not stuck with the grunt work, you’ll see results much faster and you’ll have a higher chance of getting disputes approved.

Whether you have a credit score of 620 or 751, there’s room for improvement. Securing a higher credit score can save you thousands of dollars in interest over your lifetime. So, stop waiting and start improving your credit today.