A hard credit inquiry occurs when lenders look at your credit score after you apply for new credit. This process can temporarily reduce your score by a small amount. Inquiries can stay on your credit report for up to two years, but they typically only impact your score for the first six to 12 months.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you’re wondering “what is a hard inquiry on my credit?” here’s a quick breakdown: a hard inquiry, also known as a “hard pull,” occurs when a potential lender reviews your credit report after you apply for new credit.

There are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries stay on your credit report for up to two years and temporarily hurt your score, while soft inquiries have no impact.

Below, we’ll explore the nuances of hard credit inquiries and explain how credit repair services can help you improve your credit after it takes a hit.

Key takeaways:

- Hard credit inquiries will cause your score to briefly dip.

- Inquiries will stay on your credit report for 2 years, though they only affect your score for about 12 months.

- FICO® will usually lump multiple inquiries of the same type together if they occur within a window of 14 to 45 days.

Table of contents:

- What is a hard credit inquiry?

- What is a soft credit inquiry?

- How much does a hard inquiry affect your credit score?

- How to remove a hard inquiry from your credit report

- Can you avoid hard credit inquiries?

- Work to recover from hard inquiries with Lexington Law Firm

What is a hard credit inquiry?

A hard credit inquiry is a formal request by another party to review your credit report. These requests usually come from potential lenders who want to vet your credit history before agreeing to offer you a loan. The process of looking into your credit report generates a hard inquiry.

Creditors do this to check that your credit profile meets their requirements and to look for negative items on your report, like late payments or charge-offs. The more negative items that appear on your credit report, the less likely you are to get approved for new loans or credit cards.

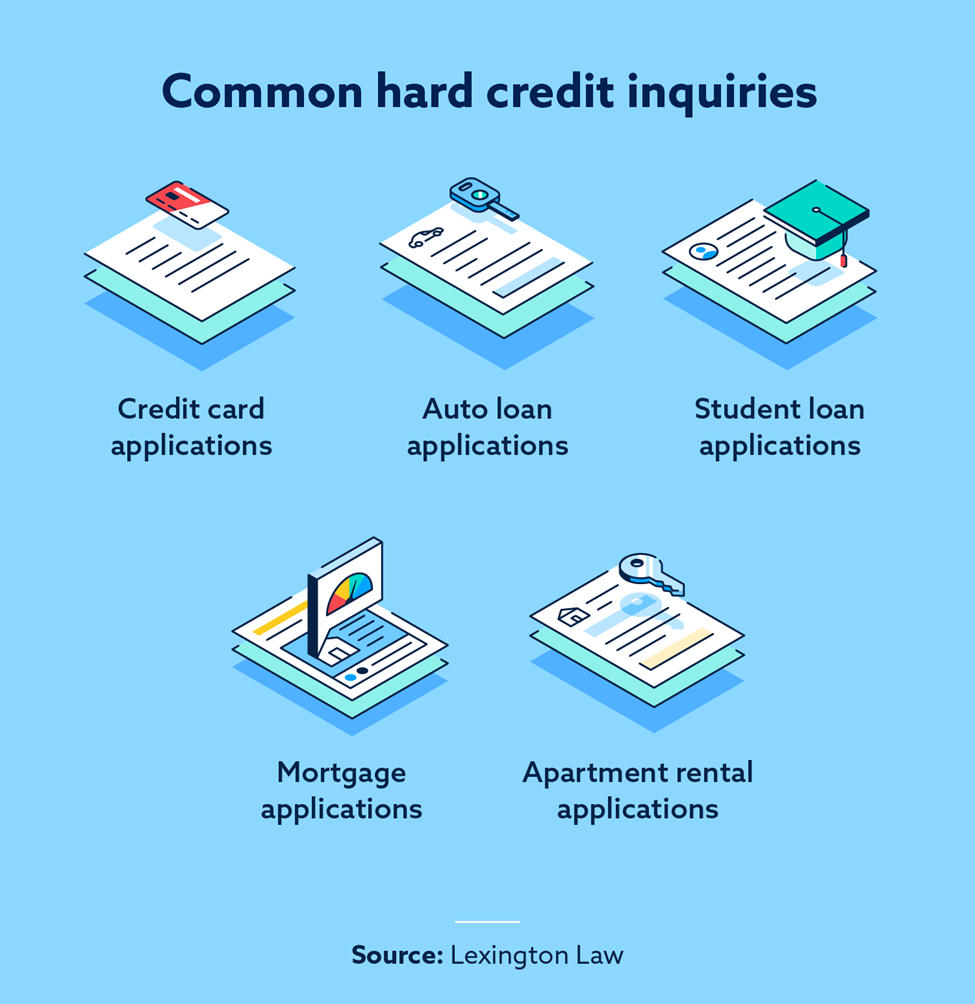

Hard inquiries typically occur when applying for:

- Credit cards

- Auto loans

- Student loans

- Personal loans

- Mortgages

- Apartment rentals

- New phone or utility applications

What is a soft credit inquiry?

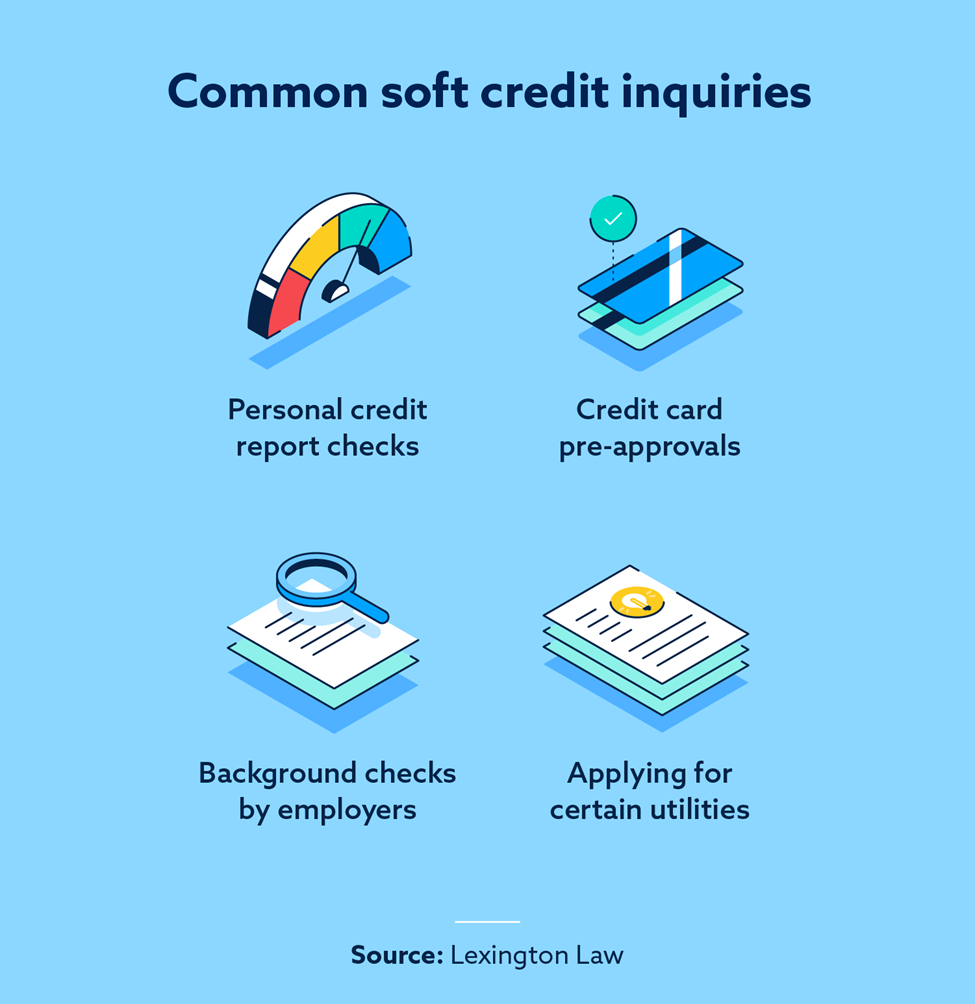

A soft credit inquiry is a check into your credit report that will not affect your credit score. While hard inquiries are thorough reviews of your credit history, soft inquiries are partial reviews that aren’t as extensive. For example, soft pull credit cards are typically sent in the mail by lenders who’ve already reviewed your report and preapproved you.

Soft inquiries typically occur when:

- You access your credit report

- You are preapproved for a credit card without request

- A potential employer performs a background check

- You apply for certain utilities and services

How much does a hard inquiry affect your credit score?

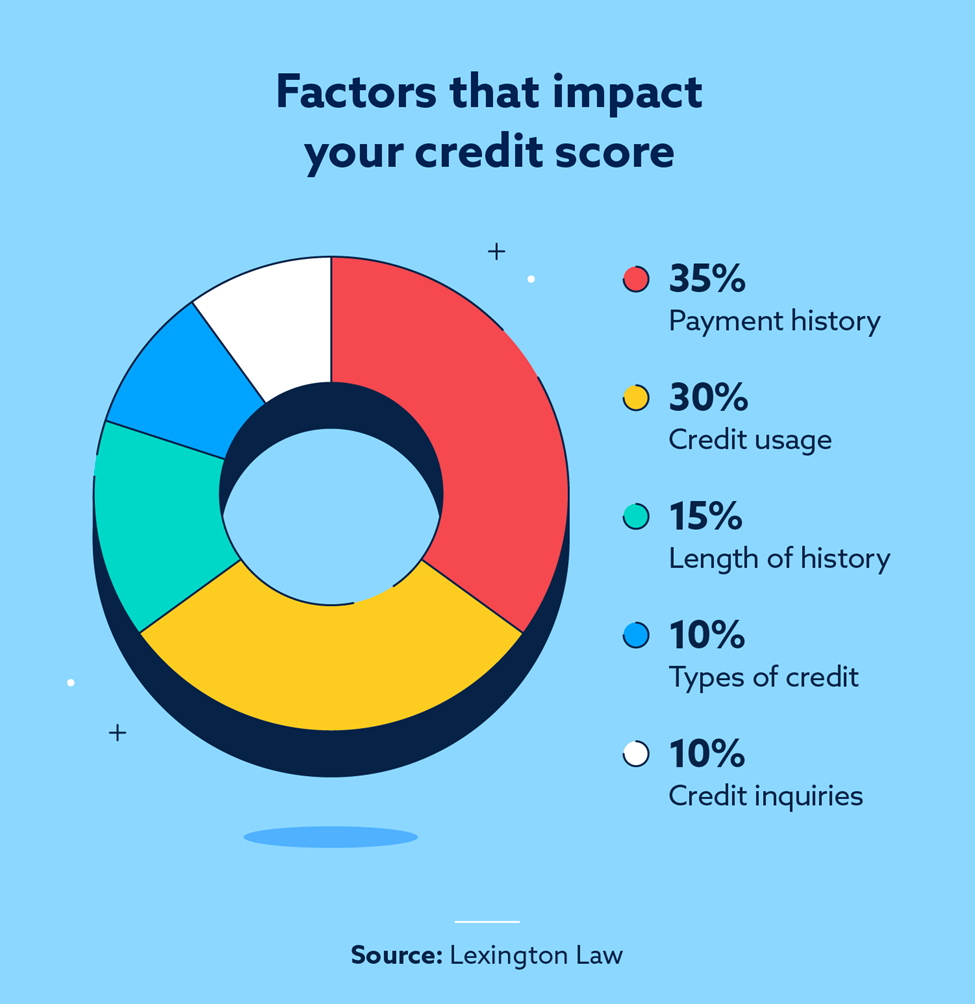

Typically, a single hard inquiry will not majorly impact your credit score. For example, one hard inquiry will usually decrease your credit score by a small amount, such as five to 10 points or less. When thinking about what affects your credit score, keep this in mind: new credit makes up 10 percent of your FICO credit score.

A hard credit inquiry impacts your credit score based on your credit history. FICO will usually lump multiple inquiries of the same type together if they occur within two weeks to 45 days, depending on the exact model being used. But be careful about applying for different kinds of credit in a short time span.

Hard inquiries may have a greater effect on your credit score if:

- You have few or no credit accounts

- You have a short credit history

- You authorize many different inquiries within a short time

When do hard inquiries fall off your credit report?

A hard inquiry will stay on your credit report for two years, though it only usually impacts your credit score for about 12 months. Inquiries within the past six months affect your credit the most.

If your credit history is substantial, a few hard inquiries on your credit report will not likely have a significant impact over the two years they are on your account.

How to remove a hard inquiry from your credit report

Credit bureaus cannot remove accurate, authorized inquiries. However, you can dispute inaccurate information and unauthorized inquiries with the credit bureaus. Federal law will support credit disputes against inaccurate or suspicious information on your credit report.

Here is how you can initiate this process:

- Frequently review your credit reports and challenge inaccurate or unfair items. In some cases, unauthorized hard inquiries could signal that you’ve experienced identity theft.

- Write letters to credit bureaus. This is one of the first steps in the credit inquiry removal process. List all relevant information about the hard inquiry, including the date it occurred.

- Wait for credit bureaus to investigate your dispute. Hard inquiries will be removed from your report if the credit bureau determines that an error has been made, which could help improve your credit.

You can contact the Consumer Financial Protection Bureau for issues concerning your credit reports, including the dispute of a hard inquiry.

Can you avoid hard credit inquiries?

It is difficult to avoid hard credit inquiries if you apply for a loan or credit card. However, hard inquiries generally don’t significantly impact your credit, so don’t let them worry you too much.

If you want to improve your credit after it has been affected by a hard inquiry, consider focusing on the other factors that play a role in determining your credit health. These factors include your payment history, your credit usage, the length of your credit history and your credit mix.

It may be easier to improve your credit by paying your bills on time, monitoring your credit card balances and clearing any collection accounts that may appear on your credit report rather than trying to avoid credit inquiries.

Work to recover from hard inquiries with Lexington Law Firm

Our credit scores can fluctuate vastly over time, but recovering from a hit is possible. Consider using our services to help you challenge inaccurate, unfair or invalid items with Experian®, Equifax® and TransUnion®. We can also help you learn more about responsible credit management to maintain your credit health moving forward.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.