Is 810 a good credit score?

October 11, 2021

Quick answer

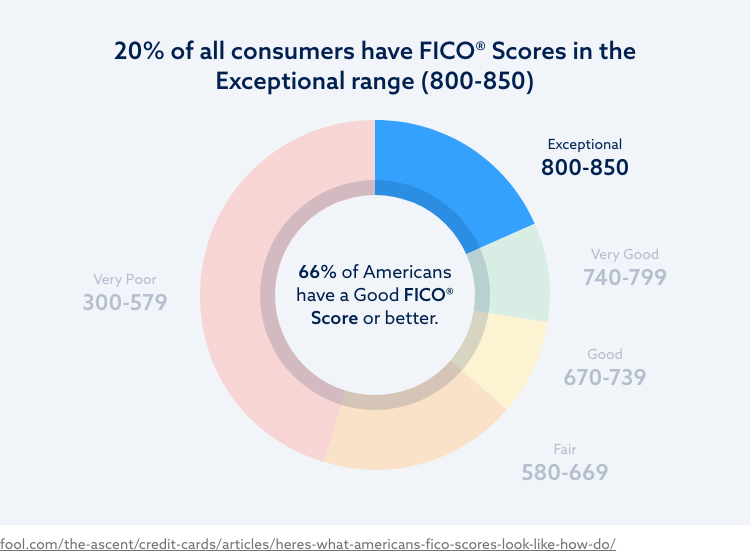

Consumers receive FICO credit scores ranging between 300 and 850. Depending on your score, you’ll fall into a credit range that’s considered very poor, fair, good, very good or exceptional. A credit score of 810 puts you in the top credit score range. Having a score in this top range gives you more accessibility to loan options, better loan terms and better interest rates overall .

What can I do with an 810 credit score?

People with a credit score of 810 or higher are said to belong to the 800 Club. Even though the highest score you can get is an 850, an 810 is generally considered a perfect score as well. This is because improving your score beyond 800 likely won’t result in any significant changes in loan terms or interest rates.

Essentially, a score of 810 should give you the best chance for approvals on loans, as well as the best lending terms and interest rates possible. Anyone who’s ever tracked their credit probably has an idea of just how difficult it is to get a score of 810.

Do you know your credit score? Find out with our FREE Credit Assessment

Get StartedA credit score of 810 likely means you’ve been using credit responsibly for a while, you pay your bills on time, you keep your credit utilization low and your credit report is void of negative items like collections or bankruptcies. As a result, lenders feel very confident that they can extend you credit with minimal risk. In exchange for you being such a low-risk borrower, creditors will offer you their best loan rates to get your business.

810 credit score mortgage loan options

Generally, you need a score of at least 620 to qualify for a conventional mortgage loan. With an 810 credit score, you should be eligible for the lowest possible mortgage rates. While mortgage rates fluctuate daily, the national average interest rate for someone with a credit score of 810 is 2.36 percent on a 30-year loan (as of April 2021). In comparison, someone with a poor credit score between 620 and 639 will receive an average interest rate of 3.92 percent.

A difference of 1.56 percent in interest might seem inconsequential, but let’s look at the math. The average national price of a new home in the United States was about $408,000 in January 2021. On a 30-year loan term, the person with a mortgage interest rate of 3.92 percent will pay $286,000 in interest over the life of the loan. In comparison, the person with the 810 credit score who gets a 2.36 percent interest rate will pay almost $125,000 less in interest over the 30 years—so having good credit pays off.

810 credit score car loan options

You can get approved for a car loan with almost any credit score, but having a score in the exceptional credit range will guarantee you much better interest rates.

Someone with a “super prime” credit score of 720 or higher can expect to get an average interest rate of 3.65 percent on a new car and 4.29 percent on a used car. In comparison, people with a deep subprime score of 579 or less typically get 14.39 percent on a new vehicle and 20.45 percent on a used car.

810 credit score credit card options

Being in the exceptional credit score range means you should be able to qualify for almost any credit card you want. Not only will you secure the lowest interest rates, but you’ll also get access to credit cards with the best perks, such as travel rewards, cashback deals and more. You may be approved for cards with no annual fees, no foreign transaction fees, sign-up bonuses and even 0 percent financing. Additionally, you’ll be approved for incredibly high credit limits.

On average, you can expect to have an interest rate of 13.5 percent on your credit card. On the other side of the spectrum, individuals with a score of 579 or lower may receive credit card interest rates of around 21 percent.

How to check your credit score for free

Take a closer look at your credit with our FREE credit assesment tool which includes your scredit score, a negative item summary and a recommended solution.

Get started today with a FREE online credit report consultation

- FREE Credit Score

- FREE Credit Report Summary

- FREE Credit Repair Recommendation

Before we can view your credit, we’ll need some information from you.

Don’t worry, this is completely secure and won’t hurt your credit score.

By clicking "Submit" I agree by electronic signature to: (1) be contacted about credit repair or credit repair marketing by a live agent, artificial or prerecorded voice and SMS text at my residential or cellular number, dialed manually or by autodialer, and by email (consent to be contacted is not a condition to purchase services); and (2) the Privacy Policy and Terms of Use (including this arbitration provision).

What is the fastest way to achieve an exceptional credit score?

If you want to get into the exclusive 800 Club, you should start by educating yourself on what affects your credit score. The FICO score model looks at five factors when determining your score, and some of these factors are weighted more heavily than others.

The five factors and their related percentage toward your credit score are:

- Payment history – 35 percent

- Outstanding debts – 30 percent

- Credit history length – 15 percent

- New accounts – 10 percent

- Credit mix – 10 percent

Working your way down this list, the most important thing you can do to build an exceptional credit score is stay current with all your payments. Next, you’ll want to pay down outstanding debts, avoid opening too many accounts simultaneously and have a healthy and diverse credit mix.

Some factors, such as your credit history length, are mostly out of your control. However, you can do yourself a favor by keeping your oldest credit card open—even if you don’t use it—to maintain a long credit history.

How long does it take to improve an exceptional credit score?

Once you get to an exceptional credit score, your primary focus will be to maintain your score, not necessarily improve it. As we’ve previously mentioned, an 810 credit score is essentially a perfect score. An increase from 810 to 850 likely won’t result in much of a difference in loan approvals, loan rates or loan terms. Instead, you’ll want to do everything in your power to stay at this credit range and not go down.

How to build your credit

You can maintain your exceptional credit range by:

- Paying all your bills on time and in full

- Paying down debts

- Keeping your credit utilization very low—below 30 percent at a minimum

- Reviewing your credit report every year to check for inaccuracies—if you find any incorrect negative items, you’ll want to file a dispute right away

- Maintaining a good mix of credit

- Keeping your oldest credit card open

Building and maintaining credit doesn’t happen overnight. Come up with a financial plan and stick to it. If you need help with credit education or credit repair, consider reaching out to Lexington Law today.