What is a judgment and how does it affect your credit score?

November 2, 2023

A judgment is a court order that results from lawsuits, and it should not affect your credit. When a debt collector enters a judgment, they have a better chance of garnishing wages and using other methods to collect payment.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

When a debt collector files with the courts in an attempt to collect payment, a judgment is the final decision from the court. This judgment outlines the responsibilities and rights of both the creditor and the person who owes the debt.

Fortunately, you no longer have to worry about a judgment on your credit report, so it shouldn’t affect your ability to get a loan. But it’s important to note that judgments are a result of a lawsuit from creditors. By understanding the different types of judgments and their details, you can navigate the court process easier and hopefully avoid the situation entirely.

What is a judgment?

A judgment is a court order that results from a lawsuit pertaining to repaying a debt. Up until recently, civil judgments were reported to the credit bureaus. When you owe a creditor money and don’t pay it, the creditor can try to recover it by going to court and suing you for it.

When a creditor sues for the money you owe, the court decides on the merits of the case. If a judge rules against you, the decision becomes a judgment, in which case they can:

- Order wage garnishment

- Order you to come up with a payment plan with the lender

- Allow the lender to attach liens to your property in order to recover their money

No matter what payment collection method the judge decides on, you’re forced to pay back what you owe because of the court order.

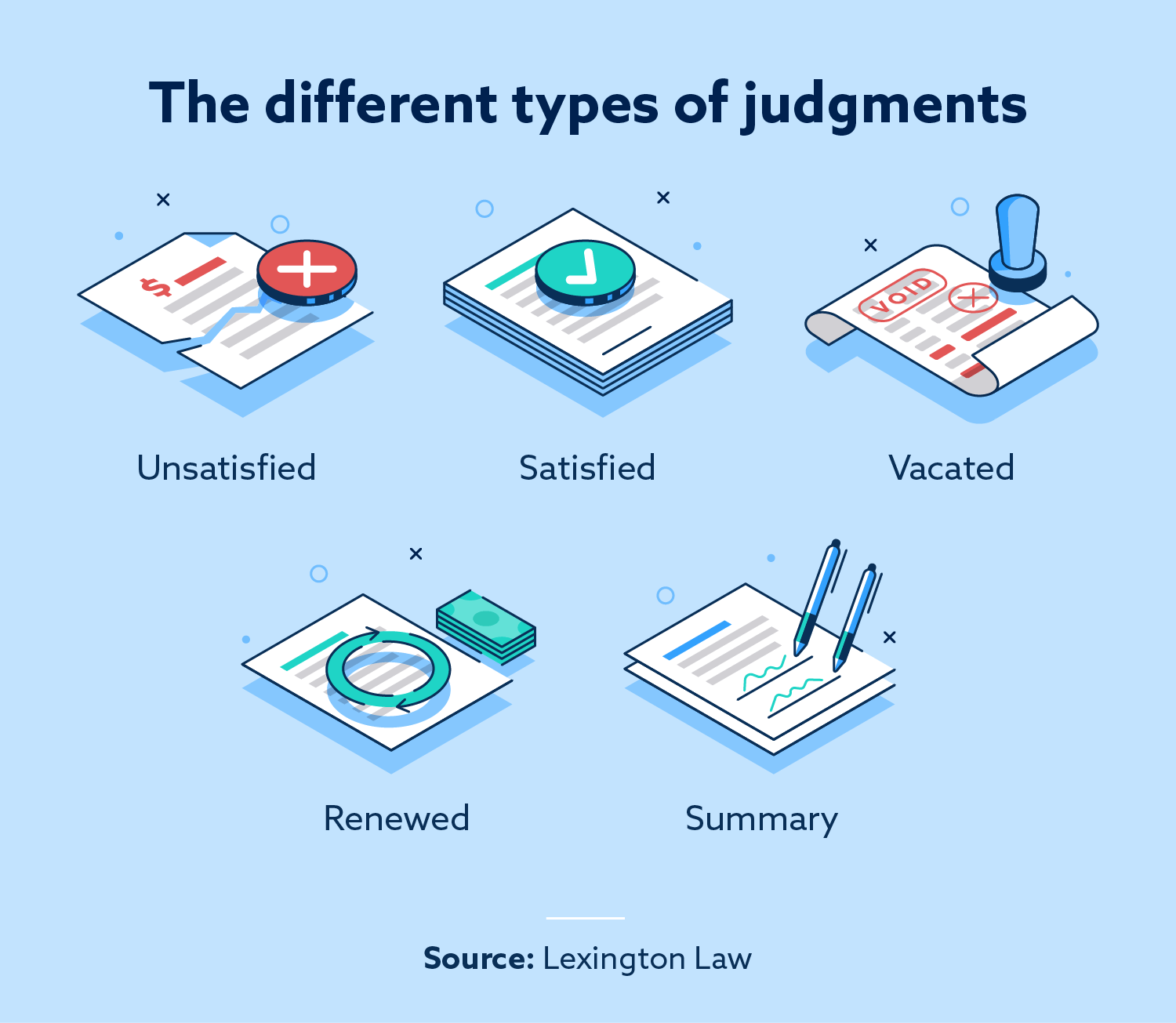

5 types of judgments

Just like there are different types of debts, there are different types of legal judgments. The following is a list of the different judgment meanings:

- Unsatisfied judgments: When a judgment is taken out against you, you are expected to honor the decision. Until the debt is repaid, the judgment remains unsatisfied.

- Satisfied judgments: This means that your debt is either paid or settled. While you may not have completely paid off your debt in full, you can satisfy a judgment by agreeing and adhering to a new payment plan.

- Vacated judgments: A vacated judgment is one that the court dismissed after an appeal.

- Renewed judgments: Also known as refiled judgments, renewed judgments are when a creditor chooses to seek a new judgment. You’ll need to check your state’s laws for renewed judgments to see if they can be filed where you live.

- Summary judgments: A summary judgment is when a court makes a judgment without a trial. This happens if either party moves for a summary judgment because there’s no disagreement about the facts of the case and what is owed.

Judgment classifications

Along with types of judgments, there are also two judgment classifications:

- Monetary judgment: This classification is when the person or organization filing the lawsuit is seeking monetary compensation. If the filer wins, the other party is ordered to pay a specified amount of money.

- Non-monetary judgment: Non-monetary judgments are when the judge orders work be done rather than providing the winner with payment. For example, if a construction company lost the lawsuit, they may need to provide their services for free.

How a judgment happens

As we’ve mentioned previously, a judgment is the end result of a lawsuit. First, a debt collector will file a lawsuit against you. In this type of lawsuit, the collection agency would be the plaintiff, and the person who owes money is the defendant.

The process is as follows:

Step 1: The plaintiff files a Summons and Complaint.

Step 2: The court receives the filing and processes it.

Step 3: The Summons and Complaint is sent to the defendant.

Step 4: Once the defendant receives the Summons and Complaint, they have a short amount of time to respond.

Step 5: The lawsuit enters the litigation process.

Step 6: The defendant receives the judgment.

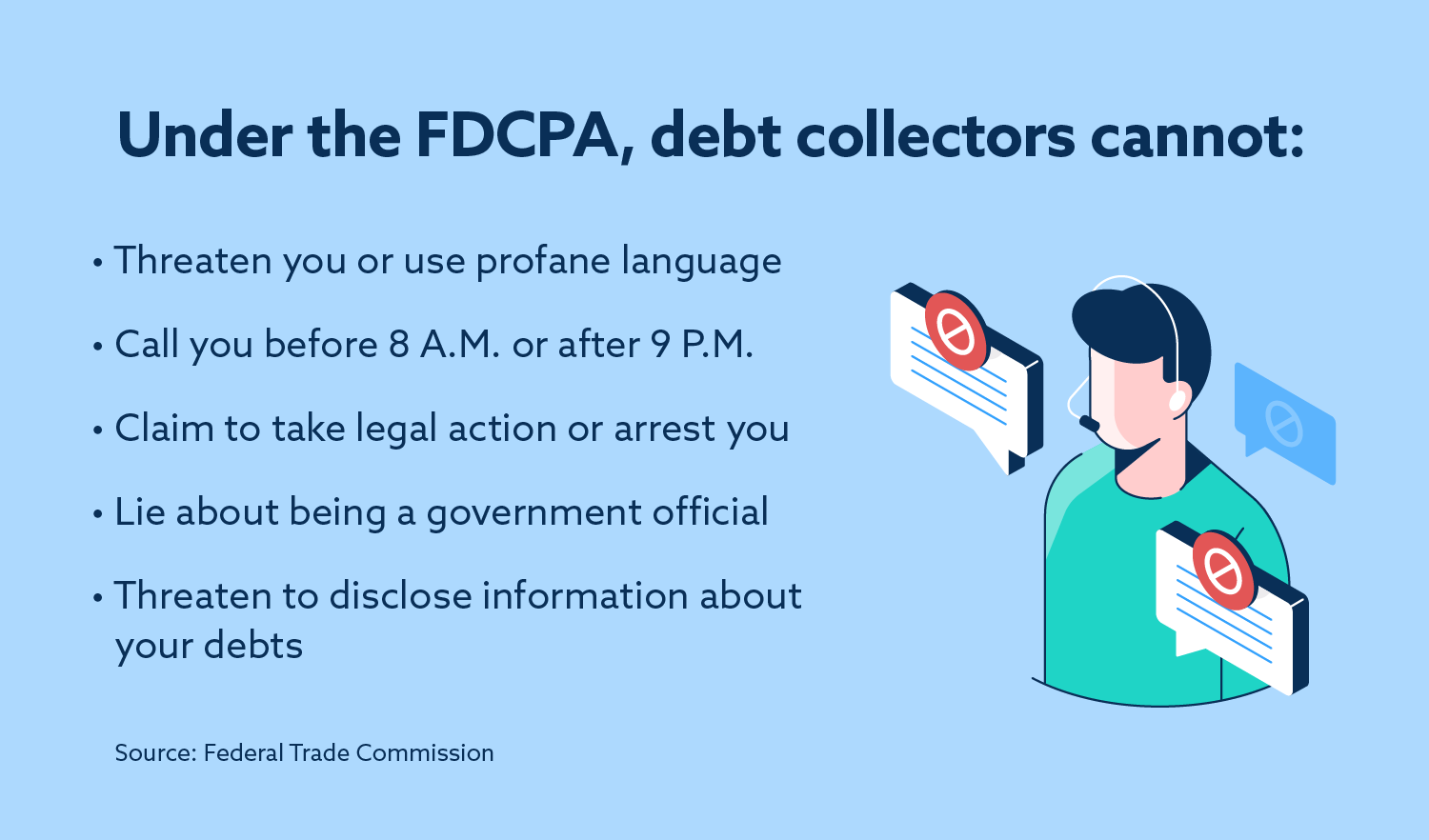

It’s also important to understand that a lawsuit must happen before a judgment, and a judgment cannot happen without this process. Collection agencies often try to make debtors believe judgments happen without the full process in order to pressure them to pay. In fact, it’s illegal for collectors to threaten legal action.

Civil judgments vs. criminal judgments

While civil judgments are settled between two parties, criminal judgments involve government attorneys that may result in jail time or loss of legal rights. Civil judgments are the most common when it comes to money that is owed to a person or company. A debt collection agency can seek a civil judgment for money owed, and an individual can seek a civil judgment against a company for a breach of contract.

Criminal judgments are the result of a person or company who broke the law—often involving theft or fraud. If the defendant in a case like this loses, it may result in jail time or other forms of legal punishment. For example, if a person committed a financial crime using the internet, they may not be able to use a computer for a specified amount of time.

3 ways to get a judgment

There are different ways a collector can get a judgment after a trial or settlement:

- Judgment after trial: After the trial is decided by a judge or jury, the judgment is recorded as the final decision.

- Consent judgment: When a lawsuit is negotiated between the parties and results in a settlement, it is a consent judgment.

- Default judgment: Default judgments happen when the defendant does not respond to the Summons and Complaint, and the plaintiff wins by default.

According to a 2015 civil justice report, the National Center for State Courts found that most civil cases were disposed of through the administrative process. They believe at least 20 percent of these were default judgments due to the defendants’ failure to respond.

What happens after a judgment is entered against you?

You will receive a notice of the judgment in the mail after the court proceedings end or if you don’t reply. At this point, the creditor can use various methods to collect the money from you. Some of the common methods include:

- Wage garnishment

- Property attachments

- Property liens

What is a judgment lien?

A judgment lien is when the judge gives a creditor the right to seize property. This is a nonconsensual lien, which means that the creditor does not need your permission to seize property as ruled by the court.

What can be seized in a judgment?

In order to receive payment, a creditor can attempt to seize various pieces of property from you. The property is appraised, and if the creditor believes the property is worth enough to help pay off your debt, they will seize and sell the property.

Although creditors can seize property to collect a debt, there are limitations. Much like Chapter 7 bankruptcy liquidation, each state has exemption amounts for different types of property. You’ll need to check your state laws to find the guidelines.

Some of the property that creditors may attempt to seize include:

- Vehicles

- Wages

- Bank accounts

- Investment securities

- Household possessions

How to avoid paying a civil judgment

States provide different exemptions, which may provide a way to avoid the seizure of certain properties, but the defendant still needs to pay in full. Exemptions are typically for specific pieces of property that are within a limit of value. For example, something worth less than $1,000 may be exempt.

Keep in mind that you’ll need to check your state’s specific exemptions. The most common types of property protected by exemptions are:

- Homes

- Jewelry

- Household necessities like furniture

- Clothing

The only other way that you may be able to avoid payment is if you were to file and win an appeal.

How long does a judgment stay on your credit report?

As of 2018, judgments are no longer reported, so they don’t show up on credit reports. This official policy, the National Consumer Assistance Plan (NCAP), came after a settlement between the major credit bureaus Experian, Equifax, and TransUnion and 30 state attorneys general. Since this did not come from a law, it could change in the future.

Judgments are no longer available through public records, either. It is important to note that if a debt gets to the point of a judgment, it typically means you have other negative marks on your credit report like late or missed payments, which will likely affect your credit.

How you used to remove a judgment from your credit report

Prior to the policy change, here is what you previously had to do to remove a judgment from your credit report.

- Appeals for a vacated judgment: If you successfully appealed your judgment, then the case was dismissed. The person suing still had the option to refile, but since it’s costly and time consuming, they often did not pursue it again.

- Disputes for inaccuracies: If the court was missing certain information when they reported judgments, the judgment could be removed. It could also be disputed due to identity theft, the lender going out of business or a clerical error.

- Pay the judgment in full: Judgments were sometimes removed after they were paid in full, and some states required it.

To remove a judgment from court records, you would have to pay in full as well. This would result in the case closing, and the courts would remove it.

Are errors affecting your credit?

Sometimes items like late or missed payments can end up on your credit reports in error. If errors are hurting your credit, or you have a question about a judgment on your credit reports, look into working with Lexington Law Firm. We have a team of professional legal consultants who help clients address errors and work to repair their credit, as well as provide ongoing financial education. We provide a variety of services, and you can get your free assessment at any time.

Alexis Peacock was born in Santa Cruz, California and raised in Scottsdale, Arizona. In 2013, she earned her Bachelor of Science in Criminal Justice and Criminology, graduating cum laude from Arizona State University. Ms. Peacock received her Juris Doctor from Arizona Summit Law School and graduated in 2016. Prior to joining Lexington Law Firm, Ms. Peacock worked in Criminal Defense as both a paralegal and practicing attorney. Ms. Peacock represented clients in criminal matters varying from minor traffic infractions to serious felony cases. Alexis is licensed to practice law in Arizona. She is located in the Phoenix office.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.