The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Key takeaways:

- Child identity theft occurs when fraudsters use a minor’s personal information to illegally obtain credit.

- You can contact the credit bureaus to check if your child has a credit report.

- Placing a credit freeze on your child’s credit can stop fraudsters from opening credit accounts in your child’s name.

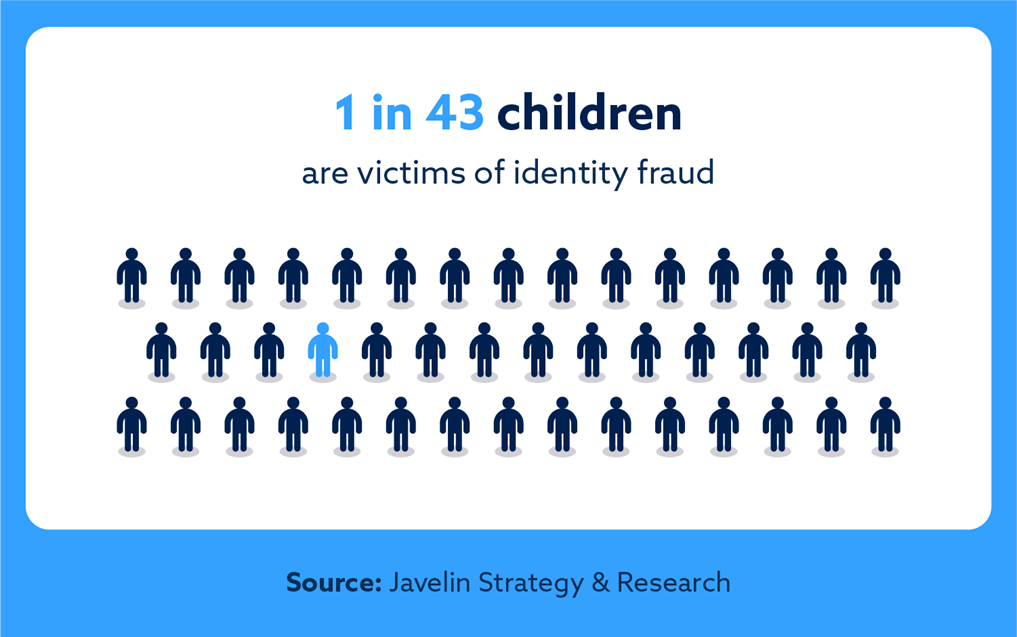

Identity theft is a widespread issue that can happen to anyone, even children. In fact, a Javelin survey revealed that approximately 1.7 million, or 1 in 43 children, were victims of identity fraud in 2022.

Since minors generally don’t have credit reports, they may not realize they’ve become victims until much later, thus making the consequences worse. Therefore, credit monitoring for minors is crucial for protecting your children’s financial future.

Read on to learn more about child identity theft and how to protect your children from becoming victims of this crime.

Table of contents:

- What is child identity theft?

- What is credit monitoring?

- How to check if your child has a credit report

- How to place a credit freeze for minors

- Steps to take if your child is a victim of identity theft

- Protecting yourself and your family from identity theft

What is child identity theft?

Child identity theft occurs when an individual steals a child’s personal details, such as their name, date of birth or Social Security number, to illegally secure credit or similar benefits. Identity thieves will use this information to open a credit card account, apply for a loan or even attempt to get government assistance.

Lack of age verification by creditors means this crime can remain hidden until a child turns 18 and applies for credit, only to discover that their credit score is much lower than it should be. Therefore, it’s important to take proactive steps to monitor your child’s credit so you’re alerted to potential signs of child identity theft.

What is credit monitoring?

Credit monitoring is a method of tracking updates to your credit report so that you can quickly address anything that seems suspicious. While it’s common for adults to keep track of their credit, many people are unaware that credit monitoring for minors is also recommended.

The three credit bureaus and some other financial companies offer child credit monitoring services. Typically, these companies charge a small fee of $10 – $20 per year to monitor your minor’s Social Security number to detect new credit accounts. Many credit monitoring products bundle children with adult subscriptions so your whole family is protected.

When you enroll your child in a credit monitoring service, you’ll get alerted if they find something suspicious so you can take quick action. Early detection is key when it comes to minimizing the damage of child identity theft.

How to check if your child has a credit report

Typically, children under the age of 18 don’t have credit reports. If your child does have a credit report, this could be a sign that their personal details have been compromised.

While you cannot access online credit reports for minors 13 years old or under due to the Children’s Online Privacy Protection Act, you can write to the three credit bureaus to request that they check if your child has a credit report. In your letter, you’ll need to provide copies of the following documents:

- Minor’s birth certificate

- Minor’s Social Security card

- Your driver’s license or other government-issued identification

- If you’re not the minor’s parent, provide proof of legal authority, like foster care certification or guardianship papers

After you’ve compiled the necessary documents, send your request to the following addresses:

| Equifax | Experian | TransUnion |

|---|---|---|

| P.O. Box 740241 Atlanta, GA 30374-0241 | P.O. Box 2002 Allen, TX 75013 | P.O. Box 2000 Chester, PA 19016 |