Many people have errors on their credit reports due to issues with credit reporting during the COVID-19 pandemic. Fortunately, there are ways to address these errors.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The COVID-19 pandemic turned most people’s worlds upside down, impacting their physical and mental health, plans and finances. More than 40 percent of American adults reported that they or someone in their household had lost a job or wages since the start of the pandemic. And of the workers who’ve reported experiencing a pay cut since February 2020, almost half (49 percent) say they’re still earning less money than they did before the pandemic.

Unfortunately, for many people, these negative financial effects also extended to their credit reports. Often, when a person loses their job or a portion of their wages, their credit is impacted and their credit score lowers. This can lead to other consequences, like loan applications being denied and more.

Remember, if you notice that your credit score is going down, it’s always a good idea to double-check why. More than one-third of Americans have at least one error on their credit reports. And the pandemic has brought on more potential for mistakes, as many credit reporting regulations were modified to accommodate people during these tough times.

Keep reading for a detailed overview of why these errors happened, how to find COVID-related errors on your credit report and what to do about them.

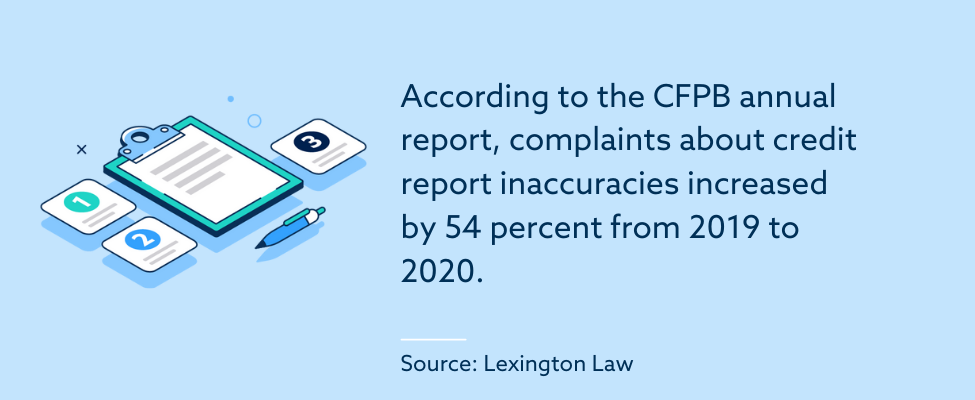

The CFPB is receiving increasingly more complaints about inaccuracies on credit reports

Complaints to the CFPB about credit report inaccuracies have been on a steady rise since the start of the pandemic. According to the CFPB annual report, complaints increased by 54 percent from 2019 to 2020. Additionally, starting in April 2020, more than 3,000 complaints were filed monthly that mentioned a keyword associated with the pandemic.

This dramatic increase in errors and complaints can be attributed to both the pandemic and the system, in general, being flawed. The processes in place don’t make handling errors very easy. The CFPB report highlighted that many consumers find it frustrating to be caught up in an unhelpful automated system when trying to dispute inaccurate information with the national credit reporting agencies. Additionally, those who attempted to file disputes complained that it took excessive time and money to correct even straightforward errors.

Pandemic accommodations caused complications

One apparent reason for credit report errors being on the rise is all the pandemic accommodations. These accommodations were created to help consumers manage their finances and credit during this difficult period.

Pandemic accommodations were temporary adjustments to rules for federal and private lenders to help relieve consumers’ financial stress. Some examples include forbearance on federally backed student loans and mortgages, deferment options with private lenders and adjustments to negative reporting rules.

Unfortunately, these new and often shifting accommodations increased the instances of errors. For example, the CARES Act allowed individuals to opt into forbearance on their mortgages without incurring penalties. However, lenders had trouble adapting to these new changes quickly.

Wells Fargo, for instance, ran into problems when trying to implement certain accommodations. The company chose to apply a blanket forbearance to all mortgages, which resulted in people who continued with their payments (and never opted into forbearance) still seeing their mortgage loans being marked as negatively impacted by COVID. In many of these cases, individuals even saw a decrease in their credit scores despite continuing to make their mortgage payments.

This is just one example of how lenders had trouble keeping up with pandemic accommodations, resulting in credit errors that did additional harm to the very consumers the accommodations were meant to protect.

Why do errors on credit reports matter?

No one should ignore mistakes on their credit reports. Your credit reports can have a far-reaching impact on your day-to-day life, and errors on your reports could be dragging your credit down. A low credit score can cost you money by causing you to be approved for credit at higher interest rates and with worse terms.

Additionally, a poor credit score can mean you’re denied credit cards, loans, mortgages, car loans and other financial products. Besides affecting your finances, some employers and landlords also require a credit score check, meaning a low score could cost you a job opportunity or a lease agreement.

In addition to all the potential downsides, you should also care about errors on your credit reports because they violate your rights. Under the Fair Credit Reporting Act (FCRA), every consumer is entitled to accurate credit reports. As your credit can affect so many areas of your life, you deserve to have a credit history that’s a fair representation of your borrowing actions.

How to check for errors on your credit reports

Typically, people can only access each report for free once per year, as mandated by the FCRA. But a change was made during the pandemic allowing everyone to check each report for free weekly through December 2022.

When you access your report, keep an eye out for COVID-related errors (as well as standard errors). If you took advantage of any pandemic accommodations, ensure your report reflects the accommodation accurately. For example, individuals who’ve taken advantage of the paused federal student loan payments shouldn’t see records of missed payments on their credit reports for the entire time of forbearance.

Other common credit report errors are:

- Accounts that should be closed showing as open

- Accounts that are up-to-date showing as delinquent

- Duplicate accounts

- Listed debts that don’t belong to you

- Data errors around balances, addresses, dates, payment history, etc.

Any type of error can be disputed to achieve the negative item being either removed from your credit report or updated with the correct information.

What you can do about errors on your credit reports

If you find errors on your credit reports, you can try working with your lender directly by asking that they update the information they’ve provided to the credit bureaus. If that doesn’t work, you can go to the bureaus directly.

You can file a dispute with the credit bureaus by following these steps:

- Get a copy of your report and find all instances of mistakes.

- Send a dispute letter to each of the credit bureaus (Equifax, Experian and TransUnion) that lists an error on your credit report. The letter should include details about what information is wrong, why you believe it’s wrong and copies of any documentation that verifies your claim. Also include a copy of your credit report with the mistakes highlighted.

- If the credit bureau you’re writing to has a dispute form, fill it out and include it.

- Keep records of all your dispute letters and correspondence.

- Send your letter by certified mail and pay for a return receipt so you have proof that the credit bureau received it.

- After receiving your claim, the credit bureau has 30 days to investigate (if they deem your dispute legitimate).

- The credit bureau will reach out to the lender or creditor who supplied the information and ask them to verify the data. If the lender or creditor cannot do so, the credit bureau will remove the negative item from your credit report.

- The credit bureau must notify you of the results of your dispute—whether it’s been approved or denied. If the dispute has been approved and results in a change, you’ll receive a free updated copy of your credit report.

As you can see, the dispute process is long and can feel overwhelming. Many consumers don’t have the time to commit to doing all this work and choose to use the professional services of a credit repair company instead. The consultants at Lexington Law Firm can help people get back on track. If a national emergency like the COVID-19 pandemic has directly impacted your credit report, you can take steps to protect your credit. Let our team show you how.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.