The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Your credit score is not directly affected when you get married. However, spouses can still impact each other’s credit through other financial decisions.

Marriage will change many areas of your life, but will it change your credit? The short answer is, no, getting married doesn’t directly impact your credit, but marriage and credit scores are still linked.

Some marriage-related changes can affect your credit, including name-change complications and adding authorized users to an account. Luckily, this doesn’t have to be seen as a negative. Instead, view your marriage as an opportunity to stay financially healthy together. The first step is understanding what will impact your credit score after marriage. This guide breaks it down so you know exactly what’s to come and how to handle it.

What happens to your credit when you get married?

When you get married, nothing automatically happens to your credit score. Remember, a credit score is a reflection of one individual’s creditworthiness, so getting married doesn’t inherently have an impact on it. Let’s look at what does happen to your credit after marriage.

You and your spouse retain your credit

Even after the marriage certificate is signed, both spouses retain their own credit scores. Neither score will change automatically, nor will a spouse’s good or bad credit immediately affect the other’s score.

You and your spouse can share credit

If you decide to cosign a mortgage or car lease, you’ll share the effects of that loan. Any activity—good or bad—made on this shared credit account will affect both spouses’ credit scores.

You and your spouse’s credit may be limited

A lower credit score could negatively impact a couple’s approvals for mortgages, loans and shared interest rates. Lenders performing credit inquiries are more likely to draw up terms and agreements based on a couple’s lowest credit score, which could also limit available credit on shared credit accounts.

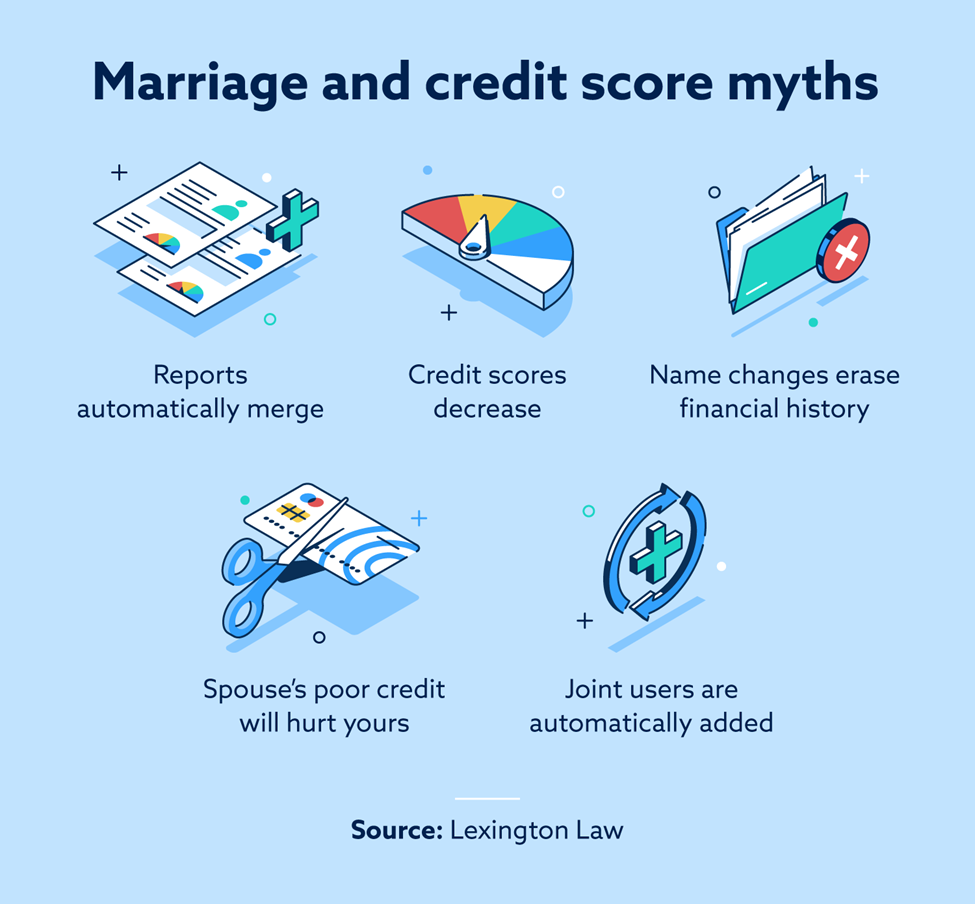

Marriage and credit scores: 5 common myths

The myths surrounding marriage and credit scores can cause unnecessary anxiety heading into a wedding day. Understanding the common myths around marriage and credit scores can help you prepare for what’s to come—and let you ignore the things that don’t really matter.

Myth 1: Credit reports merge when you get married

You don’t lose your financial identity when you get married, nor does it automatically merge with your spouse’s. Credit reports are identified by your Social Security number, not your last name or marital relationship. Until you get joint financial products, like credit lines or a mortgage, your credit report will only reflect your own credit activity.

Myth 2: Marriage lowers your credit score

Getting married will not lower your credit, but merging your spending habits with your spouse potentially can.

If a “saver” marries a “spender,” the saver might be influenced by the spouse or have to cover the other’s spending. Of course, these problems don’t just show up after a wedding day. Spending habits are usually clear early on in a relationship, and most couples find a financial equilibrium.

So, your marriage won’t lower your credit score. However, marrying someone with poor credit and then having joint accounts with them could possibly hurt your credit.

Myth 3: Your credit history is erased when you change your last name

Changing your last name doesn’t mean you’re starting a credit history from scratch. Your new name will become an additional alias on your report, and your credit report will remain the same.

When creditors report your new name at the end of the next cycle, the three major credit bureaus will automatically receive and record the new information on your report. Consider requesting a free credit report a month after the switch to ensure the new information has been noted.

Myth 4: Your spouse’s poor credit will hurt your credit score

Your spouse’s poor credit won’t automatically hurt your own credit. However, your credit health may change when you apply for joint accounts or loans. Once approved for a joint account, you’re both responsible for the account. So, if your spouse is maxing out your credit limit or missing payments, it will also affect your credit.

Myth 5: You are automatically added as a joint user on your spouse’s account

When you get married, you don’t automatically become a joint user on your spouse’s account. Also, note that your credit and bank accounts aren’t automatically merged. To authorize your spouse on your account or open a new account together, you must mutually discuss it with your financial institution. Couples may choose to merge accounts before marriage or remain financially independent.

Does your spouse’s credit affect yours?

After tying the knot, you and your spouse may start looking ahead to your next significant financial milestone. When this happens, you may wonder how your spouse’s credit can affect your options.

Both spouses’ credit scores can affect major credit evaluations, including when you:

- Merge and create joint accounts

- Attempt to buy a home or make another large purchase

- Apply for interest rates and other qualifying offers

When you and your spouse decide to get a new account or loan together, the lender pulls both of your credit reports to make the lending decision. Mismatched scores could affect mortgage interest rates, credit limits and approval chances. Since finances and relationships are intertwined, knowing how your spouse’s credit could affect you is important.

When you get married, do you share debt?

When you get married, you only share debt if you open a joint account, cosign a loan or become an authorized user on your spouse’s account. Otherwise, premarriage debt is the responsibility of the one who accrued it.

However, debts accumulated during your marriage are treated differently depending on where you live. States following community property laws consider debt acquired during the marriage to belong equally to spouses. In common law states, debts are generally the sole responsibility of the one who acquires them. If you need further clarification on the property laws of your state before, during or after marriage, consult an attorney.

And remember, even if a debt isn’t legally attributed to you, it can impact you. If your partner has tremendous amounts of debt, you might find your quality of life affected. You should discuss all debts and fully understand your partner’s financial situation before getting married.

Improving your credit with your spouse

Both spouses’ credit scores can benefit when a couple combines their finances. For some, linking financial accounts also helps couples define, manage and improve budgets, expenses and credit scores. These financial changes don’t need to happen all at once, and there’s no one-size-fits-all answer for spouses managing their finances.

Authorized users

Adding your spouse as an authorized user to an account can sometimes help improve the lower of your two scores. Spouses may consider this method if one person doesn’t have a long credit history or has a high credit utilization ratio.

Joint lines of credit

Even if couples keep separate accounts, opening a joint line of credit for everyday purchases and bills can help raise credit scores. Additionally, if your spouse has low credit, opening a joint line of credit to improve their credit health can help you qualify for a better interest rate together.

Cosigning loans

When you cosign a loan, the activity on the loan will impact both of your credit scores. If you sign for a loan together and make payments on time and in full, it can help the person with the lower credit see a bit of a boost.

Should married couples merge finances?

Merging finances as a couple is a hot topic, with financial experts arguing on both sides. A 2023 study found that couples who merged finances were happier in their relationship long-term. This is because they were more likely to experience financial harmony and so had less conflict around their finances.

Ultimately, though, this is a personal decision every couple needs to make for themselves. Couples should do what works best for their partnership to remain healthy, happy and stable.

How marriage affects your credit report

So, does getting married affect your credit score? Even though tying the knot doesn’t directly affect your credit, there’s a good chance there’ll be an impact on it at some point. You’re starting a life with this person, and your finances will be closely intertwined.

If you change your name or combine finances, monitor your credit reports for inconsistencies or errors. Credit report mistakes can negatively affect your credit health and should be dealt with as soon as possible.

Lexington Law can help you work to address inaccurate and unfair negative items on your report. Get a free personalized credit report assessment today.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.