F.I.R.E. stands for “Financial Independence, Retire Early.” The movement consists of three main strategies: spending less, making more and investing wisely.

A new financial movement called F.I.R.E. is redefining retirement, and it’s not just for grandparents anymore.

Retirement is often seen as a late-stage phase of life, one that comes long after children are grown and careers are completed. For some, retirement feels completely out of reach — one Gallup poll showed that nearly half of Americans believe they’ll never save enough to retire. Unsurprising, given that approximately three-quarters of people save less than the recommended 15% of their annual income. But a growing online community of amateur financial strategists thinks that we have the power to turn this trend around.

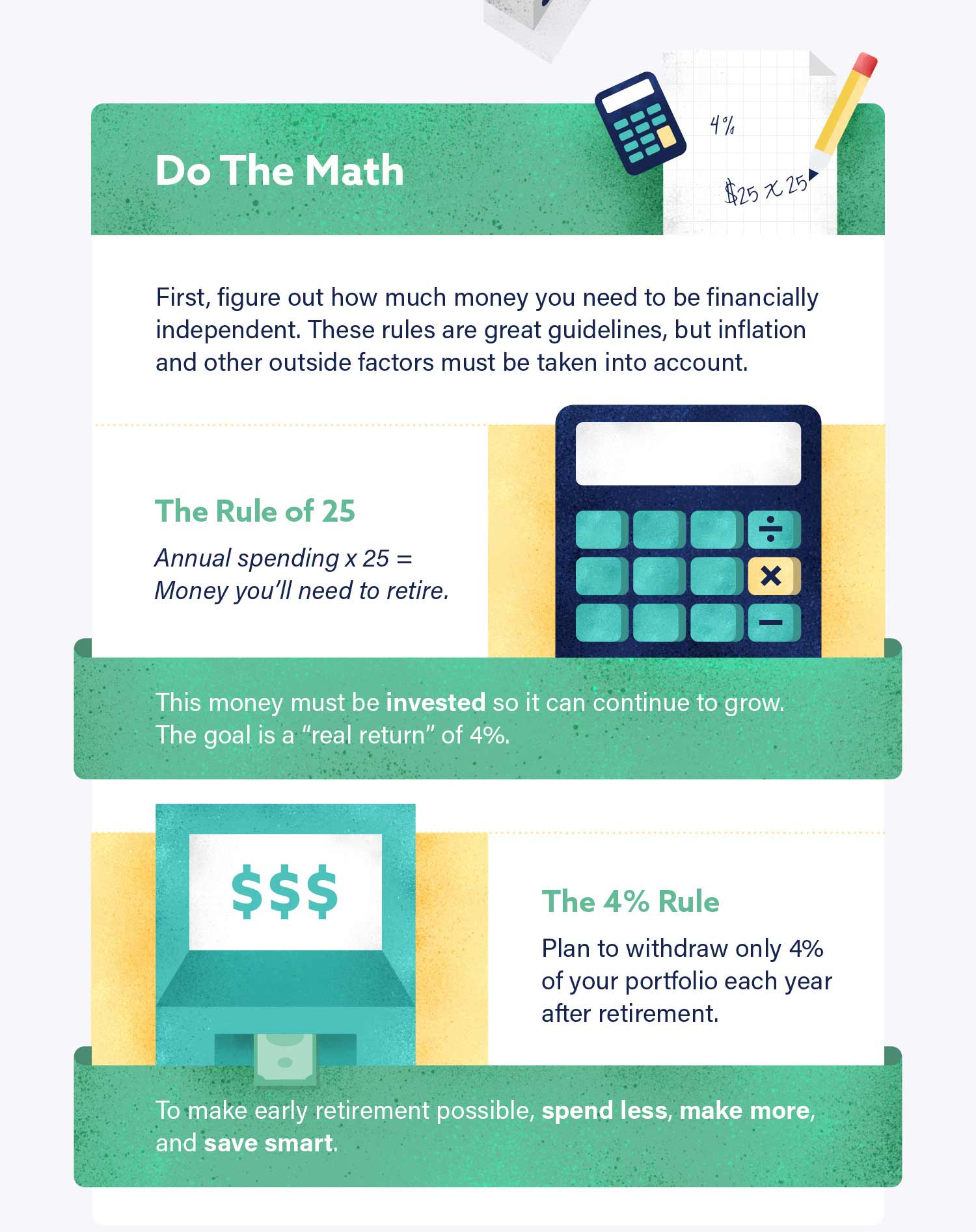

The secret, they say, is in the math: just multiply your annual spending by 25 and, once you have that amount saved, you can retire comfortably. If your number is too high to reach, cut your annual spending. If you want to get there faster, find ways to make more money and invest more wisely.

Using these strategies, F.I.R.E. followers have been known to achieve financial independence in as little as a few years. You can take a look at our infographic below to learn about the difference F.I.R.E. can make.

What is F.I.R.E.?

F.I.R.E. stands for “Financial Independence, Retire Early.” The movement consists of three main strategies: spending less, making more and investing wisely. With these three tactics, the community claims that a person can realistically grow their savings to 25 times their annual spending, at which point they’ll no longer need to collect a salary in order to live comfortably.

Strategists say with that amount in the bank, a “retiree” can plan to withdraw 4% of their portfolio each year and live on that amount without draining their funds. Ideally, a person will also have invested that nest egg wisely: F.I.R.E. encourages savers to aim for an annual investment return of at least 5%.

Of course, the math alone isn’t enough to start your F.I.R.E. journey. In 2017, the average household income in the U.S. was $63,600 and the average household spend for someone in that income range was $54,200. At that rate, it would take a person over 137 years to hit their F.I.R.E. retirement goal! The real magic of F.I.R.E. is in the lifestyle changes that allow followers to speed the process.

How to F.I.R.E.

There are three main steps to achieving financial independence and retiring ahead of schedule. Since retirement goal numbers are calculated based on annual spending, it’s about more than just saving up — lowering your spending or increasing your income will also speed the journey to financial independence. The F.I.R.E. community is full of bloggers, financial planners, lifehackers and amateur strategists who swap ideas on the best ways to accomplish those goals.

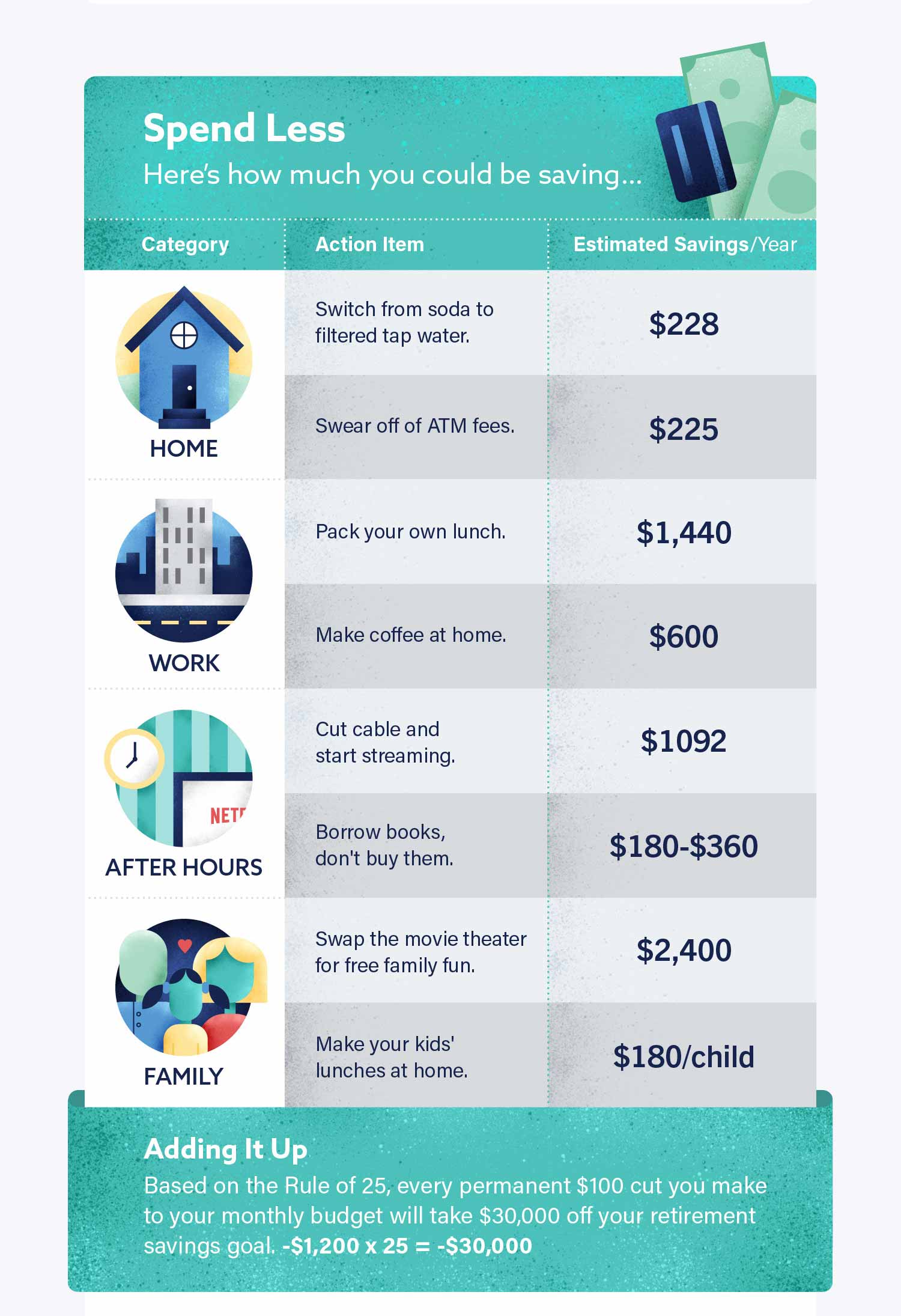

Step 1: Lower Your Annual Spending. The movement’s primary focus is drastically cutting annual spending, thereby also bringing down the amount you need to amass in savings for retirement. The founder of the movement encourages living on less than $10,000 per adult in your household annually. This requires more than your average coupon-cutting strategies. Super savers practice extreme frugality — drying clothes on a line, making their own laundry detergent, growing their own food and even switching to candlelight or installing solar to save on electricity. Many even relocate to relatively remote areas to take advantage of lower housing costs and living expenses.

Step 2: Increase Your Income. F.I.R.E. strategists point out that most people overlook the ways in which they could be making money beyond their annual salary. Many are known as“passive” streams of income, meaning they don’t require active maintenance — you can set them up once and let the cash roll in on its own.

Strategies for upping income include negotiating a raise or strategically pursuing an advanced degree that will help you net a higher salary. “House hackers” invest in larger properties and rent the empty space at the rate of their monthly mortgage payment to lower household expenses. Many F.I.R.E. members track their financial progress on a blog and collect the advertising revenue. Others find different hobbies that can generate extra cash or savings, like woodworking or fixing cars.

Step 3: Invest. Finally, it’s essential to maximize the benefit of having a growing nest egg by stashing it in places that offer reasonable rates of return. That’s why the most successful F.I.R.E. advocates tend to be fairly well-versed in at least some basic investment strategy.

Even if you don’t want the risk of investing in stocks, there are other places besides a checking or savings account that you can keep your money to net you a few more percentage points of interest in the process.

You should keep your emergency funds in a place you can withdraw from at any time, but beyond that, money you know you won’t need to withdraw for a few years can be invested. If you’re saving up for a future home, you can put that down payment into a certified deposit (CD) or purchase bonds with long maturation periods and make from 2–4% interest. Funds that you can put away for longer are better candidates for flightier investments, like stocks. F.I.R.E. also advocates maxing out any tax-advantaged accounts like your 401k, since they offer the dual benefit of high return while also lowering your annual tax payment.

What Difference Does It Make?

Small lifestyle changes can greatly accelerate your retirement progress. Every additional $100 you save per month equates to $30,000 less in savings needed to retire. So something as simple as switching from cable ($107/month) to a combination of Hulu and Netflix ($16/month) can bring you closer to your retirement goal by over $27,000.

More drastic changes have more drastic effects. Say you move from a two bedroom apartment in Baltimore ($1393/month) to a similar apartment in Springfield, Missouri ($561/month) — you’ve just made it closer to your retirement goal by a quarter of a million.

But What If You’re In Debt?

F.I.R.E. is fairly “advanced” in that it assumes savers are already used to avoiding and paying off debt. But that doesn’t mean that people with debt can’t use the same strategies that supersavers use to dig themselves out of a financial hole. Given that the movement populated by people quickly accumulating hundreds of thousands of dollars, its principles are effective for anyone looking to pay down large owed sums too.

F.I.R.E. strategists emphasize the importance of eliminating debt as quickly as possible so you can start making progress on hitting your retirement savings goal. That means locking down every dollar of discretionary spending and channeling it directly into debt payments until you’re out of the hole. And F.I.R.E. absolutely never advocates borrowing against one account to pay another: If your debt has gotten too messy to control, it’s worth looking into professional advice on how to consolidate it, lower your interest rates, and start making measurable progress toward breaking even.