The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Prepaid cards are similar to debit cards, but you don’t need a bank account to get one. You use cash to add money to the card and then use it to pay for goods and services at many of the same stores that let you use a debit card.

Prepaid cards are incredibly helpful for those who don’t have a bank account, like and for young people who aren’t old enough to open their own accounts.

Although prepaid cards work similar to debit cards, there are some key differences as well. Read on to learn how prepaid cards work, potential downsides of using them and how they differ from debit and credit cards.

What is a prepaid debit card?

A prepaid debit card functions much like a debit card that banks provide, but you don’t need a bank account to use one. You can use many prepaid cards to shop at physical and online stores.

Not only are prepaid cards useful for those who don’t have bank accounts, but they’re often used as a way to budget. If you have issues with overspending, you can load prepaid cards with a specific amount.

Prepaid cards are helpful if you:

- Don’t have a bank account and don’t like to carry around cash

- Want to cut back on your spending by limiting your available funds

How do prepaid credit cards work?

The available balance of a prepaid card is the amount of money you add to the account. Debit cards are linked directly to your bank account, but you load prepaid cards at physical stores with cash or online with another payment method.

With prepaid credit cards, you don’t need to go through a financial institution. Many local stores sell prepaid cards, and you can load some of them at the same store.

As you use your prepaid card, the money will fluctuate based on how much you spend. The money on your card is a fixed amount based on how much you added to the card. When the balance gets low, you can reload money to the card. Many prepaid cards have a website where you can see your balance and monitor your spending.

Prepaid debit cards vs. regular debit and credit cards

One of the key differences between prepaid cards and debit cards is that you don’t need a bank account for a prepaid card. Prepaid cards are also different from credit cards because they don’t offer a line of credit, so you can only spend what you load on the card. Although you don’t need a bank account, many banks and financial service companies issue prepaid cards.

Below are some additional key differences between these three types of cards:

| Prepaid cards | Credit cards | Debit cards | |

|---|---|---|---|

| Overview | Also called stored value cards, prepaid cards enable you to make purchases with preloaded funds | A form of revolving credit, credit cards let you borrow money up to a limit to make purchases | Tied to your bank account, debit cards enable you to access your funds when making purchases |

| Fees | May involve monthly fees, activation fees and other charges | Interest charges on unpaid balance and annual fees on some cards | Overdraft fees if you spend more than your account balance |

| Payments | Pay before, spend now | Spend now, pay later | Spend now, pay now |

| Withdrawals | May allow for ATM withdrawals | May allow for cash advance withdrawals | Allow for withdrawals at ATM |

| Requirements | Generally no requirements | Usually require a credit check | Require a bank account |

Are there any downsides to using prepaid cards?

Similar to other financial services, prepaid cards come with their own fees that take from your cash balance. The Consumer Financial Protection Bureau reports the following are some of the most common prepaid card fees:

- Monthly fees

- Transaction fees

- ATM fees

- Reload fees

- Balance inquiry fees

- Card declined fees

- Inactivity fees

- Paper statement fees

- Foreign transaction fees

- Bill payment fees

- Card-to-card transfer fees

- Card cancellation fees

- Card replacement fees

- Additional card fees

Some companies pay employees through “payroll cards,” which are prepaid cards where you receive your wages. If you don’t want to pay the fees associated with these cards, you have the right to decline the prepaid card. Upon request, your employer must provide you with at least one alternative payment method.

These cards also have fewer consumer protections than debit cards and credit cards. There are many protections for consumers using these cards, but they’re still lacking. Some of the protections you don’t have include:

- Overdraft protection

- More difficult dispute process and error resolution

- Quality protections from fraud and unauthorized transactions

- Unclear consumer rights and disclosures

What to look for in a prepaid card

When shopping around for a prepaid card, one of the primary factors you should consider is the fees. Different cards have different fees, so it’s helpful to check a few before choosing one. Many prepaid cards have a network of ATMs where you won’t be charged a fee, so you can check and see if these ATMs are near your home or work.

Do prepaid cards build credit?

Prepaid cards do not affect your credit score and can’t help you build credit. There are a couple of reasons why prepaid cards don’t have any impact on your credit:

- Prepaid card activity isn’t reported to the credit bureaus. The three credit bureaus that keep track of your credit history report information about your accounts — like loans or credit cards — but they don’t have any information about prepaid cards.

- Prepaid cards don’t involve credit. Since your credit score reflects how well you manage borrowed money, prepaid cards are not a good reflection of that since you’re spending money you’ve already preloaded.

If you’re looking for a way to build or rebuild your credit, consider getting a secured credit card. A secured credit card is backed by a deposit, so you’re often able to get access to this type of card with a poor credit score or no credit history.

Prepaid card FAQ

Prepaid cards are simple to use, but you may still have some questions. The following are answers to many of the most frequently asked questions many people have about these cards.

Do prepaid cards have limits?

Some prepaid cards have limits on how much or how little you can add to your card. Some have limits on both.

Do prepaid cards expire?

Another similarity prepaid cards have with debit and credit cards is the expiration date. If your card is about to expire, you may be able to transfer your balance to a new card, or you can request a check. If neither are an option, you can spend the remaining money on the card before it expires.

Are prepaid cards FDIC-insured?

If your prepaid card was purchased through an FDIC-insured bank, your prepaid card will be FDIC-insured as well. In some cases, you may need to register your card to receive the FDIC coverage.

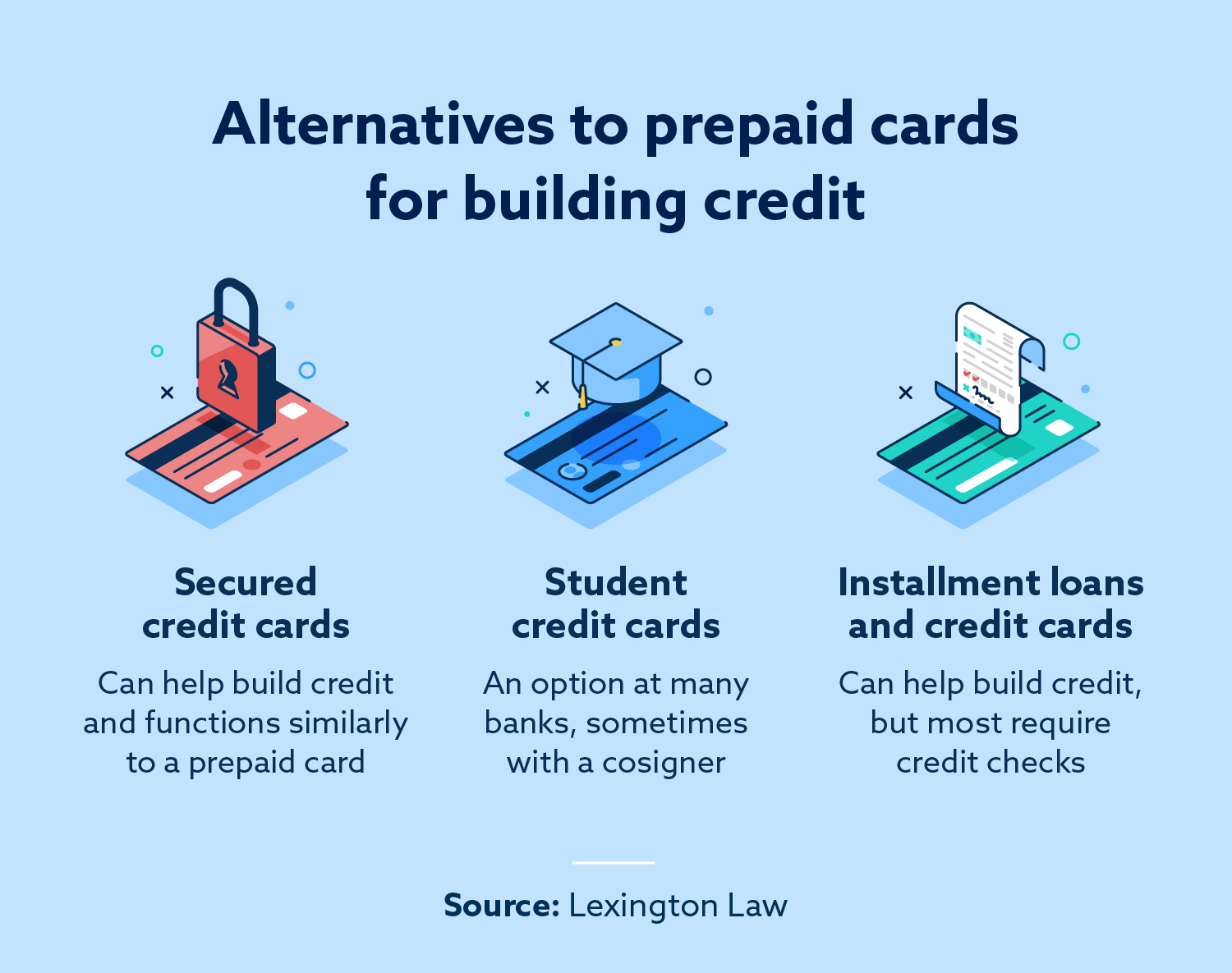

Alternatives to prepaid credit cards

If you’re looking to build credit, a prepaid credit card may not be the right option for you. There’s often no minimum credit score requirement for secured credit cards, and your payments are reported to the major credit bureaus.

Building credit is a great way to improve your financial health and save money on interest, deposits and more.

For a look at your current credit health, Lexington Law Firm provides a free credit assessment.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.