The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

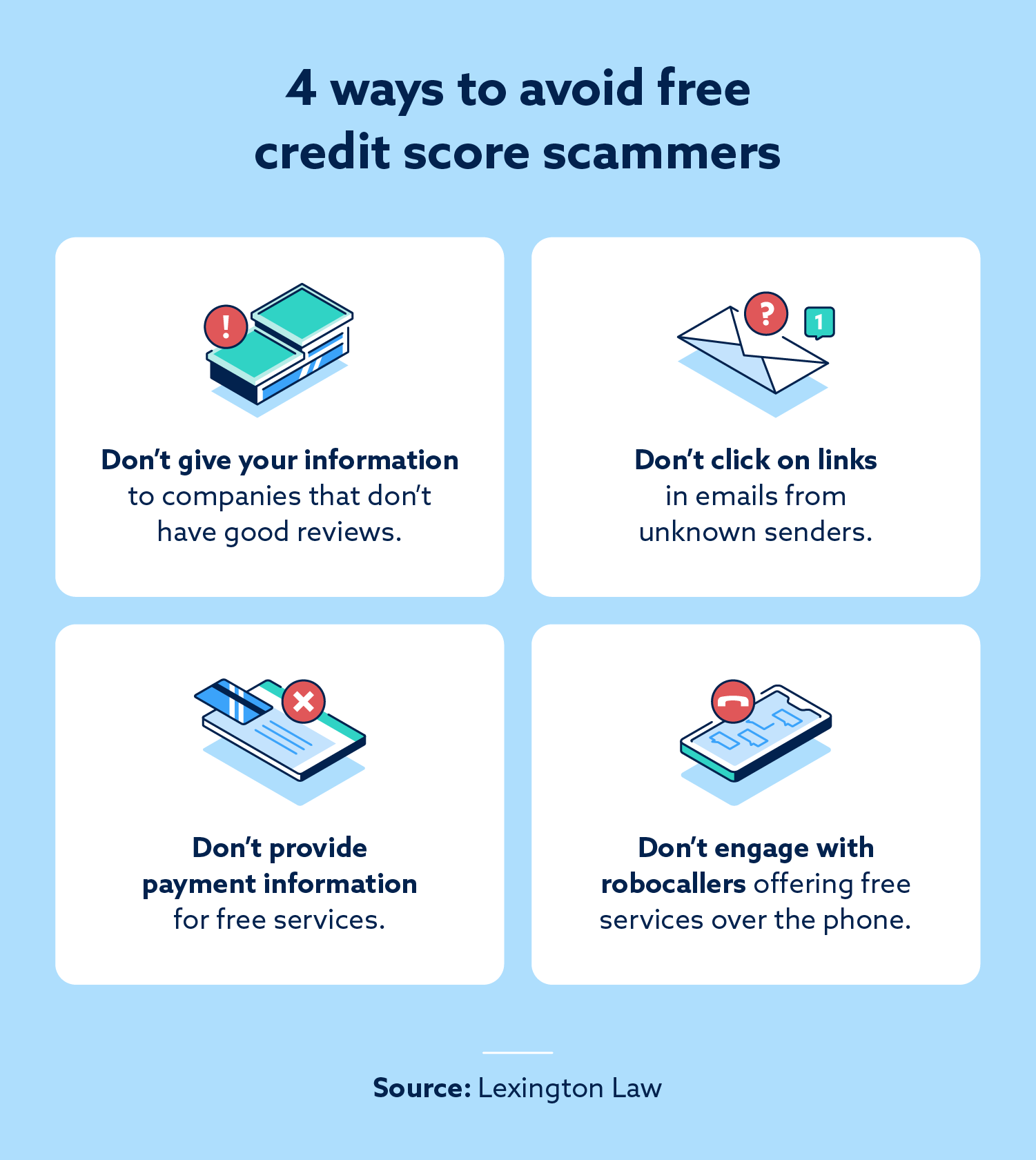

One of the best ways to avoid free credit score scams is to find reputable sources through reviews and not to click links from unknown senders advertising free scores. Some scams use robocallers as well.

A credit score is an important indicator of your financial health. It can affect your interest rates, how much your deposits are and your ability to get a loan. There are many services out there that charge you to check your credit score, which is what makes free credit score offers so alluring. Unfortunately, there are nefarious people who try to steal personal or financial information through free credit score scams.

According to the Federal Trade Commission (FTC), consumers reported losing over $10 billion to fraud in 2023. During this time, there were 5.4 million reports, and many included identity theft. This is why knowing how to spot credit score scams is so important.

Today, you’ll learn four tips to avoid credit score scams and how to find reputable organizations that provide the service legitimately.

1. Only use reputable sources for free credit scores and reports

If you’re looking to check your credit score for free, one of the most important things you can do is to find reputable companies. In order to check your credit score and report, the company needs your personal information, so you want to ensure they’re legitimate.

How to safely get your free credit report

The best source to get your credit report is through AnnualCreditReport.com, a site authorized by the U.S. government to provide you with your report once a year for free. Here, you receive your report from the three major credit bureaus — TransUnion®, Experian® and Equifax®. Doing it this way, you can ensure getting your free credit report is safe.

How to safely check your credit score for free

There are many ways to get your credit score for free, including:

- Credit card companies: Credit card companies often offer free credit scores via their mobile app and website. You can sometimes find it on your monthly statement as well.

- Banks and credit unions: Similar to credit card companies, many banks also have your credit score in their app or on their website. Not all credit unions have this service, so check to see if yours does.

- Reputable online services: Many online services that offer free credit scores, but do your research first to see if they’re reputable.

Also, keep in mind that some companies aren’t legitimate, so learning how to identify credit repair scams is helpful.

2. Beware suspicious emails

Email scams commonly advertise financial services as a way to steal your information. Bad actors use a technique known as “phishing,” which involves trying to get your information by having you click on links.

Many scammers are good at what they do, so the emails will look legitimate. They may use company logos and legitimate-looking websites to steal your information. This is why it’s helpful to look for signs of email scams:

- Email address: The sender should have an email address that’s @ the company’s website domain.

- Suspicious attachments and links: Some links or attachments can steal your information, so try not to click or open ones that look suspicious.

- Poor spelling and grammar: If you look closely, you can often find issues with spelling and grammar. They may also have awkward phrasing because they’re sometimes sent from outside the U.S.

- Sense of urgency: In an attempt to have the reader not look too closely or question the email, the sender may create a false sense of urgency to get your information.

3. Don’t provide payment information

A free credit score should be free, which is why you should be skeptical if the service is asking for payment information upfront. A free credit report scammer may ask for your payment information so they can steal it to make purchases.

It’s helpful to note that many legitimate services that provide free credit scores may ask for payment information for a free trial. If you don’t want to move forward with the membership, it may be a good idea to set a calendar reminder to cancel before you’re billed. Just be sure to check that the company is reputable before providing your payment information.

4. Ignore unknown callers and robocallers

Unknown callers can sometimes be a red flag, and robocallers are becoming more popular. Robocallers are often pre-recorded messages, but with artificial intelligence becoming more popular, they can sound even more real.

A credit score or credit report scam may be from someone impersonating a financial institution. Similar to scam emails, they may create a sense of urgency by telling you there’s a problem with your credit report and trying to entice you to give your information. This can lead to identity theft or the theft of your credit card information.

One of the simplest ways to avoid these types of scam calls is to change your phone settings. Many of the newer smartphones allow you to change the settings to send unknown callers straight to voicemail.

What to do if you’re the victim of a free credit score scam

Even with the knowledge of what to do to avoid free credit score scams, you can still become a victim. If this happens, there are some steps you can take:

- Freeze your credit: You can freeze your credit with all three bureaus to prevent anyone from opening new lines of credit until you unfreeze it.

- Report the scam: On the FTC website, you can report fraud to begin an investigation.

- Contact your bank and credit card providers: If the scammers stole your information, consider canceling your debit and credit cards and changing your bank account information.

How to get your free credit score from a reputable company

To avoid free credit score and credit repair scams, be sure to use a reputable company like Lexington Law Firm. To avoid free credit score and credit repair scams, be sure to use a reputable company like Lexington Law Firm. Get your free credit assessment today for a free credit score and credit report summary.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.