To cancel your credit card, you’ll need to contact the credit card company and follow additional steps to ensure the card is removed from your credit reports.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Canceling a credit card involves contacting the credit card company and following up to make sure the process is complete. People close their credit card accounts for different reasons. If you’re struggling to pay annual fees or interest rates, regularly overspending or have too many open cards, it may make sense to close the card.

There are steps that are helpful to take before and after you cancel your card so you avoid hurting your credit or incurring any unexpected fees. To help you navigate the process, we’ll teach you how to close a credit card account and offer some considerations before closing your account as well.

Table of contents

- How to cancel a credit card

- Does closing a credit card hurt your credit?

- What happens when you close a credit card?

- Do negative marks stay on your credit reports when you cancel a credit card?

- Should you close your credit card?

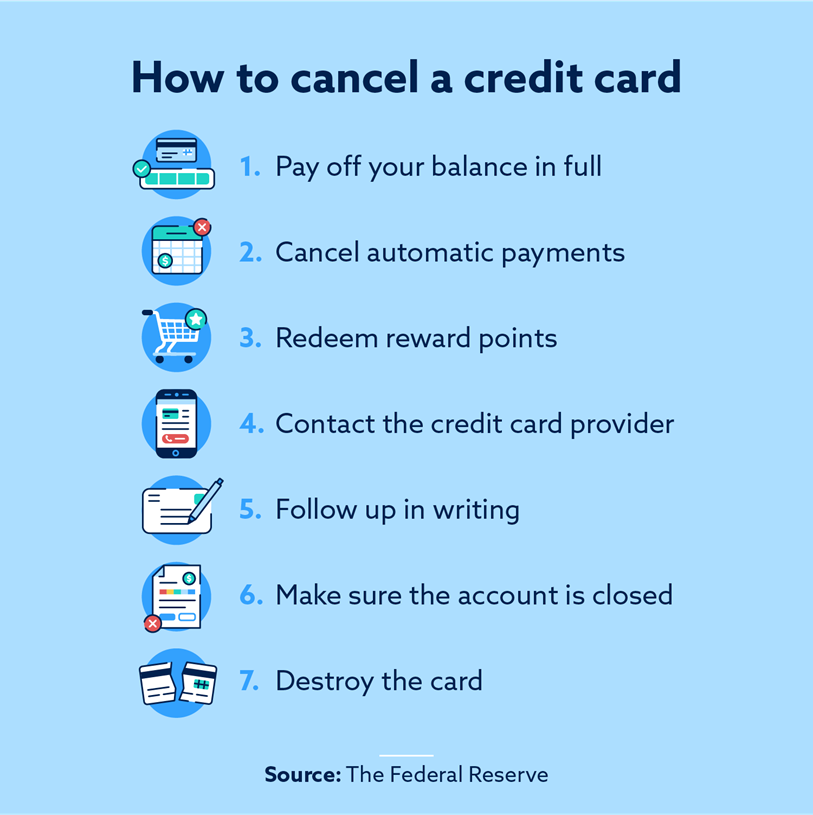

How to cancel a credit card

To cancel a credit card, you’ll need to contact the credit card company. You’ll also need to check your balances before closing it and follow up with the company afterward.

To cancel your card, follow these steps:

- Pay off your credit card balance and any fees. Check your balance thoroughly so you don’t miss any charges and you can pay in full. This amount includes recent purchases, interest since your last bill and any fees. Your credit card won’t be closed completely until the balance is paid in full.

- Remove your credit card from any linked accounts. You may have bills or other payments linked to your credit card. Be sure to change these before you close your account to avoid missing a payment elsewhere. Also remove your card from payment methods for apps such as Apple Pay, Venmo and so on.

- Redeem any rewards points you’ve accumulated. Sometimes, the rewards you’ve earned expire once you close your account. You can check to see if this is the case by reading the terms of the rewards program. You may also be able to use some of your rewards to help pay off your balance.

- Contact your credit card company. To officially close the credit card, you’ll need to call the credit card company or log in to your online account. Confirm that your balance is zero and tell them that you’d like to close your account. Be prepared because they may try to convince you to keep it open by offering a lower interest rate, an increased credit limit or other perks.

- Follow up with the card company in writing. Canceling by phone or email is usually sufficient, but sending a letter is proof that you asked for the account to be closed. This is helpful because it provides you with additional documentation in case the card company doesn’t close your account when you contact them.

- Confirm the account is closed. Make sure there’s nothing outstanding on your final statement and that it shows your balance is paid in full. It takes some time for your account to be marked as closed on your credit report. Follow up with your card company if it’s still showing as open two to three months after the cancellation.

It’s a good idea to wait to destroy the card until you confirm the account is closed. This way, you have the card information if you need to call because there are issues with closing the account. When you’re ready to destroy the card, you can simply cut it with scissors or use a strong paper shredder.

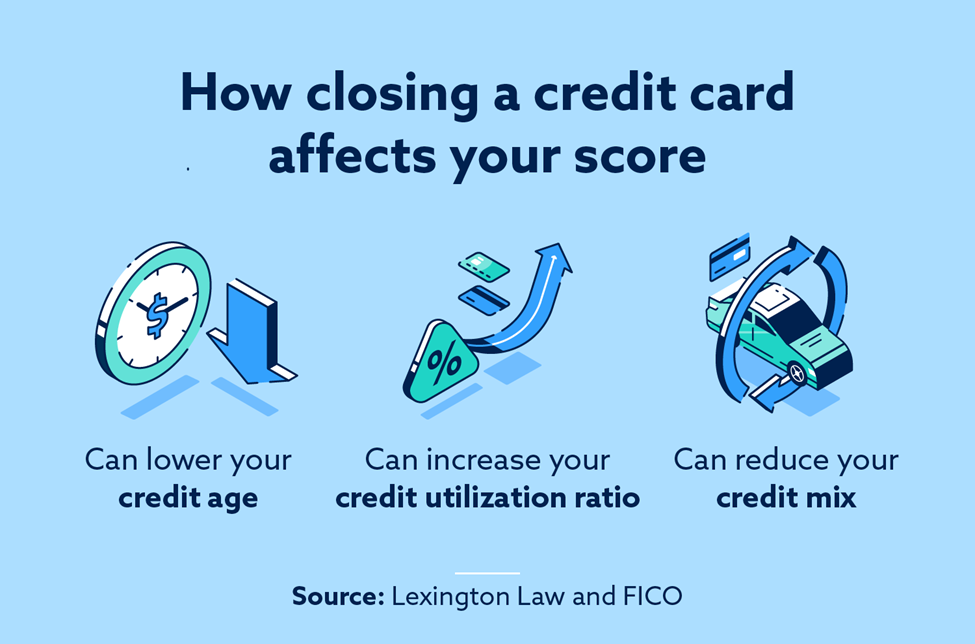

Does closing a credit card hurt your credit?

According to TransUnion®, three credit factors are affected when you close a credit card: average credit age, credit utilization ratio and credit mix. Each factor is weighted differently for your FICO® credit score.

The distribution of weight for these three factors is:

- Credit age: 15 percent

- Credit utilization: 30 percent

- Credit mix: 10 percent

Without taking the steps outlined in the previous section, like paying off your balance in full, your score may drop when you close your account.

Closing a credit card may impact credit age

The older your credit is, the better it will be for your score. If you’ve had a credit account for a long time, closing it could hurt your credit. You should consider not closing your oldest account since doing so could negatively impact the average age of your credit.

However, Forbes states the following caveat for financial institutions using the FICO scoring model:

“However, when you close an account (credit card or otherwise) FICO scoring models still count it in your average age of credit calculations. Closed, positive accounts stay on your credit report for up to 10 years, and up to seven years if negative. As long as an account shows up on your credit report, its age factors into your FICO Score.”

Canceling a credit card could hurt credit utilization

Credit utilization is the percentage of your outstanding balances compared to your overall credit limit. When you close a credit account, the total amount of your available credit decreases. Ideally, you want to keep your credit utilization under 30 percent.

For example, if you have an outstanding balance of $1,000 with a $5,000 total credit limit, your utilization is 20 percent. If you close an account that was contributing a $2,000 credit limit to your total, your available credit would lower to $3,000. With the same outstanding balance of $1,000, your utilization would then be 33 percent.

This means if you’re considering closing a credit card, it would be a good idea to also decrease the balance you’re carrying so your utilization stays in a good range.

Reducing credit mix may affect your score

Lenders want to see if you can handle different kinds of debt, such as credit cards, auto loans, student loans and mortgages. If you close your only credit card, your credit mix is less diverse—potentially lowering your credit score.

What happens when you close a credit card?

Nothing happens immediately when you close a credit card. When you close your credit card account, it should no longer show as active or open on your credit reports. As mentioned above, this change may temporarily lower your credit score. According to TransUnion, credit report updates can take up to 45 days, so you may not see a change for a few weeks.

Do negative marks stay on your credit reports when you cancel a credit card?

Closing a credit card doesn’t forgive or delete the payment history associated with it. Any negative marks, such as late payments or a debt settlement, can stay on your reports for up to seven years. If you have negative marks on your credit reports, try to bring your credit card account to good standing before closing it. For example, pay off the balance on the credit card with a lump sum or timely monthly payments.

Fortunately, closed accounts with only positive payment history for the most recent 10 years can stay on your reports for up to 10 years after being closed, which should benefit your credit, since payment history is the most important credit factor.

Should you close your credit card?

Closing credit card accounts affects people differently depending on their credit situation. For some people, closing a credit card is a good idea. If you’re dealing with high interest rates or spending outside of your budget due to the card, it may be helpful to close it.

It can be helpful to keep a card open even if you’re not using it because it helps with your credit age and utilization ratio. You may want to use it once every few months, though, because some card companies close inactive accounts.

Although closing a credit card may temporarily affect your score, is it bad to close a credit card? Not necessarily. Here are some benefits of closing a credit card account:

- There is one less payment to worry about: A credit card is another expense to keep track of, and it’s an expense that easily accrues interest.

- You can save on annual fees: Some cards come with costly annual fees that may not be worth it if you don’t use them enough.

- Time can repair your credit score: The hit to your credit is likely temporary. As you continue to make payments on your other accounts, your payment history should improve. Over time, your open accounts get older and improve your credit age as well.

What to do if your closed card is still on your reports

It’s possible that a credit card account can still be reported as open on your credit reports by mistake. If this happens, contact the credit bureaus and request the information be changed. You should also inform the credit card issuer—they’ll be obligated to contact all three credit bureaus with the correct information.

You’ll also want to notify the bureaus if you notice any inaccuracies related to the credit card account on your credit reports. This is because a single error can cause long-term damage to your credit. If you need help addressing an error on your reports, Lexington Law Firm can assist you with challenging those and provide additional financial tools and information as well. Contact one of our credit consultants today to learn more about our credit repair services.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.