The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

You can lower your credit card interest rate by following good credit habits and having a solid history of on-time payments, researching how your current interest rate stacks up against competing credit card companies’ offers and calling your credit card issuers to negotiate a lower interest rate and explain why you deserve it.

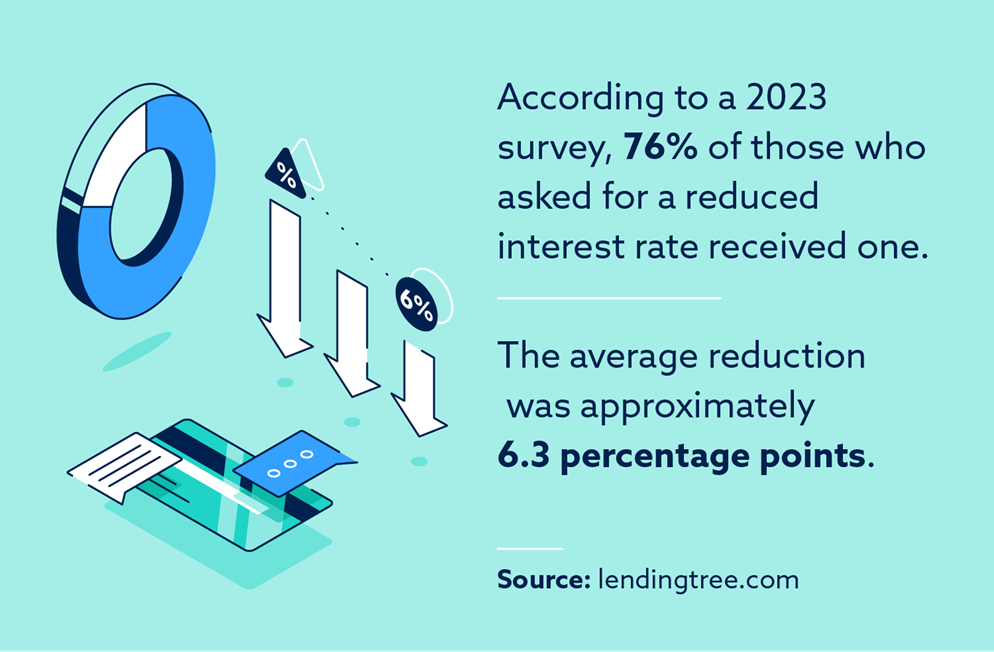

If you have credit card debt, negotiating a lower interest rate may save you hundreds or even thousands of dollars. To improve your chances of approval, it’s important to maintain good financial habits and make a convincing argument for why you deserve a rate reduction. Safeguard your financial future by learning how to lower interest rate percentages on each of your credit cards.

What is credit card interest?

Interest is what you pay to borrow money from a lender. It’s usually expressed as an annual percentage rate (APR), which is the yearly rate you’ll pay if you carry a balance on your credit card.

The higher your interest rate, the more it costs you to borrow money. Therefore, it’s critical that you learn how to lower interest rate percentages on your accounts. Here’s an example to show you how a rate reduction may benefit you over time.

Assume you have a credit card with a 19.99 percent APR and a balance of $1,000. To determine how much interest you’ll pay in 1 month, divide the APR by 12. In this case, 19.99 divided by 12 is 1.7 percent. Then, multiply your balance by 1.7 percent to determine your monthly interest cost—$16.66.

Now, assume you convince your credit card company to reduce your APR to 12.99 percent. Using the same calculations, your monthly interest cost would drop to $10.83. It may not seem like a big difference, but you’ll pay a lot more over time at the higher interest rate. For example, the interest on a $10,000 balance would be $166.58 per month if you had an APR of 19.99 percent, but it would only be $108.25 at an APR of 12.99 percent. Assuming you pay the same amount of interest every month, that’s a difference of just under $700 per year.

1. Plan ahead: improve your chances of getting approved

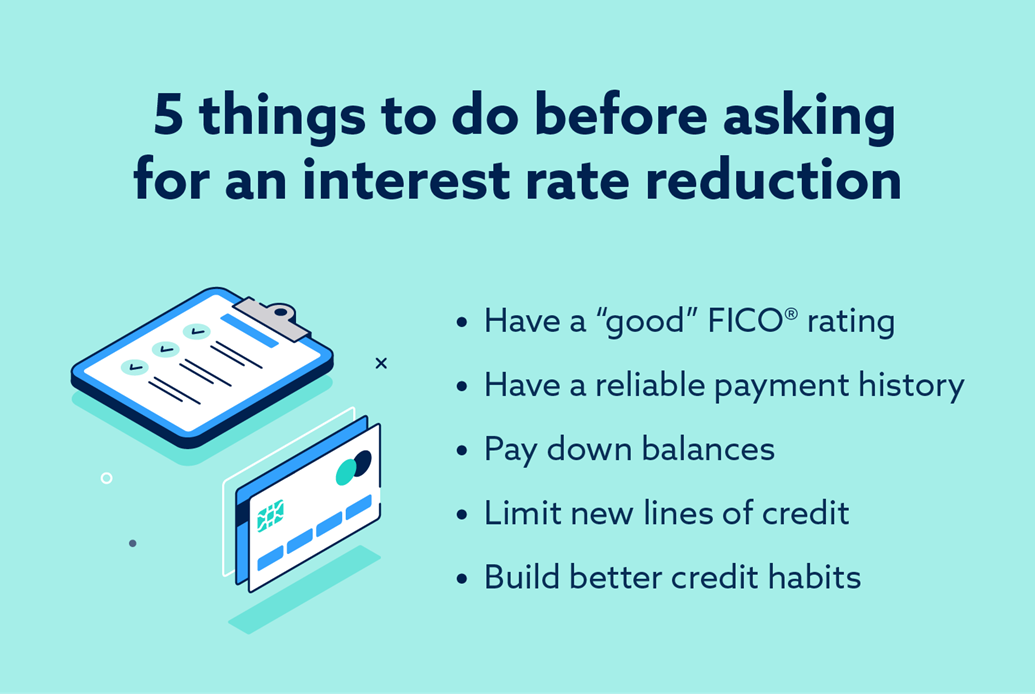

Before you contact your credit card companies, you need to be in a strong financial position. Banks and other lenders are much more likely to work with you if you have a history of positive financial habits. After all, reducing your interest rate leaves them with less revenue, so you have to prove you’re a good risk.

First, make sure you have a history of on-time payments. If you’ve had a late payment or two, consider waiting six months to one year to request a rate reduction. In the meantime, focus on paying down debt and staying well below your credit limit on each card.

Checking your credit reports and scores

Now is a good time to pull your credit reports and look for errors. If you find any, such as incorrect balances or late payment notations when you’ve never been late, have them corrected right away. Erroneous information can hurt you when negotiating with lenders, applying for new accounts and refinancing existing loans.

It’s also helpful to request your FICO credit scores. To increase your chances of qualifying for a rate reduction, you may want to wait until you have a score of at least 670. Scores in the 700s are even better. If your scores are below 670 when you pull them, spend a few months fixing your credit.

Making other financial changes

The following actions may also help you qualify for a rate reduction on each of your credit cards:

- Paying down debt: If possible, pay off some of your smaller balances or make a decent dent in one of your bigger debts. Credit card companies may be more likely to lower your rate if you can demonstrate that you’re committed to being responsible with your money.

- Avoid applying for new accounts: When you apply for a new account, the lender has to check your credit report to see if you meet certain requirements. These checks go on your credit reports as hard inquiries. If you have several hard inquiries in a short amount of time, lenders worry you’re at risk of defaulting on your current obligations, making them unlikely to reduce your interest rate.

- Schedule your payments: To avoid late payments, consider setting up autopay on your credit card accounts.

- Take steps to reduce the risk of identity theft: If someone steals your identity, they can quickly charge thousands of dollars under your name, leaving your credit in shambles. As you prepare to call each creditor, take steps to reduce your risk of identity theft, such as freezing your credit, shredding bank statements and keeping your financial information secure.

2. Do your research

The next step is to figure out your current rate and compare it to the average rate. If you already have a below-average APR, your credit card company may not be inclined to reduce it even further.

To find current rates, visit the National Credit Union Administration website and click on the most recent month and year. As of September 29, 2023, consumers paid an average of 12.65 percent on cards issued by credit unions and 14.93 percent on cards issued by banks.

Once you know where your rate stands, do a little more research to find out what other credit card companies are charging. If you can show that other banks are charging less than what you pay, your credit card company may be more willing to work with you.

3. Make the request: ask your credit card issuers

Now, it’s time to ask each credit card company to lower your rate. If every card has the same APR, consider starting with the one that has the highest balance. Otherwise, start with the card that has the highest interest rate.

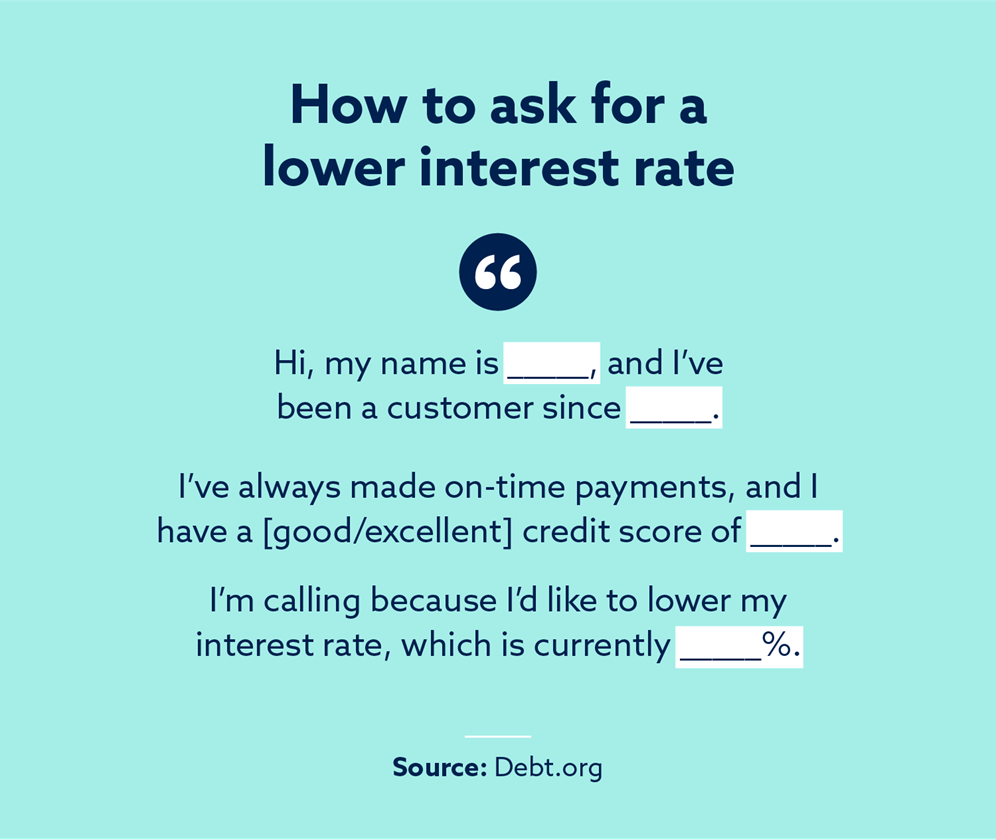

This is where the time you spend on research will really pay off. Once you verify your account information, let the customer service agent know why you’re calling and what you’d like them to do. Here’s a script you can use:

“I’ve been a customer since [date]. In that time, I’ve never made a late payment, and I always pay more than the minimum due on my account. My current interest rate is [rate]. I’d like to reduce that to [lower rate].”

It may help to explain why you want a lower rate. For example, if you want to pay off your debt faster, a lower rate can help you reach your goals. Just remember to stay calm and be polite during every interaction.

4. Consider alternatives

You may not be able to get a rate reduction every time you call, so take time to research the alternatives. One option is to do a balance transfer, which allows you to move debt from a high-interest card to a lower-interest card.

Debt consolidation is another option. When you consolidate debts, you take several accounts and roll them into a single loan. For example, if you have three credit cards and an auto loan, you may be able to consolidate them into a single personal loan. This allows you to lock in a single rate and may even help you reduce your monthly payment.

Frequently asked questions

Does asking for a lower interest rate affect credit score?

In most cases, requesting a rate reduction doesn’t hurt your credit. The exception is if your credit card company requires a hard inquiry. In that case, your score may temporarily drop by a few points due to the appearance of a new inquiry on your credit reports.

Can I ask again if I get rejected the first time?

If your credit card company won’t reduce your interest rate, you can always do a balance transfer or consolidate your debts. Another option is to wait a few months and ask again. If you take this approach, be sure to maintain good financial habits.

One thing you should never do is close an account in good standing simply because the issuer wouldn’t give you a lower rate. Closing an account may hurt your credit, making it more difficult to qualify for rate reductions on your other cards.

The importance of maintaining good credit

Before you attempt to lower the interest rate percentages on your credit cards, you need to have a strong credit profile. If you pull your reports and notice any errors, find a professional credit repair service, like Lexington Law, to help you. They may be able to address these errors and assist you as you work on improving and maintaining your credit health.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.