The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Consumer credit protection laws regulate creditors and lenders so they don’t take advantage of their customers with unfair fees, lending practices or methods of collecting payment. Of course, consumer rights were not always formally recognized.

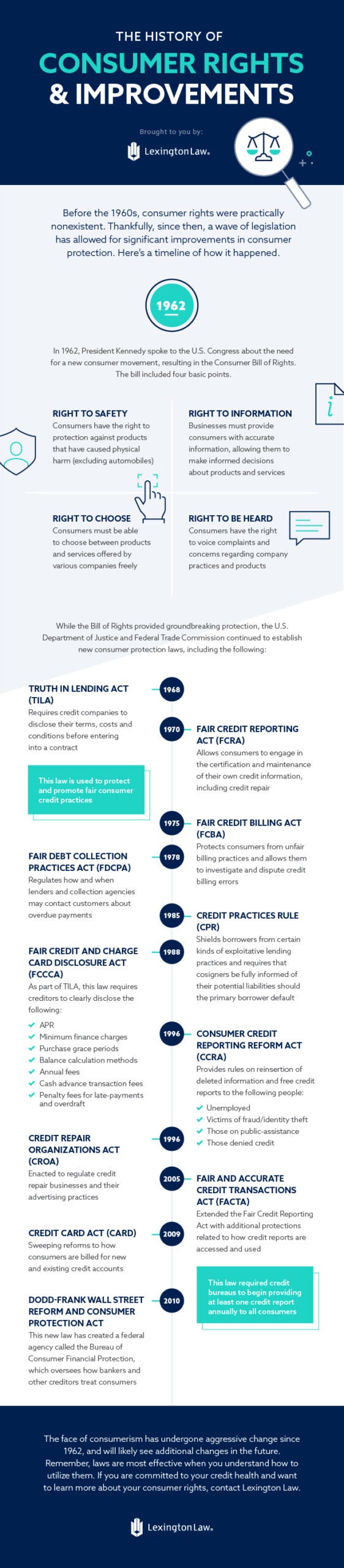

Before the 1960s, the concept of consumer rights was virtually nonexistent. There were no protective measures to help consumers when they dealt with creditors, credit reporting or even credit repair. Individuals who were often the most desperate for help were taken advantage of by predatory lenders and creditors. As consumerism took a sharp spike upward, the government recognized that legislation would need to be put into place to protect consumers.

Keep reading for a complete overview of the history of consumer rights, or skip to the end to see a graphic summing up the most important points.

1962: The Consumer Bill of Rights

In 1962, President Kennedy introduced to Congress the need for consumer rights protection. This resulted in the Consumer Bill of Rights, which started with four main points. Those points were:

- The Right to Safety: The Right to Safety was introduced as a part of the Consumer Bill of Rights in 1972. This right states that consumers have protections against products that physically harm them (excluding automobiles). In response to this right, businesses have implemented product standards, warning labels and testing regulations. The Consumer Product Safety Commission (CPSC) enforces this right.

- The Right to Information: Consumers have the right to complete and accurate information to make informed decisions before purchasing products or services. This right ensures companies don’t participate in false advertising, must disclose in full any past issues with their product or service and must always include proper packaging.

- The Right to Choose: Consumers have the right to choose between vendors and should have options when looking at products and services. The government can step in and encourage the market to always have options by outlawing price gouging and underselling and introducing patent and antitrust laws.

- The Right to Be Heard: When consumers have an experience with a business they feel is unfair, they have the right to be heard. The Federal Trade Commission (FTC), the Better Business Bureau (BBB) and the U.S. Attorney General’s office are just a few places where consumers can file complaints and concerns.

After just a few decades, by 1985, the Consumer Bill of Rights was expanded to include four other sections.

- The Right to Basic Needs: All individuals have the right to basic needs, including access to essential goods and services like food, clothing, shelter, education, public utilities, healthcare and sanitation.

- The Right to Redress: All individuals have the right to receive a fair settlement of any won claims, such as compensation for unsatisfactory services, broken goods or misrepresentation of goods or services.

- The Right to Consumer Education: Consumers have the right to be given adequate information to make an informed choice about their goods and services. Additionally, lenders must tell consumers of their basic consumer rights and how to take advantage of them.

- The Right to a Healthy Environment: Everyone has the right to live and work in an environment that’s safe for current inhabitants and future generations.

1968: Truth in Lending Act (TILA)

In 1968, the Truth in Lending Act (TILA) was enacted by the federal government. The TILA is part of a collection of laws under the Consumer Credit Protection Act (CCPA). The CCPA was created to protect consumers by enforcing fair reporting around credit and prohibiting deceptive advertising by creditors.

The TILA protects consumers from unfair or incorrect credit card billing and charging practices. It also states that all lenders must clearly report to borrowers the total cost of borrowing money. This includes communicating the APR, any interest and fees over the entire span of a loan term, the number of payments required, any late fees and when they apply, prepayment loan restrictions and any other essential terms.

1970: Fair Credit Reporting Act (FCRA)

Another part of the CCPA is the Fair Credit Reporting Act (FCRA), introduced in 1970. The FCRA protects consumer information collected by credit report agencies and used by credit bureaus, medical information companies and tenant screening services.

The FCRA has two main focuses. The first is to ensure that no one other than qualified and approved parties can access a consumer’s credit information. The second purpose is to hold credit bureaus responsible for keeping accurate credit data on consumers. This means that:

- Consumers are entitled to one free credit report annually from each major credit bureau so they can review their accounts for inaccuracies.

- Credit bureaus must investigate any valid disputes filed by consumers about inaccurate data on their reports.

- Consumers have the right to remove negative information from their report after the allotted maximum time (usually seven years).

- The FCRA regulates the type of data the credit bureaus collect.

1975: Fair Credit Billing Act (FCBA)

The Fair Credit Billing Act (FCBA) was introduced in 1975 as a way to protect consumers from unfair credit billing processes. Most notably, this law protects people from being liable for unauthorized charges, charges with errors or undelivered goods or services on their credit cards.

Some of the most significant protections under the FCBA are:

- You are protected when your credit card is lost or stolen. If you report the card as stolen or missing before any fraudulent charges are made, you’re not responsible for those charges.

- The maximum liability for unauthorized use of your credit card is $50.

- You can file disputes for charges you deem unfair (errors, undelivered goods or services, fraud charges). Under the FCBA, the creditor must acknowledge your complaint and file an investigation.

1978: Fair Debt Collection Practices Act (FDCPA)

In 1978, the Fair Debt Collection Practices Act (FDCPA) was enacted into law. After receiving countless complaints about how debt collection companies would try to gather payments, it was decided that protective measures needed to be put into place. The FDCPA regulates how debt collectors can approach consumers to avoid unethical or abusive practices.

Some of the consumer protection details offered by the FDCPA are:

- Debt collectors can’t harass you, are only allowed to call you between 8 a.m. and 9 p.m. (unless you give permission otherwise) and can’t contact you at work.

- Debt collectors must always disclose the purpose of reaching out to you, such as identifying that they’re trying to connect with you as they want to collect payment.

- Debt collectors can’t threaten consumers.

- Consumers can request that all communication stop and the debt collector must oblige.

- Consumers have the right to ask that debt be validated.

- Debt collectors are not allowed to discuss your debt with other parties.

1985: Credit Practices Rule (CPR)

In 1985, the federal government introduced the Credit Practices Rule (CPR). The Credit Practices Rule has three major provisions that keep credit contracts safe for the consumer. The provisions are:

- Credit contracts cannot include a confession of judgment that would have the consumer giving up certain lawsuit rights to obtain the credit contracts.

- All creditors must advise consumers who cosign for credit of their obligations, including the potential consequences if the other party doesn’t pay.

- In some cases, late charges are prohibited.

1988: Fair Credit and Charge Card Disclosure Act (FCCCDA)

The Fair Credit and Charge Card Disclosure Act (FCCCDA) was implemented in 1988 to amend the TILA. This law requires that credit card companies and loan agencies disclose all terms and fine print associated with credit cards, loans and lines of credit.

Some of the information creditors must share under the FCCCDA includes APRs, credit limits, outstanding balances, renewal and cancellation privileges, attachment fees and grace period extensions.

1996: Consumer Credit Reporting Reform Act (Reform Act)

The Consumer Credit Reporting Reform Act, more commonly referred to as the Reform Act, was enacted in 1996. This law was brought forward as a reform to the FCRA. This new act modified the FCRA to provide free credit reports to anyone unemployed or on public assistance, victims of fraud or identity theft and those denied credit. Additionally, the Reform Act created new rules related to reinserting deleted information into credit reports.

1996: Credit Repair Organizations Act (CROA)

The Credit Repair Organizations Act (CROA) was introduced in 1996 to ensure credit repair organizations didn’t use unfair or deceptive business practices with their clients. Some of the notable restrictions on credit repair organizations under the CROA are:

- They can’t exaggerate or misrepresent their services.

- They can’t make false statements about consumer accounts to the credit bureaus or furnishers.

- They can’t ask for a fee up front when no work has been performed.

- They can’t offer to create a new identity for customers.

- They can’t ask consumers to waive their rights.

It can be helpful to check your state’s credit repair laws as well.

2005: Fair and Accurate Credit Transactions Act (FACTA)

In 2005 the Fair and Accurate Credit Transactions Act (FACTA) was passed in an effort to help victims of identity theft. Some of the rules passed under FACTA are:

- Consumers can have access to a free credit report from each bureau every 12 months.

- Consumers can register fraud alerts on their own cards.

- Lenders, regulators and payment processors must have more oversight when looking for fraudulent and suspicious credit activities.

2009: Credit Card Accountability, Responsibility and Disclosure Act (CARD)

The Credit Card Accountability, Responsibility and Disclosure (CARD) Act of 2009 focused on reforming how credit card lenders charge fees, including:

- Giving all consumers at least 21 days to pay their bills from the day the statement is mailed.

- Providing customers at least 45 days’ notice before fees and rates go up.

- Requiring credit card companies to apply payments above the minimum amount to the customer’s highest interest rate balance first.

- Stopping credit card issuers from charging a first-year annual fee that exceeds 25 percent of the credit card’s limit.

- Limiting the marketing efforts to consumers under the age of 21.

2010: Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd–Frank)

The 2010 Dodd-Frank Reformation Act was created as a direct response to the 2008 financial crash. The act targeted the sectors of the financial market that are believed to have played a significant role in the market crash, including mortgage lenders, banks and credit rating agencies.

Some of the significant changes made under this act were:

- The Financial Stability Oversight Council can—and does—monitor the financial stability of major financial firms in the U.S.

- A new agency, called the Consumer Financial Protection Bureau, was created to monitor and prevent predatory mortgage lending.

- Banks have restrictions on how they can invest. For example, they can’t invest in private equity firms and hedge funds.

Additional acts

Some additional acts related to consumer rights that are noteworthy are:

- Health Insurance Portability and Accountability Act (HIPAA). This act was passed in 1996 to protect consumer data from being shared without a person’s consent. All companies that deal with protected health information (PHI) have to have processes in place that allow them to remain HIPAA compliant. HIPAA serves to protect American consumers and reduce the risk of health fraud.

- Servicemembers Civil Rights Act (SCRA). This was enacted in 2003 to protect military members on active duty. During active duty, the SCRA ensures that specific financial obligations (interest rates, foreclosures, repossessions, income taxes, civil proceedings, etc.) cannot move forward or change for military members. This allows active-duty military members to focus on their job and return home without major financial surprises.

Understand and assert your rights

This history of consumer rights shows what steps the government has taken to protect consumers—and that these protections are continuously updating with the times. Ultimately, it’s best for all consumers to understand their rights so they can assert them. Lexington Law Firm cares about consumer advocacy. Our credit repair service helps people take advantage of their right to repair their credit. If this interests you, get started with our team today so you can take steps toward cleaning your credit.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.