The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

6 in 10 Americans have a FICO score above 700.

A good credit score can potentially help you save money on your mortgage, car insurance, credit cards and many other things. Alternatively, a bad credit score could increase costs in these same areas.

Many of life’s biggest purchases (like a house, a car or college tuition) are things that can affect your credit. Most people don’t have enough disposable money to pay for these large expenses up front.

How much damage can a bad credit score really cause? A 2020 survey suggested that individuals who take out an auto loan of $25,346 with a “fair” credit score could pay up to $3,847 more interest than a person with a “very good” credit score taking out the same loan.

Similarly, someone with a “fair” credit score may pay $8,640 in interest for a student loan, but another student with a “very good” score might only pay $3,933 interest for the same loan.

It can be helpful to know credit score statistics to understand your eligibility and trustworthiness in comparison to other Americans for making large purchases and paying back your loans on time. We’ve compiled a list of the most important credit score statistics you should know. This information could help you make critical decisions regarding your score and may help you improve your credit score.

Note: we reference the most updated data available, but sometimes that information is from many years ago—check each individual source for specifics.

General credit score statistics

According to recent research, millions of Americans are credit invisible, while others have a credit history that is insufficient. Here are some general credit score statistics that highlight credit reports, average monthly credit scores and other current data.

- Nearly 28 million Americans are credit invisible, meaning they have no credit history with a nationwide consumer reporting agency. (Source: Oliver Wyman, 3)

- 21 million Americans had credit history that has gone stale or is insufficient to produce a score under the most common scoring models. (Source: Oliver Wyman, 3)

- 38 percent of adults ages 18 to 24 say they never check their credit scores. (Source: Javelin)

- 27 percent of adults say they check their credit score monthly. (Source: Javelin)

- 1 in 3 adults are unable to obtain a credit score from conventional models. (Source: VantageScore)

- More than half a million Credit Karma members achieved an average first score of 639 after not having an initial TransUnion score when they checked their credit scores for the first time. (Source: Credit Karma)

- Average credit score from 2012 to 2021: (Source: Experian)

- 2012: 693

- 2013: 691

- 2014: 693

- 2015: 695

- 2016: 699

- 2017: 699

- 2018: 701

- 2019: 702

- 2020: 710

- 2021: 714

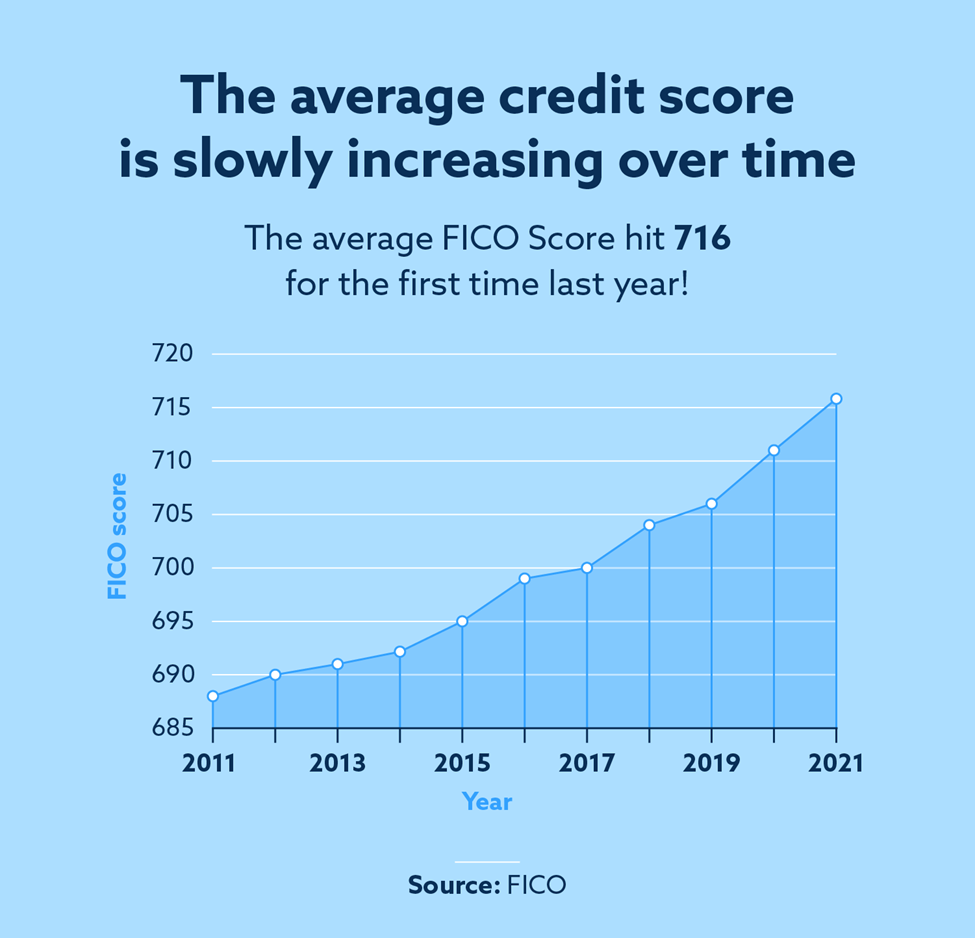

FICO score statistics

When considering how Americans are doing financially, especially by each generation, FICO scores allow us to analyze changes in stability and creditworthiness. Here are some of the most recent FICO statistics.

- The average FICO score hit 716 in April 2022. (Source: FICO)

- 23.3 percent of Americans have a FICO score between 800 and 850. (Source: FICO)

- 9 percent of Experian customers have a FICO score below 550. (Source: Experian)

- From 2020 to 2021, the average subprime consumers’ FICO score increased by eight points, from 578 to 586. (Source: Experian)

- Nearly 60 percent of Americans have a FICO score above 700. (Source: Experian)

- The Villages, an adult community in Florida, had the highest average FICO score of American cities at 785. (Source: Experian)

- California cities Los Altos (777) and Saratoga (776) took second and third place for the cities with the highest average FICO score. (Source: Experian)

VantageScore statistics

Since 2006, VantageScore has encompassed 2,500 users between 2,200 financial institutions. Average VantageScore statistics of 2021 show generational disparities and contrasts.

- The average VantageScore credit score in January and February of 2022 was 696. (Source: VantageScore)

- Generation Z had a median VantageScore of 661 in 2021. (Source: Experian)

- Millennials had a median VantageScore of 667 in 2021. (Source: Experian)

- Generation X had a median VantageScore of 685 in 2021. (Source: Experian)

- The baby boomer generation had a median VantageScore of 724 in 2021. (Source: Experian)

- VantageScore is able to score about 96 percent of all consumers in the United States who are 18 or older. (Source: VantageScore)

- Approximately 14.5 percent of adults nationwide are newly scorable. (Source: VantageScore)

- In 2021, 1 in 3 adults were unable to obtain a credit score from conventional models. (Source: VantageScore)

- States with the highest average VantageScores in March 2022: (Source: VantageScore)

- Minnesota: 726

- New Hampshire: 722

- Vermont: 721

- Massachusetts: 719

- Washington: 718

- States with the lowest average VantageScore in March 2022: (Source: VantageScore)

- Mississippi: 662

- Louisiana: 670

- Alabama: 673

- Arkansas: 673

- Oklahoma: 674

Credit score demographics

Credit scores vary across different age groups and demographics. Listed below are 2021’s VantageScores separated by age group, income bracket and data change over the past year.

- Average credit score per age group, as of 2021: (Source: Experian)

- 18-24 years old: 679

- 25-40 years old: 686

- 41-56 years old: 705

- 57-75 years old: 740

- 76+ years old: 760

- Average credit score per income bracket: (Source: Federal Reserve Bank of New York)

- Low income: 658

- Moderate income: 692

- Middle income: 735

- Upper income: 774

Understanding credit score statistics isn’t as complex as you may think. Maintaining a strong credit score is crucial to financial stability and can help you get approved for loans and credit cards. Not sure how to look at or take care of your credit score? There are many great resources available to help you view and build credit, including credit repair sites and other financial assistance.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.