The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

In the United States, the median home price reached $431,000 in the third quarter of 2023. Unless they’ve been stockpiling money, most people don’t have enough cash to purchase a home outright. That’s why mortgages exist. To help you understand your financing options when you’re looking to buy a house, here’s an overview of the five types of mortgages available to residential buyers.

What is a mortgage?

A mortgage is a type of loan used to purchase real estate. If you don’t repay the loan as agreed, the lender has the right to take the property from you, sell it and use the money from the sale to cover your balance. This is a process known as foreclosure.

When you’re shopping for a mortgage, it’s important to understand the terminology used by real estate agents, brokers and other professionals.

Principal is the amount of money you borrow. For example, if you need to borrow $380,000 to cover the cost of a home, you have a principal balance of $380,000.

Interest is the cost of borrowing money. It’s usually expressed as a percentage, for example, 5.8 percent. A high interest rate could increase your total cost of ownership by hundreds of thousands of dollars, so it’s important to shop around for the best rates.

Your loan term is how long you have to pay back the loan. The two most common loan terms are 15 years and 30 years. So, for example, if you have a 30-year mortgage, you have 30 years to pay back the principal balance.

When you shop for a mortgage, you also need to think about your monthly payment. In many cases, you’re required to put property taxes and homeowners insurance premiums into an escrow account. If this applies to your situation, your monthly mortgage payment will be higher to account for insurance and taxes.

5 types of mortgages

Although every mortgage has the same basic purpose, different types of mortgages address different situations. Here are the five most common.

Conventional

A conventional loan is a mortgage that’s not part of a government program. You get this type of mortgage through a private bank or credit union. One of the main advantages to getting a conventional loan is you don’t have to pay for private mortgage insurance if you make a down payment of at least 20 percent of the purchase price of the home.

Private mortgage insurance is a type of insurance that protects your lender in the event you default on your loan. You have to pay extra for PMI, so avoiding it is a good way to keep your costs as low as possible.

One of the major drawbacks of conventional mortgages is they have stringent credit requirements. You generally need a score of at least 620, making conventional loans a poor fit for subprime (scores ranging from 580 to 619) or deep subprime (scores below 580) borrowers.

Conforming

Every conforming mortgage must follow (conform to) the standards set by Fannie Mae and Freddie Mac, which are home mortgage agencies backed by the U.S. government. Both agencies provide funds to banks, making more mortgages available to American consumers.

To conform to the Fannie Mae and Freddie Mac standards, lenders must vet mortgage applicants carefully. This means you generally need decent credit to qualify. You also need an acceptable debt-to-income ratio. This ratio compares your monthly debt payments to your gross monthly income to make sure your estimated mortgage payment isn’t too high.

The main drawback of a conforming mortgage is that there’s a limit to how much you can borrow. The Federal Housing Finance Agency has announced that the 2024 baseline loan limit for a single-family home is set at $766,550. In areas with a high cost of living, the loan limit for a single-family home is $1,149,825.

Government-backed

A government-backed loan is insured by the federal government, but it’s issued by a private lender, giving you the best of both worlds. One of the biggest advantages of government-backed loans is that banks view them as less of a risk than other types of loans. Therefore, you may get approved even if your credit score is too low for a conventional mortgage.

One potential drawback is that you may have to pay for private mortgage insurance if you can’t afford to put down 20 percent on a home. This increases the total cost of purchasing.

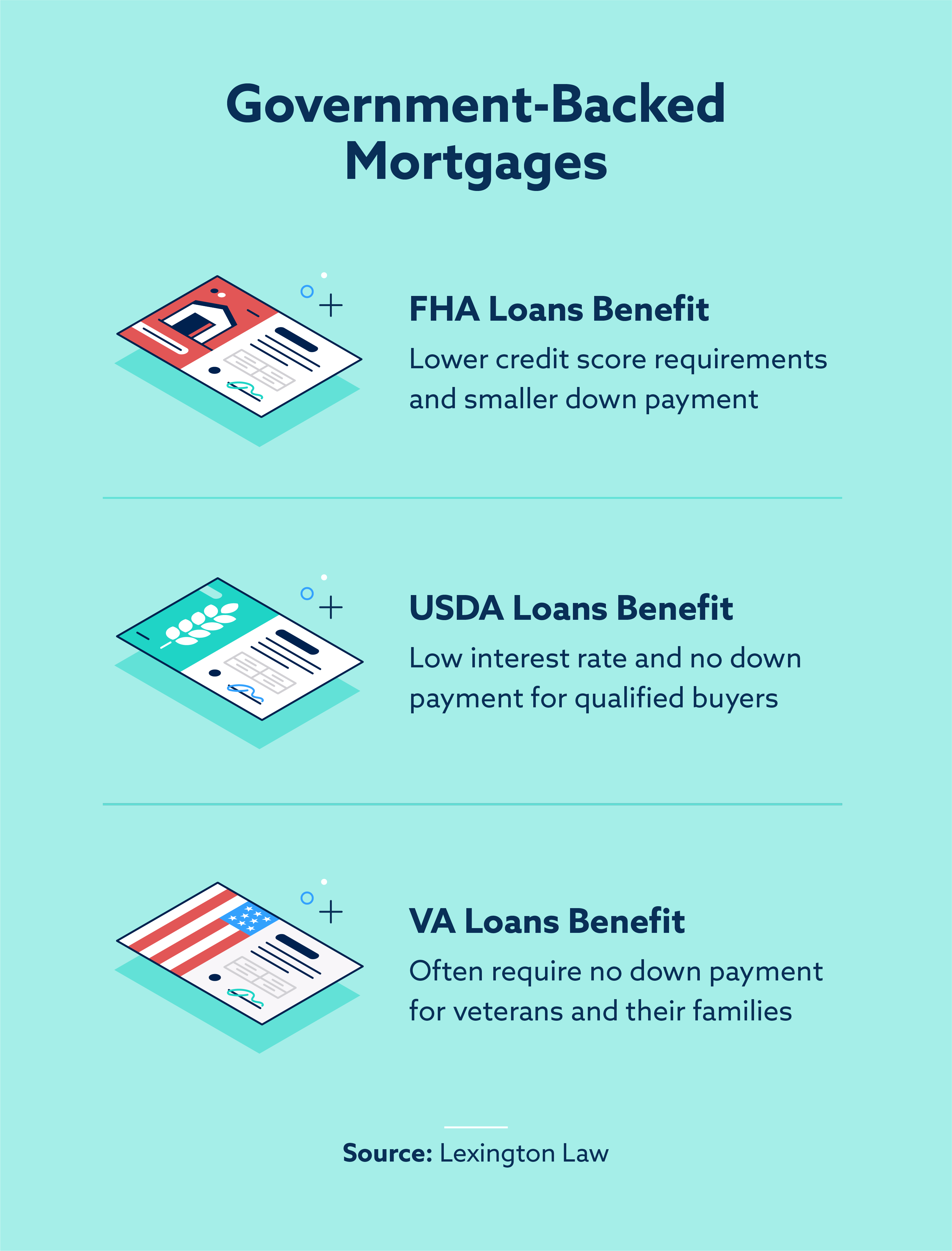

These are the three most common types of mortgages backed by government agencies:

- VA loans: To thank veterans and current members of the military for their service, the Department of Veterans Affairs backs loans for eligible service members. The biggest advantage of getting a VA loan is that you don’t always have to make a down payment. You do need to meet certain lending requirements, however.

- FHA loans: The Federal Housing Administration backs some loans to make it easier for Americans to purchase their homes. If you qualify for an FHA loan, you may be able to put down as little as 3.5 percent. FHA loans are also available to consumers with scores below 580, making them an attractive alternative if you can’t qualify for a conventional mortgage due to your credit history.

- USDA loans: The U.S. Department of Agriculture backs loans made to borrowers in rural areas. To qualify, you must meet the minimum income and credit requirements.

Interest-only

An interest-only mortgage is a special type of adjustable-rate mortgage (you’ll learn more about adjustable rates in the next section). During the first few years, you don’t pay back any of the principal balance. Instead, you just pay the interest.

After this initial period, you begin paying the principal and the interest. Since the rate is adjustable, it changes each year based on market conditions.

The main advantage of an interest-only loan is that you have a low payment for the first few years. That said, your payment will go up eventually. Your interest rate may also increase significantly.

Jumbo

Jumbo mortgages are ideal for borrowers living in areas with very high costs of living. For example, it’s tough to find a home in the Los Angeles area that costs less than $1 million. You might not get very far with the conforming mortgage loan limit.

A jumbo mortgage allows you to borrow more than the conforming limit set by Fannie Mae and Freddie Mac. Due to the amount of money involved, your lender may require excellent credit and a low DTI ratio. It may also take longer to get approved for this type of mortgage.

How does interest work on a mortgage?

Lenders offer fixed-rate mortgages and adjustable mortgages. A fixed-rate mortgage is exactly what it sounds like—a home loan with a fixed interest rate, a rate that stays the same for the entire loan term.

The main advantage of a fixed-rate loan is that you know exactly how much you’ll pay every month. You don’t have to play guessing games based on changes in the market. That said, if you apply for a mortgage when rates are high, you’ll be locked into the same rate unless you refinance your loan.

An adjustable-rate mortgage has an interest rate that goes up and down. If you apply when rates are high, there’s a chance the rate could go down in the future. However, there’s also a chance your rate will go even higher, increasing your monthly payment beyond what you can comfortably afford.

Tips for getting the best loan terms

To keep your costs in check, follow these tips to get the best loan terms available:

- Save up: Save as much as you can for a down payment. The more money you put down, the less you have to borrow.

- Shop around: You don’t have to go with the first lender you find. Take time to compare rates and find the best deal for your situation.

- Clean up your credit: Some types of mortgages are only available to consumers with good credit. If you have low scores, work to increase them before you apply for a home loan.

If your credit is holding you back from the home of your dreams, don’t despair. The team at Lexington Law may be able to help by addressing any inaccurate negative items listed on your credit reports.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.