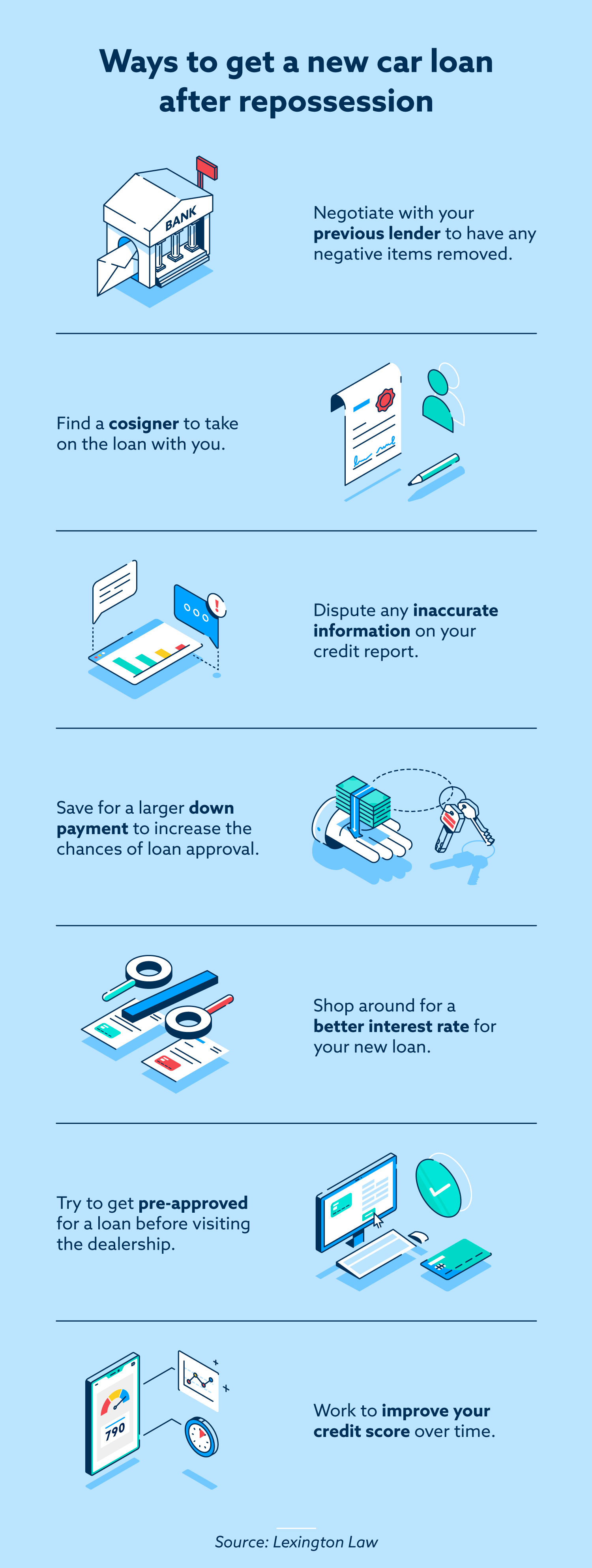

You can get a new car loan after repossession by finding a cosigner, negotiating with your previous lender, disputing inaccurate items on your report, saving for a larger down payment, shopping around for better rates, trying to get preapproved for a loan or improving your credit.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

After your car is repossessed, your credit report will include a negative item that notes the repossession. As a result, it can be much more difficult to get a new car loan, since creditors take payment history into account when evaluating your loan application. That said, you can work toward finding a new car loan by addressing inaccuracies on your credit report, building your credit or finding a cosigner.

If your car has been repossessed, you may be in need of a new vehicle for essential transportation. Unfortunately, the negative item that shows up on your credit report after a repossession makes it more difficult to secure a new loan.

Many lenders may be unwilling to offer you a new loan, or they may offer a loan with a high interest rate, which could make it difficult for you to pay it back.

Instead of agreeing to loan terms that may not suit you, try some of the following ideas to get a new car loan after your car has been repossessed.

1. Find a cosigner

Having someone with strong credit cosign on a new car loan is a way to get a better interest rate. A favorable loan will provide the opportunity to rebuild your credit by paying on time each month.

A cosigner will be equally responsible for the loan, so it is usually best if you sign with a trusted friend or family member.

2. Negotiate with your previous lender

Writing a goodwill letter to your previous lender can lead to an agreement where the negative item is removed in exchange for a fixed amount of money. Make sure to get any agreement in writing before settling the loan.

If your debt has already gone to collections, you may need to settle the original loan and the collection account separately. In any case, working to have negative information removed from your credit report will make it easier to get a new car loan.

3. Dispute inaccurate items on your report

If you believe that there is inaccurate information on your credit report, a credit dispute offers the possibility of having negative items removed entirely.

Consider using credit repair services to assist in the formal dispute process.

4. Save for a larger down payment

If you are able to do so, increasing the down payment you offer for a new car is likely to lead to more favorable terms—since the total amount of the loan will be lower and the lender takes on less risk.

If you purchase a used car, the same down payment can make a bigger impact on the interest rate of your car loan. For example, a $5,000 down payment is 20 percent of a $25,000 car loan, but it’s 50 percent of a $10,000 car loan, which means the lender is absorbing less risk with the loan.

5. Shop around for better rates

Looking at multiple lenders is useful after a repossession, as the first institution to offer you a loan may not make an offer that will work for your budget. A high interest rate can make even a relatively small loan feel more burdensome.

Use online comparison tools to compare rates for your credit between different financial institutions. If you belong to a credit union, check if they’re able to offer you a loan that works well for you.

6. Try to get preapproved for a loan

Before visiting the dealership, try to get preapproved for a loan. Lenders who use a preapproval process will look at your debts, income and credit history to determine how much they are willing to lend you.

Once you have a solid loan offer in hand, you will be able to shop more confidently for a new vehicle.

7. Improve your credit over time

Although it is not a short-term solution, working to improve your credit is the best way to get a new car loan with favorable terms. In general, those with better credit receive better interest rates for car loans.

Read on for some thoughts about improving your credit score so that you can get an excellent rate on a loan.

How to improve your credit after a repossession

While a negative item often leads to significant damage to your credit, the damage is not permanent. You can begin making a positive effect on your credit by doing the following:

- Make payments on time: Consider setting up reminders or autopay for bills to stay on top of payments.

- Work to get collection accounts settled: If possible, work with your original creditors to settle balances and have negative items deleted from your credit report.

- Keep your utilization down: Aim to keep your credit utilization under 30 percent, which means using less than about one-third of the total credit available to you.

In addition to the above, take some time to review your three credit reports, which you can access for free from each credit bureau at least once each year.

If you have any inaccurate information on your credit report, work with the credit repair consultants at Lexington Law Firm to start the process of addressing these items, working with the goal of improved credit in mind.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.