The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

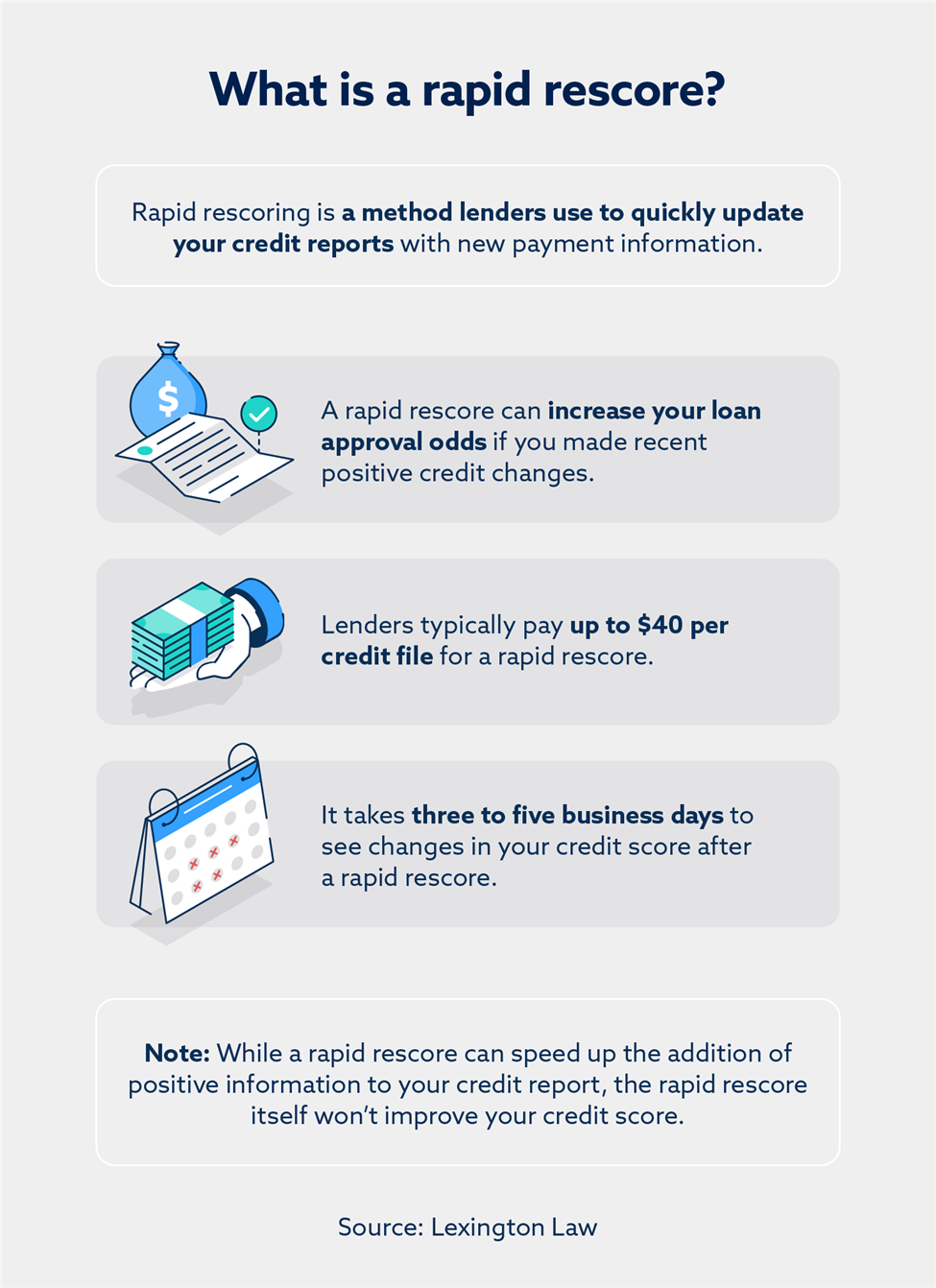

A rapid rescore is a method lenders use to promptly add new payment data to your credit reports. The goal is to accelerate positive changes to your credit so you can meet the eligibility requirements for a mortgage loan.

When applying for a mortgage, your credit score is one of the most influential factors in determining your approval, interest rate and loan terms. Typically, the better your credit, the lower your interest rate will be, which could save you thousands over the life of your mortgage.

If you’re ready for mortgage applications but don’t have the best credit, you may have received advice to consider a rapid rescore, a process brokers and mortgage lenders use to help clients quickly update their scores to reflect their current status.

Table of contents:

- How does a rapid rescore work?

- Who do you work with to get a rapid rescore?

- Who should consider getting a rapid rescore?

- How much does a rapid rescore cost?

- How long does a rapid rescore take?

- Know what a rapid rescore won’t do

- Thinking long-term about your credit health

How does a rapid rescore work?

If you’re interested in securing a mortgage, your lender might suggest a rapid rescore. If you choose to move forward with the rescore, you will submit proof of up-to-date information on your accounts to the credit bureaus—through your lender—to hopefully see a quick improvement in your credit score.

Typically, the credit bureaus update your score every 30 – 45 days. Let’s say one of your biggest accounts missed the reporting deadline after you made a considerable payment. This could result in the old balance showing on your credit for 60 days. When you’re applying for a mortgage, a 60-day timeline is far too long and won’t help your application. In this case, you would likely want a rapid rescore.

Another common area where people see delays in their credit report updates is with disputed information. Individuals who dispute inaccuracies on their credit reports usually have to wait several months to see a change reflected on their credit reports. Once again, this can be detrimental to someone’s mortgage application.

If you’re applying for a mortgage and you’ve gone out of your way to improve your accounts, you’ll want it reflected on your credit report as soon as possible. For example, if you’ve filed a dispute regarding inaccurate negative information on your account, you can provide the supporting documentation and, ideally, have the rapid rescore process reflect any changes quickly.

You can do the same if you’ve made payments on accounts and don’t want to wait for your report to update—simply provide the supporting documentation and follow through with a rapid rescore.

The impact on your credit score will depend on the type of information you’re updating. For example, paying off a small debt may only marginally increase it, while removing an incorrect collection account can sometimes result in a more significant credit score bump.

Note that a rapid rescore itself doesn’t inherently improve your score—it isn’t the same as credit repair. In fact, if you’ve recently done something that would hurt your credit, your credit score could even go down after the rescore. It all depends on what actions you’ve taken in the recent past.

Who do you work with to get a rapid rescore?

You can only complete a rapid rescore through the lender or broker; you can’t initiate one on your own. The mortgage lender will submit the documents on your behalf, and you can often see a new result within a few business days.

Who should consider getting a rapid rescore?

While the rapid rescore process is common when seeking mortgage approval, it’s also useful for other lending approvals.

A rapid rescore is ideal for anyone who knows they’re sitting on the edge between two different credit score ranges. In this case, a rapid rescore can bump you to the next score range and help you qualify for better terms or interest rates. You should speak to your lender and verify that moving up to the next credit range will actually make a difference in your mortgage approval.

Additionally, rapid rescoring is an excellent option for anyone who can quickly make changes that would matter to their score. For example, if someone just got a bonus at work and could use that money to pay off their credit card balance, this would significantly improve their credit utilization ratio.

How much does a rapid rescore cost?

A rapid rescore costs money because it asks for a quick turnaround from the credit bureaus to process the provided information and update the credit report.

A rapid rescore can cost up to $40 per line item. Additionally, all three credit bureaus typically need to be updated, so updating a single item can cost up to $120. But since the Fair Credit Reporting Act doesn’t allow lenders to charge for handling credit report disputes or updates, your lender will pay the cost of rapid rescoring.

Unfortunately, some lenders don’t offer rapid rescoring services since the cost would be on them.

How long does a rapid rescore take?

A rapid rescore will update your credit within three to five business days of receiving the supporting documentation. In comparison, it usually takes between 30 and 60 days for a payment to reflect on your credit report. Successful credit disputes can take even longer—often taking up to three months to show up.

However, note that you shouldn’t go through with the rapid rescore until you’ve done what you need to do to hopefully improve your credit. Rapid rescores rely entirely on your supporting documents, so you need to prove that the action has already been taken and your credit report requires an update. For example, if you made a large payment, you’ll have to wait until the payment goes through and your account statement reflects it.

Know what a rapid rescore won’t do

While a rapid rescore has its benefits, it’s essential to understand its limitations too. A rapid rescore can’t replace taking steps to repair your credit. Instead, it’s a solution for someone who can make a quick improvement. So, a rapid rescore is great if you can do something like quickly pay off all your outstanding debt, but it can’t remove the impact of missed or late payments.

Similarly, rapid rescoring can’t replace building your credit over a series of months and years. Sure, if you have an incorrect negative item on your credit report that has recently been removed, rapid rescoring might help quickly reflect any increase in your credit score. But if the negative item is legitimate, the primary way to reduce its impact on your score is to build up a positive credit history instead.

If a rapid rescore doesn’t help you with your credit score, there are other options out there:

- Find a different lender: Shop around and see if you can find a lender who’ll offer you a better rate and loan terms. For example, credit unions and online lenders can often beat the loan offerings of traditional banks.

- Use a credit service: Use a credit coverage service like ExtraCredit to help build up your score using alternative credit data, such as rent and utility payments.

- Refinance later: One alternative is to simply get the mortgage now and refinance later when you’ve had the time to improve your credit.

Thinking long-term about your credit health

Remember that rapid rescoring is a quick fix that only helps a specific kind of person—a person seeking a mortgage or auto loan approval and straddling two different credit score ranges.

Regardless of whether you opt for rapid rescoring or not, you should consider whether you also need to focus on repairing your credit. A good credit score can open the door to many new financial opportunities and help you secure the best financing possible when you need new credit. Lexington Law Firm offers credit repair services through which we help review your credit report, file any valid disputes on your behalf and handle communication with the credit bureaus. Let us help you with credit repair—find out how today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.