The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

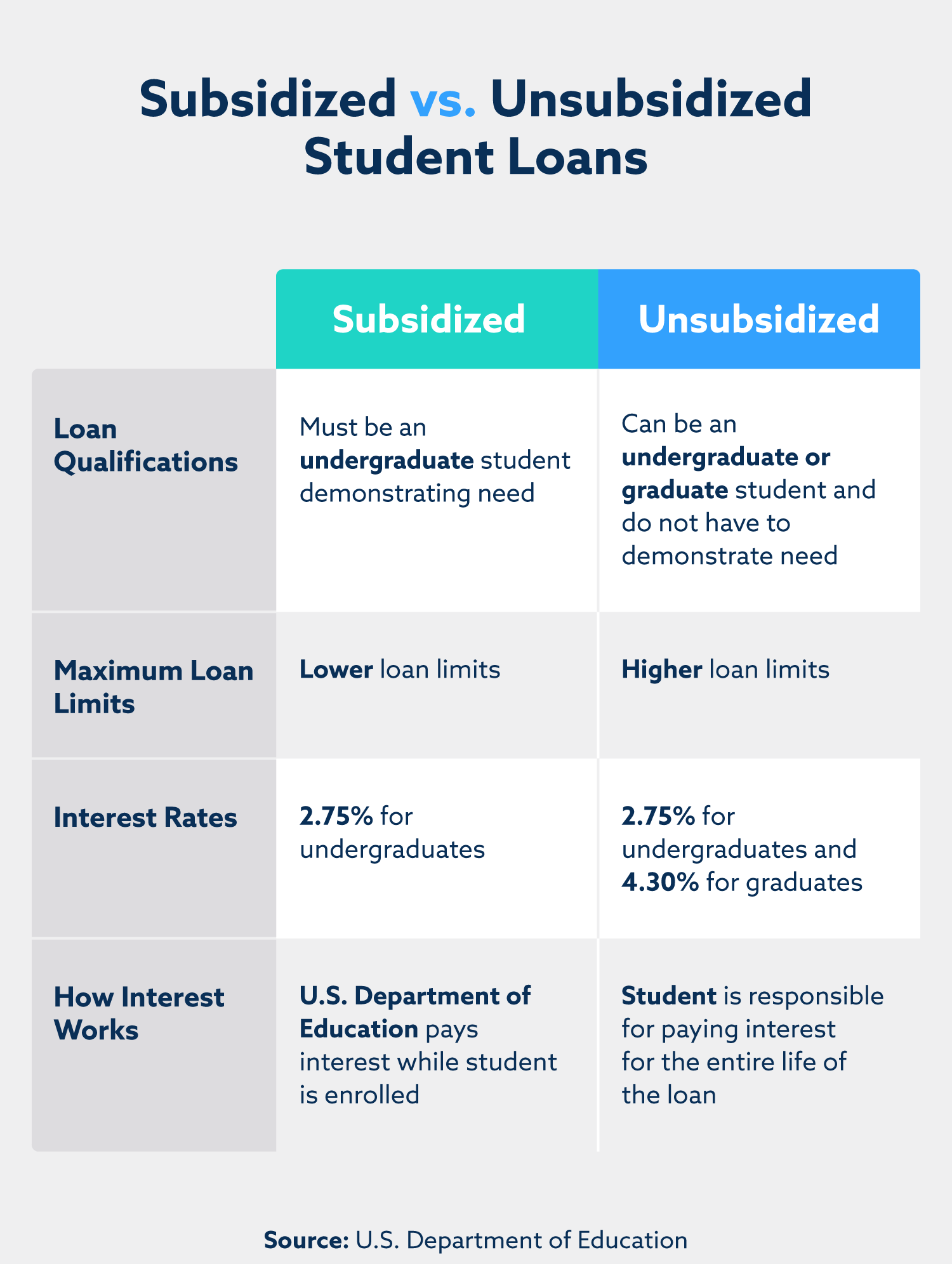

The main differences between federal direct subsidized and unsubsidized loans are the qualification criteria, the maximum limits and how the loan interest works.

The federal direct loan program offers subsidized and unsubsidized loans to college students. If you’re about to apply for a federal student loan, you may wonder what the differences are between subsidized vs. unsubsidized loans.

A federal direct subsidized loan is a loan where the government pays the interest while the student is in school. A federal direct unsubsidized loan is one in which the student is responsible for paying all interest, receiving no additional federal aid.

So, why would anyone choose a federal direct unsubsidized loan? Typically, it’s because the student doesn’t qualify for a subsidized loan. Let’s take a closer look at subsidized vs. unsubsidized loans so you can understand each option’s qualifications, advantages and disadvantages.

What Is the Difference Between Subsidized and Unsubsidized Student Loans?

The primary differentiators between federal direct subsidized loans and federal direct unsubsidized loans are the eligibility requirements, the maximum loan amounts offered and how the loan interest works.

Loan qualifications

Subsidized loans are more challenging to qualify for, as they’re meant for people in financial need.

Subsidized: To qualify for a subsidized loan, you must be an undergraduate student who can demonstrate financial need based on the information you submit through the Free Application for Federal Student Aid (“FAFSA”).

Unsubsidized: Unsubsidized loans are available to both undergraduate and graduate students, and there’s no requirement to demonstrate financial need.

Maximum loan limits

Your school will determine exactly how much you can borrow each year, but there are federal limits. These limits are based on what school year you’re in and whether you file as a dependent or an independent.

Subsidized: Subsidized loan limits tend to be lower than unsubsidized limits. The aggregate limit for an independent student with subsidized loans is $23,000.

Unsubsidized: Unsubsidized loan limits tend to be higher than subsidized loan limits. The aggregate limit for an independent student with unsubsidized loans is $31,000.

How interest accrues

Subsidized: The U.S. Department of Education pays the interest for subsidized loans as long as the student is enrolled in school at least half-time. It will also pay the interest during your grace period—defined as the first six months after leaving school—and any deferment period. This means the loan amount won’t grow while the student is in school because the government has been paying the interest.

Unsubsidized: With an unsubsidized loan, what you owe on your student loan increases while you’re in school because interest is accruing. Whether you’re an undergraduate or a graduate student, you’re responsible for paying all the interest during the entire life of your unsubsidized loan.

Interest begins accruing on unsubsidized loans from the moment the money is disbursed, so your loan is immediately growing in size. At some point, the loan’s interest might capitalize. This means the interest is added to the principal amount and your interest essentially begins accruing interest. If you have a large loan, this can add a significant amount to your balance. Notably, this is a major downside to unsubsidized loans.

What are the similarities between subsidized and unsubsidized student loans?

When it comes to interest rates, fees and the “maximum eligibility period”—the amount of time you’re able to take out loans—subsidized and unsubsidized loans are virtually the same.

Fees

On top of interest, you can expect to pay a small fee for both types of loans. Direct subsidized and unsubsidized loans initially disbursed on or after October 1, 2020, are charged a fee of 1.057 percent of the loan amount. This fee is deducted from each loan disbursement.

Undergraduate Interest Rates

The interest rates for both subsidized and unsubsidized loans for undergraduate students are the same. Currently, the rate is at 5.5 percent for loans disbursed on or after July 1, 2023, and before July 1, 2024. The one exception is for direct unsubsidized loans for graduate students, which have an interest rate of 7.05 percent.

Maximum eligibility period

For both loan types, the time you’re eligible for your loans is equal to 150 percent of the time of your program. For undergraduates pursuing a four-year bachelor’s degree, this means they’ll be eligible for their loans for six years. Those in a two-year associate degree program will be eligible for three years. This ensures students can still receive loans even if they’re unable or choose not to graduate within the program’s timeframe.

How to Apply for Subsidized and Unsubsidized Loans

Once you’re ready to apply for a federal direct loan, fill out the FAFSA. Your school will send you a detailed report of what student aid you’re eligible for. Any grants or scholarships are free money, so make sure to accept them. They’ll also decide which loans you’re eligible for, the amount you can borrow each year and what loan type you can get: subsidized or unsubsidized.

Are there other student loan options?

In addition to federal loans, students can opt to get a private loan. Let’s quickly look at the comparison between private and federal student loans.

Pros of private student loans

- Private student loans can typically be refinanced. So, if you improve your credit or the economy changes and interest rates go down, you can refinance to a lower interest rate.

- If you have good credit, you may be able to secure a lower interest rate than those offered by the government.

- There’s often no initial fee for taking out a private student loan.

- Private lenders often approve higher loan limits, which can be very beneficial if you attend an expensive school.

- Getting approved for a private student loan is often easier and faster.

Cons of private student loans

- Private student loans typically require the student to make payments immediately, so the borrower has to find a way to make payments while in school. However, some private lenders allow you to defer your payments until graduation.

- Federal student loans come with income-driven repayment and loan forgiveness programs for qualifying individuals. Most private lenders don’t offer anything similar.

- If you have poor credit, your private student loan will likely have a high interest rate.

- There are no subsidies for private student loans.

- Private student loans aren’t typically discharged in a bankruptcy filing.

A private student loan is likely only a better choice if you have excellent credit or weren’t approved for a federal loan.

Your credit matters for your student loan and beyond

No matter what type of student loan you go for, it’s essential to understand how it affects your credit so you can set yourself up for financial success after graduation. With responsible, on-time payments, you’ll be well on your way to healthy credit for life. And it’s never too early to take control of your credit. Establishing strong credit while you’re a student can give you a solid financial start when you graduate. Not sure where to begin with a credit evaluation? Lexington Law offers a free credit assessment that gives you your credit score, credit report summary and a credit repair recommendation.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.