The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A goodwill letter is a written correspondence that asks creditors to remove negative remarks from your credit reports.

Key points:

- A goodwill letter is more likely to work on smaller negative items, such as late or missed payments.

- The creditor has no obligation to honor or even respond to a goodwill letter.

- Write a goodwill letter as you would for any business-related correspondence—keep it professional, clear and concise.

- Take the necessary steps to avoid incurring negative items in the future.

Negative items, such as late or missed payments, can have a considerable effect on your credit score and make it harder for you to secure loans in the future. Luckily, if your late payments are a one-time thing and you have an overall positive relationship with your lender, you may be able to send a goodwill letter to have these negative items removed.

Read on to learn more about goodwill letters and how you can use them when taking control of your credit.

What is a goodwill letter?

A goodwill letter is a request to creditors to remove negative remarks from your credit reports. As the name “goodwill” suggests, this request puts it on the creditor to make a good-faith effort to cooperate and work with a client or customer, and to establish a good business reputation with its clients.

A creditor might be willing to take such action if you have good history with the individual creditor and have demonstrated effort on your part to handle credit and finances more responsibly.

Creditors are never obligated to remove accurate negative items simply because you ask. And in some cases, creditors may not be able to remove the items due to internal policies or agreements with the credit bureaus.

Nevertheless, making the request only takes a bit of your time, so it might be worth a try.

When should you use a goodwill letter?

It’s best to send a goodwill letter when you have a logical reason for missing a payment. Potential reasons for sending a goodwill letter include:

- You experienced an unforeseen financial hardship that temporarily prevented you from paying your bills, like losing your job.

- You or a loved one had a medical emergency.

- You recently changed banks and forgot a payment during the switch.

- You moved locations, but they didn’t send the bill to your new address.

- You were under the impression that you set up automatic payments, but there was a technical difficulty.

Whatever your reason for missing the payment, be sure to communicate to the creditor that you’re committed to getting your credit back on track.

What can goodwill letters remove?

Goodwill letters are more likely to work for smaller negative items, such as late or missed payments. That’s because many creditors have agreements with credit bureaus that they will not negotiate with individuals to have repossessions, collection accounts or charge-offs removed in exchange for payment.

While you’re free to send a goodwill letter any time, they are—generally—most effective when you want to get a mark related to a one-time negative issue removed.

How long will it take to get a response?

A goodwill letter is an unofficial letter sent to a creditor. As such, there’s no timeline requirement or even an obligation on the creditor to respond to the letter. How long the letter takes to generate a response—or whether any response is generated—varies.

A goodwill letter is not an official credit dispute letter. When someone finds an inaccurate item on their credit report, they can send a credit dispute or verification letter to the credit bureau.

This prompts the credit bureau to launch an investigation, which comes with specific timelines that must be followed by the credit bureau and any creditor that is asked to provide documentation for the negative item.

A goodwill letter acknowledges that a negative item has been reported correctly, and asks that your creditor remove it out of their own good will.

Do goodwill letters work?

While there is never any guarantee that a goodwill letter will be successful, they have the best chance of working when the borrower and the lender have a good relationship.

If you’re already in collections or have a long history of making late payments, you might not have good enough standing to successfully make the request.

How to write a goodwill letter

Write a goodwill letter as you would any business-related correspondence. Type and print it, and keep it professional, clear and concise.

While you can provide details about the reasons for a lapse in payment or another negative factor, a goodwill letter should not focus on the emotional aspects. The goal should be to show the creditor that the issue was not indicative of how you normally handle credit. You may also draft the letter in a way that shows that you have substantially improved how you handle credit.

This helps the creditor see you as a more valuable client, which can encourage them to do a goodwill favor for you. The goal of such a letter should not be to make the creditor feel sorry for you.

When writing your letter, include details that can help the creditor identify your account and the negative item in question. Then, provide a short description of why you think the creditor should remove the negative mark. You should include:

- Your account number

- The date and type of issue that occurred

- Information that identifies the negative mark

- Information about how long you have had a relationship with the creditor

- Information that shows this is not habitual behavior for you

- Sincere regret that this occurred

- A specific call to action that explains what you are asking of the creditor

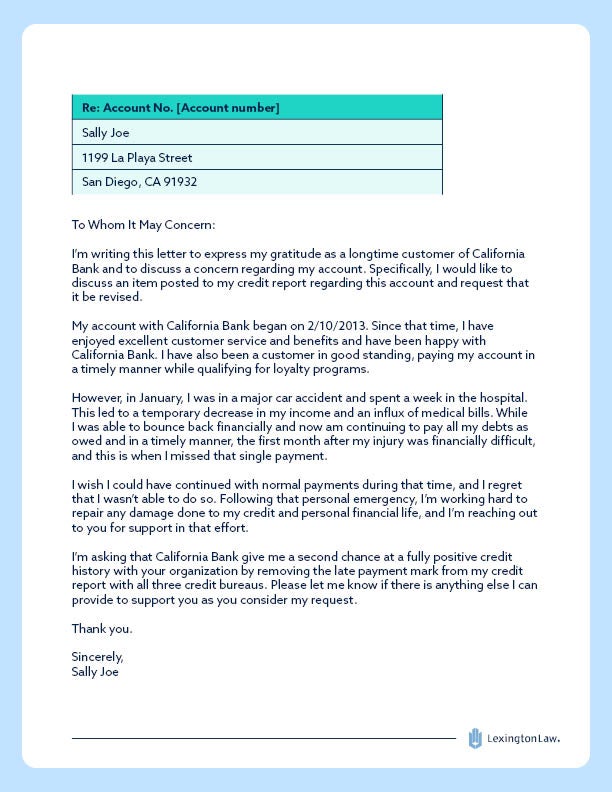

Example of a goodwill letter

If you’re unsure how to write a goodwill letter, check out this example to get started. Note how in this example we present a hypothetical situation of why this person is deserving of goodwill.

Re: Account No. [Account number]

[Name]

[Street Address]

[City, State, Zip Code]

To Whom It May Concern:

I’m writing this letter to express my gratitude as a longtime customer of [Creditor] and to discuss a concern regarding my account. Specifically, I would like to discuss an item posted to my credit report regarding this account and request that it be revised.

My account with [Creditor] began on [Date]. Since that time, I have enjoyed excellent customer service and benefits and have been happy with [Creditor]. I have also been a customer in good standing, paying my account in a timely manner while qualifying for loyalty programs.

However, in January, I was in a major car accident and spent a week in the hospital. This led to a temporary decrease in my income and an influx of medical bills. While I was able to bounce back financially and now am continuing to pay all my debts as owed and in a timely manner, the first month after my injury was financially difficult, and this is when I missed that single payment.

I wish I could have continued with normal payments during that time, and I regret that I wasn’t able to do so. Following that personal emergency, I’m working hard to repair any damage done to my credit and personal financial life, and I’m reaching out to you for support in that effort.

I’m asking that [Creditor] give me a second chance at a fully positive credit history with your organization by removing the late payment mark from my credit report with all three credit bureaus. Please let me know if there is anything else I can provide to support you as you consider my request. Thank you.

Sincerely,

[Name]

Goodwill letter sample + template

How to avoid incurring negative items in the future

As mentioned above, goodwill letters are most likely to work for one-off occurrences. So, if your goodwill letter is successful and a creditor agrees to remove a negative remark from your credit report, it’s important that you take the following precautions to avoid incurring negative items in the future:

- Stay organized. Organizing your finances can help you remember to pay them on time.

- Pay your bills automatically. If you frequently forget to make payments, set up automatic transfers to stay on top of your bills.

- Update your contact information. If any personal information changes, like your address, be sure to update it on your statement.

- Have an emergency fund. Building an emergency fund will hopefully allow you to keep making payments, even in the event of an unplanned expense.

If you’re looking to improve your credit, Lexington Law Firm may be able to help you. Lexington Law Firm’s credit repair service can help you address questionable negative items on your credit reports. Start today with a free credit assessment.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.