A credit builder loan is a type of loan that helps you rebuild poor credit or establish credit for the first time.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A credit builder loan is a type of loan that helps you rebuild poor credit or establish credit for the first time. Its sole purpose is to help you improve your credit, and having good credit—or even any credit at all—isn’t required to apply for one.

Taking out a credit builder loan means borrowing a specific sum of money you can’t access right away. Instead, the funds get deposited into a savings account that gets set aside until your loan term ends and you’ve made all of your payments.

How does a credit builder loan work?

A credit builder loan functions in the opposite way of a traditional loan, which gives you immediate access to funds that you repay later.

With a credit builder loan, you make monthly payments toward your borrowed money, which is set aside in a secured savings account. This allows you to make consistent, on-time payments on the loan that will show up on your credit report, which will likely improve your credit. Once you’ve fully repaid the loan, the lender will give you access to the funds.

How to improve your credit with a credit builder loan

If you make your payments on time for the duration of the loan, you show that you’re a reliable borrower. This is reflected on your credit report, which is what your credit score is based on.

Since this isn’t a traditional loan, making your payments early won’t have any advantages over just paying your monthly balance on the agreed-upon schedule. But by following these steps, you can use credit-building loans to increase or establish your credit rating.

1. Assess your average monthly expenses

Before you take out a credit builder loan, it should be helpful to take stock of your recurring bills and compare them to your income. Check past billing statements, add up your recurring bills and estimate monthly living expenses like groceries and gas. Compare this to your monthly income to see how much you can realistically spare for loan repayments.

2. Choose a realistic loan amount

Using the budget you came up with in step one above, select a loan amount with monthly payments you’re confident you can afford. Remember, playing it safe with a smaller amount is usually better.

3. Follow your payment plan

Just as paying back a credit builder loan can help your credit, failing to make payments will hurt it—and so will getting into more debt with a budget stretched too thin. Prioritize on-time loan repayments so you don’t get penalized.

4. Monitor your credit

Periodically check your credit and monitor the general trajectory. Aim to check it once a month, and remember that It’s normal for your credit score to fluctuate, so don’t worry if you see it temporarily drop a few points. Keep in mind that it may take several months after you take out a credit builder loan to see positive growth.

5. Develop a long-term financial plan

Once you receive your proceeds at the end of your repayment term, you can use that money to establish a long-term plan. Consider putting that money into a rainy day fund in case an emergency arises. That way, you have a buffer to stay out of debt or pay bills on time to continue building your credit.

How to get a credit builder loan

Ready to take out a line of credit for bad credit repair or credit establishment? Follow these steps to apply for a credit builder loan.

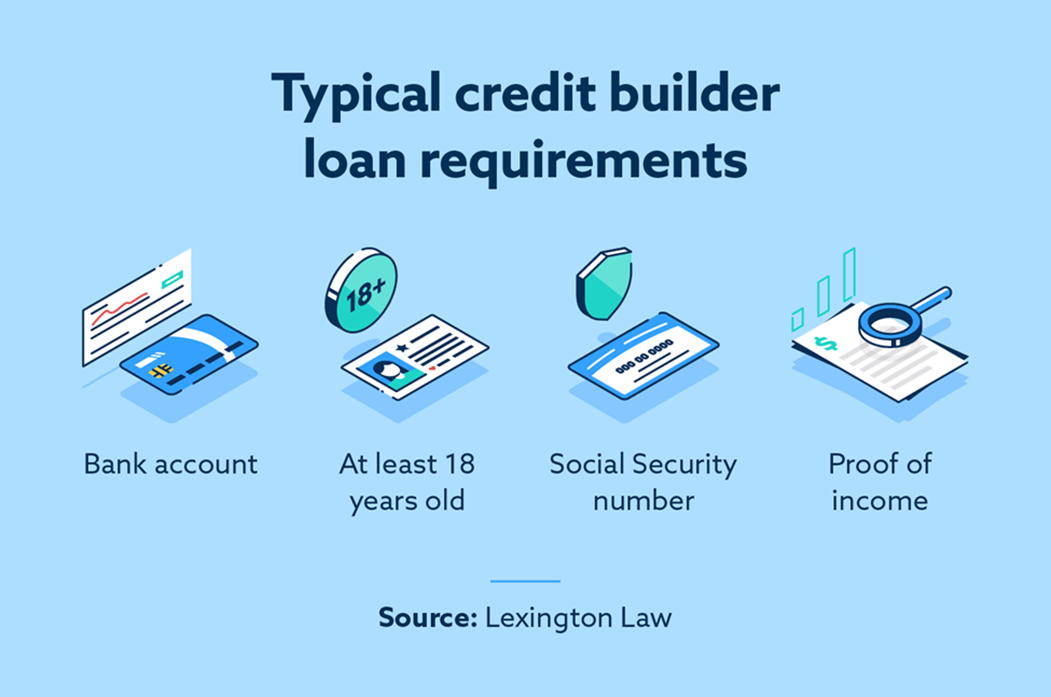

- Step 1. Gather documentation: Before you start the loan application process, consider gathering the relevant documentation. Having your Social Security number, bank statements, contact information, mortgage or rental statements, pay stubs and tax returns handy should speed up the process.

- Step 2. Find a lender: Many large national banks don’t offer this type of loan, so you may have to research or call multiple institutions in your area.

- Step 3. Apply for a loan: Once you’ve found a lender, it’s time to get your documents together and formally apply for the loan. This shouldn’t take long and can often be done online, though local lenders may require you to come in and apply in person.

- Step 4. Follow your repayment schedule: As part of your loan approval, you’ll need to set up a repayment plan. Whether you pay by automatic account transfers, cash or check, you’ll want to make your monthly payments on time for the duration of your repayment period.

Where to get a credit builder loan

Since credit builder loans aren’t very profitable, they’re rarely advertised by financial institutions—or not offered at all. Check these places instead of large national or international banks.

Credit unions: To get a loan from a credit union, you need to become a member. Common membership requirements include living in the area where the credit union is based or working for a certain company. You might also have to pay a membership fee.

Community banks: Small local banks usually offer credit builder loans as well. You can search for local banks in your area and call them to inquire about what types of loans they provide.

Online lenders: It’s possible to find online lenders who offer credit builder loans, and finance companies are becoming increasingly aware of the benefits of offering them.

Lending circles: A lending circle allows individuals to borrow and lend money at little to no expense. Under this arrangement, people contribute money and take turns borrowing from that pooled fund. Mission Asset Fund is a nonprofit that offers lending circles and reports to all three credit bureaus to help participants raise their scores.

Drawbacks of a credit builder loan

A credit builder loan can be a helpful tool if you need to build your credit from the ground up or improve poor credit. Here are two situations in which this loan type may not be the right option for you:

- If you need access to funds right away: Remember that you’ll be contributing your funds to an account you can’t access until the loan term is up. If you need immediate funding, a credit builder loan won’t help you.

- If you don’t have disposable monthly income: If you have to stretch your budget to fund a credit builder loan, you could risk missing a payment and damaging your credit.

Fortunately, even if a credit builder loan isn’t the right option for you, there are still other ways you can build your credit.

Other options for improving credit

A credit builder loan isn’t the only way to build credit. Even if you have a poor credit score, there are other options to improve your credit standing.

Apply for secured credit cards

This is a great option for poor credit carriers because approval is basically guaranteed. The only requirement is a cash deposit, which also becomes your credit limit. Your activity on a secured credit card gets reported to the credit bureaus just like with a credit builder loan, so you can demonstrate a positive repayment history and help your credit.

Become an authorized user

If you can’t qualify for a credit card of your own, a low-risk way to build credit is to become an authorized user on someone else’s credit card. This allows you to use the credit card owner’s line of credit, but the card owner is the only one responsible for payment.

If you have a friend or family member who’s willing to add you to their card—and they have responsible credit usage habits—their payments and activity will appear on both of your credit reports, giving you a chance to improve your credit.

Take out a secured personal loan

A secured personal loan requires you to deposit collateral to borrow funds. This makes it less risky for lenders to loan to you since they can seize your collateral if you don’t make your payments as scheduled. While this is an option to build up your credit, the possibility of losing your collateral makes it riskier.

Take out an unsecured personal loan

This type of personal loan isn’t backed by collateral, but the interest rates are typically much higher, making this a more expensive way to build your credit. These loans are also harder to get approved for since the lack of collateral means a higher risk for lenders. You might need slightly better credit to qualify for an unsecured loan, and you can expect to pay more interest on it than you would on a secured loan.

Credit builder loan FAQ

If you’re thinking about taking out a credit builder loan, you may have a few remaining questions. Below, we’ve answered some of the most frequently asked questions regarding credit builder loans.

Is a credit builder loan a good idea?

As with any other type of loan, responsible credit usage is key to improving your credit. If you are confident you can make monthly payments on time, this is a great way to build credit.

How much will a credit builder loan help my credit?

The specific effect on your credit is hard to predict because it relies on many different factors, but it could be significant. Payment history alone accounts for 35 percent of your FICO® score.

How much can I borrow with a credit builder loan?

This figure can vary by financial institution. Digital Federal Credit Union, for example, offers credit builder loans ranging from $500 to $3,000 with terms spanning 12 to 24 months. You may want to shop around to see what your options are.

Do you pay interest on a credit builder loan?

Yes, credit builder loans include interest that you must pay off over the course of your repayment term.

Financially empowering yourself requires discipline and patience, especially if you’re climbing out of a bad credit history. But, the possibility of financial freedom exists for anyone willing to commit to the process, and many resources are available to help you along the way. The credit repair team at Lexington Law Firm can provide tools to help you work toward a better financial future and guide you through your credit journey.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.