A personal line of credit (PLOC) is a form of revolving credit that allows you to access funds and pay the loan back with interest. Some PLOCs offer better interest rates than credit cards.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Lines of credit are a major contributing factor to the average consumer debt in the United States, but personal lines of credit may provide funds when you need them the most. When you have a personal line of credit, you may also have some peace of mind because it can provide you with funds in an emergency or when you’re low on cash.

Here you will learn about what personal lines of credit are, their pros and cons and how they compare to other lines of credit. By the time you finish reading, you’ll have a better idea of whether or not a personal line of credit is right for you and your situation.

What is a personal line of credit (PLOC)?

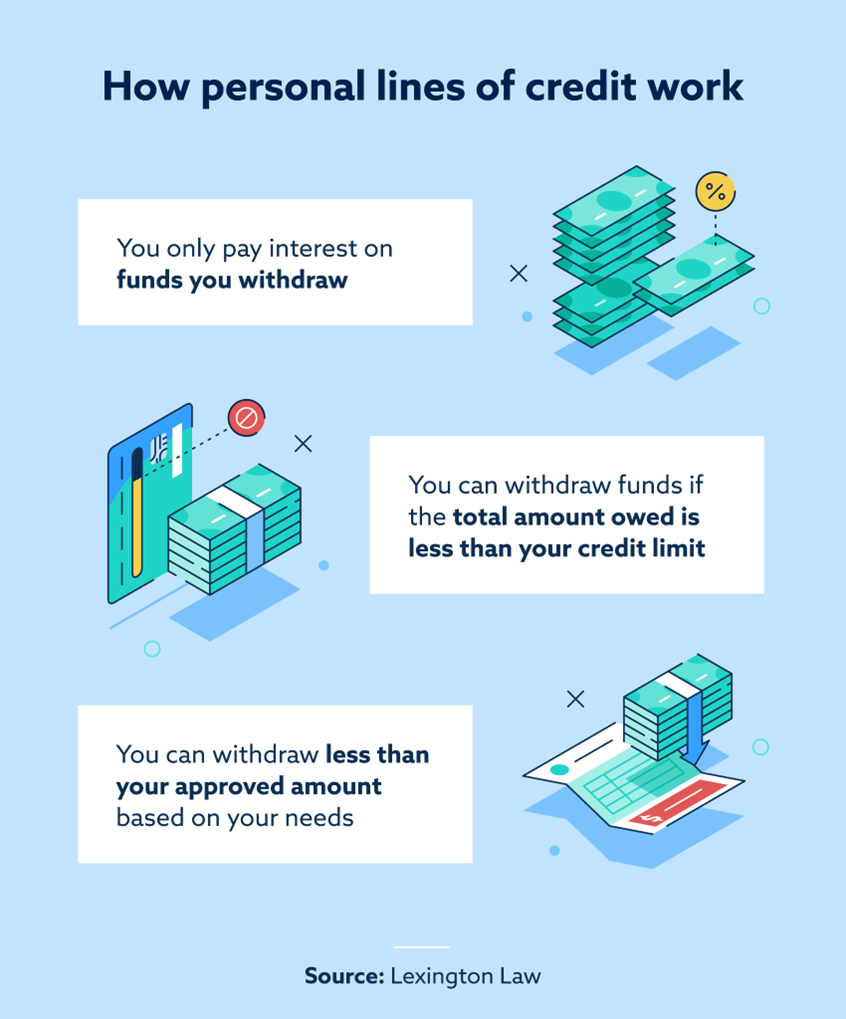

A personal line of credit (PLOC) is a type of flexible loan you can use whenever you need it, paying back the interest and principal only when you use the credit—similar to how a credit card functions. This is different from an installment loan, where you repay the amount borrowed in full with interest over a fixed term.

A personal line of credit is revolving debt. This means it’s available to you all the time, with a predefined maximum, and it’s often used by individuals to cover an income gap.

A personal line of credit shouldn’t be confused with a home equity line of credit or a business line of credit. A home equity line of credit allows you to borrow credit against your home. A business line of credit is similar to a personal line of credit but should only be used for business expenses.

How does a personal line of credit work?

Personal lines of credit work like credit cards, but you don’t use a card. Similar to credit cards, you will need to apply through a financial institution, and they’ll run a credit check on your credit report. If you’re approved, the financial institution will give you a credit limit, and you can access the funds as needed.

Although you won’t have a credit card, you can access the funds by going directly to a bank branch or using their website. You may also be able to move funds to your bank account via an app. You’ll eventually make payments on the borrowed funds with interest.

Unlike credit cards, personal lines of credit expire. When you’re approved, the bank will let you know how long the line of credit is good. According to Forbes, the typical term for personal lines of credit is two to seven years.

Personal line of credit vs. personal loan

A personal loan is a lump-sum loan that you’re responsible for paying back in its entirety plus interest. Unlike with a PLOC, you are responsible for the entire amount you’re approved for, even if you don’t use it all. However, loans usually have lower interest rates because they’re less risky for lenders.

Personal lines of credit are often a preventative measure, whereas personal loans are typically for making a large purchase. Using a personal line of credit to make a large purchase may not be a good idea because they have higher interest rates, and you may need to pay the funds back sooner.

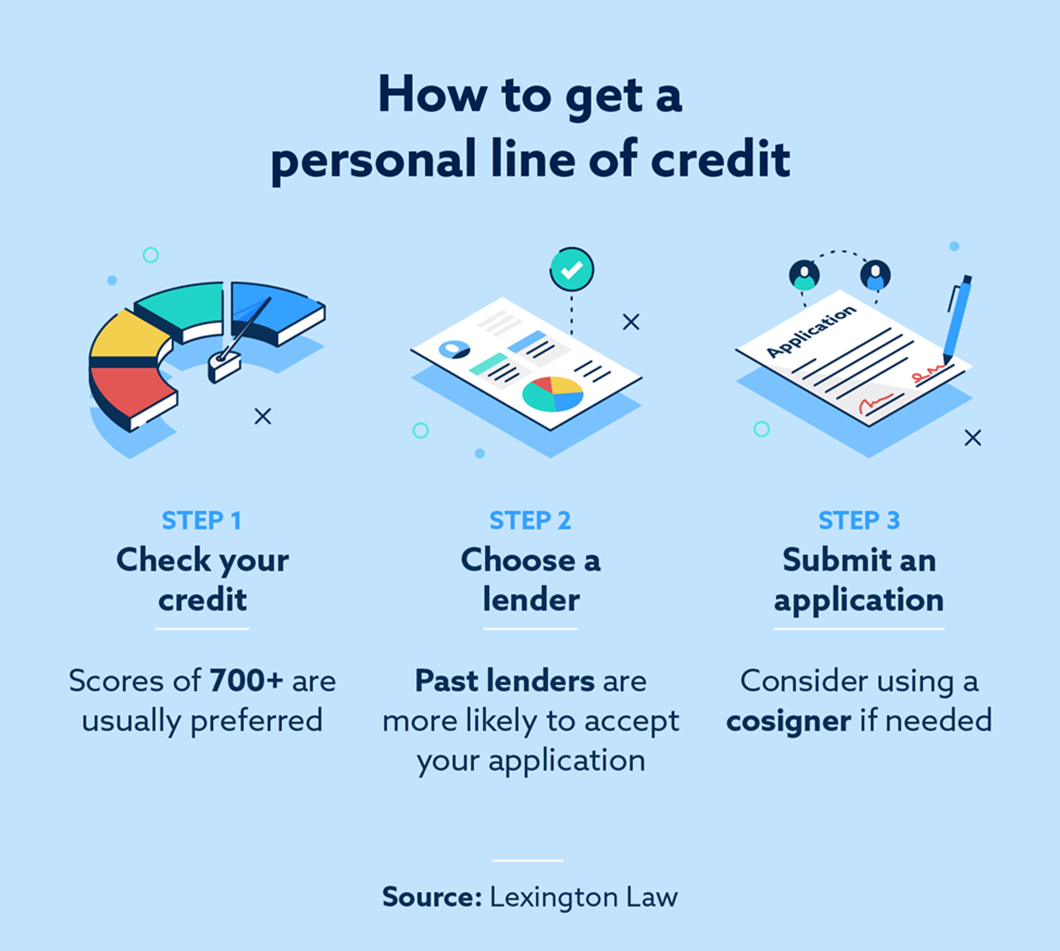

How to get a personal line of credit

The process for getting your personal line of credit can differ depending on your credit standing. Below are three steps explaining how to get a personal line of credit:

- Check your credit: Applying for a PLOC involves a hard inquiry into your credit score, so it may be best to check your credit first. Unfortunately, you may not be able to secure a personal line of credit if you have poor credit because they typically require a higher credit score.

- Choose a lender: Before applying, shop around and see which lenders offer the best interest rates and lowest fees.

- Submit an application: Once you choose a lender, you’ll need to fill out an application. Oftentimes, you’ll need two forms of ID, bank statements, tax returns and other financial documents.

If you have difficulty getting approved for a PLOC, you still have options. If you can get a cosigner, you’re more likely to get approved. This cosigner would be responsible for the loan if you default. Alternatively, you can pursue a secured loan, which is less risky for lenders.

Pros and cons of a personal line of credit

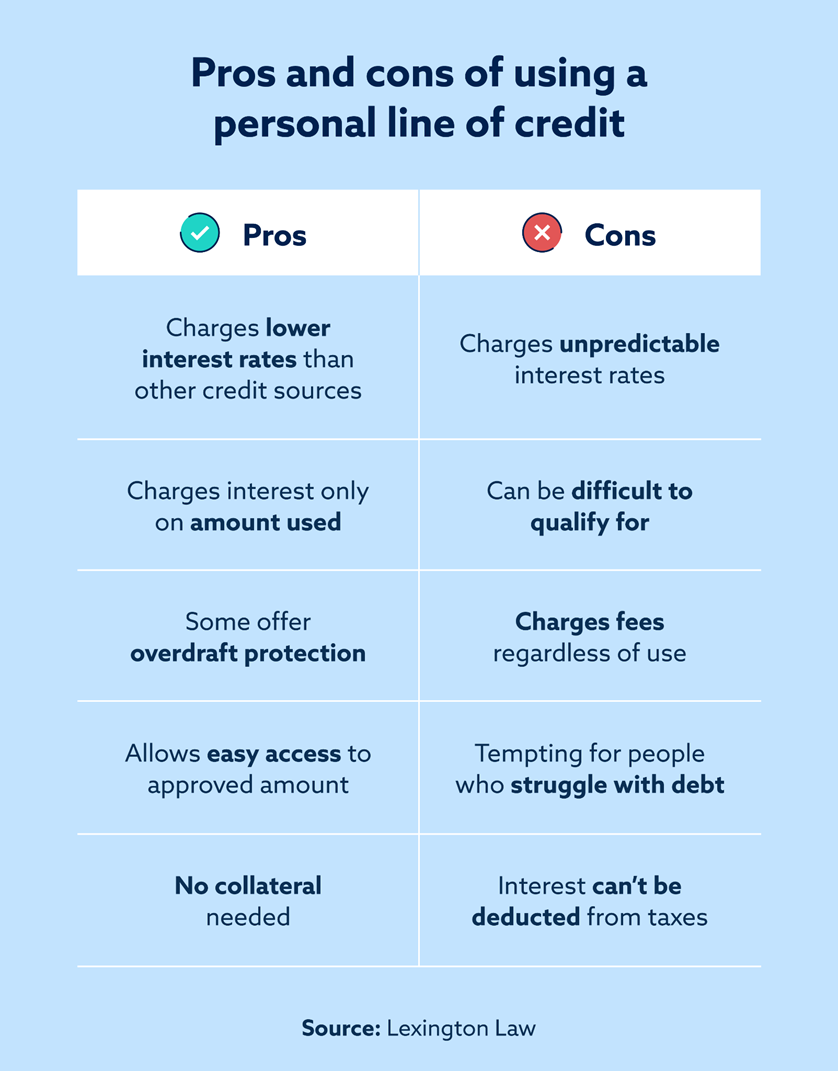

PLOCs are ideal for financially responsible individuals who need a short-term solution to cover unexpected expenses. But they’re not a great fit for everyone. Here are some pros and cons of securing a personal line of credit.

Pros of using a personal line of credit

- They charge lower interest rates than other credit sources: PLOC interest rates are generally lower than personal loan or credit card rates.

- They charge interest only on the amount used: If you use less than the approved loan amount, you will only accrue interest on the funds you withdraw.

- Some offer overdraft protection: Some PLOCs provide overdraft protection.

- You don’t need collateral: PLOCs are unsecured, so you don’t need to put down collateral like you would with a home equity line of credit.

- They allow easy access to the approved amount: It’s easy to withdraw from your PLOC once you’ve been approved.

Cons of using a personal line of credit

- They charge unpredictable interest rates: Variable interest rates make it difficult to budget payments.

- They can be difficult to qualify for: Unsecured loans like PLOCs often require higher credit scores.

- They charge fees regardless of use: Many lenders charge maintenance fees even if you don’t withdraw any funds.

- They can be tempting for people who struggle with debt: Some people have difficulty paying back large sums.

- The interest isn’t tax deductible: There are some forms of tax-deductible interest, but PLOCs do not qualify.

Other lines of credit types

There are other lines of credit beyond personal lines. Below are some other options to consider before applying.

Personal line of credit vs. credit card

Credit cards allow you to make smaller regular purchases in situations where you don’t have the cash. Many offer points or cash back for certain purchases, providing you with some extra benefits for using the credit card. These usually have a monthly limit on how much you can charge.

Credit cards are different from PLOCs because with PLOCs you’re approved for a maximum amount within a specific time frame. This money goes straight to your account, and you can take out whatever amount you need as long as it’s less than the maximum amount you’ve been approved for.

Home equity line of credit (HELOC)

A home equity line of credit (HELOC) is a secured loan where your home’s value is the collateral for your loan. This is different from a PLOC because PLOCs are typically unsecured, so they don’t require collateral. To take out a HELOC, you must own or be making payments on a home.

Business line of credit

If you own a business, you can get a business credit card. These cards often offer higher credit limits for various business expenses. Business owners often use them to buy equipment, merchandise and other items that help with day-to-day operations. They can also be used for other expenses, such as fuel or business-related dining.

Alternatives to a personal line of credit

If you’re denied a personal line of credit or would like alternatives, you have other options you can consider. For example, you can choose an unsecured personal loan or a secured credit line. These loans are different from a personal line of credit because:

- You get all the money up front and need to pay interest on all of it.

- They usually have higher interest rates than PLOCs.

- There is a predefined payment deadline date for all the money to be paid back in full along with interest.

Additionally, a secured personal loan requires you to put cash or an asset on the line. If you don’t pay the money back, the lender can go after the collateral for payment.

Some other options include:

- 401(k) loans: You can borrow from your 401(k) retirement funds, and the interest payments on these loans go back into your account.

- Home equity loans: If you’re a homeowner, you can borrow against your home’s equity. Depending on the lender, you may be able to borrow up to 85 percent of the equity with a home equity loan.

Should you get a personal line of credit?

If you’re concerned about unexpected expenses or gaps in income, you may want to consider a personal line of credit. For example, those who are self-employed may experience a drastic dip in earned income at certain times and can rely on their PLOC to cover bills.

Additionally, a PLOC may be a way to pay off high-interest credit cards. If you have significant credit card debt or another loan with a high interest rate, a personal line of credit might help. If your personal line of credit has a lower interest rate, consider using the funds to pay off the other debts.

Personal line of credit FAQ

We’ve provided answers to some common questions about PLOCs below.

Is it hard to get a personal line of credit?

For those with a credit score of 670 or higher, it shouldn’t be a problem getting approved for a personal line of credit. There’s more risk involved with these lines of credit, so you may not get approved if you have a lower score.

Do I qualify for a personal line of credit?

In addition to good credit, the financial institution will also look at other aspects of your finances. They may want bank statements, pay stubs and other information about your income.

Are there disadvantages to personal lines of credit?

There are some disadvantages to personal lines of credit, like higher interest rates and fees, but they may still be a good idea depending on your specific financial situation.

Can a personal line of credit hurt my credit score?

Like other forms of credit, personal lines of credit can either help or hurt your credit score. If you are late with your payments or miss payments altogether, a PLOC can harm your credit. But if you make regular, on-time payments, a PLOC could improve your credit.

How credit repair may help you get a personal line of credit

It can be very beneficial to have a personal line of credit when you’re in a tight financial situation and need some cash. Before you apply for a personal line of credit, make sure to check your credit and ensure you’re in good standing. If your credit is on the lower end, consider improving it so your chances of being approved for a PLOC increase. If you don’t know where to start, get your free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.