The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A FICO® score is a type of credit score. There are many different ways of “calculating” credit scores based off of your credit history, which is why your score can look different. FICO is one of the ways of calculating a credit score and is the most widely used by lenders.

It’s common for people to use the terms “credit score” and “FICO score” interchangeably, and while they have similarities, they’re not the same.

In this guide, we teach you the difference between these two credit terms, why these scores matter and what you can do to improve them.

Table of contents:

- What is a credit score?

- What is a FICO score?

- Is a FICO score the same as a credit score?

- How is a FICO score calculated?

- What is a good FICO score?

- How to get your FICO score

- FICO score vs. VantageScore

- Other kinds of credit scores

- How to improve your FICO score

What is a credit score?

Credit scores are three-digit numbers that represent the likelihood of you being a responsible borrower. Your credit score is an important indicator that financial institutions look at when reviewing your loan or credit application. Your credit score may also be a factor when you’re looking to rent, turn on utilities or get a job.

What does a credit score mean to a lender?

Your credit score is a quick way for a lender to see how financially responsible you are. A credit score indicates your “credit risk” to lenders, which is how likely you are to pay back your loan and make payments on time.

When you have a higher credit score, it’s a signal to lenders that you make your payments on time, don’t spend too much and have experience using credit. A lower credit score can mean the opposite. Credit scores are often lower because they have derogatory marks like late or missed payments, collection accounts, bankruptcies and other situations that may show financial hardship.

A lender will usually look at more than just your credit score, they’ll also look at a copy of your credit report.

What is a FICO credit score?

A FICO score is a type of credit score created by the Fair Isaac Corporation (FICO). It ranges from 300 to 850 and is used by most lenders.

How do lenders use FICO credit factors?

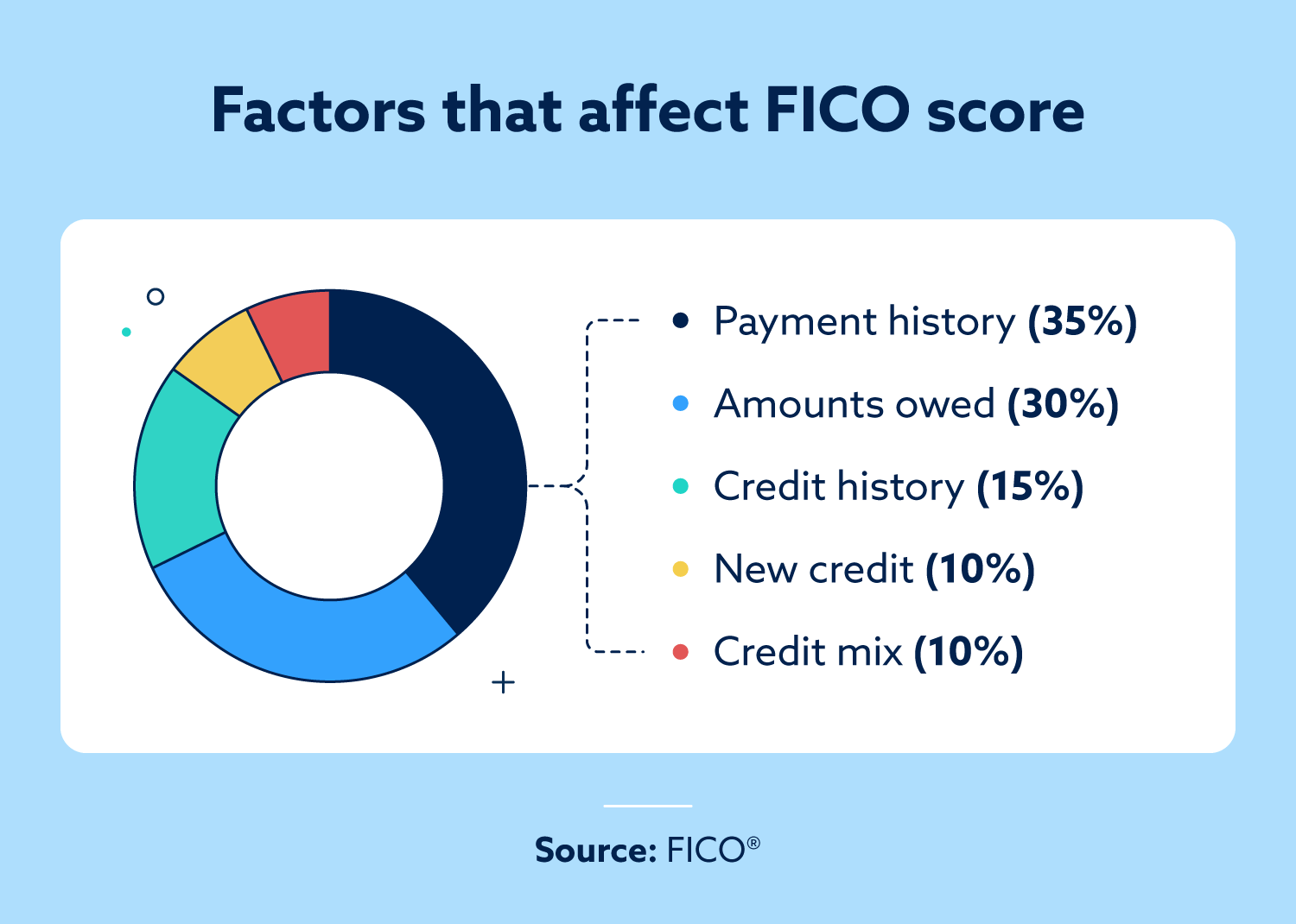

FICO uses five factors to calculate your credit score, and each one has a different weight. This means that some factors are more important than others. For example, your payment history is much more important than your credit mix. Understanding these factors is the first step toward improving your score.

| FICO score factors | What this means to lenders |

| Payment history (35 percent): How consistently you make on-time payments on time. Primarily considers the past two years, but it can go back as far as seven years. | Shows that you are more likely to repay a future loan. |

| Amounts owed (30 percent): How much you owe compared to your max credit limit. Looks at the max limit for all of your cards combined. | May indicate that you’re spending more than you can afford, which can make it difficult to pay back your loans. |

| Credit history (15 percent): The average age of all your lines of credit. Includes credit cards, auto loans and home loans. | A long credit history shows that you have experience with credit and long relationships with lenders. |

| New credit (10 percent): How often and recently you’ve applied for new lines of credit. Triggered whenever there is a hard inquiry into your credit report. | Too many new credit applications can indicate that the person may not have the funds to realistically repay a future loan. |

| Credit mix (10 percent): The different types of credit accounts on your credit report. | A mix of both revolving credit and installment loans shows lenders that you have experience with and can handle different types of credit. |

You can get an idea of how you’re doing with each of these areas by taking a look at your credit report. There are also services like Lexington Law Firm that break down your credit history and tell you how well you’re doing for each grading factor.

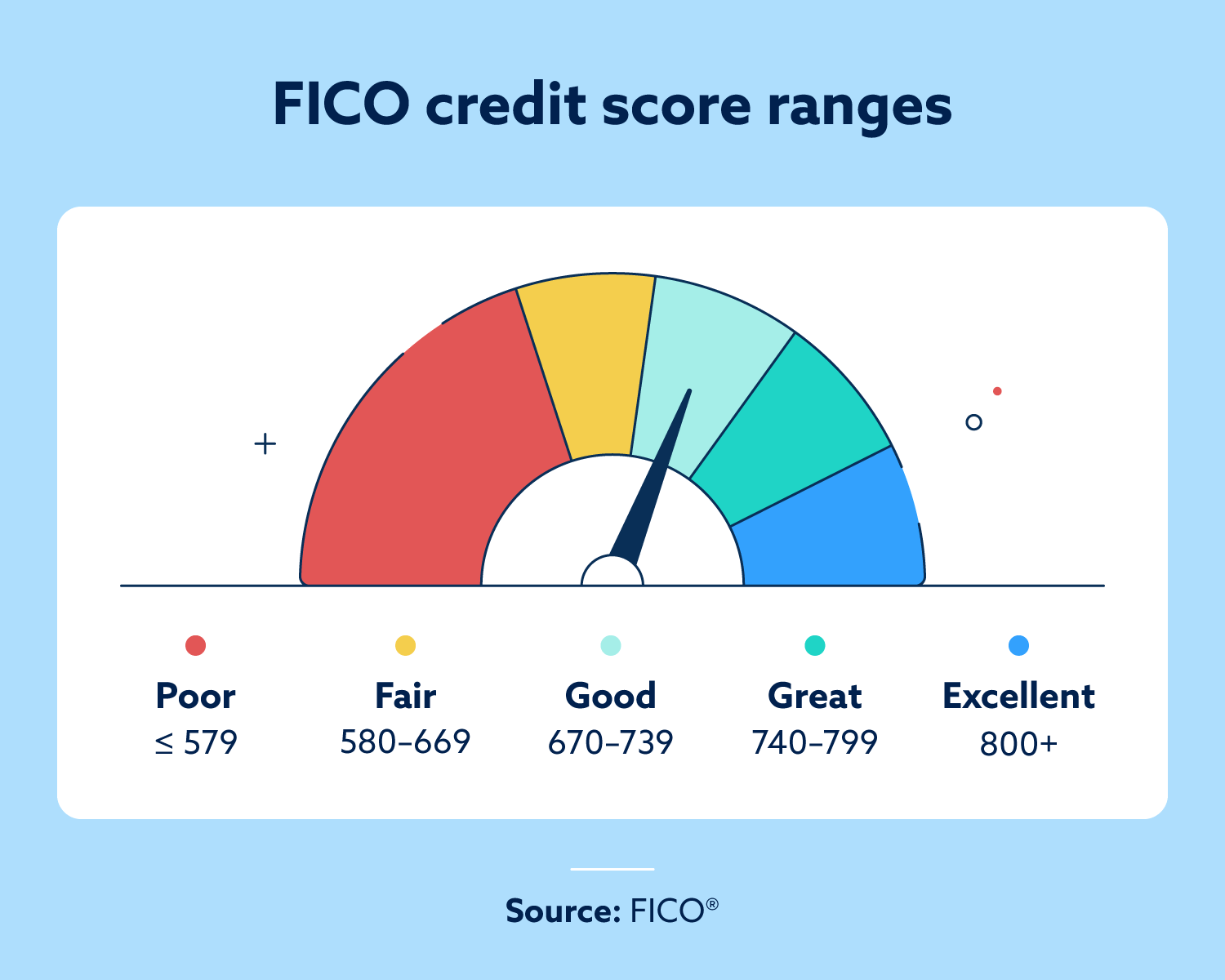

What is a good FICO score?

Generally speaking, anything above 670 is seen as a good credit score. However, this will vary from lender to lender.

The FICO score groups people’s scores into these categories:

- Exceptional: 800+

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 579 and below

Is a FICO score the same as a credit score?

Yes – a FICO score is a type of credit score. Although the FICO score is the most commonly used credit scoring model, it’s not the only one.

If you’ve ever checked your credit score on your bank website and then seen a different score on your credit monitoring app and wondered which is right, the answer is that both of them are – they’re just calculated differently. Your bank might be showing you a FICO credit score while your app is showing you VantageScore® credit score, which is a different type of scoring model.

If you’re wondering which credit score to trust, we always recommend checking your FICO score because it’s the one your lender will probably look at. And of course, always remember to also check your credit reports as well.

Why is my FICO score higher than my credit score?

People commonly wonder why their FICO score is higher or lower than their other credit scores, and this can happen for different reasons. As mentioned above, different scores may have different scoring models, so they may weigh factors of your credit report more or less than the FICO model being used. Your credit scores may differ because the information comes from different reporting agencies.

How to get your FICO score

You can get your FICO score directly from FICO or one of its partners.

- Check the FICO Open Access Program: FICO has partnered with several institutions to provide your FICO score number for free under its open access program. Check to see if your bank or credit and financial counseling program is listed.

- Purchase access from FICO: You can purchase your score and other services from FICO.

- Purchase from an authorized FICO retailer: FICO-authorized retailers are Experian and Equifax.

Some banks, like Wells Fargo, provide you with your FICO score through their mobile app as well.

When you receive your score from any provider online, make sure to confirm which scoring model was used. Most lenders do use FICO scores when making lending decisions, but it’s still helpful to understand the other scoring models — like VantageScore®.

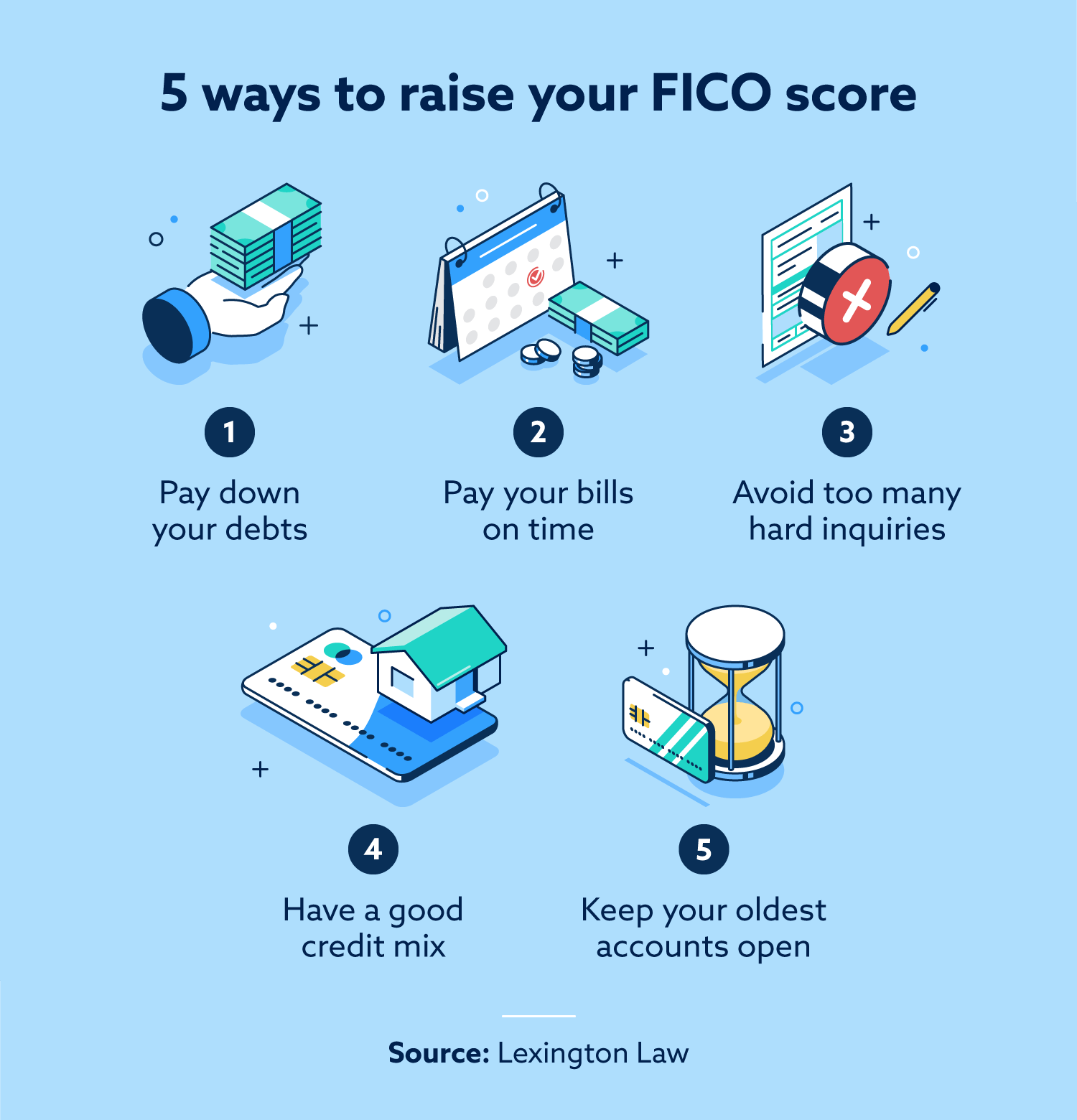

How to improve your FICO score

Now that you know the five factors that FICO uses to calculate your score, you can take action to improve each one.

- Pay down your debts: Your credit utilization is 30 percent of your credit score. When possible, pay more than the minimum on your credit cards to keep your utilization as low as possible.

- Pay your bills on time: Payment history is the most important factor when FICO calculates your score, so making timely payments is helpful. One way to do this is to set up automatic payments.

- Avoid too many hard inquiries: If you apply for too many credit cards or loans, it can lower your credit score. Try to limit hard inquiries to once or twice a year. There will be a small drop in your score, but it’s temporary.

- Have a good credit mix: If possible, have both revolving and installment credit. This can mean having a credit card or home equity line of credit (HELOC) and a car or mortgage loan.

- Keep old accounts open: If there’s a credit card you don’t use anymore, it’s good to keep it open to improve your credit history. A good strategy may be putting a small monthly bill on it or using it for gas to ensure it’s not closed for inactivity.

It’s also important to check your credit reports frequently. Your credit reports can give you a better understanding of what’s hurting your credit, and you’ll want to make sure that your credit reports don’t contain any inaccurate or false information that’s unfairly affecting your credit. If that’s the case, Lexington Law Firm can help you address the errors to get the accurate credit report you deserve. Check out our services today.

Note: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.