The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Medical bills are generally not reported to the credit bureaus unless they are sent to collections because you missed a payment.

Medical bills are generally not reported to the credit bureaus unless they are sent to collections.

Medical bills in collections can take a toll on both your wallet and your credit score. Having an account in collections is a sign to lenders that you’re unable to keep up with your payments, and may mark you as a risky borrower.

Consumer Reports found that almost one-fifth of American credit scores have been negatively impacted by unpaid medical expenses. Luckily, there are many steps you can take to prevent a medical bill from going to collections.

Before we explain more about how your score is affected, we’ll dive into how medical bills are sent to collections in the first place.

How does a medical bill go to collections?

Like any missed payment, a medical bill is sent to a collection agency if you are severely past due. Healthcare providers typically offer a grace period between the initial missed payment and when the bill is sent to collections, though the amount of time given will vary. An unpaid medical collection account can stay on your credit report for up to seven years if it is fairly reported.

As of 2022, the main three credit bureaus (Equifax, Experian and TransUnion) are enacting three rules in regard to medical collections:

- Medical debt in collections will not appear on a person’s credit report until one year has passed since the debt was reported. This period gives consumers time to find solutions for the bill like starting a payment plan or arranging for the insurance company to pay the bill.

- The credit bureaus will remove medical collections from credit reports if the debt is reported as paid.

- Medical collection debt under $500 will also be removed from credit reports.

How much do medical collection accounts affect my credit?

The impact of unpaid medical collections on your credit depends on how late you are on the debt. Payment history accounts for 35 percent of your credit score, so an account that is significantly late on payments that is also in collections will likely result in a damaged score.

Fortunately, according to FICO® Score 9’s scoring model, unpaid medical collections have a lower impact on credit scores than unpaid non-medical collections. However, although this scoring model can benefit some, not all lenders use FICO Score 9. Some lenders use older models and non-FICO models depending on their preference.

How can I prevent medical bills from appearing on my credit report?

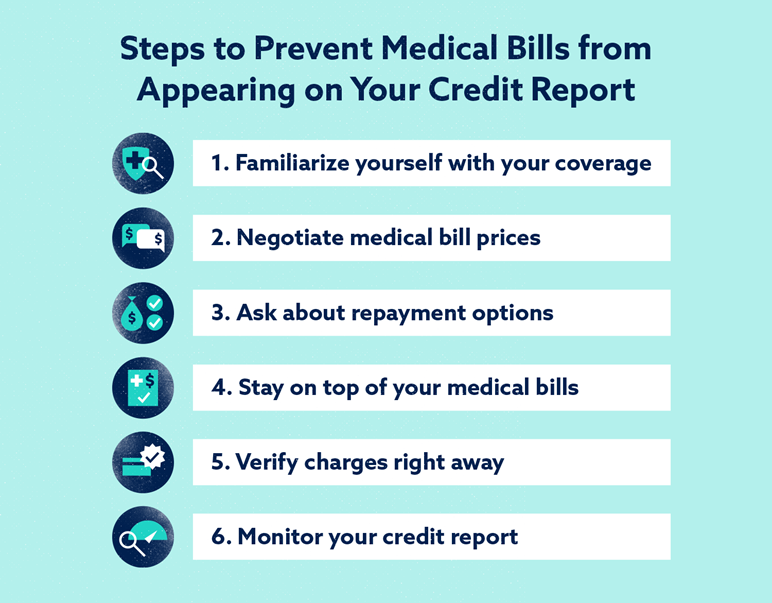

There are a few ways you can prevent medical bills from ending up on your credit. For example, you can make sure you understand your coverage, negotiate bills when possible, work out payment plans with your healthcare provider, stay on top of your bills, verify all charges and keep an eye on your reports.

Here’s a list of how and why you should do each of these things to keep medical bills away from your credit report.

1. Familiarize yourself with your healthcare coverage

Knowing what is and isn’t covered—in addition to your copay—for different procedures helps you anticipate and plan for potential costs. Always ask ahead of time how much a procedure may cost if your insurance does not cover it or if you don’t have insurance.

2. Negotiate medical bill prices

You ideally want to negotiate the prices of your medical bills prior to starting any treatment or procedure to see what options are available, but you can also negotiate after. For example, some healthcare providers charge lower rates or charge on a sliding scale for patients who don’t have health insurance or enough coverage.

Some healthcare and insurance providers are willing to negotiate medical bills. You can research the average prices of your procedure and ask your healthcare provider if they’re willing to lower their prices based on the average. This is not guaranteed, but it never hurts to ask.

3. Ask about repayment options

If you’re unable to negotiate the price and can’t pay the full sum up front, you can ask about enrolling in a payment plan. Again, it’s ideal to work this out prior to your treatment or procedure, but you can ask about your options afterward if necessary. It’s also not guaranteed that your healthcare provider will agree to a repayment plan.

4. Stay on top of your medical bills

Get in the habit of checking your balance with your healthcare and health insurance providers after every procedure or visit. This way, you likely won’t get caught by surprise with a bill you didn’t know about. Contact both your healthcare provider and your insurance provider if you haven’t received a bill you were expecting in order to ensure you don’t miss paying it.

5. Verify charges right away

After receiving your bill, confirm what items are covered by your insurance company to make sure the listed charges are correct.

You should also get clarification from your insurance company and medical provider on any charges that you’re not familiar with or that seem inaccurate. This way, you can potentially avoid mistakenly paying for something.

To do this, you can ask for an itemized bill to see what specific charges are contributing to the total bill. Then, verify each with your healthcare provider. You can more easily audit your medical bill when you can clearly see your expenses.

6. Monitor your credit report

You may sometimes have a medical debt in collections without knowing it. This can be due to your healthcare provider having the wrong contact information on file, a bill being lost in the mail or your healthcare provider mistakenly charging you for someone else’s bill.

Keeping an eye on your credit report can help you crack down on any inaccurate debt. You can get a free credit report from each credit bureau every year through AnnualCreditReport.com.

How can I remove medical collections from my credit report?

Medical collections can be removed if they are paid, if you negotiate a pay for delete or another arrangement with a collection agency or if what is reported is unfair, inaccurate or unverified.

An example of this would be a bill that does not actually belong to you. If you find you have an unfairly or inaccurately reported medical bill on your credit reports, you can sign up for Lexington Law. Or you can learn more about how you can remove a medical collection account to ensure your information is accurate and fair.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.