The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Nobody likes to check their credit and see a drop in their score from a late payment. If this has happened to you, you may be wondering, “How long do late payments stay on credit reports?” In short, a late payment can stay on your credit reports for up to seven years.

This means it’s crucial to understand how late payments are reported, when late payments fall off your credit report and what you can do to avoid late payments in the future. While it’s important to ensure you make your payments on time, we know that life happens. Here, we’ll explore important questions like “How long do things stay on your credit report?” and “How long does debt stay on a credit report?” By the time we’re done, you’ll have the information you need to work on maintaining or even raising your credit score.

What is considered a late payment?

In general, a late payment is when you make a payment toward your debt that is after the specified due date. Each lender can have different parameters for what they consider a late payment, and this can affect how they report to the credit bureaus.

Regardless of the credit card you’re using or the type of loan you’re paying off, it’s a good idea to confirm when payments are due and what the specific guidelines are. A good rule of thumb is to ensure you make payments within 30 days of the scheduled due date to keep them off your credit report, but it’s always better to pay sooner rather than later. It’s also important to note that although late payments may not be reported for 30 days, you can still accrue late fees.

When a payment is late, it can be considered delinquent, and this is when your lender may report the late payment to the major credit bureaus. Late payments aren’t just a problem for credit cards, either. They also matter for any type of installment or revolving loans, such as:

- Car loans

- Student loans

- Mortgages

- Personal and business lines of credit

In some cases, a delinquency can lower your score significantly, so it’s best to avoid delinquency if possible.

How long does a late payment stay on your credit?

As we’ve mentioned, once a late payment is considered delinquent and reported to the major credit bureaus, it can take up to seven years to fall off and no longer appear on your credit report.

Your lender reports to the credit bureaus on a regular basis, so the seven-year clock will start from the original delinquency report date. On your credit report, you’ll typically be able to see when the late payment was reported, and this is the date to keep in mind.

For example, if your credit card payment was due on June 15, 2021, but you were late, and it was reported on July 28, this would be the start of the seven years. Even if you bring the account current after it was reported, that delinquency may still show up on your credit report until July of 2028.

How do late payments affect credit scores?

Late payments can negatively affect your credit quite a bit. In fact, a late payment can cause your credit score to potentially drop significantly, depending on your current credit score and other factors. Some of the factors that determine how a late payment affects your score include:

- Frequency of late payments: If this is a one-time occurrence, the hit to your score might not be as bad as if you miss payments on a regular basis.

- Current score: Late payments have a larger negative impact on higher credit scores than lower ones. So, if your score is in the 700s, you may see a more severe drop in score than someone with a score of 600.

- Number of delinquent accounts: If you have multiple credit cards from different financial institutions and are late on more than one, this may also have a larger impact on your score.

Fortunately, as time goes on, these late payments have less of an influence on your credit. This means that a late payment that was reported three years ago won’t affect your score as much as a late payment from a month ago.

How to remove late payments from your credit report

There are a few ways to potentially get a late payment removed from your credit history, including negotiating with your lender. Before you do that, though, you should check to see if there are any errors in the way the late payment is recorded on your credit report. If the late payment item is proven to be inaccurate, the credit bureaus are required by law to address or remove it.

Step 1: Look for inaccurate late payments

These days, many people make their payments online or even automatically, and it’s possible that a lender’s system can make a mistake and not register a payment. If you believe you made your payment on time, make sure you have records in case you need to escalate the issue. This is why it’s always a good idea to keep a folder or notebook with confirmation numbers or emails when you make payments.

Step 2: Reach out to your lender

If you’ve found that the late payment was reported in error, reach out to your lender to let them know. Sometimes, they’ll see the error on their end. In other cases, the error may need to be escalated.

Step 3: Get documentation

If your lender sees the error on their end, they may tell you they’re going to contact the credit bureaus—make sure you get documentation of the situation. When you speak to a representative of your lender, ask them to send you a letter recognizing the error and stating that they plan on resolving it.

If you don’t see the item come off of your credit report within the next month or two, you can file a dispute with the credit bureaus.

Step 4: File a dispute

It’s possible that your records may not align with your lender’s, or your lender might not be willing to remove the late payment from your credit report. If this happens, you can file a dispute directly with the credit bureaus to hopefully get resolution.

What can I do to minimize the impact of a late payment?

If you learn that your late payment item is completely accurate, is there a way to minimize the impact it has on your credit report? While there are no guarantees, there are some methods you can try.

Write a goodwill letter

A goodwill letter might be helpful in your situation and may encourage your lender to remove the late payment from your credit report. If you want to write a goodwill letter, it’s important to be apologetic and explain that you’ll do what you can to avoid late payments in the future. Also, keep in mind that your chances may be better if the late payment wasn’t a large amount or if you usually make your payments on time.

Negotiate a better outcome

Now it’s time to put on your negotiator hat. Before you try to discuss the removal of the late payment from your credit report, get into the mind of your lender. Ask yourself what they want. Typically, they want to ensure you pay off your balances and continue to use your line of credit. You might want to send a pay for delete letter or request that the lender doesn’t report the late payment to the credit bureaus if you catch it in time.

The lender reporting the late payment may allow you to make a larger monthly payment than usual or pay off your entire balance. This is your chance to get creative—don’t be afraid to ask them what options they think would make sense. Collaborate with them and you may find a solution together. And, as mentioned earlier, if you reach an agreement, request that you receive some documentation for your records.

Use a third party

If you don’t feel like you’re the best person to communicate with your lender, that’s understandable. In this case, using a third-party negotiator might be your best option. A third-party negotiator can include a credit repair service or a law firm. Before hiring a third party, be sure to do your research, because there are nefarious actors looking to take advantage of people in a tough financial situation.

How can I avoid late payments?

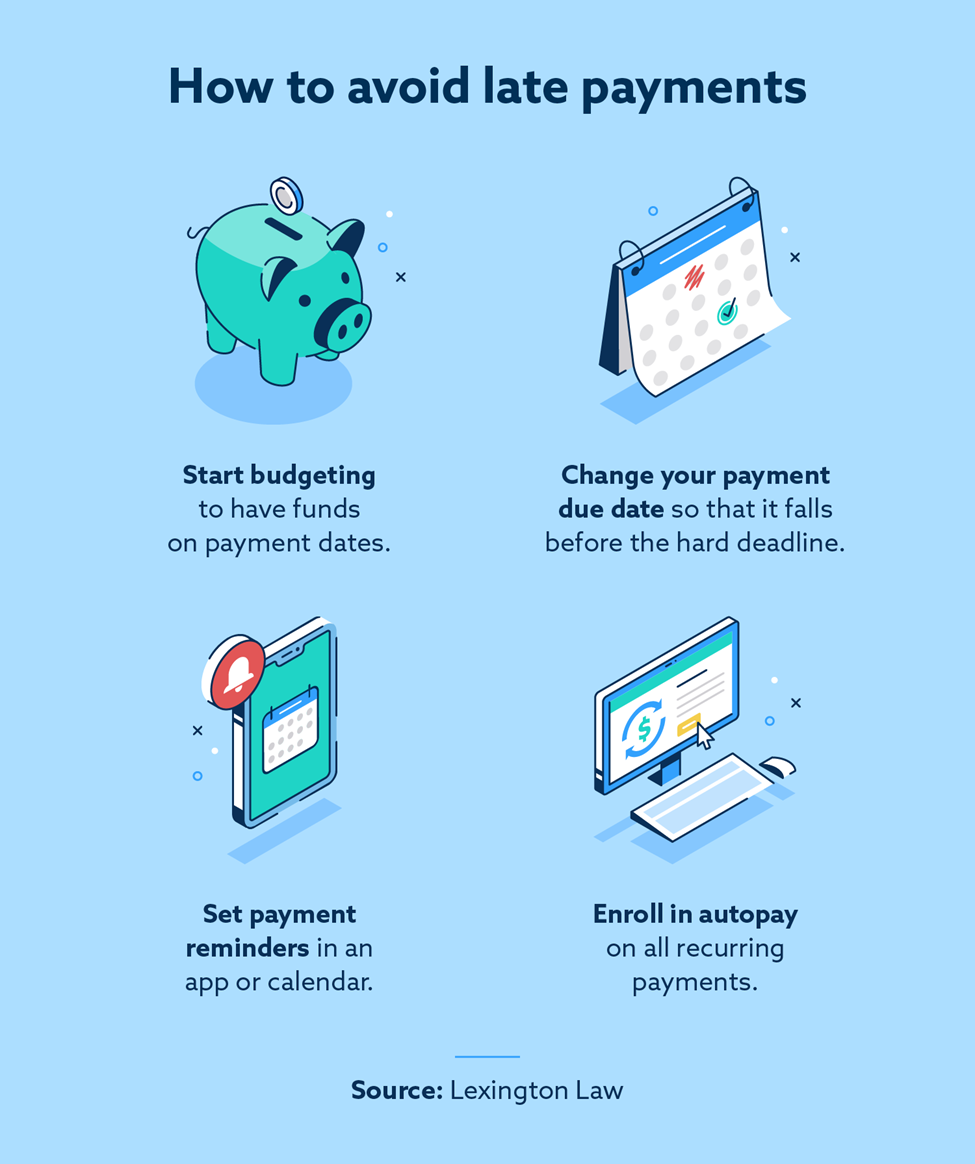

Remember, late payments on your credit report affect future financial opportunities. If you want to avoid late payments in the future, there are some practical steps you can take. Many of these methods take minimal effort, and you can automate them with ease.

Start budgeting

First and foremost, it’s helpful to have a budget that keeps your payments a top priority. You can do this by setting money aside from the paycheck prior to the payment date or having a savings account that’s specifically for payments to lenders.

Change your payment due date

Changing your payment due date might be another great option to ensure you never make a late payment again. It’s common for payments to be at a strange time between paychecks or near your other bills. Figure out a monthly date that works for you, and if you can’t change it on your lender’s website, call them to see if they can make the change on their end.

Set payment reminders

If you don’t want to set up automatic payments, set personal reminders. There are plenty of apps and calendars for your smartphone that allow you to remind yourself to make payments. Or, if you have a calendar in the house or at work that you use, write your reminders there.

Set up autopay

Many lenders have an automatic payment feature on their website. Check the portal where you make payments and you can usually find it. Here, you can schedule payments for a specific amount, and oftentimes, you can adjust the payment frequency instead of paying monthly. For example, some companies let you pay weekly or biweekly if you want to split up your payments.

Get additional help for managing late payments on your credit report

Credit is hard to build but easy to damage. Rather than dealing with seven years of a negative mark on your credit, use some of these tips to help you decrease the impact of late payments or avoid them entirely.

If you’re having trouble with your credit or late payments, Lexington Law may be able to help. Our credit repair professionals have the knowledge to help you through the dispute process from beginning to end. If you need assistance with filing a dispute or addressing a late payment on your credit report, contact us today for a consultation.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.