The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

It is better to leave a credit card with a zero balance open because removing the account could negatively impact several credit factors. However, canceling a credit card can be a smart financial move in certain situations. For example, if you have a card with a high annual fee and rarely use it, canceling it might be a good idea to avoid unnecessary charges.

If you’ve successfully paid down a credit card, you may be wondering if it’s better to close it or leave it open with zero balance. While it’s recommended that you keep unused credit cards open instead of canceling, there are certain instances when canceling that credit card may be in your best interest financially.

Let’s examine the pros and cons of keeping and closing your zero-balance

Is it better to cancel zero-balance or keep them?

The general rule of thumb is that it’s best to keep your unused cards rather than cancel them. Open credit cards, even ones you aren’t actively using, help you build up your credit history and increase your available credit. That increase helps lower your credit utilization rate, which is the percentage of available credit you have used. These details are important because they relate to two factors that credit bureaus rely on when determining your credit score.

If you choose to keep a credit card open, try to use it occasionally to prevent the card issuer from decreasing your credit limit or closing your account due to inactivity.

On the flip side, sometimes the knowledge that you have a credit card available for purchases is too big of a temptation. If you’re having trouble controlling your credit card spending or if your credit card has a high annual fee, you may be better off canceling your card.

How does closing a credit card could impact your credit?

Canceling a credit card, particularly an older one, can lead to a credit score drop. The two primary potential causes of this drop are:

- An increase in your credit utilization rate because you have less available credit

- A decrease in the average age of your credit history

Let’s look more closely at how these two factors can directly impact your credit score. Understanding each one can help you determine whether or not you should close your zero-balance credit card account.

Your credit utilization rate could skyrocket

Even if you aren’t making purchases on a credit card, that available credit is helping to boost your credit utilization rate, which accounts for 30 percent of your credit score. The more available credit you’re using, the worse off your credit score will be.

To understand how your credit utilization ratio — and thus your credit score — could be affected by closing a credit card, here’s a helpful example. Let’s say you have two credit cards:

- One has a $3,000 limit and a $3,000 balance (this is the money you owe).

- The other has a $3,000 limit and $0 balance.

- Your credit card utilization rate between both cards is 50 percent ($3,000 total balance divided by $6,000 total limit multiplied by 100 = 50 percent utilization).

- However, if you close the credit card with the $0 balance, your credit utilization rate jumps to 100 percent ($3,000 total balance divided by $3,000 total limit multiplied by 100 = 100 percent utilization).

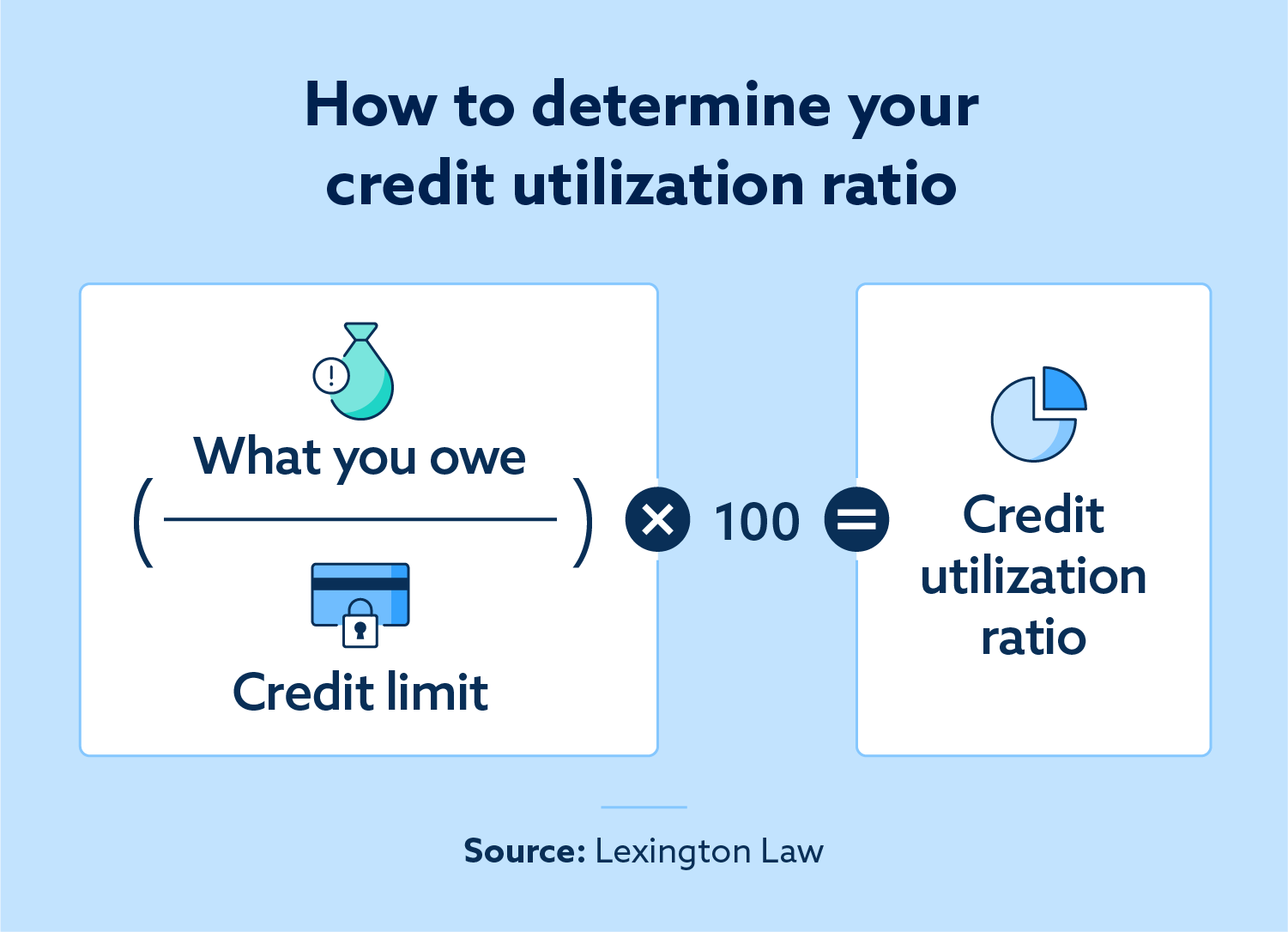

According to FICO®, the goal should be to keep your utilization ratio below 30 percent. There’s an easy formula you can use to calculate your credit utilization ratio:

- Step 1. Divide the total amount of your overall credit debt by the total credit limit available across all of your credit cards.

- Step 2. Multiply the result by 100 to produce your credit utilization ratio.

Pro tip: Before you close a credit card, take some time to determine what your credit utilization ratio would be. If that number will jump significantly, it may be a better idea to keep your zero-balance card open until you can pay down your total credit card balance.

The length of your credit history could decrease

The longer you’ve had a credit card open, the better. This helps to build your credit history, which accounts for 15 percent of your credit score. If you have a positive history associated with your credit card paired with years of having that card in your name, it’s a good idea to keep that card open and in use, as it improves the length of your credit history.

One easy way to keep a credit card in use without driving up your balance is to only use it for recurring payments for things like streaming services or other subscriptions. That way, you’ll know exactly how much is going on that card each month and can easily pay off the balance in full.

When should you close your zero-balance credit card?

Depending on your financial situation, there can be compelling reasons to cancel your unused credit card.

The card has a high annual fee

If you’re charged a high annual fee by your credit issuer, canceling may be a smart money move. However, it’s worth trying to have the fee waived before you decide to cancel, especially if you receive rewards through the card such as travel credits and perks. Call your credit card issuer to ask for the annual fee to be waived and mention that you’re considering closing your account. It never hurts to ask.

You’re a victim of fraud

If your credit card is lost or stolen, the issuer will usually close the account and send you a replacement. But, if a business continues to allow unauthorized charges even after you report the issue, closing the card might be the best financial move to protect yourself from further fraud.

You’re going through a divorce

If you’re separated or getting a divorce, it’s a good idea to close any accounts you share with your ex, as you could end up saddled with a credit card balance they’ve accrued on the account.

You’re out of debt

Everyone is different, and for some, the temptation to keep a credit card and not use it is too high. For those struggling to get out of debt or for those who recently climbed out of credit card debt, it might be a good idea to cancel your unused credit card and stick to using cash or your debit cards to avoid sinking back into revolving credit card debt.

How to cancel your credit card in 6 steps

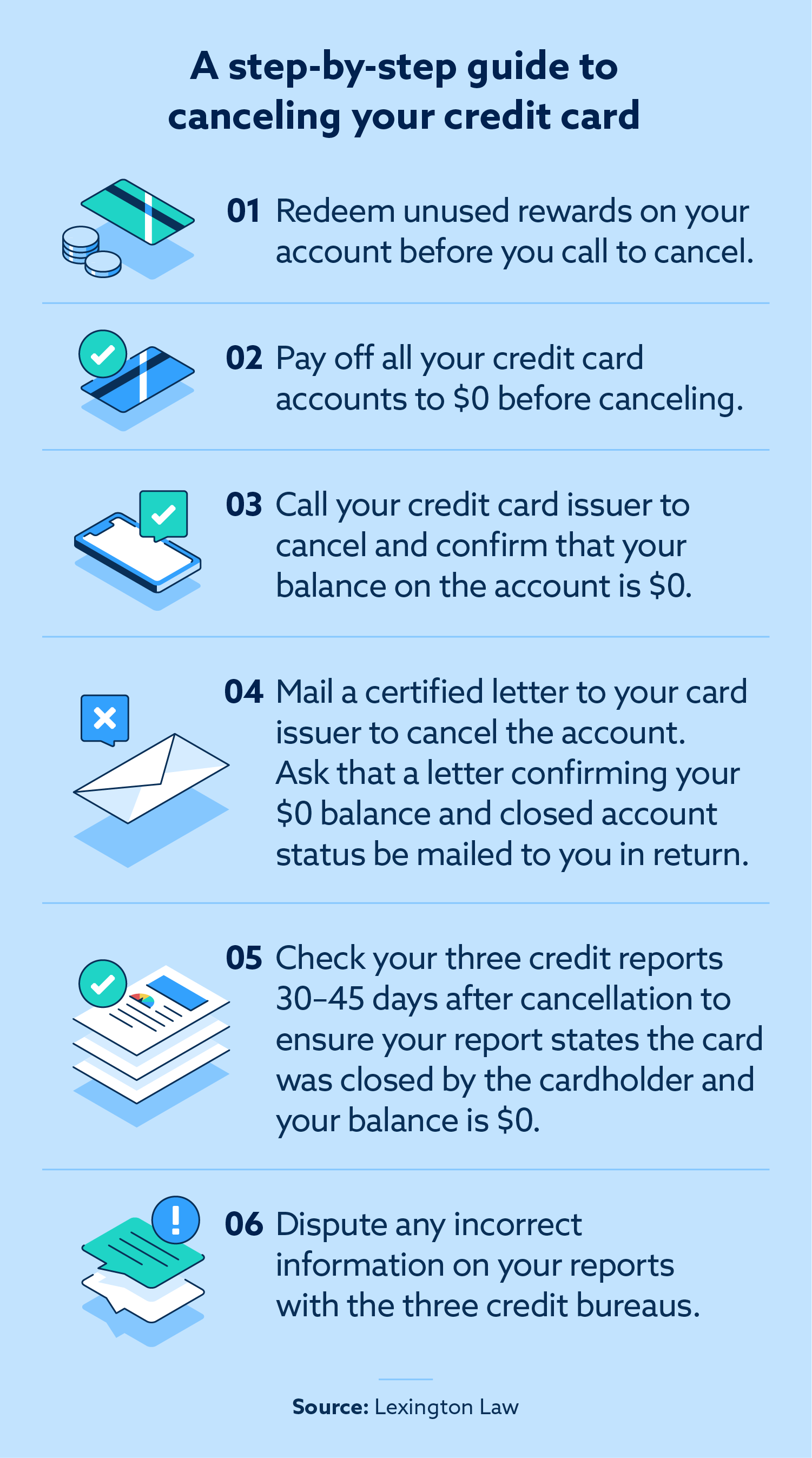

If you do decide to close your credit card, there are several steps you should take to ensure you’ve properly closed your account.

- Redeem rewards points: Refer to your credit card’s redemption rules to learn how to redeem your points prior to closing your account.

- Pay off your balance to zero (if it isn’t already): Pay off any remaining balance on your card before attempting to cancel it.

- Confirm your zero balance: Contact your credit card issuer online or via phone to make sure that your balance is zero.

- Make it official with certified mail: Send a certified letter to the company that issued your card requesting they send you a written letter verifying the zero balance and the closed status of your account. Keeping a paper trail is a great way to maintain a record of when the account was closed in case you need to contest any information on your credit report down the line.

- Monitor your credit reports: Check your credit report 30-45 days after your card is closed to make sure the card is officially reported as “closed.”

- Dispute any errors: Once you’ve reviewed your updated credit report, be sure to dispute any incorrect information you may find.

Bottom line: It depends on your financial situation

Deciding if it’s better to close a zero-balance credit card or leave it open is a personal decision — the answer will depend on your unique financial circumstances. No matter your situation, it’s important to cancel any unused cards in a way that keeps your financial health intact and minimally impacts your credit score.

For some, having unused credit cards may be no temptation whatsoever, but for others, the knowledge of having a card available to use could be difficult to ignore. Canceling a credit card won’t necessarily change your spending habits in the long run, so it’s important to develop a healthy approach to your personal finances by creating a realistic budget and sticking to it.

Tame your credit card debt with Lexington Law Firm

When you have a credit card with a zero balance, the decision whether to keep it open or not depends on your credit score goals. If inaccurate information on your credit reports is dragging your score down, credit repair services can help you challenge these errors and potentially boost your score.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.