The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

There are many different reasons for a sudden drop in your credit score. Common examples include late payments, a credit utilization increase or a recent loan or mortgage application.

When working on your credit score, any drop can be a source of frustration. However, know that fluctuations in credit scores are fairly common.

There are many different reasons for a sudden drop in your credit score. While some reasons are obvious, others are harder to uncover.

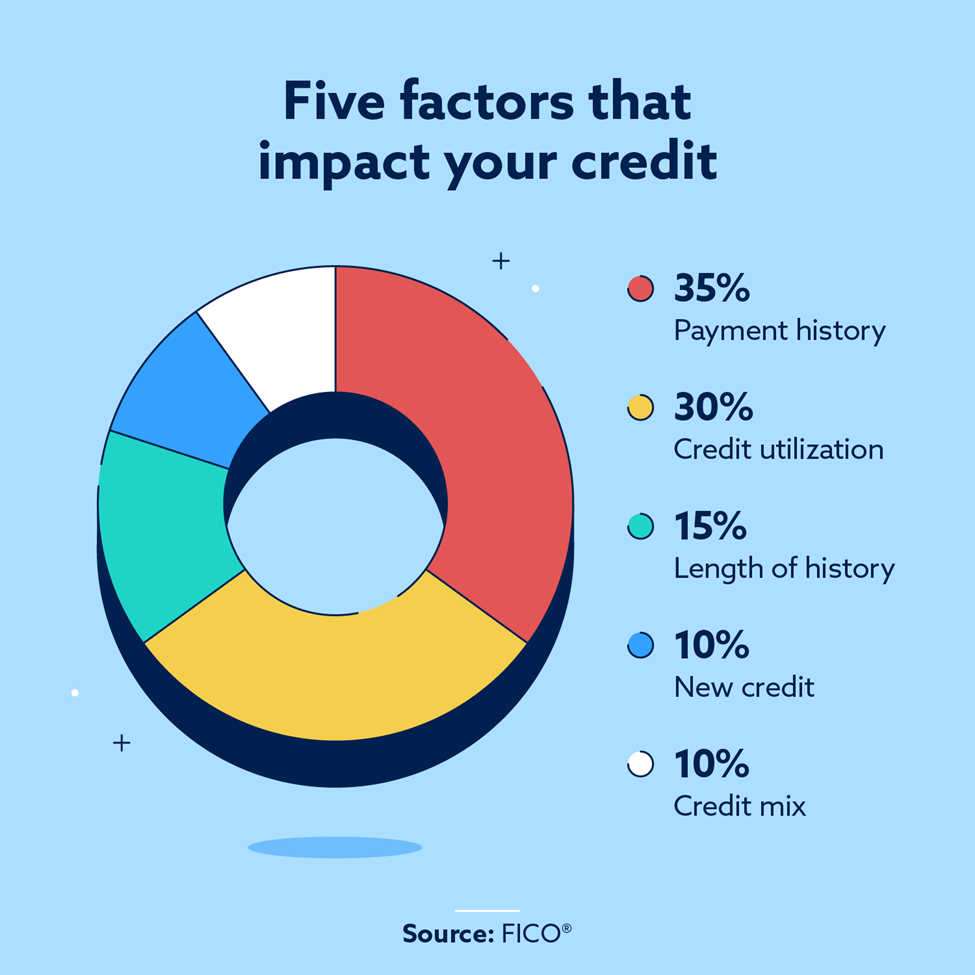

The top thing to know to understand credit score drops is how credit scores are calculated. Payment history plays a big role in determining your credit score, meaning that a missed or late payment could hurt your score.

Other key factors include how much of a balance you have on your credit cards and how long you’ve had open lines of credit.

It’s important to identify the cause behind a recent drop so you can work on improving your score. Our guide will break down 12 different reasons why your credit score might drop and ways to address each issue.

Table of contents

- You have missing or late payments

- You applied for a mortgage, loan or new credit card

- Your credit utilization has increased

- Your credit limit was lowered

- You closed a credit card

- You paid off a loan

- You applied for a lot of credit

- Your credit report has inaccurate information

- You’re a victim of identity fraud

- You cosigned a loan or credit application

- You experienced a bankruptcy or foreclosure

- Your unpaid account was sent to collections

1. You have missing or late payments

As we mentioned, payment history is the biggest factor affecting your credit score—in fact, it accounts for 35 percent of your FICO® score. Creditors typically report a late payment once you are 30 days past due. Your score will likely decrease after your payments become 60 or 90 days past due. Late payments can typically stay on your reports for up to seven years.

Solution

If you miss a payment, pay it in full as soon as you can—ideally before it’s 30 days past due. The sooner you send the payment to your creditor, the better. Additionally, you may be able to discuss options like pay for delete with your creditor.

2. You applied for a mortgage, loan or new credit card

When you apply for new credit, you authorize the lender to check your credit score and history. This is known as a hard inquiry and typically affects your credit score. Applying for too many cards in a short period of time can make it appear to lenders as if you are desperate for credit.

Solution

As long as you don’t continue to apply for new credit, the effect on your score should only really last for a year. Focus on cards you have a good chance of getting approved for so that you avoid unnecessary inquiries.

3. Your credit utilization has increased

Your utilization is the balance-to-limit ratio on your credit cards and other areas where credit was extended to you on revolving credit accounts. The second-most significant detail on your credit report, credit utilization is responsible for 30 percent of your FICO credit score. As a general best practice, try to keep your credit card balances under 30 percent of your credit limit. For example, $500 balance / $2,000 limit = 25 percent utilization.

Making a large purchase or not paying your balance in full every month can increase your credit utilization ratio. Keeping your credit utilization low by paying off your balances can help your credit.

Solution

You can lower your credit card utilization by paying off some credit card debt, requesting a credit limit increase on one of your cards or opening a new credit card.

4. Your credit limit was lowered

If your credit limit is lowered, but your balance remains the same, it raises your credit utilization. This can then lower your credit score.

Solution

If your credit limit is lowered, you’ll want to decrease your credit card spending, pay off credit card balances or consider opening a new credit card to get your utilization back under 30 percent.

5. You closed a credit card

Closing a credit card can affect your credit in two ways. First, it can lower your overall credit limit and increase your utilization ratio. If the card is your oldest credit card account, it severely lowers the average age of your credit card accounts as well. The length of your credit history accounts for 15 percent of your FICO credit score.

Solution

Unless the card has a high annual fee, you might want to keep the account open to maintain your credit limit and length of credit history.

6. You paid off a loan

Paying off a loan gives you more financial freedom, but it can affect your credit. Lenders look for diverse types of credit, and paying off a loan leaves you with one less credit account. An appropriate number of open accounts can show that you have a healthy credit mix, which accounts for 10 percent of your FICO credit score.

Solution

As long as you keep your other accounts active, make payments on time and keep your credit utilization ratio low, your credit score should recover from any temporary dips after paying off a loan.

7. You applied for a lot of credit

Applying for one new line of credit every so often will only shave a few points off of your credit score. However, because each credit application may lower your score by a few points, it can compound into a double-digit score drop if you attempt to open multiple lines of credit all at once.

In addition to lowering your credit score, applying for multiple cards at the same time can also signal to a potential lender that you are a higher credit risk, which could come with higher interest rates and lower credit limits.

Solution

If you do need to open a new line of credit, be savvy about your approach. Wait at least 90 days between new credit card applications (or ideally a full six months) to avoid a more significant negative impact to your credit score.

Or, if you’re shopping around for a specific type of loan, like an auto loan, submit all of your applications within a short period of time so they’re grouped together and only appear as one inquiry on your credit report.

8. Your credit report has inaccurate information

If, for example, a payment is falsely reported late, or an account is wrongfully reported as closed, the mistake could cause your credit score to drop.

Solution

Regularly reviewing your credit reports is one of the best ways to ensure your credit reports are accurate. If you do find an error, you should dispute the information with all three credit bureaus, assuming the error is on all three credit reports.

9. You’re a victim of identity fraud

A credit score drop could be a sign of identity theft. If you spot problems, such as addresses where you’ve never lived or unfamiliar accounts, on your credit report, you should take immediate action.

Solution

The FTC runs identitytheft.gov, which can help you create a personal recovery plan. You may also want to lock or freeze your credit with the three credit reporting bureaus, or set up a fraud alert.

10. You cosigned a loan or credit application

You’re legally responsible for any loan or credit card you cosign for, so it can affect your credit if you’re a cosigner for a friend or relative and they miss a payment on their account.

Solution

Keep an eye on the cosigned account by having statements sent to your home or monitoring them online. It’s a good idea to set aside money in case you need to cover any missed payments.

11. You experienced a bankruptcy or foreclosure

These items also leave long-lasting marks on your credit report. A foreclosure mark on your credit report can stay there for up to seven years, but the bankruptcy item will depend on what type of bankruptcy you filed. For example, Chapter 7 bankruptcy can stay on your report for 10 years from the date filed, while Chapter 13 can stay on your report for up to seven years.

Solution

There’s no quick fix for repairing a credit score damaged by bankruptcy or foreclosure. However, responsible credit use can help you improve your score over time.

12. Your unpaid account was sent to collections

A collection account indicates a severe delinquency, which will hurt your credit. Like most items, a collection account will affect your credit less the older it gets, but it can typically remain on your credit report for up to seven years.

Solution

Try asking for a goodwill deletion on accounts you’ve already paid. Sending a goodwill letter to the collector may convince them to remove the collection from your credit report.

Why did my credit score drop for no reason?

Even if it isn’t immediately clear, there’s likely a clear reason why your score dropped. By running through the reasons we listed above, you can likely pinpoint why your score dropped.

If you’re still unsure, you can review your credit report from the three major credit bureaus to see exactly why your score has recently changed.

One of the most common causes of a large credit score drop is a late or missing payment. Additional factors such as a large purchase that used up 30 percent or more of your available credit could cause a large score decrease.

How to improve your credit

Once you’ve determined the cause of a recent score drop, here are a few approaches to take to help you rebuild your credit:

- Pay down credit card balances: Credit utilization is a leading cause of score drops. If paying off your card balances seems out of reach for you, you could request a credit limit increase or refinance credit card debt with personal loans, which don’t contribute to debt utilization in the same way.

- Avoid late payments: Typically, late payments don’t show up on your credit report unless you’re more than 30 days late in paying. So if you have recently missed a payment, prioritize paying it as soon as you can to prevent any credit score impacts. As a proactive measure, you can set up automatic withdrawals to pay your credit card balance each month.

- Avoid applying for new credit: Until your score bounces back, avoid applying for a new line of credit, and certainly avoid applying for multiple lines of credit in a short time frame. This can lead to double-digit credit score decreases.

- Practice good money habits: If your score has recently dropped, it’s a good idea to set up a budget to help you avoid adding to your debt balance, reduce your credit utilization rate and ultimately build your credit back up.

What to do about a score drop

Your credit score is based on the information in your credit reports, so it’s important to regularly monitor your credit reports for changes. Watch for mistakes from the credit bureaus or your creditors, since they could unfairly lower your credit score.

If you notice inaccurate or unfair negative items listed on your credit reports, Lexington Law’s credit repair services can help you work to address these items and ensure your credit history is fairly reported.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.