The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you’re considering taking out a loan or credit card, you’ve probably checked your credit score to weigh your odds of getting approved. But what if it’s different depending on which scoring model you check?

Since you have multiple types of credit scores, the number can vary based on the scoring model. Continue reading to learn more about the different credit scores, including FICO® and VantageScore®.

Table of contents:

- What is a credit score?

- What are the different credit scoring models?

- How are credit scores calculated?

- Why are my credit scores different?

- How to check your credit score

What is a credit score?

A credit score is a three-digit number that predicts your credit risk based on data from your credit report. Lenders use credit scores to determine who to approve for loans and at what interest rates. Credit scores typically range from 300 to 800 points. A high credit score indicates that you’re more likely to pay back your loans, while a lower credit score signals that you may be a risky borrower.

What are the different credit scoring models?

FICO and VantageScore are the two most popular scoring models used in the United States. Both models calculate your score based on a set of factors that assess an individual’s credit risk. However, the two models use different algorithms and assign different weights to each factor.

Let’s look at the different types of credit scores and how they stack up.

FICO scoring model

The FICO score was the first consumer credit score developed by the Fair Isaac Corporation (FICO) in 1989. According to myFICO, 90 percent of top lenders use FICO scores to determine loan approvals, interest rates and credit limits.

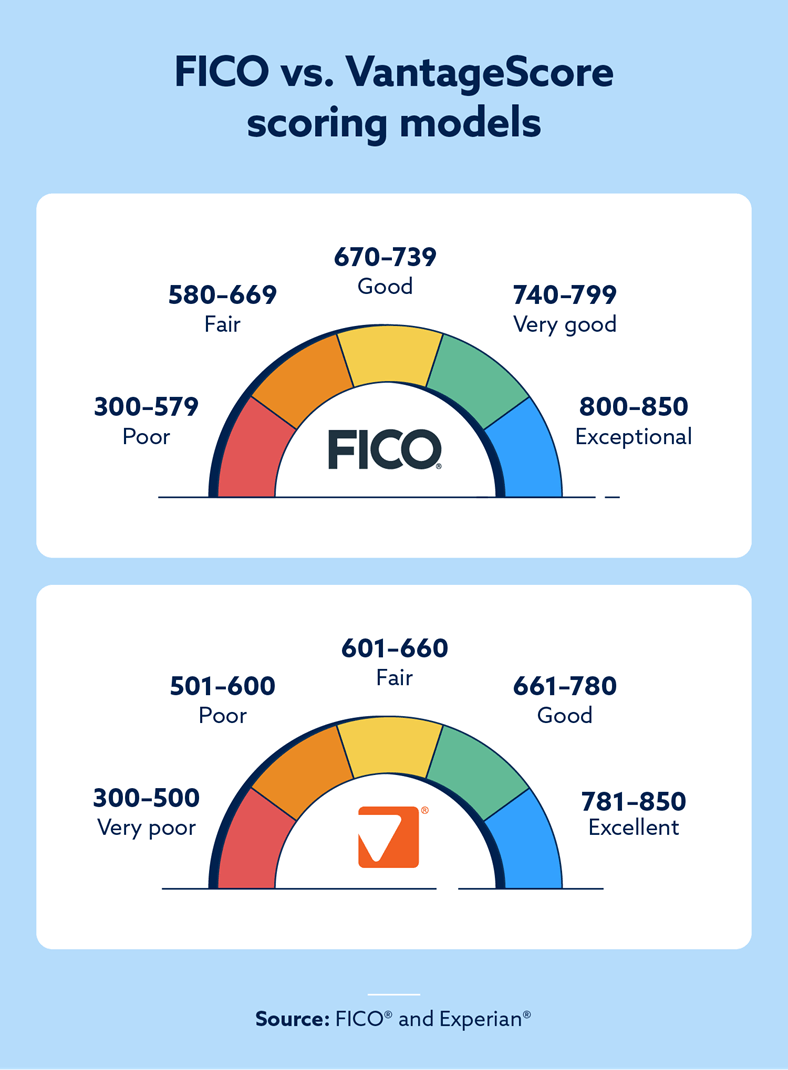

A good FICO score will help you secure better loan terms and rates. The latest FICO model categorizes your score based on these ranges:

- 800+: Exceptional

- 740 – 799: Very good

- 670 – 739: Good

- 580 – 669: Fair

- <580: Poor

VantageScore model

The VantageScore model was developed in 2006 by the three credit bureaus—Experian®, TransUnion® and Equifax®—as an alternative scoring model.

Like the FICO scoring model, VantageScore ranges from 300 to 850. According to Experian, here’s how the newest VantageScore model groups scores:

- 781+: Excellent

- 661 – 780: Good

- 601 – 660: Fair

- 500 – 600: Poor

- <500: Very poor

Other credit scoring models

While FICO and VantageScore are the most widely used, they aren’t the only scoring models out there. Here are some lesser-known credit scoring models you may encounter:

- TruVision Credit Risk: Developed by TransUnion, TruVision aims to broaden credit opportunities with insights beyond traditional credit information. The model combines “traditional, trended, blended and alternative data.”

- OneScore: Unveiled in 2023 by Equifax, OneScore is a new scoring model aimed to paint a more comprehensive picture of loan applicants. According to a recent press release, OneScore is a “robust, multi-data score that leverages traditional credit history and differentiated alternative data.”

- CE Credit Score: Created by CE Analytics, CE is an independent credit scoring model that uses advanced analytics and behavioral trends.

How are credit scores calculated?

Your credit scores are calculated based on a set of factors from your credit report. However, each scoring model assigns a certain weight to each factor to calculate your score.

Let’s look at how the FICO and VantageScore models calculate credit scores.

How is your FICO score calculated?

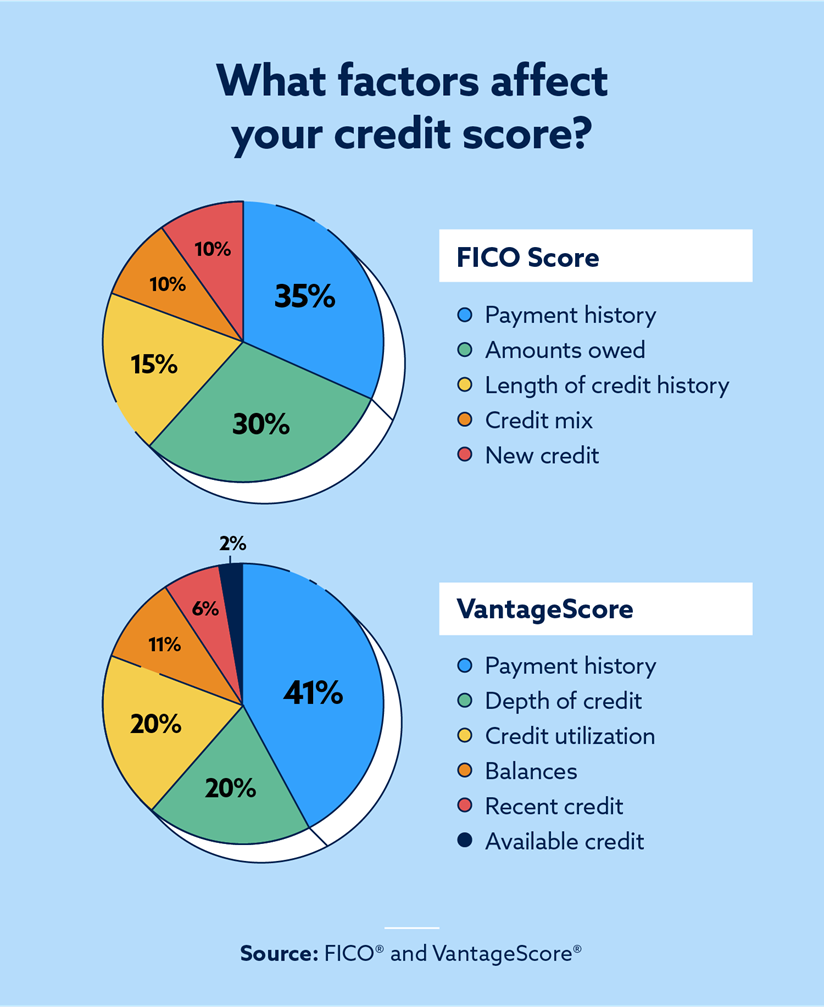

With the latest FICO scoring model, your history of paying past accounts on time is the most important factor when determining your credit score. Other factors include how much of your available credit you’re using, how long you’ve had your accounts, the different types of loans you have and how many new accounts you have.

Here’s exactly how FICO calculates your score:

- Payment history: 35 percent

- Amounts owed: 30 percent

- Length of credit history: 15 percent

- Credit mix: 10 percent

- New credit: 10 percent

How is your VantageScore calculated?

Like the FICO model, payment history is the most significant factor when calculating your VantageScore. Additional factors include the age of your accounts, how much credit you use, total balances on your accounts, new accounts you’ve opened and how much credit you have available.

Here’s a look at the factors that determine your VantageScore:

- Payment history: 41 percent

- Depth of credit: 20 percent

- Credit utilization: 20 percent

- Balances: 6 percent

- Recent credit: 11 percent

- Available credit: 2 percent

Why are my credit scores different?

It’s normal for your credit scores to be different. Here are a few of the main reasons credit scores vary:

- Your score is calculated using different scoring models: Your credit scores may vary because there are multiple different types of credit scoring models. Since scoring models weigh certain factors differently, your score may vary slightly depending on which credit score you check.

- There are different versions of credit scoring models: Each scoring model has multiple versions that periodically update. For example, FICO 8 and FICO 9 have key differences, such as the impact of third-party collections and rent payments.

- Not all lenders report to all three credit bureaus: Another reason your credit score may vary is because some lenders don’t report to all three credit bureaus. As a result, one of the credit bureaus could be missing information that either increases or decreases your score.

- Credit scores update frequently: When you check your credit score can play a role in what number you see. Credit scores generally update at least once a month and sometimes even multiple times per month. So even if you’re using the same scoring mode, it’s normal for your credit score to fluctuate over time.

How to check your credit score

Accessing your credit score doesn’t have to be a hassle. Here are the easiest ways to check your credit score for free:

- Credit bureaus: You can check your credit score via any of the three major credit bureaus—Experian, TransUnion and Equifax.

- Your bank or credit card issuer: Most banks and credit card issuers provide customers with complimentary access to their credit score.

- Third-party platform: Some third-party platforms provide free credit scores. For example, Lexington Law Firm provides a free credit snapshot, which includes your credit score and credit report summary.

Regularly checking your credit score and credit report can help notify you of inaccurate information that may be hurting your credit. If you notice errors on your credit report, it’s important to investigate and address them with the credit bureaus.

Learn how Lexington Law Firm’s services could help you effectively manage and monitor your credit today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.