If you stop paying your credit card, you can expect late fees, increased interest rates, and a significantly decreased credit score.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you stop paying your credit card, you can expect late fees, increased interest rates and a damaged credit score. If unexpected circumstances—such as unemployment or medical bills—leave you with more debt than you can afford to pay, it may be difficult to stay on top of credit card bills.

The consequences may seem small at first, but as more time passes, the effects of not paying your credit card become more serious. Our guide will cover the most common drawbacks for negligent card payments and share some of Lexington Law Firm’s debt relief suggestions.

Key takeaways:

- Most credit cards offer a grace period before payments are considered late.

- Payment history makes up 35 percent of your FICO® credit score.

- Closing your oldest credit cards can hurt your credit.

Table of contents:

- Late fees and interest begin to accrue

- Collections efforts from creditors increase

- Credit score drops

- Account may go to collections

- When do the creditors report a payment missed or late?

- What happens to credit card debt if I move out of the country?

- Can I go to jail for not paying my credit cards?

- Manage your credit with Lexington Law Firm

Late fees and interest begin to accrue

Late fees are capped at 25 percent of your credit limit for the first year after you’ve opened an account. This is part of your rights outlined in the Credit Card Accountability Responsibility and Disclosure Act of 2009 (also known as the Credit CARD Act).

The fee is added to your credit card balance and becomes subject to interest charges based on your APR, or annual percentage rate.

After two missed payments (60 days), your interest will typically increase to the higher penalty APR outlined in your card’s terms and conditions agreement. The card issuer may not lower the interest rate for six months.

Late fees and finance charges will continue to increase your monthly payment, making it more difficult to catch up.

Collections efforts from creditors increase

Your creditors will begin to contact you to collect the payment you owe them. They will continue to contact you regularly and with increasing frequency until the missing payment is fulfilled.

Under the Fair Debt Collection Practices Act, debt collectors must abide by debt collection laws about communication with consumers. For instance, they are not allowed to call at unusual hours. Consumers have the right to request the debt collector to stop contacting them. However, these laws only apply to debt collectors and not your original creditors.

Credit score drops

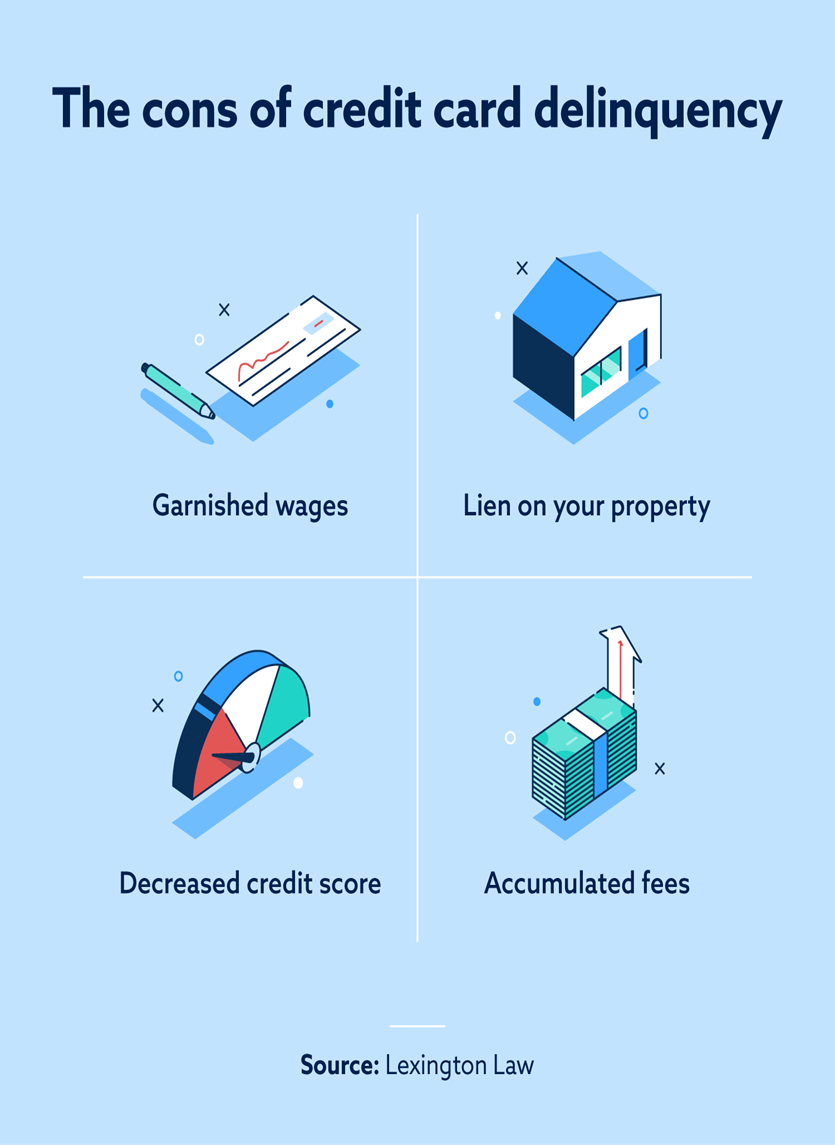

If you miss a payment by 30 days, the creditor will report it to the three credit bureaus: Equifax®, Experian® and TransUnion®. Since payment history determines 35 percent of your FICO credit score, this means your credit score will likely drop. If the account goes to collections, it will be considered a serious delinquency.

A low credit score will make it difficult to obtain a credit card, loan, or even a job in the future. It will also decrease your ability to get approved for a lease or mortgage.

Account may go to collections

Once you’ve reached 180 days late, the creditor will typically charge off the debt and sell it to a collection agency. The term “charged off” doesn’t mean the debt will go away—not only are you still responsible for the amount owed, but additional fees and interest may be added to your balance.

Charge-offs can remain on your credit report for seven years. However, the original creditor or debt collector can sue you for the debt up until the statute of limitations expires.

When do the creditors report a payment missed or late?

FICO credit scores consider the details of a missed payment, such as how late it was. Creditors typically report late payments in set intervals:

- Late by 30 to 59 days

- Late by 60 to 89 days

- Late by 90 to 119 days

- Late by 120 to 149 days

- Late by 150 to 179 days

- Late by 180 or more days

What happens to credit card debt if I move out of the country?

Your creditors may still send you to collections or file a lawsuit against you if you have debt after moving abroad. Creditors can go after any assets you leave behind in a checking, savings, or investment account. If you continue working for an employer based in the U.S., your wages could be garnished.

If you move abroad, you will continue to accrue penalties and significant damage to your credit, which could be problematic if you ever decide to return to the United States.

Can I go to jail for not paying my credit cards?

There is no debtors’ prison in the United States, but if a creditor sues you in a court of law and wins a judgment, they may be able to garnish your wages or file a lien on your property.

Manage your credit with Lexington Law Firm

One of the most important factors determining your credit is whether or not your payments have been made on time. Late or missed credit card payments can lower your score, preventing you from obtaining loans or credit cards with better terms and lower interest rates. If you notice an inaccurate late payment or another error on your credit report, our services can potentially help you address inaccurate negative items and work to improve your credit.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.