If a person has debt when they pass on, either their estate or a probate court may use their assets to pay off the balance.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

“What happens to credit card debt when you die?” is a more nuanced question than you might expect. If a person passes away before they can repay their credit card debt, creditors can receive the payments they’re owed in several ways. Creditors may contact the deceased’s estate and request that assets be used to pay off outstanding balances. If a deceased individual doesn’t have an estate, a probate court can step in to resolve things.

Below, we’ll break down some of the facts and myths surrounding this question, discuss what creditors can and can’t do to retrieve missing funds and explain how Lexington Law Firm can help answer your debt settlement questions.

Key takeaways:

- Assets, including cash, stocks, bonds and real estate, can be used to pay off outstanding debts.

- You aren’t responsible for a deceased spouse’s debts unless you are a cosigner on their account.

- Laws exist to protect the loved ones of the deceased from creditors and collection agencies.

Table of contents:

- 5 reasons why you might be responsible for someone else’s debt

- What happens to your debt when you die with no estate?

- Is there a statute of limitations for debt?

- Can creditors go after beneficiaries?

- What assets are protected from creditors?

- Get debt relief assistance with Lexington Law Firm

5 reasons why you might be responsible for someone else’s debt

“Can you inherit debt?” is a common question that someone might ask if a parent or loved one recently passed on. In most instances, your parent’s credit card debt can’t be transferred to you even if that debt is outstanding. However, five specific scenarios can act as exceptions:

- 1. You’re a cosigner: If you and the deceased were cosigners on an account with an outstanding balance, you may be responsible for the debt.

- 2. You have a joint account: The same rules apply if you have joint credit cards with the deceased individual.

- 3. You live on community property: Certain states will require you to handle a deceased individual’s community property-related debts if you live on that property.

- 4. State law demands it: State law can require beneficiaries to pay certain debts, like healthcare bills that were covered with credit cards.

- 5. You’re the executor or administrator of their estate: State law requires executors to pay off debts using the deceased assets that are not protected from creditors.

What happens to your debt when you die with no estate?

If an individual who doesn’t have an estate passes away with outstanding debt, the creditor will likely write off the debt as a loss. More specifically, the creditor will declare that the debt is uncollectible and file for a write-off with the appropriate legal authorities.

Is there a statute of limitations for debt?

A statute of limitations refers to the maximum amount of time where legal action can be taken against an individual. If court proceedings aren’t initiated within that time frame, it is impossible to try and initiate them afterward.

When considering the statute of limitations on debt collection by state, the rules varies nationwide and you should review the law in your state. In some states, the statute of limitations for oral agreements is two years, while the open accounts, promissory notes and written contracts have a limitation period of four years. In other states, the written contract for open accounts can be up to 6 years. This means the law prevents debtors from taking legal action against you after these time frames.

Can creditors go after beneficiaries?

In most instances, creditors are not legally permitted to seek payments from your beneficiaries. The Federal Trade Commission (FTC) established the Fair Debt Collection Practices Act (FDCPA) in 1977 to help protect people from aggressive collection tactics.

As mentioned previously, creditors have the right to request payments from beneficiaries under very specific circumstances. Furthermore, creditors aren’t legally permitted to harass you or your beneficiaries, nor can they threaten to have the authorities arrest you. If calls and letters become too frequent, you also have the right to cease communication with a collection agency under the FDCPA.

What assets are protected from creditors?

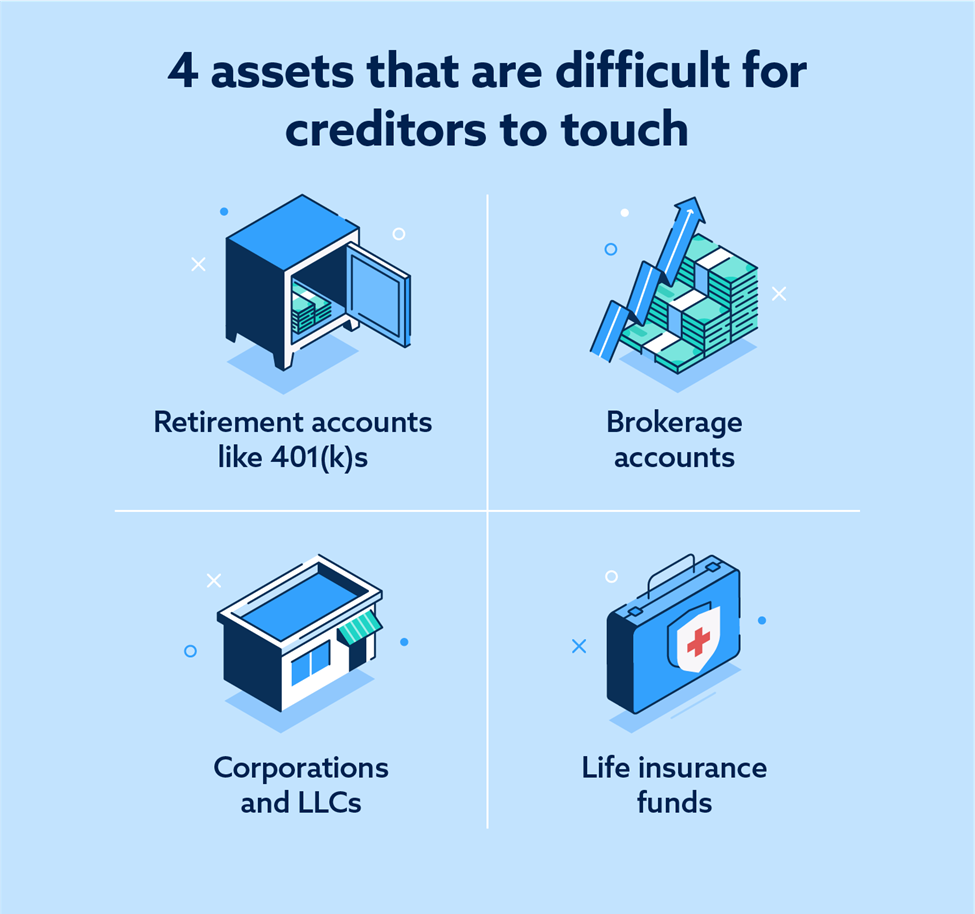

Creditors can attempt to seize the deceased’s assets if money is owed, but certain assets are protected by laws based on the area where the deceased previously resided. Some assets that are protected from creditors include:

- Retirement accounts: Assets held in 401(k), IRA and Roth IRA accounts have certain protections from creditors.

- Life insurance proceeds: The cash value and death benefits of a life insurance policy are partially or wholly exempt from the deceased’s creditors in most jurisdictions.

- Brokerage accounts: The investment assets of the deceased are protected from creditors under certain circumstances

- Corporations & LLCs: The personal assets of members and shareholders of LLCs and corporations are generally exempt from collection agencies, except for under some circumstances

- Home exemptions: Via a homestead exemption, a set amount of the deceased’s equity is protected from creditors.

Get debt relief assistance with Lexington Law Firm

Debt can be challenging to tackle without an effective strategy. Lexington Law Firm can help you find debt relief tailored to your unique situation and share resources to bolster your financial knowledge.

Learn more about our services, including creditor interventions and a junk mail reducer—both useful tools when collection agencies contact you too frequently.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.