How much a secured credit card can raise your credit score depends on the factors currently affecting your credit, like payment history and credit utilization. Responsible use of a secured card can result in a significant positive impact on your credit over time.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

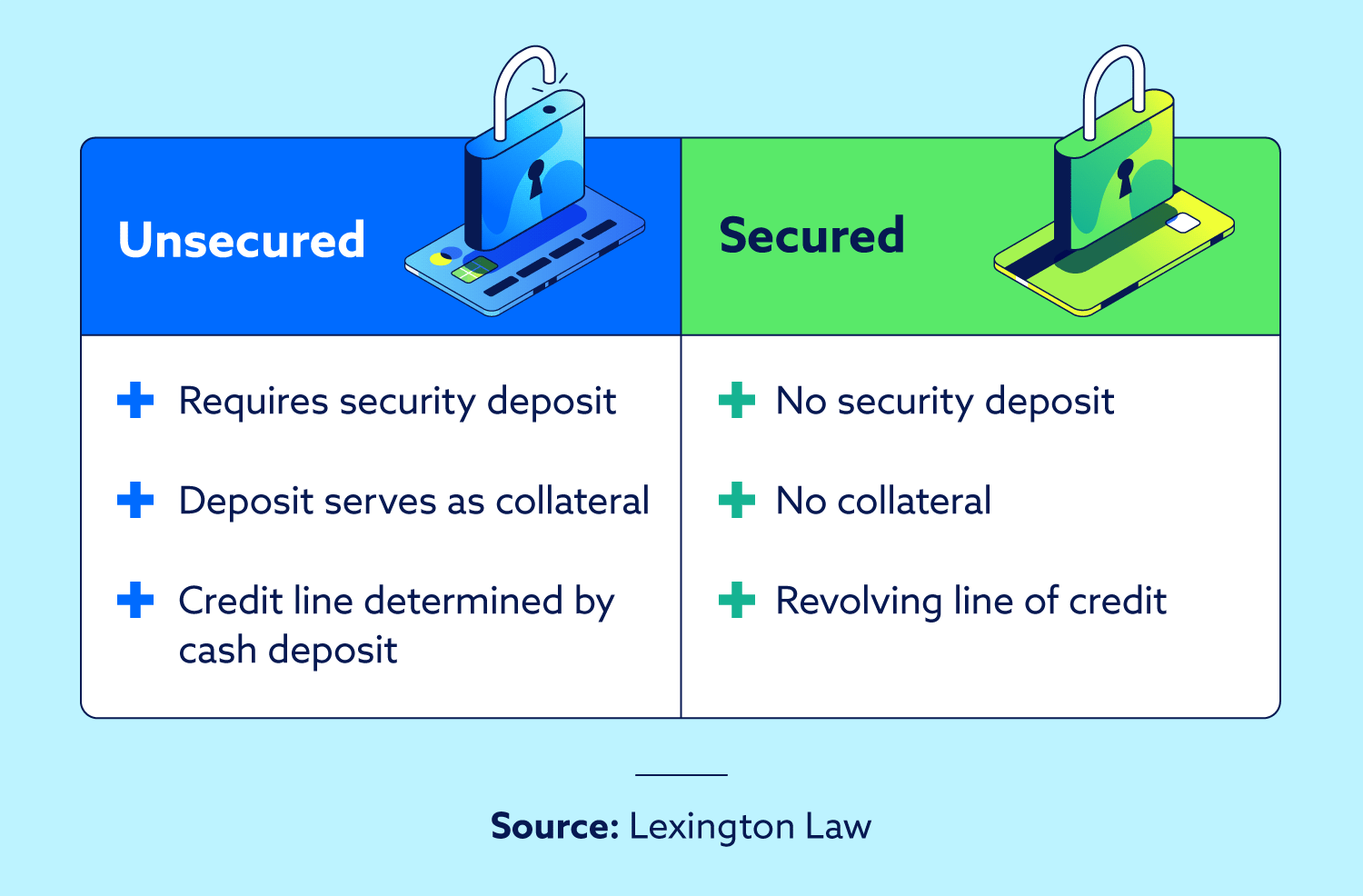

A secured credit card is a type of credit card that requires a cash deposit instead of a minimum credit score. As a result, it’s easier for those with no credit or bad credit to qualify for this type of credit card.

If you’re trying to build or rebuild your credit, you may wonder how much a secured credit card will raise your score. Depending on your unique credit situation, the answer could be a few points or 100+ points.

To better understand how secured credit cards work, we’ll look at the pros and cons of secured credit cards, how they affect your credit, and other options for building credit.

Table of Contents:

- How secured credit cards work

- How much will a secured credit card raise my score?

- How to use a secured credit card to build your score

- How to choose a secured credit card?

- Other ways you could build credit

- Secured credit cards can be a helpful tool

- How much will a secured credit card raise my score FAQ

How secured credit cards work

A secured credit card works just like other types of credit cards, except you must provide a deposit when you open the account. This deposit will then establish your credit limit. For instance, if you put up a $500 deposit, your initial credit limit will likely be $500.

You’ll accrue a balance as you make purchases with a secured credit card. When your statement is issued, you must pay the balance in full to avoid interest charges. You cannot use your deposit to pay the balance.

Each month, the credit card company will report your usage to the credit bureaus. Information like the card’s credit limit, balance and payment history will all appear on your credit reports. By managing a secured credit card responsibly, you can begin building credit.

How much will a secured credit card raise my score?

It is nearly impossible to accurately predict how much a secured credit card will raise your credit score. This is because there are a lot of factors that determine your credit score.

For those with no credit score, a secured credit card can help you get a credit score in as little as 3 to 6 months.

On the other hand, if you have poor credit, it will likely take much longer to see score improvement from a secured credit card, especially if you have late payments, charge-offs and collections on your credit reports.

By keeping the credit utilization on your secured credit card low and paying your statement on time, you can begin seeing progress over time.

How to use a secured credit card to build your score

When using a secured credit card to build credit, managing the card responsibly is key. Here are some tips to help you get the most out of your secured card:

- Choose the best card: A secured card that lets you upgrade to an unsecured card and increase your credit limit will benefit long-term credit building.

- Pay your statement each month: Payment history makes up the biggest portion of your credit score, so avoiding late payments is best for score improvement.

- Keep utilization low: Try not to max out your secured card. You should aim for a credit utilization ratio of 30% or less. So, if you have a credit limit of $500 on your card, keep your balance to $150 or less.

- Be patient: Account age is another important factor of your credit score, and waiting is the only way to improve it. The longer you have the card open, the better.

- Watch your other credit accounts: Your other credit accounts have just as much impact on your score as your secured credit card. To help with the credit-building process, you’ll need to manage all credit accounts well.

In addition to building credit, you can rebuild credit with a secured credit card as well. It may take longer when you are starting with poor credit, but a secured credit card can be a useful rebuilding tool.

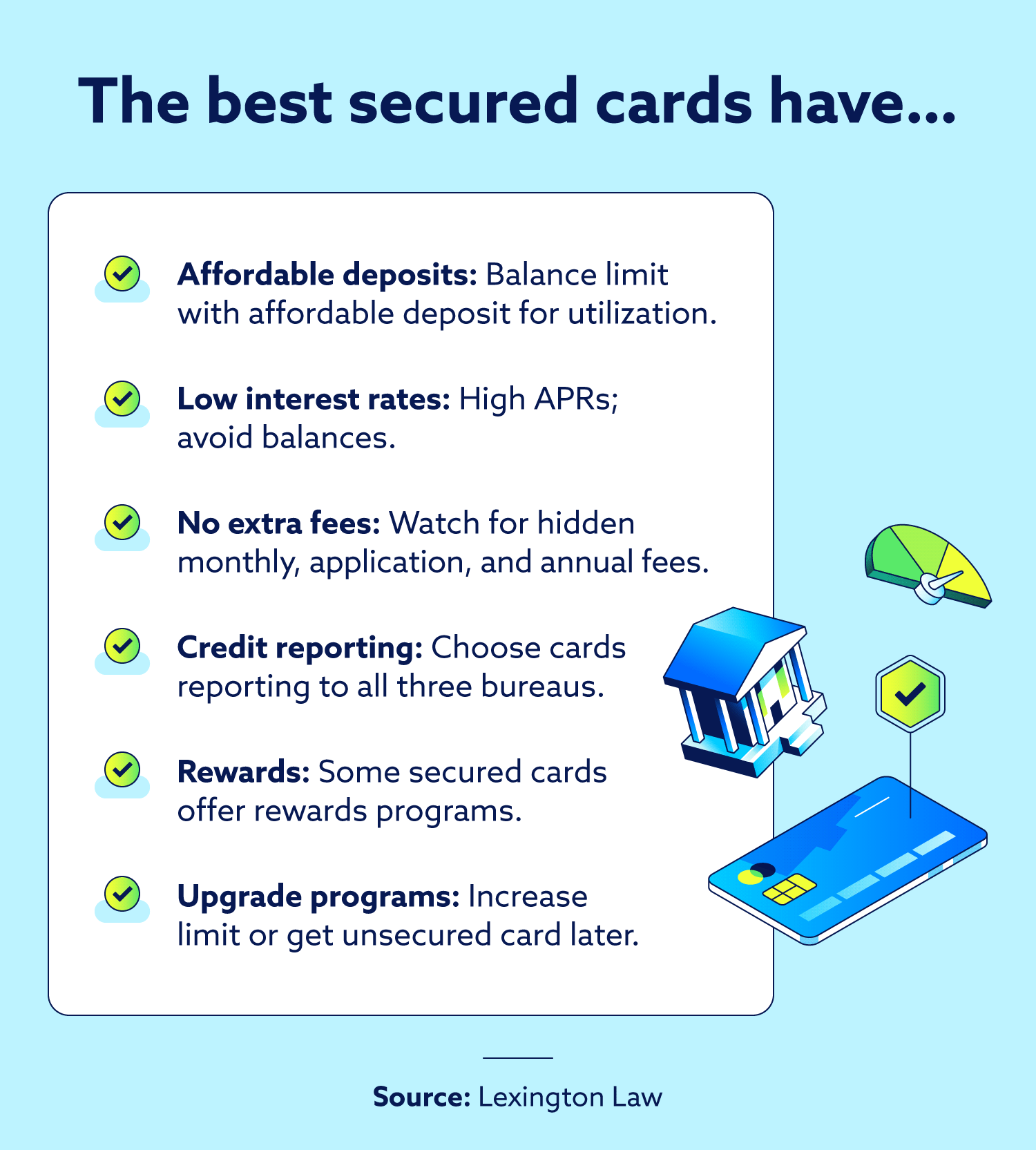

How to choose a secured credit card

Opening a secured credit card can be a great way to build credit, but there are a few potential downsides to consider. Here are some things to consider when choosing a new secured credit card.

- Credit limit: This impacts your utilization, so you’ll want to balance a reasonable credit limit with a cash deposit that you can afford.

- Interest rates: The APRs offered on secured cards are often higher than those on unsecured cards. If the rate is high, avoiding carrying a balance on the card is best.

- Extra fees: Many of the secured cards marketed to those with bad credit come with unnecessary hidden fees. Watch out for monthly maintenance fees, application fees, and high annual fees.

- Credit reporting: For the best credit benefit, you’ll want to find a card that reports to all three major credit bureaus: Experian®, Equifax® and TransUnion®.

- Rewards: While not many secured cards offer a rewards program, a few do, and this might be the benefit that wins out over another card.

- Upgrade programs: Some secured credit card issuers allow you to increase your credit limit with no additional cash deposit after a set number of months or upgrade to an unsecured version of the card.

Choosing the card that best suits your needs, both now and in the future, is crucial.

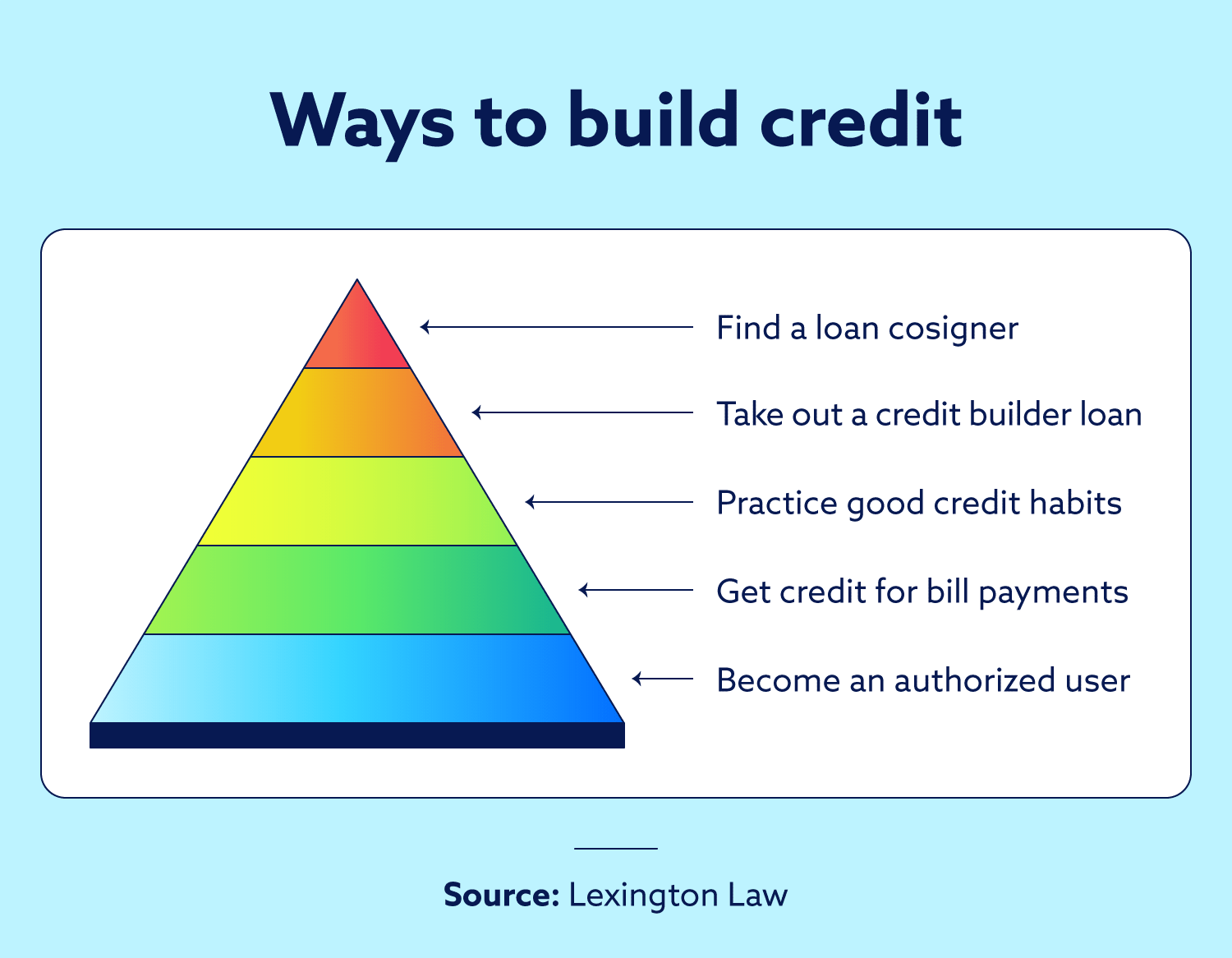

Other ways you could build credit

A secured credit card is just one option for building credit. Other solutions include:

- Getting added as an authorized user

- Taking out a credit builder loan

- Getting credit for the bills you already pay

- Finding someone to cosign a loan

- Practicing good habits with your existing credit accounts

Your unique credit situation will determine which credit-building actions will be best for you. In addition to actively improving your credit, you should also avoid actions that can damage your credit, such as closing accounts, applying for a bunch of new credit, or maxing out your credit cards.

Secured credit cards can be a helpful credit-building tool

Now that we’ve explored what a secured credit card is and how you can use it to build credit, you should have an idea of whether you should get one.

A secured credit card can be a useful tool in building your credit, but there is more that you can do.

With help from Lexington Law Firm, you can learn more about the factors affecting your credit and uncover any credit reporting errors that you need to address. Gain personalized insight into your credit situation today with your free credit assessment.

How much will a secured credit card raise my score FAQ

How fast will a secured credit card build credit?

Someone starting with no credit may be able to get a score within 3 to 6 months of opening a secured credit card. Likewise, someone with a thin file (very little credit) may see score improvement even quicker.

An individual with poor credit may need to wait longer to see significant score improvement, depending on their particular credit profile.

How can I raise my credit score 100 points in 30 days?

While no magic wand will instantly fix your credit, there are several strategies you can use to improve your credit score fast. Becoming an authorized user and adding rent or utility payments to your credit reports can quickly improve your payment history. You can pay down your balances and request credit limit increases to improve utilization.

You can also dispute the errors on your credit reports. Negative items like late payments significantly impact your score, and removing the errors can improve your score substantially.

Should I get another secured credit card to raise my credit score?

It is often better to focus on the secured credit card you already have. Adding another secured credit card may improve your utilization. It can add to your payment history but will also damage your credit, affecting new credit and the length of credit history.

If you want to avoid unsecured credit cards completely, having more than one secured credit card might be a worthwhile option.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.