The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Understanding how to get a loan can feel like navigating a labyrinth, but it may be easier than you think. In fact, with total household debt in the U.S. reaching $18 trillion in 2024, borrowing is a widespread and accessible practice. Loans serve various crucial purposes, from funding significant purchases—such as a car or a home—to covering unexpected expenses.

While it may be easy to obtain a loan, securing an affordable one can be another matter entirely.

In this guide, we’ll cover all the details on how to get a loan, from preparing your application to understanding the differences between personal loans, car loans and bank loans.

You’ll learn:

- Strategies to prepare finances before applying for a loan

- How to research lenders and gather documentation

- The different loan types and qualification factors

Preparing for your loan application

If you’re thinking about applying for a loan, go through these steps before beginning your application:

- Determine the amount: Be precise about the exact amount of funds you need to achieve your goals—don’t borrow more than you need.

- Evaluate income: Evaluate your monthly cash flow to determine a reasonable loan repayment amount. For example, if your monthly income is $5,000, a comfortable loan payment might be close to $500. (Keeping loan payments to around 10 percent or less of your gross monthly income is generally considered a good rule of thumb.)

- Calculate your debt-to-income (DTI): Understand your DTI ratio (total monthly debt payments divided by gross monthly income) as lenders will use it to gauge your ability to handle more debt.

- Get familiar with your credit report: Understand where your credit score stands, and make sure everything on your credit report is accurate.

- Improve your credit score: If you need to improve your score before seeking a loan, follow good credit practices likepaying all bills on time and reducing overall balances.

- Understand the types of loans: Learn about the types of loans and choose the right one. Avoid using loans for the wrong things, like using a personal loan to buy a car.

How to apply for a loan

Once you’ve prepared your finances, it’s time to embark on the loan application process.

Step 1: Research lenders

When you’re checking out different ways to get a loan, you’ll see online lenders and your regular banks. Online lenders can be quicker and easier to work with—but sticking with your current bank might result in a lower interest rate.

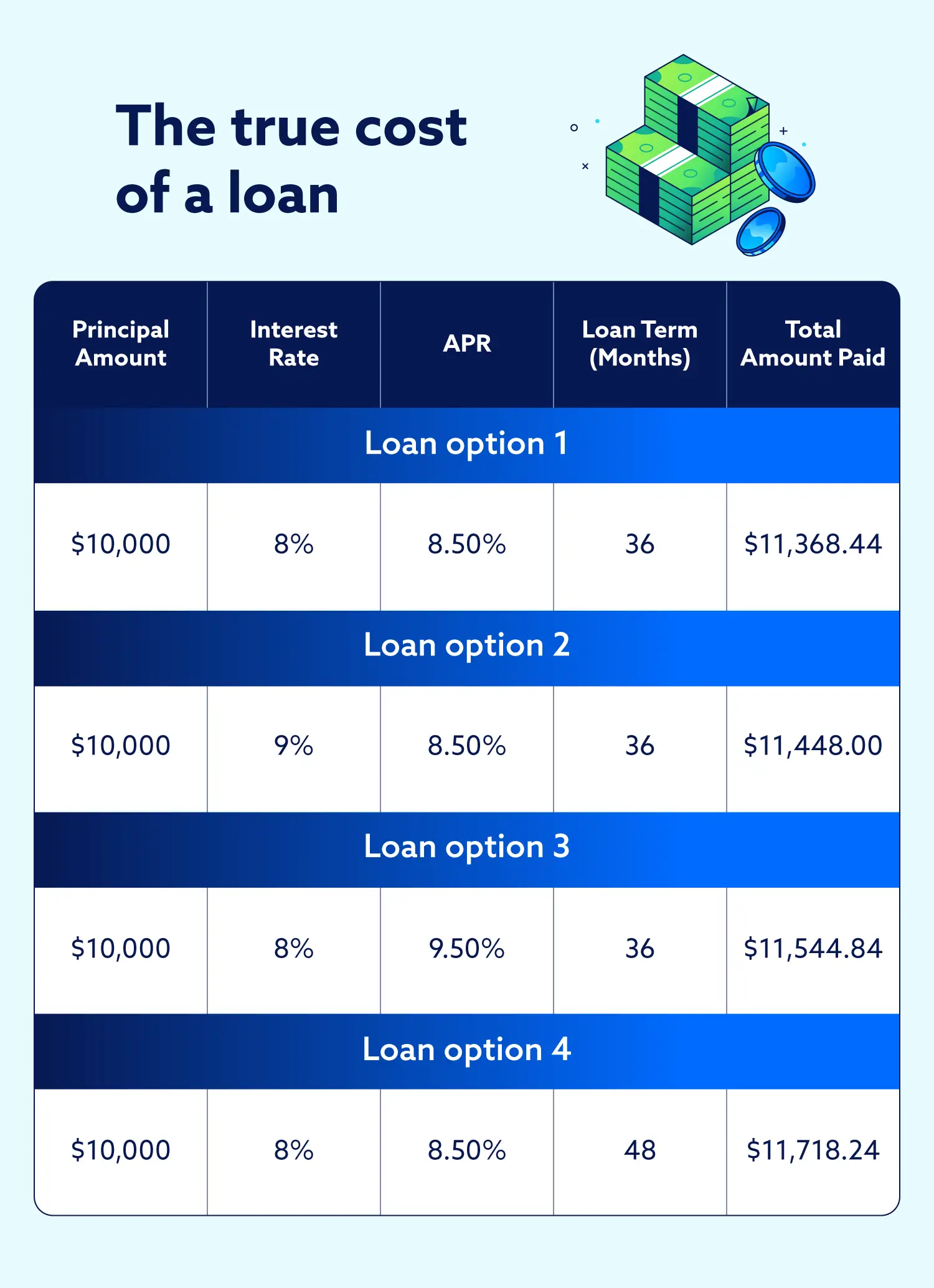

No matter which type of loan or lender you’re looking at, when you’re evaluating, pay attention to the annual percentage rate (APR), interest rates and additional fees. You need to know how much the loan will cost in total, not just how much you’ll pay each month.

And if you have multiple offers, use online comparison tools to make sure you’ve found the best terms.

Step 2: Gather documentation

For a smooth loan application process, you’ll want to gather all the required documentation in advance. Lenders typically require government-issued ID, proof of income and bank statements—make sure to have these handy when filling out the application.

Step 3: Complete the loan application accurately

Be honest and thorough when completing your loan application. Inaccurate information can lead to denial, so take your time to complete every field correctly. Before signing, carefully read all terms, including interest rates, the repayment schedule and note any potential fees.

Step 4: Submit your application

After submitting your application and documents, it’s time to sit tight and wait. The lender will review everything in a process called underwriting. In this process, they assess your creditworthiness using the information you submitted and determine the risk of lending to you. Approval times vary from a few days to a few weeks.

How to qualify for a loan: 5 specific scenarios

Different financial situations may require different approaches when seeking a loan. Here’s how to navigate some common scenarios.

|

Loan type |

What you need |

|---|---|

Personal loan |

Good credit, stable income and low DTI are key. |

Car loan |

Pre-approval helps budgeting and negotiation at dealerships. |

Bank loan |

An existing relationship with the bank may offer better rates and terms. |

Bad credit loan |

Secured loans or a co-signer can increase approval odds. |

No credit loan |

Secured cards, builder loans or a co-signer can help. |

How to get a personal loan

Personal loans serve various needs, from debt consolidation to home improvements. Lenders for these types of loans will primarily assess your credit score, income stability and DTI ratio.

- Common uses: Debt consolidation, home renovations, medical expenses

- Key approval factors: Credit score, income stability, DTI

How to get a car loan

Getting pre-approved for a car loan is one of the best ways to get a good deal at the dealership. It helps define your budget and strengthens your negotiation, especially if you have poor credit.

- Benefit: Pre-approval for budgeting and negotiation

- Important terms: Interest rate, loan duration, fees

How to get a loan from the bank

Having an established relationship with a bank can be very helpful when taking out a loan. Banks are often more willing to offer preferential interest rates or more flexible terms to their existing customers, and typically provide a wide range of loan options. You can even consult a loan officer at your bank to find the best option.

While it’s technically possible to walk into a bank and get a small loan on the same day, it’s highly unlikely for most people and most loan types. Banks need to assess your creditworthiness and income by gathering documentation, which typically takes more than a few hours. So, if you’re looking to get a loan from a bank, expect it to take some time.

- Potential advantage: Better rates or flexible terms with established relationships

- Action: Discuss your needs with a bank loan officer

How to get a loan with bad credit

While obtaining a loan with bad credit can be more difficult, it’s possible. Secured loans and co-signers are great options to explore to help you get where you need to be. While you may encounter higher rates and fees, these are manageable, and sometimes necessary, on a path to better credit.

- Common options: Secured loans, co-signers

- Key considerations: Higher interest rates and fees

How to get a loan with no credit

If you lack credit history, you’re not out of luck. You can explore options like secured credit cards, credit-builder loans or bringing along a co-signer. Building positive credit through responsible financial habits is essential for future borrowing.

- Common options: Secured credit cards, credit-builder loans and co-signers

- Crucial step: Establishing a positive credit history

Check your credit today

Now that we’ve covered the key steps and considerations for getting a loan, you’re ready to get started on your loan journey. By preparing your finances, understanding the application process and researching lenders and loan types, you’ll be able to manage your debt responsibly.

Whether you’re navigating your first loan or seeking better terms, understanding how to get a loan with favorable terms is a significant step on the road to financial stability.

Get your free credit assessment today to get started.

Loan FAQ

How do I borrow money ASAP?

To borrow money ASAP, consider options like online lenders offering quick approvals or cash advance apps (which may not require a credit check). Some banks may provide existing customers with expedited processing for smaller loans, although same-day funding for walk-ins is rare.

Which loan is easy to borrow?

Secured loans or those with a co-signer might be easier to get if you have bad or no credit, as they reduce the lender’s risk. For those with good credit, personal loans from online lenders can have relatively straightforward application processes.

What income do you need for a loan?

There isn’t a universal minimum income; it varies by lender and loan type. Lenders use your income to calculate your debt-to-income (DTI) ratio. A lower DTI, supported by a stable and sufficient income, generally allows you to borrow a larger amount with better terms.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.