The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

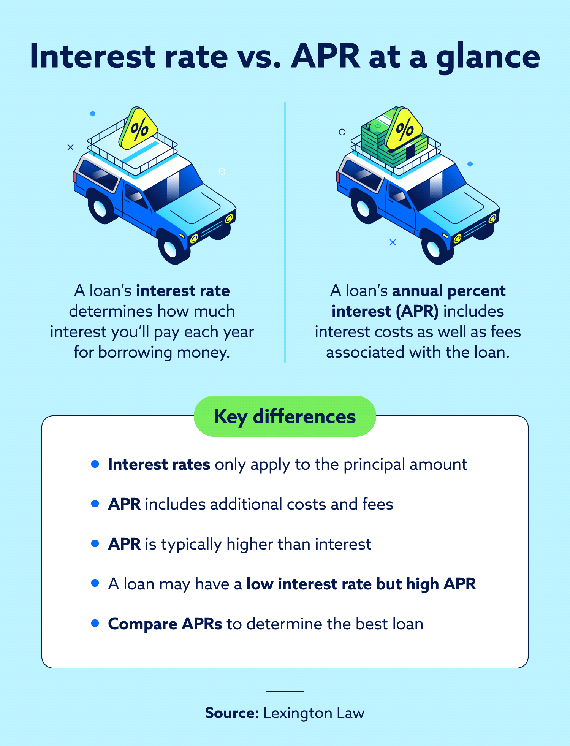

The interest rate for a loan determines the amount of interest you’ll pay annually after borrowing money. However, the loan’s annual percentage rate (APR) also includes additional costs and fees.

Whether you are purchasing a home or vehicle or have another loan that includes interest, it’s helpful to understand the annual percentage rate (APR) vs. interest rate. This knowledge can help you compare loans and get the best deal possible.

When comparing loans—especially for a mortgage—you’ll likely encounter information about both interest rates and annual percentage rates. Not only does your credit score play a role in mortgage interest rates, but so do other factors involving your finances. This is true for auto loans and personal loan interest rates as well.

Continue reading to learn more about the differences between APR and interest rate, as well as how to compare loans so you can save money.

Table of contents:

- What is an interest rate?

- What is APR?

- Interest rate vs. APR key differences

- How does APR affect mortgage

- What is APR for cars?

- Are interest rates or APRs more important than comparing credit cards?

- Improve your credit for better loan options

- FAQ

What is an interest rate?

The interest rate is a percentage that determines how much you’ll pay to the lender for taking out the loan. When you take a loan out, you may see a “principal amount” as well as the interest rate. The principal is the amount of money you borrowed. When you make your payments, a percentage of the payment goes toward the principal, and a percentage goes toward the interest.

How are interest rates calculated?

To calculate interest, lenders consider factors like current market rates, their own cost of funds, the borrower’s creditworthiness and the loan term.

For example, on a $10,000 loan at a five percent annual interest rate, you’d pay $500 in interest for the year ($10,000 x 0.05). However, most lenders compound interest, meaning they apply it to the principal amount, as well as interest you’ve previously incurred.

These charges typically occur regularly (e.g., monthly), so the actual interest you pay may be slightly higher than this simple calculation.

What is APR?

The annual percentage rate of a loan includes much more than just the interest rate. For example, when you take out a mortgage loan, additional costs and fees are associated with the loan. Because the APR considers more factors, it will be higher than your interest rate.

Some of the additional expenses for a mortgage loan included in the APR may be:

- Privatized mortgage insurance (PMI)

- Certain closing costs

- Mortgage or discount points

How is APR calculated?

Without knowing all of the additional expenses, it can be difficult to calculate the APR when estimating the cost of a home. By using the interest rate, you can get a rough idea of what your principal and interest payments will be.

For example, if you take out a 30-year mortgage for $300,000 with a 3 percent interest rate, your monthly payments will be $1,264. The first month, $514 of your payment will go toward the principal and $750 will go toward interest. After the first year, you’ll have paid $6,254 toward the principal and $8,914 toward interest.

As you make payments on the loan, the principal balance of the loan will decrease, so while you continue to have a 3 percent interest rate, the amount you pay each month in interest will decrease.

Additionally, APRs can be fixed or variable. A fixed APR remains the same throughout the loan term, while a variable APR can change over time, often tied to a benchmark interest rate like the prime rate. Variable APRs are more common with credit cards or adjustable-rate mortgages.

Interest rate vs. APR key differences

The APR will provide much more information about what you’re actually paying when you take out a loan. The Truth in Lending Act (TILA) was enacted in 1968, and it helps protect consumers by ensuring that lenders and creditors are fully transparent. This means they must be up front about all of the loan terms, as well as fees and additional costs included in the APR.

Although your interest rate doesn’t include as much information, it’s still important to consider. Your interest rate affects the total cost of the loan and your monthly payments.

How does APR affect mortgage

When comparing mortgage options, it’s important to look at the APR, the length of the mortgage, the cost of discount points, and how long you plan to stay in the home you’re purchasing. This is especially true for first-time homebuyers.

While annual percentage rates take into account the fees associated with a mortgage, the cost of those fees is spread out over the entire life of the loan. For that reason, you may only benefit from the lower APR if you stay in the home for a certain amount of time.

For example, some mortgages include discount points, which require an up-front cost to lower the interest rate. Initially, these mortgages may actually be more expensive due to the price of the points. However, after reaching a break-even point, a mortgage with a lower APR will save money.

The table below compares the cost of three hypothetical loans with different interest rates, APRs and discount points.

How costs for a 30-year, $300,000 mortgage can vary |

|||

|---|---|---|---|

| Interest rate | 4% | 3.75% | 3.5% |

| Fees | $4,000 | $4,000 | $4,000 |

| Discount points | 0 | 1 | 2 |

| Points cost | $0 | $3,000 | $6,000 |

| APR | 4.11% | 3.94% | 3.77% |

| Monthly payment | $1,432.25 | $1,389.35 | $1,347.13 |

| Cost after one year | $21,187.00 | $23,672.20 | $26,165.56 |

| Cost after three years | $55,561.00 | $57,016.60 | $58,496.68 |

| Total cost | $519,610.00 | $507,166.00 | $494,966.80 |

| Break-even point | N/A | 69 months | 70 months |

What is APR for cars?

Depending on the dealer and where you live, the APR for a car loan will be different from a mortgage loan APR because of the additional fees. For auto loans, lenders calculate the interest rate for each borrower individually, and then they include additional fees and expenses to calculate the APR.

Some factors lenders may consider for your rates include:

- Vehicle age

- Down payment amount

- Borrower income and expenses

- Credit history and score

- Loan term

Typically, the APR will be higher than the interest rate on car loans due to finance charges associated with the loan. When taking out an auto loan, you can ask the car dealer to show you an itemized list of the charges affecting the APR.

Are interest rates or APRs more important when comparing credit cards?

Many credit card lenders use “APR” and “interest rate” interchangeably. What separates credit card APRs from those of other loans is that credit cards are a form of revolving credit, which means that you can avoid interest charges by paying off your balance each month. Many credit cards offer no interest for a certain amount of time. For example, you may see offers that have no interest if you pay a purchase off within 12 months.

Improve your credit for better loan options

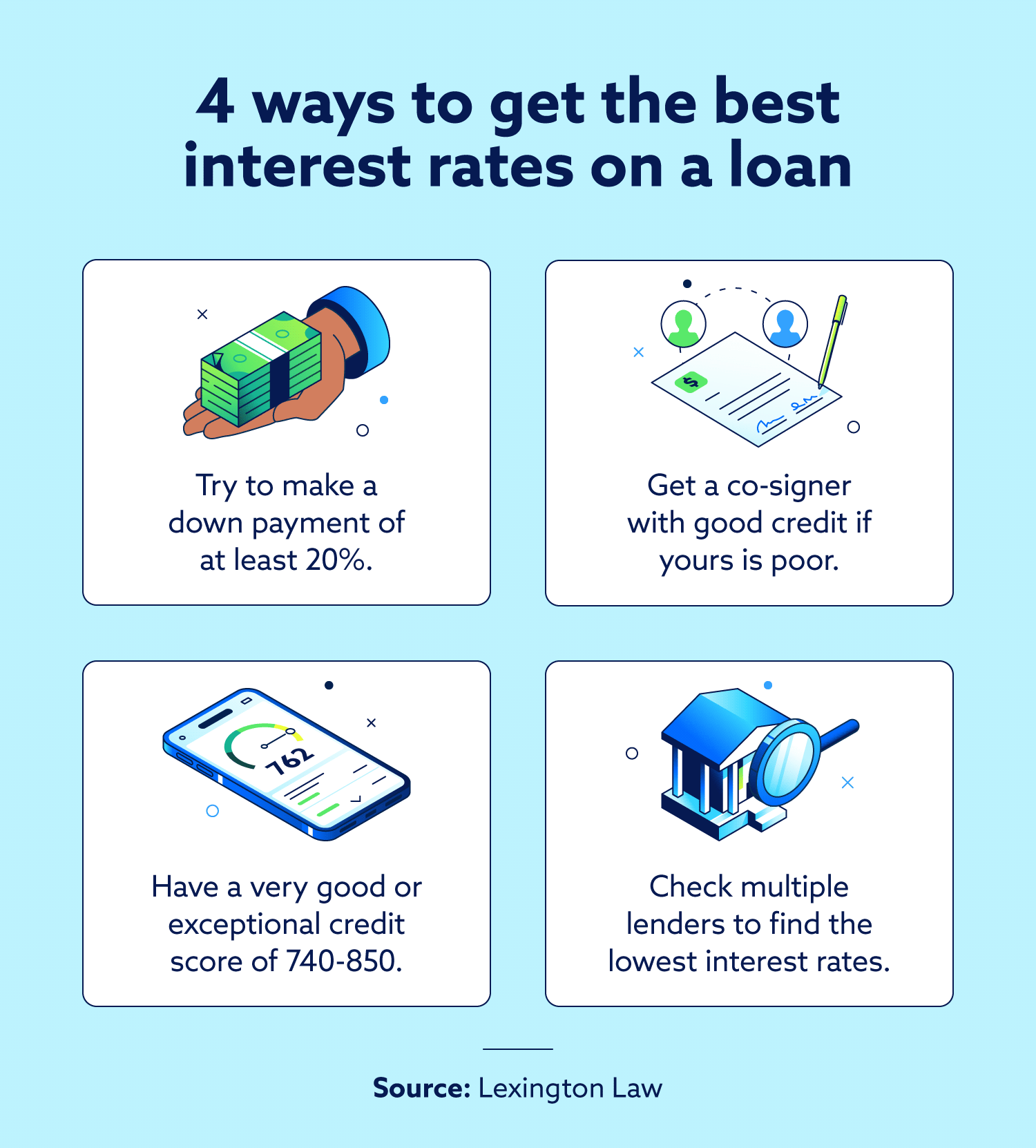

Before applying for a loan, the best thing you can do is improve your credit score. Whether you want a credit card, a car loan, or a mortgage loan, your credit score will play a major factor in the types of rates you get.

The first step to improving your credit score is knowing what yours is, and you can use Lexington Law Firm’s free credit assessment to find out. This will give you detailed information about your credit, and you can also learn more about our additional credit services.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.