The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Let’s set the record straight: Lexington Law Firm is not a credit repair scam. We prioritize safety and honesty and work hard daily to help educate consumers on their credit and credit repair options.

To help clear up the confusion, we’ll debunk some common credit repair myths and give you tips for avoiding scams targeting Lexington Law Firm customers.

5 common misconceptions about credit repair

Recently, there has been much confusion about what credit repair is, how it works and whether or not it is legal. To help clear things up, let’s explore the five most common misconceptions regarding credit repair.

Misconception #1: Credit repair can remove all negative marks.

Credit repair does not remove negative marks that appear on your credit reports if those items are accurately reported. Credit repair organizations like Lexington challenge and dispute items that are erroneously listed on your credit reports. These challenges and disputes are filed with the credit bureaus and furnishers (the creditors who report to the bureaus). Unless the bureau or furnisher can show that the item should be listed on your report, it has to be removed.

Credit reporting errors are pretty common, with more than 4 in 10 consumers finding errors on their credit reports, according to a Consumer Reports study. These errors damage your credit score.

The Fair Credit Reporting Act gives you the right to challenge and dispute mistakes, omissions and fraudulent entries so that they are removed from your credit and no longer unfairly impact your credit score.

Credit repair does not dispute valid negative information. If, for instance, you have an accurate 30-day late payment reporting, credit repair cannot be used to remove this information from your credit reports.

Misconception #2: Credit repair is guaranteed to work

There are no guarantees with credit repair. Disputing information takes time, and the credit bureaus may deny a dispute either because the creditor fought it or because your dispute lacked information.

Sometimes, a dispute has to be filed multiple times and be accompanied by evidence before the credit bureau will remove inaccurate information from your credit reports.

It is also possible that even with successful disputes, your credit doesn’t improve much. Credit repair does not guarantee a good credit score.

Having good credit requires a good credit history. This means that even if you remove bad items from your history, if you don’t have enough good items, you won’t have a good score. Additionally, your credit score may be impacted by factors that a credit repair organization cannot help with, such as credit utilization (the percentage of your total available credit you are using), new inquiries, or persistent late payments.

While there are no guarantees that repairing your credit will be as successful as you want it to be, it’s better than allowing errors to stay. Knowing you have errors on your credit reports and not doing anything could open you up to additional credit issues.

Misconception #3: Credit repair is a scam

Credit repair is legal and is even something you can tackle yourself. The Fair Credit Reporting Act (FCRA) gives you the right to dispute errors you find on your credit reports. It also outlines the credit bureau requirements for handling your dispute.

The rights and protections afforded to you by the FCRA also allow you to hire a credit repair company to help you challenge the inaccurate information on your reports on your behalf.

However, just because credit repair is legal doesn’t mean there aren’t scams out there. The Credit Repair Organizational Act (CROA) sets forth strict guidelines for credit repair companies.

CROA states that a credit repair company cannot:

- Guarantee results: Credit repair companies cannot make any promises about their services. If you see a credit repair company or its agents promising to “clean” your credit, deliver results in a set time (30 days, for example) or increase your credit score (“Boost your score by 100 points!”, for example) it may be a scam.

- Ask for payment before services are rendered: CROA does not permit credit repair companies to charge for services before they’ve actually been rendered. (See our billing page to learn more about how and when we charge for our services).

- Try to penalize you for cancelling: All credit repair companies are required by law to give you at least three days to cancel services with them and there is no penalty for canceling.

If a company does not adhere to these rules, it is a red flag that it might be running a scam.

Other scams to watch out for include the following:

- Free credit score scams

- Debt relief scams

- Debt collection scams

- Interest rate reduction scams

- Foreclosure rescue scams

- Recovery scams

Misconception #4: Credit repair is a quick process

Credit repair takes time. Getting a single error removed from just one bureau’s credit report may take months.

The reason for the delay is the need for the credit bureau to investigate your dispute. Once a dispute is filed, the credit bureaus have 30 days to come up with an initial conclusion. When you provide additional evidence during this period, the credit bureau will get an extra 15 days to review it.

If your dispute is valid, it may take up to another 30 days for the updated information to be reflected on your credit report. If the credit bureau denies your dispute, you can reopen the investigation and provide additional evidence for your dispute. This restarts the 30-day clock.

Misconception #5: Credit repair is only needed once

You wouldn’t get the oil in your car changed just once and then never again; similarly, credit repair is an ongoing process.

Even if you successfully remove all the errors appearing on your credit report, that doesn’t mean there won’t be additional errors in the future. Also, inaccurate information removed from your credit reports may reappear months or years later.

It’s important to continuously monitor your credit reports and initiate a dispute immediately when you find an error or you believe someone may have stolen your identity and taken out credit in your name.

How to protect yourself from Lexington Law Firm refund scams

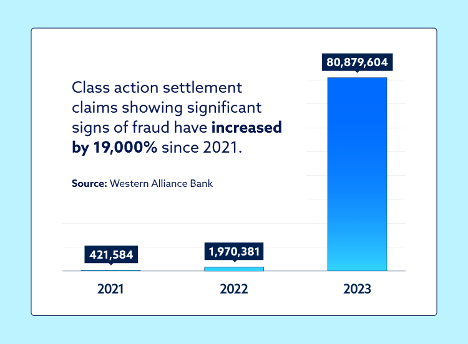

Unfortunately, fraudsters have been claiming to be Lexington Law Firm or the CFPB to try to get victims to provide sensitive information or payment.

The CFPB is directly responsible for distributing payments from the settlement in 2023, not Lexington Law Firm. If you receive any communication from a party other than the CFPB regarding the settlement or a payment, it should not be trusted. Please visit the CFPB website directly for any questions.

Here are some red flags that you’ve been targeted by a scam:

- Bank account information is requested to initiate a deposit

- Demands for upfront payment or fees

- Offers to expedite the mailing of your check

- Offers to pay you with cash, gift cards or cryptocurrency

- Contacted through social media

Is Lexington Law Firm Legitimate?

Yes, Lexington Law Firm is a legitimate credit repair company. We have been in business for more than 20 years and have helped millions of people work to repair their credit.

Is Lexington Law Firm a loan company?

No, Lexington Law Firm does not issue or fund loans of any kind. Any offer claiming to provide loans on behalf of Lexington Law Firm is a scam and should be avoided.

Stay protected against Lexington Law Firm refund scammers

Knowledge is your best tool for knowing when you’re dealing with our legitimate company or a fraudster running a Lexington Law Firm scam. By understanding what credit repair is, how it works and your rights, you’ll have the tools to avoid a credit repair scam and hopefully spot scammers trying to “help you” get a refund.

Lexington Law Firm is a legitimate credit repair company that has helped millions of people address their credit issues. We don’t just help you file challenges; we also help you monitor your credit and provide personalized insights into the factors affecting your credit. Get started on your credit repair journey today with a free credit assessment.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.