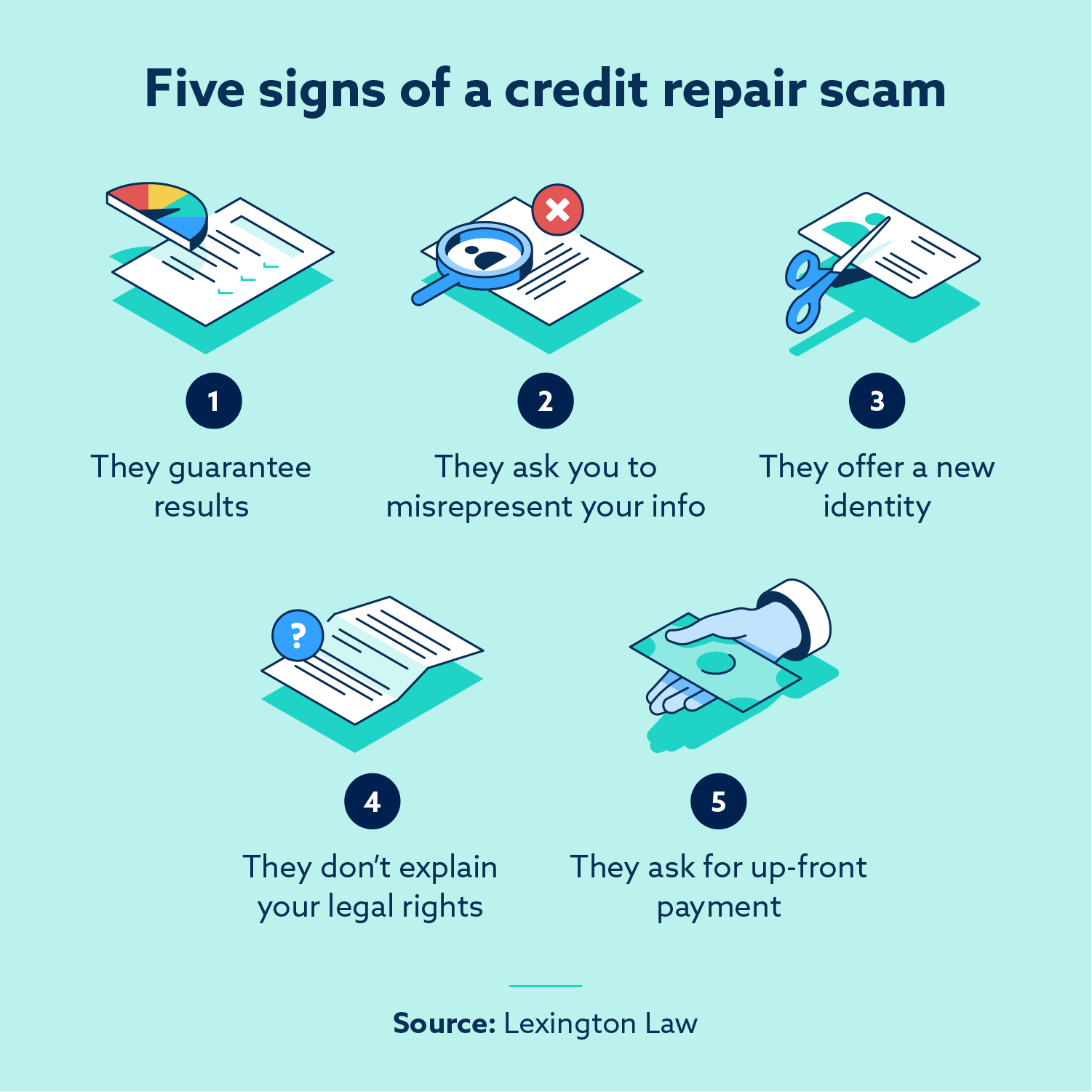

Five signs of a credit repair scam are they guarantee results, ask you to misrepresent information, claim a new identity is needed, don’t explain your legal rights and request up-front payment.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you have poor or damaged credit and want to repair it, you may have considered using a credit repair service to help. Unfortunately, there are many companies and individuals that want to take advantage of unsuspecting consumers needing help with their credit.

While there are legitimate companies that can help you repair your credit, there are also credit repair scams that are only after your money and your information for identity theft purposes. To keep both safe, we created this guide to help you tell the difference between legitimate credit repair companies and credit repair scams.

Five signs of a credit repair scam

There are many things credit repair companies are not allowed to do or promise customers. If it sounds like it is too good to be true, it probably is, and you should steer clear of that company. We have put together a list of signs you should watch out for when working with credit repair companies.

1. They guarantee results

Under the Credit Repair Organizations Act (CROA), credit repair companies cannot guarantee results. Here are a few common examples of false promises, unethical credit repair companies might make:

- Improvement to your credit score

- Results in a fixed time-period

- Removal of all negative items, even if they are accurate

2. They ask you to misrepresent information

An unethical credit repair company might ask you to misrepresent your information. This can range from unlawfully using an EIN or CPN number in place of your social security number to claim you are a victim of identity theft when you are not.

3. They claim a new identity is needed

A credit repair company cannot promise or offer you a new identity. Anyone offering you a new identity is a fraud. Besides guaranteeing results, scammers may try to promise you a clean slate with a new Employer Identification Number (EIN) or a credit privacy number (CPN).

They tell you to use these numbers on your future credit applications instead of your Social Security number. We explain more about common credit repair scams below.

4. They don’t explain your legal rights

Credit repair companies should explain your legal rights to you from the beginning. These are a few common things an unethical credit repair company might do:

- Tell you not to contact the credit bureaus directly

- Not give you a copy of the contract to review before signing

- Fail to inform you that you can repair your credit yourself without the help of a credit repair company

- Leave out important information from the contract, like the date services will be executed or the amount you will pay

If you feel like the company is not telling you everything or refusing to answer your questions, you should seek services elsewhere.

5. They request up-front payment

The Credit Repair Organization Act (CROA), prohibits credit repair companies from asking for any payment before they render services. Many scammers know that most consumers don’t know this and, as a result, promise a quick turnaround on credit repair for a large upfront payment.

Some illegitimate credit repair companies may not allow you to cancel unless you pay a fee. All credit repair companies are required by law to give you at least three days to cancel services with them and there is no penalty for canceling.

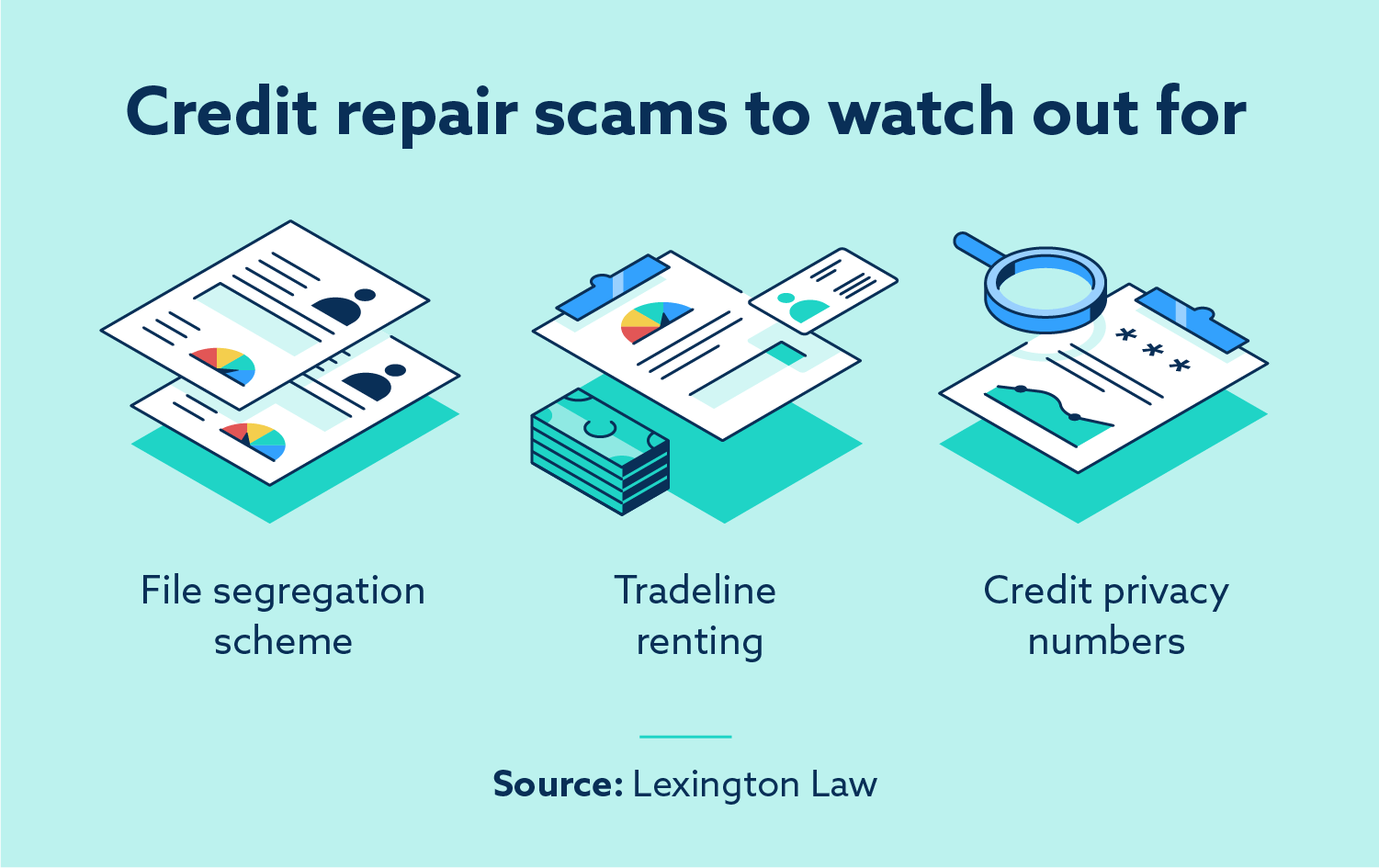

Common credit repair scams

You will most likely see credit repair companies illegally promising results. However, it is important to familiarize yourself with other scams so you understand what is and is not legal. We highlighted a few common ones below.

File segregation schemes

A file segregation scheme is when a company or individual offers to give you an Employee Identification Number (EIN) to use in place of your Social Security number when you apply for credit. It is illegal for companies to do this, and it is illegal for consumers to obtain one to use in place of their Social Security number.

Tradeline renting

Tradeline renting is when you pay for authorized user status so that the tradeline shows up on your credit reports to improve your score. This doesn’t repair any negative information on your credit, but adding a positive tradeline to your credit report can boost your score.

While this isn’t necessarily illegal, it can get you into trouble. There is nothing wrong with a loved one adding you as an authorized user. However, if you pay to “rent” a tradeline from a stranger, you don’t know how it will impact your credit and it may be a scam to get your money.

Credit privacy numbers

Like an EIN, a credit privacy number (CPN) is created by scammers to use in place of your Social Security number when applying for credit. Simply put, a CPN is a fake Social Security number. Usually, these are created using somebody else’s identity and using one can be considered identity theft.

What to do if you are scammed

There are a few things you can do if you realize you’ve fallen victim to a credit repair scam. Take a look at your options below.

- Report the organization to your state attorney general

- File a complaint with the Federal Trade Commission and the Better Business Bureau

- Consult with an attorney if you’d like to take further legal action

How to tell if a credit repair company is legitimate

There are surefire ways to tell if a credit repair company is legitimate. For example, a legitimate company will not make you promises and guarantees when it comes to how many points they can improve your score. They will also help you understand your legal rights under the credit laws.

One of the best ways you can discover if a credit repair company is legitimate or not is by looking up online reviews. Most reputable credit repair companies have reviews from current and former clients as well as from credible websites that review credit repair services.

Can credit repair companies fix your credit?

Yes, a legitimate credit repair company can help you work to remove inaccurate negative items from your record that may be damaging your credit score. Here are ways to recognize a legitimate, expert credit repair company. Although you can work to repair your credit yourself without a credit repair company, ideally a credit repair company would make the process much easier. Here are some signs of a legitimate, expert credit repair company:

- They create a repair strategy custom to your unique situation. A good credit repair company will customize their course of action only after evaluating your credit reports and credit history. Everyone’s credit history is different, and their approach to repairing your credit should reflect that.

- They maintain communication with you during the process. A credit repair company that maintains scheduled calls, emails or any other form of communication with you will help you stay up-to-date with your case progress. They should not keep you in the dark as they are conducting their services.

- They inform you of your rights from the beginning. At the time of signing, a credit repair company should provide two documents: a disclosure of your right to repair your credit yourself and a detailed contract of services.

- They make realistic claims about their services. Like we said above, credit repair companies cannot guarantee results. A legitimate credit repair company will not guarantee timeframes or point changes, but they can guarantee the delivery of services—access to credit monitoring tools, or letters delivered on your behalf.

How to safely repair your credit

Making payments on time and disputing inaccurate information on your credit reports can help you repair your credit. While you can do this on your own, a professional credit repair agency like Lexington Law Firm can help make the process easier and more efficient.

Lexington Law Firm proudly adheres to CROA to make sure we give our clients the best experience possible. For over a decade, we have helped clients send communications regarding information that is unfair, inaccurate and unsubstantiated.

Sign up today for a free credit assessment to see your FICO® score and a short summary of your credit report.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.