A credit check is a formal inquiry into an individual’s credit history to assess their creditworthiness. This process involves reviewing a credit report to evaluate past financial behavior and predict the likelihood of future debt repayment.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A credit check, or credit inquiry, is the simplest and most efficient way for lenders to see whether or not they should lend you money. With U.S. credit card debt exceeding $1 trillion in 2024, it may be no surprise that lenders will want to carefully evaluate your financial history before approval.

Functionally, your credit report is just that: an indicator of whether or not you’ll be a risk for the lender. Think of it as a detailed snapshot of your financial past and present, providing the bank with the insights it needs to make informed decisions.

Today, we’ll examine what a credit check entails, the different types of inquiries and why they matter to your financial health.

What is a credit check?

A credit check, also known as a credit inquiry or credit pull, is the formal process by which authorized entities review your credit history. It’s most often used by lenders to gauge your creditworthiness when you apply for credit products like loans, credit cards or even apartment rentals.

The process involves reviewing your credit report—that aforementioned detailed record of your past financial behavior. The report includes information about your open and closed credit accounts, payment history, outstanding debt and any negative marks, such as bankruptcies or collections.

Who can perform a hard credit check?

You have to be authorized to perform a hard credit check. Under the Fair Credit Reporting Act (FCRA), anyone running a hard credit check must be able to prove that they’re doing so for a legitimate business reason. This is to protect the privacy of your personal information and credit activity.

Organizations like lenders, landlords, insurance companies and others will often partner with credit reporting companies to check your credit before lending or view your credit report directly if they have authorization to.

Entities that commonly run hard credit checks include:

- Lenders: When you apply for a loan, credit card or other forms of credit, these institutions will perform a hard credit check to assess your creditworthiness. They may also do so when considering credit limit increases or during debt collection processes.

- Insurance companies: In some places, insurance providers may conduct hard credit checks to determine auto or homeowner’s insurance premiums.

- Government authorities: For certain benefits or licenses, governmental agencies might perform hard credit checks to evaluate your financial responsibility.

- Employers: Potential employers may conduct hard credit checks as part of their hiring process.

- Landlords: When you apply to rent a property, landlords often perform hard credit checks to evaluate your ability to meet your financial obligations under the lease agreement.

- Utility companies: When establishing new service, utility companies (like your electricity, gas or water company) may conduct a hard credit check to determine if a security deposit is required.

Any organization must typically get your permission before running a hard credit check, so always read the fine print carefully to know when this will happen.

Beyond standard credit checks, the FCRA also allows credit bureaus to share your report:

- When legally required ( like in the case of a court order)

- For services benefiting your lenders

- When you specifically authorize it in writing

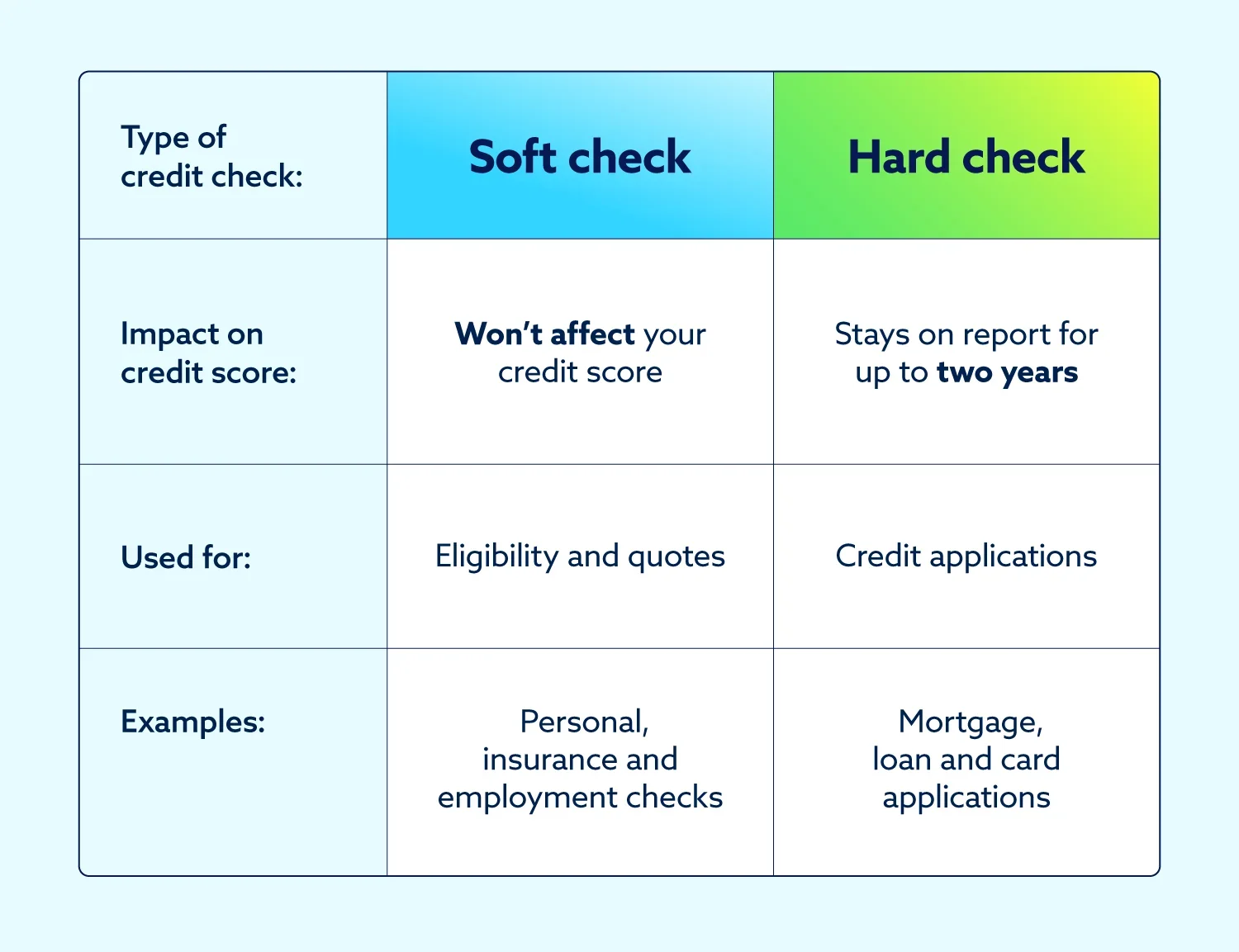

Differences between soft and hard credit checks

Now that we’ve determined what a credit check is, let’s take a look at the two primary types of credit checks: soft and hard inquiries. While both soft and hard credit checks examine an individual’s credit history, they have significantly different purposes and impacts.

What is a soft credit check?

A soft credit check is an initial look at specific (usually top-level) information within your credit report. It’s like a glance rather than a deep dive. These checks typically don’t impact your credit score—and can be as simple as you viewing your own credit report.

Examples of a soft credit check might include:

- Checking your own credit score

- Getting pre-approved for a credit card or loan

- Insurance companies requesting your information for quotes

- Potential employers verifying your identity for employment purposes

The good news? You can experience multiple soft credit checks without affecting your credit score. So, if you want to check your credit score every day, go right ahead.

What is a hard credit check?

A hard credit check works a little differently. A hard credit check is a more comprehensive search of your credit report. It provides a complete view of your credit history, including any other recent credit applications you’ve made.

Examples of a hard credit check might include:

- Applying for a mortgage

- Applying for a credit card

- Applying for a personal loan

- Financing a car or furniture purchase

- Opening new accounts, like a mobile phone contract or utilities

Numerous hard credit checks conducted over a short time can negatively affect your credit score. These inquiries may stay on your credit report for up to two years—so be judicious about allowing them.

Soft credit check |

Hard credit check |

|

|---|---|---|

Purpose |

Reviewing your own credit, pre-approvals, quotes, identity verification |

Applying for new credit or services |

Impact |

Generally no impact on your credit score |

Can potentially slightly lower your credit score |

Requires consent |

Typically does not require your explicit consent |

Requires your explicit consent |

Record on report |

Recorded on your credit report, but only visible to you |

Recorded on your credit report and visible to lenders |

Examples |

Checking your credit score |

Applying for a mortgage |

What can affect your credit score?

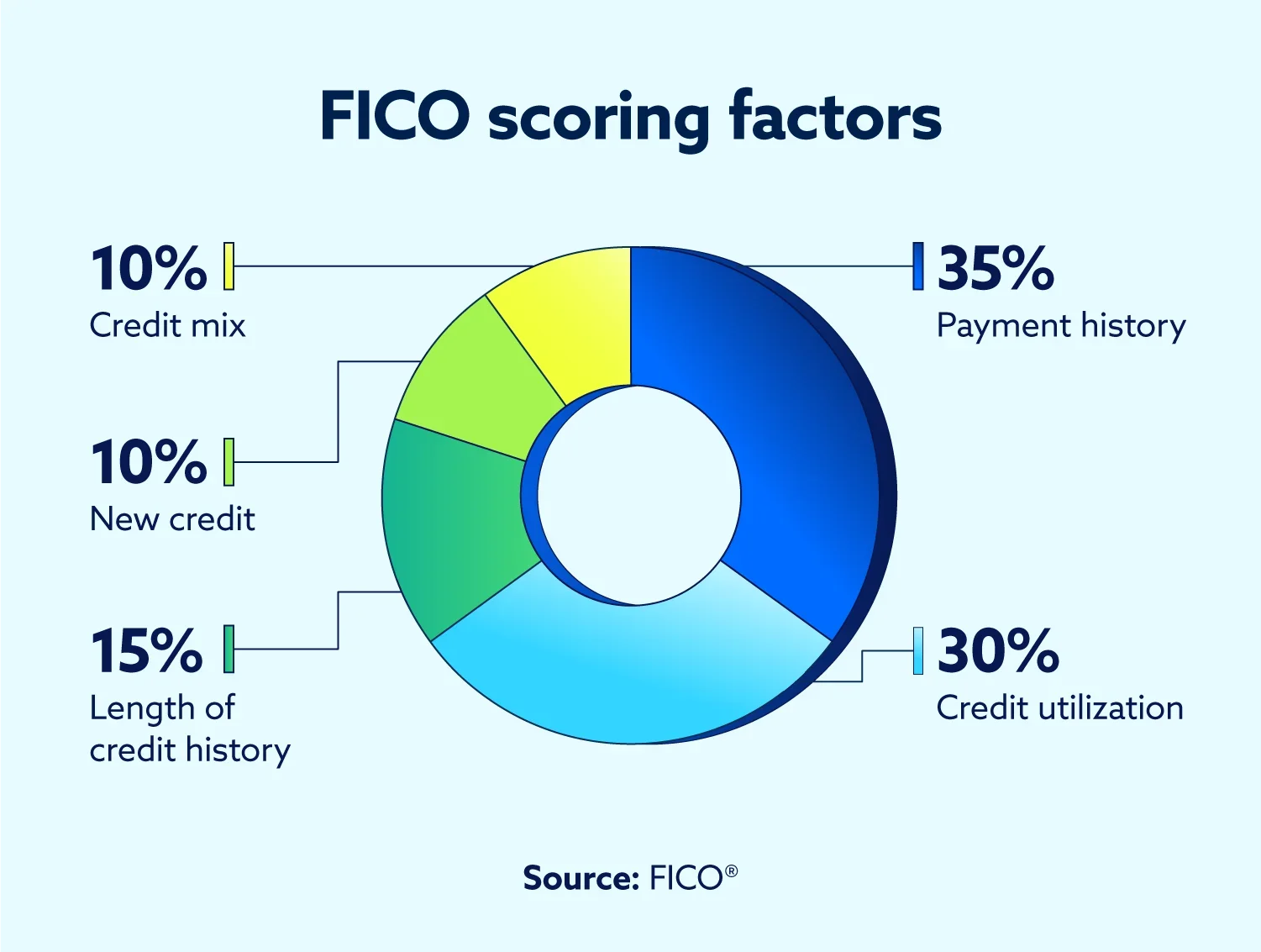

Your credit score is a dynamic number influenced by several aspects of your financial behavior. Key factors include the consistency of your bill payments, the total amount of your outstanding debt, the age of your credit accounts, any recent credit applications and the mix of credit types.

A good credit score reflects a reliable history of repaying debts as agreed, signaling to lenders that you are a low-risk borrower.

If you’re looking to improve your credit score, there are several steps you can take—but be prepared for the process to take time.

While focusing on making timely payments on all your debts and keeping your credit utilization low are crucial, your entire credit history plays a role in shaping your score over time. This includes the age of your accounts, the types of credit you use, and any recent credit applications, so be prepared for the improvement process.

How to quickly improve your credit score

Although building excellent credit is a marathon, not a sprint, certain actions can lead to faster improvements in your credit score:

- Correct errors on your credit report: Review your reports for inaccuracies and dispute them immediately.

- Pay down credit card balances: Reducing your credit utilization ratio can positively impact your credit score quickly.

- Become an authorized user: If someone with good credit adds you as an authorized user, their positive credit history may be reflected on your report.

- Address past-due accounts: Bringing delinquent accounts up to date can prevent further negative impact and may lead to a score increase over time.

Check your credit today

Knowing when hard credit checks happen (and when they will show up on your credit report) means you can be proactive about your credit management. Having a clear picture of your credit standing empowers you to make sound decisions and take control of your financial future. To see where you stand, get your free credit assessment today.

Credit check FAQ

Do credit checks hurt your credit score?

Soft credit checks do not harm your credit score. Hard credit checks from credit applications can cause a slight, temporary dip. This impact lessens over time.

How long do credit checks stay on your credit report?

Soft inquiries remain for up to two years but don’t affect your score. Hard inquiries also stay for up to two years, with the main score impact in the first year.

Can I check my own credit?

Yes, you have the right to check your credit report. Doing so results in a soft inquiry and will not lower your credit score. You can get a free copy of your credit report from each of the three major credit bureaus (Equifax®, Experian® and TransUnion®) once every 12 months; you are also currently able to get a free online copy of your credit report from each of the three major credit bureaus each week by going to AnnualCreditReport.com.

How do multiple credit checks work?

Multiple soft inquiries have no negative effect. However, several hard inquiries in a short period can lower your score more than one hard inquiry by itself.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.