The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

No, collection agencies can’t report an old debt as new. Creditors can sell your old debt, which means adding a new open date, but this does not make the old debt new. The original delinquency date remains the same and should fall off your credit report after seven years.

In 2023, the Urban Institute estimated that more than 1 in 5 Americans have accounts in collections. If you’re one of those Americans with an account in collections, you may be wondering: Can a collection agency report an old debt as new?

This is a common question due to how lenders and collection agencies sell your debt to different collectors. Any debt over a year or two old is typically considered “old debt.” Understanding how these collection accounts work can help you protect your credit score and get back on the right track financially.

Not only will we discuss how resetting debt works, but we’ll also cover how you can manage your debt and pay off collections. Plus, learn your rights when it comes to collection agencies.

Table of contents:

- Can a debt collector restart the clock on old debt?

- What is the statute of limitations on debt?

- What actions can reset old debt?

- Are time-barred debts on your credit report?

- Four steps to take if you’re contacted about an old debt

- How to dispute collection accounts on your credit report

- FAQ

Can a debt collector restart the clock on old debt?

An account in collections can have different dates attached to it, but the collection agency cannot report the old debt as new. This should provide some relief if you’re concerned about a collection account staying as a derogatory mark longer than it should on your credit report.

Creditors and collection agencies will sell your old debt to other collection agencies if they can’t collect. If this happens, multiple dates for a single collection can show on your account, but that single collection will maintain the same delinquency date attached to the original charge-off.

When lenders or anyone reviewing your credit report sees the collection, they may see multiple dates, but they’ll also see the original date. This won’t affect the seven years it takes for a collection to fall off your credit report.

How will a debt collector notify me about a debt?

Before reporting debt information to a credit reporting agency, a debt collector is generally required to attempt contact using at least one of the following methods:

- In person

- Phone call

- Letter by mail and allow a reasonable period (typically 14 days) for any notification that the letter was undeliverable

- Electronic message and provide a reasonable timeframe (often 14 days) for notification of a failed delivery

Receiving a validation notice regarding a debt from a debt collector generally signifies that they have met their contact obligations and may proceed to report the debt to credit reporting companies.

What is the statute of limitations on debt?

Old debt has a statute of limitations, giving collectors a specific window to take action against you. For example, to collect on an old debt, some collectors will sue you, but they can only do so if it falls within the statute of limitations. The statute of limitations can vary, so the Consumer Financial Protection Bureau recommends consulting an attorney to find out the laws in your state.

Just know that although the collector cannot sue outside of the statute of limitations, they can still attempt to collect old debt by calling and sending letters.

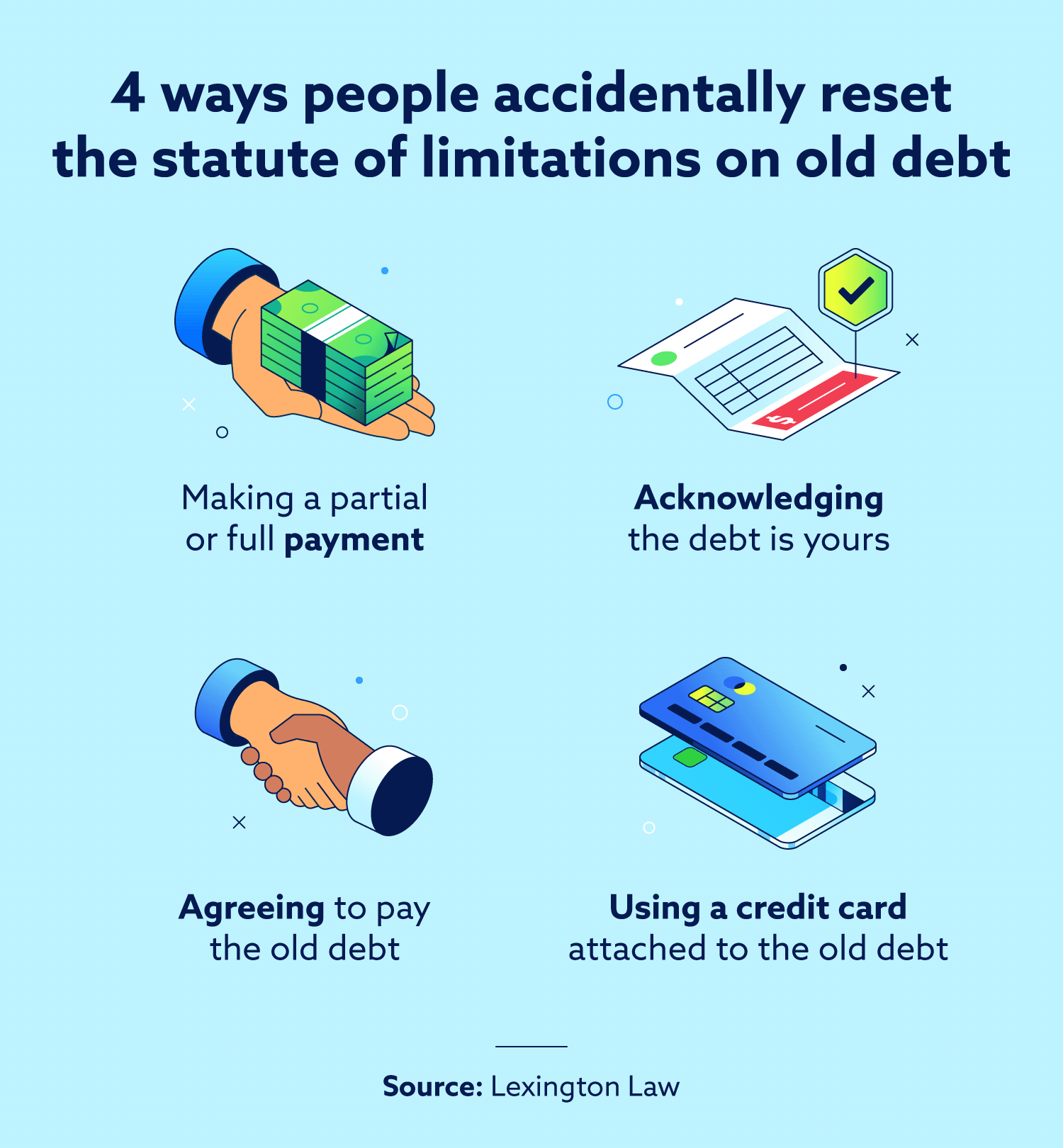

What actions can reset old debt?

It’s possible to reset the statute of limitations on your old debt, which gives collection agencies the opportunity to take action against you. The following actions can reset the statute of limitations on old debt:

- Making a partial or full payment on the old debt

- Acknowledging and agreeing to pay on the old debt

- Making a charge on a credit card that has the old debt

Are time-barred debts on your credit report?

Time-barred debts are the debts that have gone past the statute of limitations, and they can show up on your credit report. Collection accounts stay on your credit report for seven years, so if the statute of limitations is less than seven years, the collection can still show up on the report.

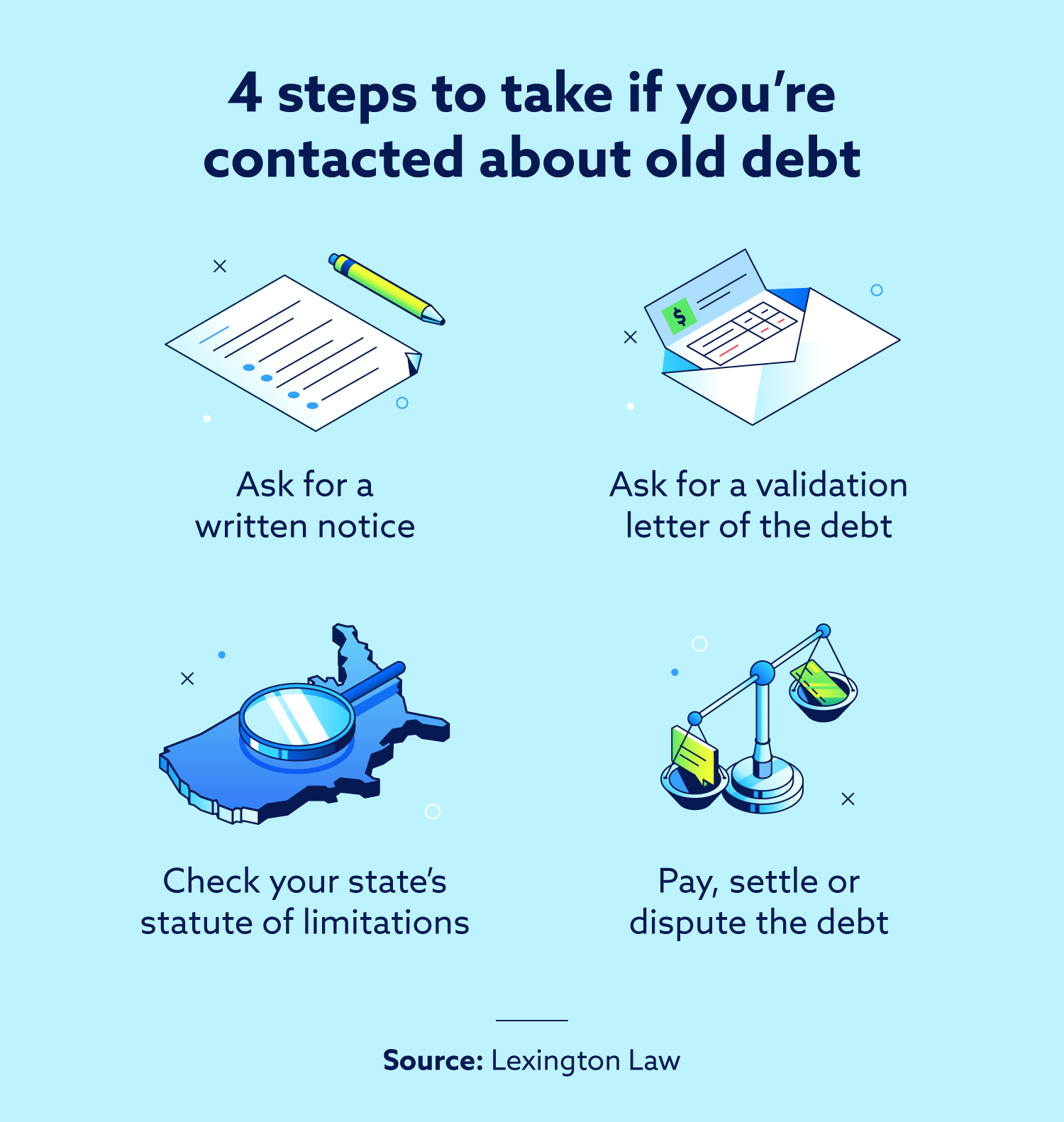

Four steps to take if you’re contacted about an old debt

Although old debts retain the same delinquency date and won’t show up as new, there may be a concern that you’ll reset the clock on the statute of limitations. This is where it’s helpful to know your rights if you hope to avoid resetting the date on an old debt.

1. Ask for a written notice

The Fair Debt Collection Practices Act from the Federal Trade Commission (FTC) requires collectors to send a written notice of your debt, among other rules that protect you. Asking for a written notice can help you avoid saying something on the phone that may reset the debt.

It can also help you avoid potential debt collection scams where individuals may try to impersonate legitimate collectors. Verify the debt and the collector’s identity before providing any personal information.

2. Validate the debt

It’s possible that a debt was reported in error, which means you may be able to remove delinquency from your credit report. First, you’ll need to validate whether or not the debt is accurate.

You have 30 days from the time the agency contacted you to request the validation of the debt—simply tell the collection agency that you’re going to dispute the collection and would like a validation letter.

3. Check if the debt is within the statute of limitations

While you’re waiting to validate the debt, it’s a good idea to contact an attorney to further discuss your rights and see if the debt is within the statute of limitations. Some attorneys even provide a free consultation.

4. Take action

It’s now time to decide which action you’d like to take: pay, settle or dispute. If the debt is legitimate, you can pay it in full or see if you can set up a payment arrangement. You can also try to negotiate the debt—many collectors will settle the account for less than what you owe. If you pay the debt off, be sure to request a pay for delete letter, as this is how you can potentially remove collections from your credit report.

You also have the right to request that the collection agency no longer contact you in the future, but this does not stop them from taking action if the debt is within the statute of limitations.

How to dispute collection accounts on your credit report

If there are any collections accounts on your credit reports that are unfair, inaccurate, or unsubstantiated. If you run into this issue, you may want to work with an accredit credit repair agency that will work with you to dispute these collection accounts.

Lexington Law Firm has been representing our clients since 2004, so we have years of experience helping people repair their credit. Not only can we help you dispute inaccurate collection accounts, but we can help you find any other errors that may be on your report, negatively affecting your credit.

To learn more, take our free credit assessment.

FAQ

The topic of old debt and collections can get complicated, so we’ve answered some frequently asked questions about old debt below.

How long can a debt collector pursue an old debt?

Debt collectors can continue to pursue old debts beyond the statute of limitations in your state, but they can’t take action against you beyond that point. The collection can stay on your credit report for seven years from the date of delinquency.

Does disputing a collection reset the clock?

Disputing an old debt only restarts the clock on the statute of limitations if you admit that the debt is yours. By requesting the collection agency to validate the debt, it is not an admission of owning the debt.

Can a debt collector take you to court after seven years?

Generally, a debt collector cannot take you to court after the statute of limitations for that debt has passed. The specific time limit varies by state and type of debt, so it’s important to know the laws in your location.

What is the 7-in-7 rule for debt collection?

The “7-in-7 rule,” established by the Consumer Financial Protection Bureau (CFPB) in 2021, limits how frequently debt collectors can contact you by phone. According to this rule, a debt collector can’t make more than seven phone calls within seven days to a consumer about a debt. They’re also not allowed to call a consumer within seven days after having a telephone conversation about that same debt.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.