The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

When filing taxes as a college student, make sure you determine your dependency status, calculate your income, compile your student tax forms and claim any education tax credits or deductions.

College is a time to expand your mind and learn how to be independent. However, you may still need help with certain financial situations, like applying for a credit card or navigating taxes.

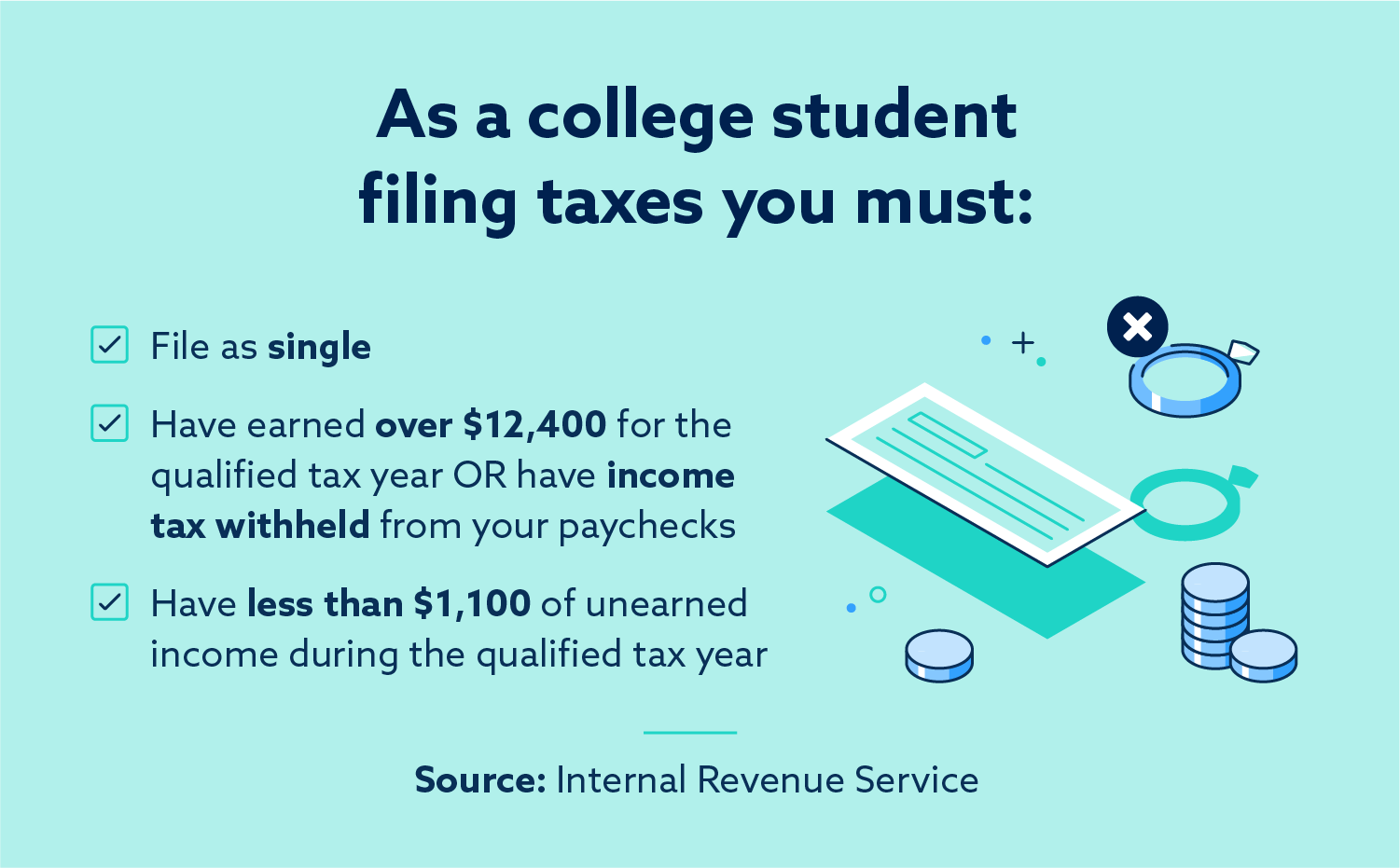

College students need to file taxes if they meet certain requirements. Examples include making more money than the minimum threshold or supporting another person in your household. Understanding whether you qualify and how to file correctly can be difficult if you’ve never done it before.

This article discusses how to determine whether you need to file taxes as a college student. It also covers how to prepare the right documents and choose a filing status to secure qualifying tax breaks and deductions.

Do College Students Need to File Taxes?

College students need to file taxes if one of the following situations applies:

- Your gross income was above the minimum threshold. As of 2024, you must file a tax return if your gross income was $14,600 or more. This applies if you’re unmarried and under 65 years old. Your gross income includes any earned income from a job plus other payments, such as tips or investments.

- You’re married. Married couples can file jointly or separately. Each filing status has its own income requirements. If filing separately, your gross income must be at least $5. When filing together, your combined income must be $30,750 or more if one spouse is under 65.

- You supported other people in your household. If you’re under 65 and have a dependent, you must file a tax return if you earned at least $21,900.

- You worked in a state that collects income tax. In this case, you may need to file a state tax return along with your federal return. Check your state’s tax website to determine if you qualify.

How to Choose the Right Tax Filing Status

The IRS recognizes five tax filing statuses:

- Single

- Married, filing jointly

- Married, filing separately

- Head of household

- Qualifying surviving spouse

Your filing status determines several factors, including your tax rate, whether you need to file a return and what credits you can claim. These factors affect how much you pay or get back as a refund.

Can Your Parents Claim You on Their Taxes?

Your parents can claim you on their taxes until you’re 24 if you’re a full-time student. If you have a job, the answer becomes more complex. According to IRS instructions, the following criteria must apply for a parent to claim a college student as a dependent:

- You are either under 19 years old, under 24 if a full-time student or any age and permanently and totally disabled.

- You lived with your parents for more than half the year, but some exceptions apply.

- Your parents pay more than half your financial support.

Parents who claim college students as dependents may be eligible for certain education tax credits to supplement tuition, fees or other related costs.

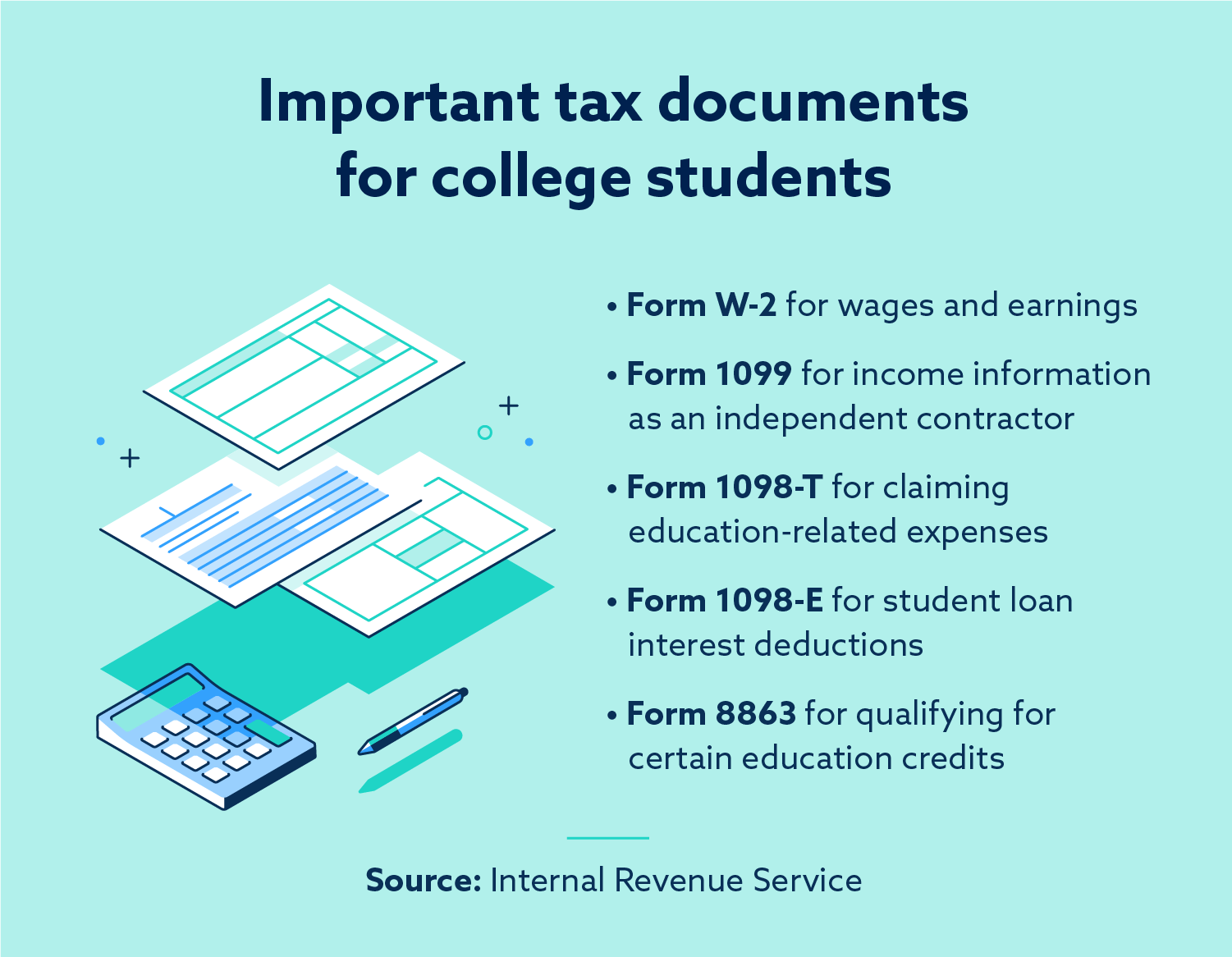

What Documents Do College Students Need to File Taxes?

You may need several documents to file taxes as a college student, depending on your financial situation. Common documents include:

- Form 1040. This is a basic income reporting form anyone can use. There are three schedules to choose from based on what type of income you’re reporting and what credits or deductions you wish to claim. For example, choose Schedule 1 to deduct student loan interest. Schedule 3 can help claim eligible education credits.

- Form W-2. You’ll receive a W-2 from your employer if you earned $600 or more throughout the year. This form details your total earnings and any state or federal income tax withholdings.

- Form 1099. If you earned money from freelance, gig or contract work, you’ll receive this form detailing your total earnings. These types of jobs don’t withhold taxes, meaning you may end up owing money after filing.

- Form 8863. This form enables claiming education credits, such as the American Opportunity Credit and Lifetime Learning Credit. These credits are based on any qualifying education expenses you paid to your school.

- Form 1098-T. Issued by your school, this form reports tuition payments and education-related expenses. You must include it when filing taxes to receive education credits.

- Form 1098-E. Your loan provider will send this form if you made any student loan payments the previous year. You may be able to deduct some or all of the student loan interest you paid if it was $600 or more.

If you expect a tax refund, have your bank account information on hand. This enables direct deposit. Additionally, verify whether you need to include funds received from a scholarship or grant in your tax filing.

Many of these financial awards are tax-free. However, you may need to report them if you used the money for unqualified expenses, such as housing or food.

Tax Credits and Deductions for College Students

First, let’s explore the difference between tax credits and deductions. A tax credit directly reduces the amount of taxes you owe. For example, if you owe $3,000 in taxes and qualify for a $1,000 tax credit, your tax bill decreases to $2,000.

Meanwhile, a tax deduction reduces your taxable income, lowering the amount of taxes owed. For instance, let’s say you have a $2,500 student loan interest deduction and your taxable income is $40,000. This deduction reduces your taxable income to $37,500.

In either case, these benefits help reduce your overall tax liability. There are three key tax benefits available for college students.

American Opportunity Credit

The American Opportunity Credit provides up to $2,500 per year for eligible students during their first 4 years of higher education. This credit covers tuition, fees and course materials, and the first $2,000 spent is refundable.

If claiming the credit reduces the amount of taxes you owe to $0, you can receive 40% of the remaining credit up to $1,000 as a tax return. Some requirements to be eligible for the AOC are:

- Be enrolled in a degree program at a qualifying educational institution

- Be enrolled at least halftime for one academic period, such as a semester, trimester or quarter

- Not have any felony drug convictions

- Have an adjusted gross income of $80,000 or less if single or $160,000 or less if married, filing jointly

Lifetime Learning Credit

The Lifetime Learning Credit offers up to $2,000 per year for qualifying education expenses, including tuition and fees. Unlike the AOC, the LLC doesn’t limit how many times you can claim it on your taxes. This credit helps a wider range of students, including those in grad programs, enrolled part-time or pursuing career-development courses.

However, the LLC is nonrefundable, meaning it can reduce your tax bill but won’t result in a refund. To be eligible, you must:

- Be enrolled at a qualifying educational institution for at least one academic period

- Have paid for qualifying education expenses

- Have an adjusted gross income of less than $90,000 if single or less than $180,000 if married, filing jointly

Student Loan Interest

If you paid interest on student loans, you may qualify for a deduction of up to $2,500. This deduction reduces your taxable income, decreasing the amount of taxes owed. You qualify for this benefit if you:

- Paid interest on a qualifying loan during the previous year

- Were legally obligated to pay interest on that loan

- Have an adjusted gross income that’s less than the amount set for that tax year

- Aren’t filing as married, filing separately

- Weren’t claimed as a dependent on someone else’s tax return

Tax Filing Help for College Students

Filing taxes as a college student may seem complicated. However, you don’t have to navigate the process alone. The IRS Free File program assists in preparing and filing federal income tax returns for those with an adjusted gross income of $84,000 or less. The IRS also manages the Volunteer Income Tax Assistance program. If you make $67,000 or less, have a disability or speak limited English, you can use this program for free. Additionally, some colleges offer tax guidance for students. Consult your institution to see what types of financial education it provides.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.