The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Building wealth in America isn’t getting any easier, especially for the younger generations. From rising grocery costs to record-breaking housing prices, many Americans are feeling the pressure.

According to the U.S. Bureau of Labor Statistics, the cost of living has surged more than 20 percent over the past four years, and wages are struggling to keep up. For Millennials and Gen Zers especially, the path to financial freedom feels longer and out of reach. What factors are shaping the financial journeys of Americans today?

We surveyed 1,000 people ages 18 and up to explore how different generations view wealth-building opportunities, compared to the ones their parents had. We also asked about their financial outlook, the impact of parental support and whether or not they believe today’s economic policies are working in their favor.

The results revealed some striking truths.

Key takeaways

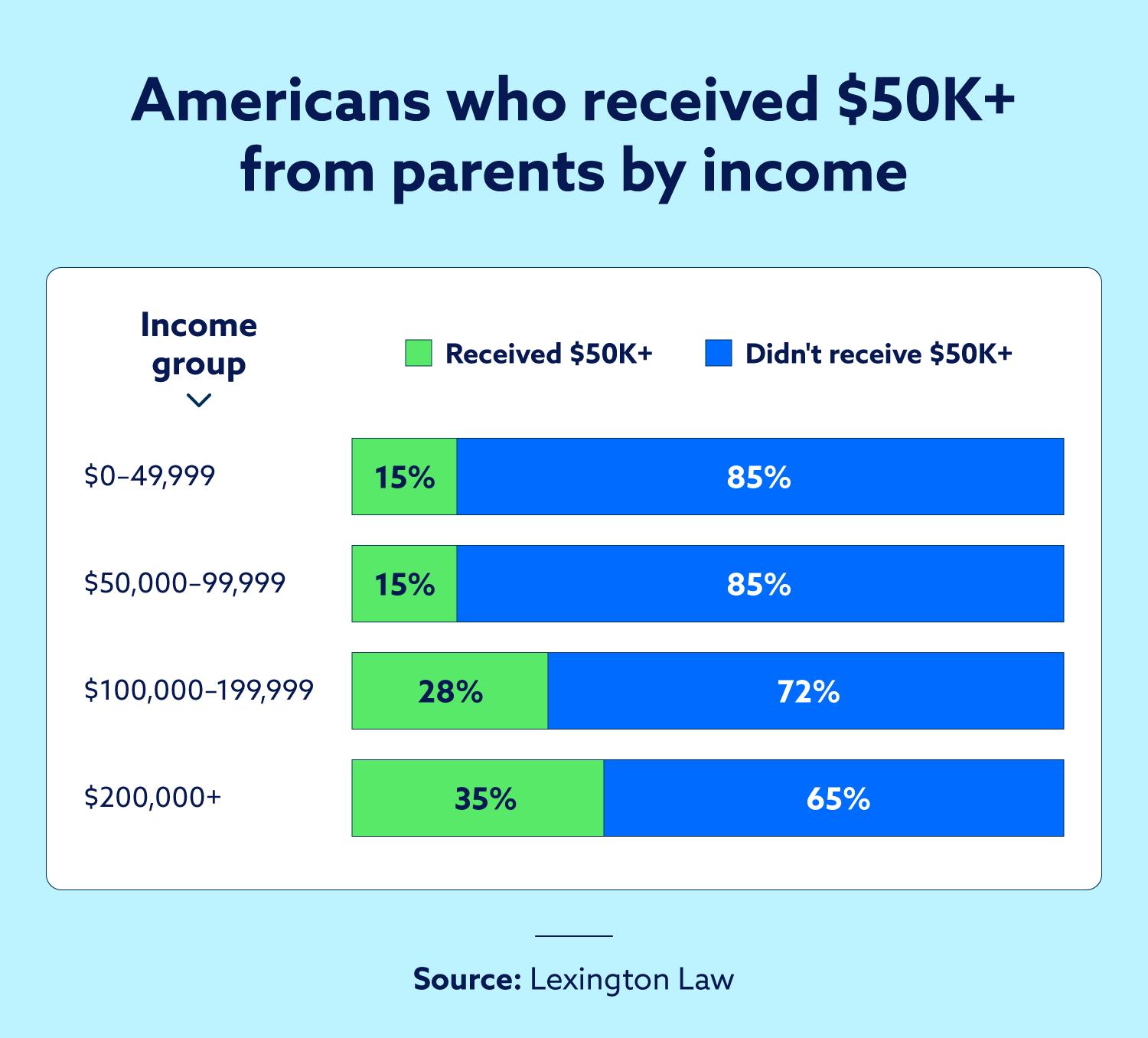

- High earners are 2.5x more likely to have received $50K+ in financial help from their parents.

- Gen Z remains wildly optimistic about their financial future, despite believing the system is rigged and facing delayed independence.

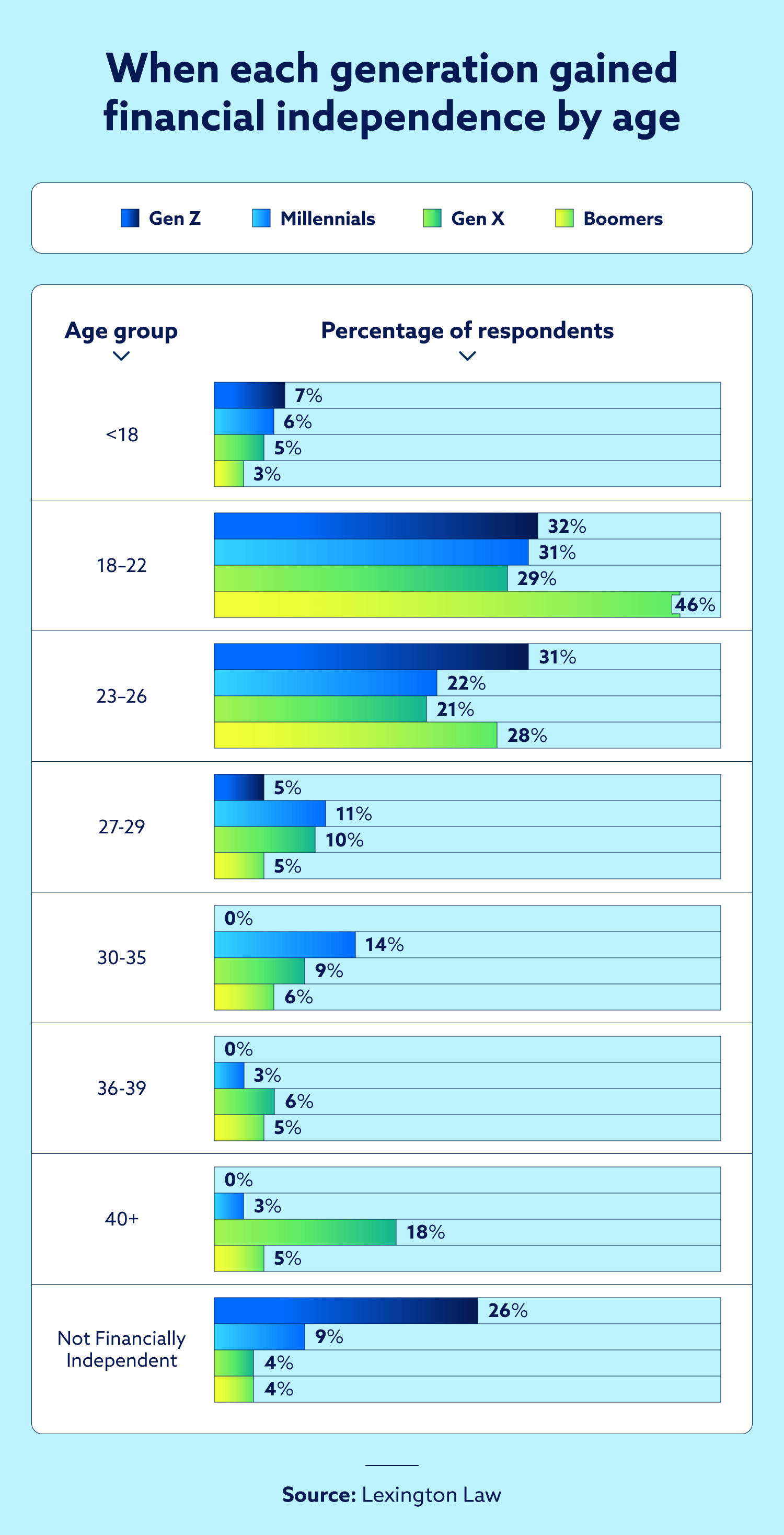

- Nearly half of Baby Boomers reached financial independence by age 22, faster than any other generation.

- Gen X has the highest income of any generation and the worst financial outlook.

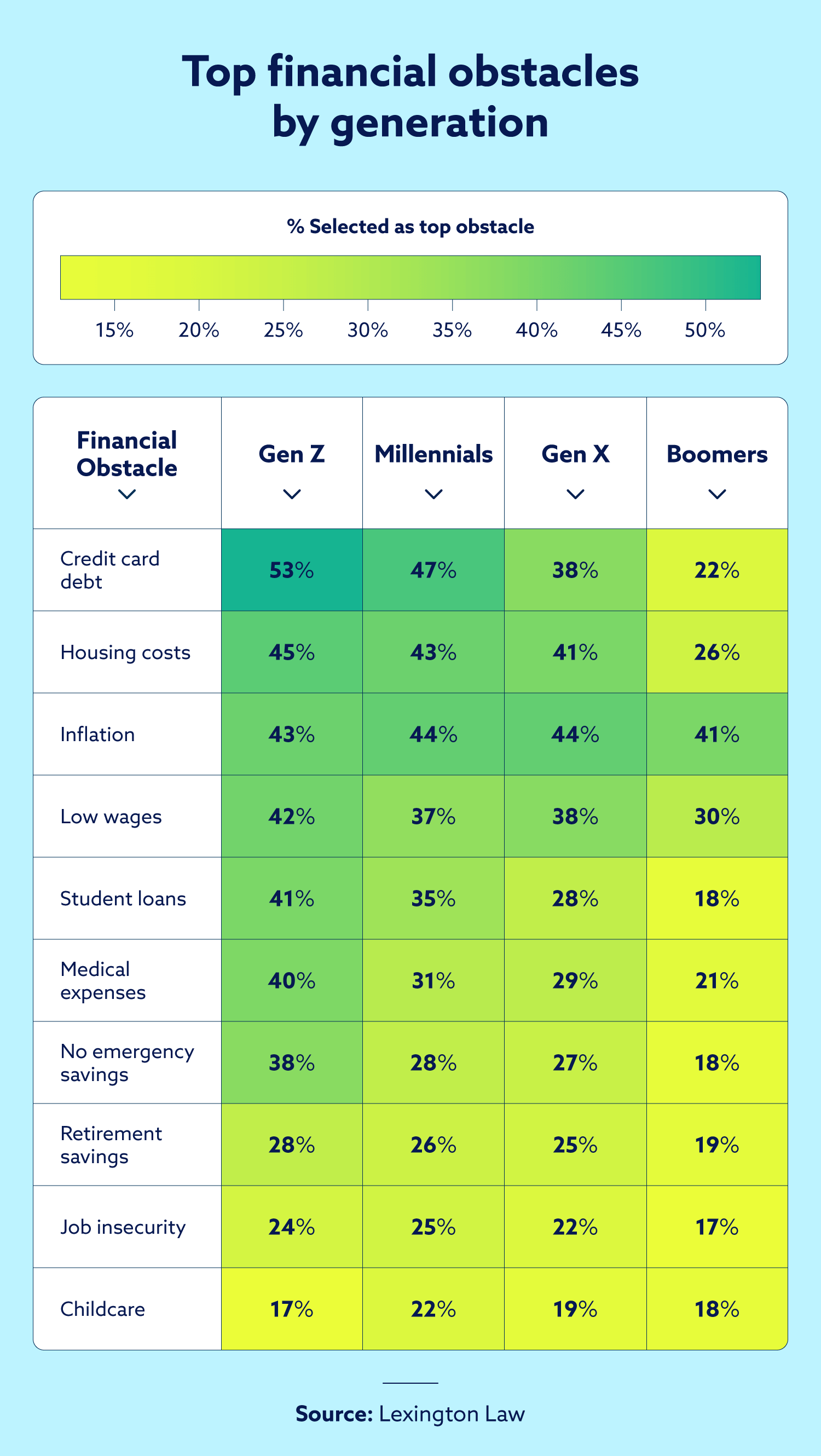

- Rising costs are the #1 obstacle to building wealth, according to every generation.

High earners are 2.5x more likely to have gotten big money from their parents

While many high earners are often seen as “self-made,” our survey challenges the idea that they got there on grit alone. It found that people earning $125,000 or more per year are 2.5 times more likely to have received at least $50,000 in financial help from their parents—that’s 36 percent compared to just 14 percent of lower-income earners.

Additionally, Gen Xers surveyed reported the highest levels of financial support from parents, with nearly 1 in 4 receiving over $50,000. That kind of support, however, isn’t the norm; more than half of Americans (53 percent) received $10,000 or less, if anything at all.

From a home down payment to paying off student loans, a financial boost can more than likely create long-term advantages. For those without it, financial stability can feel out of reach.

The great generational wealth delusion / Gen Z stays optimistic despite acknowledging a rigged system

Even when facing debt and higher costs of living, Gen Z surprisingly remains optimistic about their financial future.

Our survey revealed that 87 percent believe they’ll be just as or more successful than their parents. Part of this confidence may stem from early financial support, where 49 percent of Gen Z respondents reported receiving more than $10,000 from their parents, helping them manage early adulthood.

Optimism, however, isn’t limited to those with a high net worth. In fact, those making under $25,000 annually reported a more positive financial outlook than those earning $125,000 or more (31 percent compared to 49 percent who feel pessimistic).

Additionally, 72 percent of those respondents also believe the system is rigged in favor of older generations. This shows money and mindset don’t always go hand in hand, especially for newer generations redefining success.

Americans agree: Baby Boomers had the best wealth-building opportunities

Another interesting finding from our survey is that 36 percent of Americans believe Baby Boomers had the best opportunity to build wealth—more than any other generation. It’s not just perception. Nearly half of Boomers (48 percent) say they reached financial independence by age 22.

That early independence gave Boomers a valuable head start on saving, investing and building wealth. Younger generations, on the other hand, are financially reliant on family well into their 20s and even 30s, according to the U.S. Department of the Treasury. With rising costs of living, today’s road to financial autonomy looks much different from it did for Boomers.

Gen X has the most money (and the worst outlook)

Gen Xers may be earning the most, but they’re also feeling the weight of it. Our survey found that more than half (54 percent) report incomes over $100,000, the highest across all generations. Still, nearly half (49 percent) say they’re pessimistic about their financial future.

Gen Xers also reported having the most support from their parents—23 percent of them receiving over $50,000—yet still having the bleakest 10-year outlook.

It’s possible this generation feels caught in the middle: caring for aging parents while supporting their adult children. For Gen Xers, financial success may come with just as much stress.

Financial independence keeps getting pushed further out

Financial independence is noticeably arriving much later than it once did. While nearly half of Boomers (49 percent) were financially independent by age 22, only 36 percent of Gen Z reached that milestone between 23 and 29, with 26 percent of them still relying on parental support. Even 36 percent of Gen Xers didn’t become independent until after age 30.

As it turns out, higher income doesn’t always mean an earlier start. The survey reported that 26 percent of those earning $125,000-$149,999 were most likely to become independent at age 40 or older, and a quarter (25 percent) of those earning $200,000 or more didn’t reach independence until ages 30-35.

According to the U.S. Federal Reserve, rising housing costs, stagnant wages and student loan debt all play a role. These economic issues, likely long-term effects of the 2008 recession, seem to push financial independence further down the road.

This insight could indicate how common—and vital—parental support has become. With nearly 1 in 4 young adults (ages 18-29) still relying on help from family, one could agree that today’s path to adulthood is more rooted in family resources. While financial independence is still the goal, its delayed timeline highlights the economic shifts for many.

The #1 obstacle to wealth building, according to every generation

Across every generation, the biggest roadblock to building wealth is clear: rising costs. Nearly three-quarters (73 percent) say the rising cost of living is crushing their ability to save and build wealth. From gas to groceries, general American spending habits now demand a larger income.

Housing costs come in second at 65 percent, showing just how far out of reach homeownership has become for many. Also, while debt often leads financial conversations, only 28 percent of respondents said it was their top concern. Stagnant wages are the major obstacle, according to 49 percent of respondents.

It doesn’t stop there. For Boomers especially, healthcare costs are front and center, with 62 percent naming it their biggest challenge. These numbers seem to suggest that wealth building isn’t just about budgeting better but also surviving an expensive economy.

Lifelong wealth starts with a clean credit report

If there’s one thing this data makes clear, it’s that building wealth isn’t just about what you can earn—it’s about where you start and how you grow from there. While some people get a financial head start, many are facing rising costs and limited support. That’s why factors you can control, like building credit, become increasingly important for reaching financial goals.

A strong credit history can help you qualify for better rates and access opportunities faster. If you’re unsure where you stand, get your free credit assessment to see what’s possibly holding you back and what can be fixed.

Methodology

The survey was conducted by SurveyMonkey Audience for Lexington Law Firm. It was fielded between June 20, 2025 and June 22, 2025. The results are based on approximately 1,000 completed surveys.

In order to qualify, respondents were screened to be residents of the United States and over 18 years of age. Data is unweighted, and the margin of error is approximately +/-2 percent for the overall sample with a 95 percent confidence level.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.